India Geriatric Healthcare Market Size, Share, Trends and Forecast by Product Type, Service Type, Disease Indication, End User, and Region, 2025-2033

India Geriatric Healthcare Market Overview:

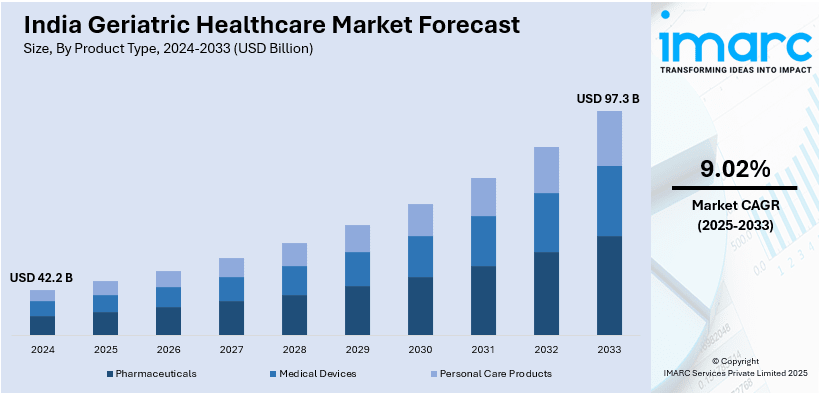

The India geriatric healthcare market size reached USD 42.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 97.3 Billion by 2033, exhibiting a growth rate (CAGR) of 9.02% during 2025-2033. The market is growing because of a population that is aging, rising investments in healthcare, new technologies, and an upsurge in the demand for high-end medical care, highlighting ease of access, affordability, and quality care for older persons in different healthcare facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 42.2 Billion |

| Market Forecast in 2033 | USD 97.3 Billion |

| Market Growth Rate 2025-2033 | 9.02% |

India Geriatric Healthcare Market Trends:

Rise of Home-Based Healthcare Services

India geriatric healthcare market is witnessing a transition towards home healthcare services, responding to the increasing desire of geriatric people to be provided with medical care in the comfort of familiar surroundings. This involves a variety of services, such as skilled nursing, physiotherapy, palliative care, and chronic disease management. The progress in telemedicine, wearable health monitoring technologies, and artificial intelligence (AI) based diagnostics has also made the provision of medical care at home even more convenient. For instance, in June 2023, Max Healthcare and MyHealthcare together unveiled an AI-enabled remote patient monitoring network, making home-based care possible through device-integrated monitoring, electronic medical records, and AI-enabled vital tracking for better healthcare accessibility. Furthermore, by cutting the instances of hospital outings, homecare amplifies ease of use, minimizes health spending, and benefits overall quality of life among aged citizens. The rise of custom-fit care plans tailored to specific medical conditions is driving India's elder-care system toward a more patient-centric approach. Demands for home healthcare caregivers and professionally qualified geriatric care professionals also increasing also portray a more global shift towards changing India's health delivery system. This shift reflects the growing focus on accessibility, effectiveness, and quality of care for the nation's geriatric population.

To get more information on this market, Request Sample

Integration of Digital Health Solutions

Incorporation of e-health solutions is changing the landscape of geriatric healthcare in India. Easy use of smartphone-based health applications, computerized health records, and AI-supported diagnostic instruments ensures effective surveillance and management of diabetes, cardiovascular complications, and neurologic illnesses. Increased accessibility through widespread mobile telephone usage and growing internet coverage has improved virtual consulting, medicine alerts, and far-reaching tracking of health status. Wearable technology continues to add value by recording real-time vital signs, enabling prompt identification of health abnormalities and timely medical care. Additionally, digital health solutions advance synchronization of healthcare providers, caregivers, and relatives, promoting a comprehensive and well-coordinated geriatric care system. With India's digital infrastructure evolving further, the contribution of technology to geriatric healthcare will grow, promoting better health outcomes, boosted convenience, and a more proactive strategy for managing age-related medical conditions.

Expansion of Specialized Geriatric Healthcare Facilities

The rise in specialized geriatric healthcare facilities is transforming the elder care space of India. With the geriatric population of the country increasing incrementally, a demand for the establishment of dedicated healthcare infrastructure aimed at catering to the specific medical and lifestyle needs of geriatric people has been witnessed. According to the sources, in June 2023, the Tamil Nadu government opened the 1,000-bed Kalaignar Centenary Super Speciality Hospital at Guindy, upgrading geriatric care with high-end cardiology, oncology, and multi-specialty care to enhance care for elderly patients in Chennai. Moreover, geriatric hospitals, rehab facilities, and aged care villages are becoming a core part of this shift. These centers provide multidisciplinary care, such as specialized medical care, physiotherapy, mental health care, and long-term nursing care. Assisted living facilities provide a supportive and structured setting where older adults can live independently while receiving required healthcare and daily living support. Rehabilitation centers also emphasize post-surgical rehabilitation, stroke rehabilitation, and mobility improvement, greatly enhancing quality of life. The establishment of such specialized facilities points to India's dedication towards upgrading geriatric healthcare, so that the geriatric population has access to all-round, dignified, and quality medical treatment in a changing healthcare scenario.

India Geriatric Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, service type, disease indication, and end user.

Product Type Insights:

- Pharmaceuticals

- Medical Devices

- Personal Care Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes pharmaceuticals, medical devices, and personal care products.

Service Type Insights:

- Home Healthcare Services

- Hospital and Clinical Services

- Assisted Living and Nursing Care

- Palliative and Hospice Care

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes home healthcare services, hospital and clinical services, assisted living and nursing care, palliative and hospice care.

Disease Indication Insights:

- Cardiovascular Diseases

- Neurological Disorders

- Diabetes and Endocrine Disorders

- Respiratory Disorders

- Osteoarthritis and Musculoskeletal Disorders

- Cancer

- Others

The report has provided a detailed breakup and analysis of the market based on the disease indication. This cardiovascular diseases, neurological disorders, diabetes and endocrine disorders, respiratory disorders, osteoarthritis and musculoskeletal disorders, cancer, others.

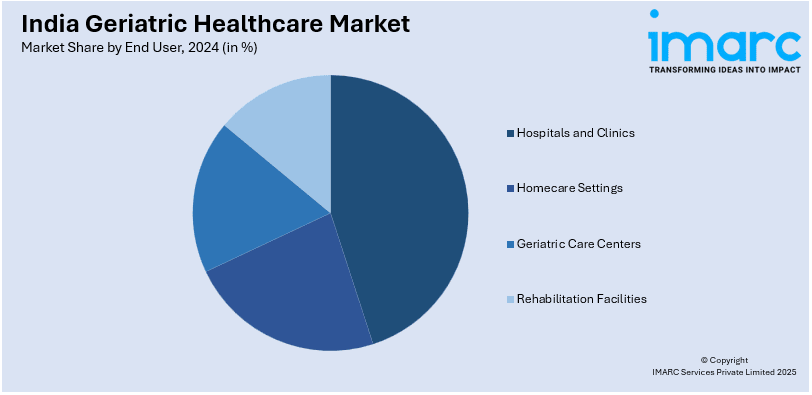

End User Insights:

- Hospitals and Clinics

- Homecare Settings

- Geriatric Care Centers

- Rehabilitation Facilities

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, homecare settings, geriatric care centers, and rehabilitation facilities.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Geriatric Healthcare Market News:

- In December 2024, MeitY-NASSCOM Centre of Excellence (CoE) partnered with startups to create AI-based diagnostic instruments and affordable IoT devices, driving healthcare accessibility in India. Top innovations are cervical cancer screening powered by AI and handheld glaucoma detection machines. The mission is in tune with the National Digital Health Mission to enhance rural healthcare.

- In November 2024, the Indian government launched the AIIMS Darbhanga project, a ₹1,264 crore super-specialty hospital that would bolster Bihar's healthcare system. The project is likely to improve geriatric care, delivering cutting-edge medical facilities to older patients in Bihar, surrounding states, and Nepal, representing strong development in India's healthcare sector.

- In February 2024, Aether Mindtech from Hyderabad rolled out Evolv28, the first non-invasive wearable in India for mental wellness. Leveraging Variable Complex-weak Magnetic Fields (VCMF), it activates the brain stem to improve mindfulness, stress reduction, and sleep quality. The wearable enables brainwave training, achieving cognitive equilibrium and emotional strength with customized mobile-app-based programs.

India Geriatric Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Product Type Insights: Pharmaceuticals, Medical Devices, Personal Care Products |

| Service Types Covered | Home Healthcare Services, Hospital and Clinical Services, Assisted Living and Nursing Care, Palliative and Hospice Care |

| Disease Indications Covered | Cardiovascular Diseases, Neurological Disorders, Diabetes and Endocrine Disorders, Respiratory Disorders, Osteoarthritis and Musculoskeletal Disorders, Cancer, Others |

| End Users Covered | Hospitals and Clinics, Homecare Settings, Geriatric Care Centers, Rehabilitation Facilities |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India geriatric healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India geriatric healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India geriatric healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The geriatric healthcare market in India was valued at USD 42.2 Billion in 2024.

The India geriatric healthcare market is projected to exhibit a (CAGR) of 9.02% during 2025-2033, reaching a value of USD 97.3 Billion by 2033.

The market is fueled by growing life expectancy, expanding prevalence of chronic diseases among the elderly, and rising health awareness. Increasing insurance coverage, better medical infrastructure, and government initiatives through schemes for the elderly boost market demand. Spreading home healthcare and geriatric-focused services also augurs well for sustainable growth in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)