India Geriatric Healthcare Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End-User, and Region, 2025-2033

India Geriatric Healthcare Products Market Overview:

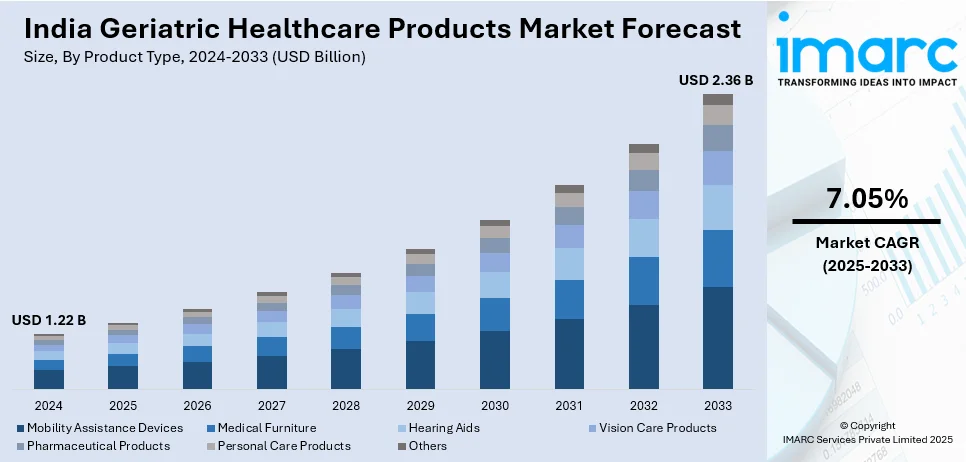

The India geriatric healthcare products market size reached USD 1.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.36 Billion by 2033, exhibiting a growth rate (CAGR) of 7.05% during 2025-2033. The India geriatric healthcare products market share is growing due to a rising elderly population, increasing chronic diseases, advancements in healthcare technology, and expanding home healthcare services, which improves accessibility and quality of life for senior citizens.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.22 Billion |

| Market Forecast in 2033 | USD 2.36 Billion |

| Market Growth Rate 2025-2033 | 7.05% |

India Geriatric Healthcare Products Market Trends:

Advancements in Healthcare Technology

Advancements in healthcare technology are significantly influencing the India geriatric healthcare products market outlook by improving accessibility, convenience, and efficiency in elderly care. The development of smart medical devices such as wearable health trackers, remote monitoring systems, and artificial intelligence (AI)-powered diagnostic tools, is enhancing real-time health tracking and early disease detection among senior citizens. These innovations allow continuous monitoring of vital signs, reducing hospital visits and enabling better chronic disease management at home. Additionally, mobility aids including lightweight and ergonomic wheelchairs, smart walking canes, and robotic exoskeletons, are improving the quality of life for elderly individuals with limited mobility. Telemedicine platforms are also playing a crucial role by providing virtual consultations, minimizing hospital visits, and ensuring timely medical attention. Hearing technology is also evolving, with Hearzap, supported by 360 One, launching Zenaud, India’s first rechargeable In-The-Canal (ITC) hearing aid designed by GN Hearing. It aims to enhance accessibility and affordability, making advanced hearing solutions more attainable for the elderly. Furthermore, home-based healthcare equipment like automated pill dispensers, smart beds, and oxygen concentrators, is making elderly care more efficient while reducing dependency on caregivers. The integration of AI and Internet of Things (IoT) in healthcare products is further personalizing treatments and enhancing elderly care solutions.

To get more information on this market, Request Sample

Rising Geriatric Population

As life expectancy increases due to advancements in medical care, India’s elderly population is projected to reach 193.4 million by 2031, significantly driving the demand for specialized healthcare solutions. This demographic shift is leading to a higher prevalence of age-related ailments such as arthritis, osteoporosis, diabetes, and cardiovascular diseases, necessitating the use of assistive devices, orthopedic support, and chronic disease management products. Moreover, aging weakens immunity, making senior citizens more susceptible to infections and requiring regular medication, nutritional supplements, and home-based medical equipment like oxygen concentrators and monitoring devices. The demand for mobility aids such as walkers and wheelchairs, is also rising as seniors experience reduced physical strength and coordination. Additionally, with more families adopting nuclear lifestyles, elderly individuals are increasingly relying on home healthcare services and products that offer convenience and independence. The government is also launching various initiatives like healthcare schemes and subsidies, to improve geriatric care, further supporting the India geriatric healthcare products market growth. As the elderly population continues to expand, the need for advanced and accessible healthcare products is becoming more crucial in ensuring a better quality of life for senior citizens.

India Geriatric Healthcare Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end-user.

Product Type Insights:

- Mobility Assistance Devices

- Wheelchairs

- Walkers

- Canes

- Medical Furniture

- Hospital Beds

- Lift Chairs

- Hearing Aids

- Vision Care Products

- Reading Glasses

- Contact Lenses

- Pharmaceutical Products

- Chronic Disease Medications

- Supplements

- Personal Care Products

- Adult Diapers

- Skincare

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mobility assistance devices (wheelchairs, walkers and canes), medical furniture (hospital beds and lift chairs), hearing aids, vision care products (reading glasses and contact lenses), pharmaceutical products (chronic disease medications and supplements), personal care products (adult diapers and skincare), and others.

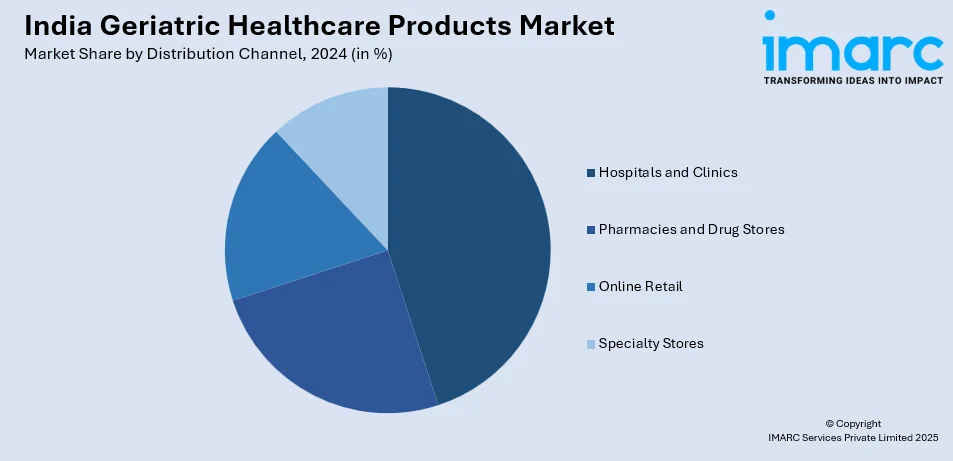

Distribution Channel Insights:

- Hospitals and Clinics

- Pharmacies and Drug Stores

- Online Retail

- Specialty Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospitals and clinics, pharmacies and drug stores, online retail, and specialty stores.

End-User Insights:

- Home Healthcare

- Assisted Living Facility

- Nursing Homes

- Hospitals

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home healthcare, assisted living facility, nursing homes, and hospitals.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Geriatric Healthcare Products Market News:

- In October 2024, Hearzap launched the Philips HearLink 50 miniRITE, an AI-powered hearing aid designed to improve the listening experience for individuals with hearing loss.

- In March 2024, researchers at IIT Madras developed NeoStand, an electric standing wheelchair that allows users to shift from a seated to a standing position with a single button press. This indigenous innovation is designed to improve mobility, independence, and quality of life for individuals with mobility impairments.

India Geriatric Healthcare Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Hospitals and Clinics, Pharmacies and Drug Stores, Online Retail, Specialty Stores |

| End-Users Covered | Home Healthcare, Assisted Living Facilities, Nursing Homes, Hospitals |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India geriatric healthcare products market performed so far and how will it perform in the coming years?

- What is the breakup of the India geriatric healthcare products market on the basis of product type?

- What is the breakup of the India geriatric healthcare products market on the basis of service type?

- What is the breakup of the India geriatric healthcare products market on the basis of disease indication?

- What is the breakup of the India geriatric healthcare products market on the basis of end-user?

- What are the various stages in the value chain of the India geriatric healthcare products market?

- What are the key driving factors and challenges in the India geriatric healthcare products market?

- What is the structure of the India geriatric healthcare products market and who are the key players?

- What is the degree of competition in the India geriatric healthcare products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India geriatric healthcare products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India geriatric healthcare products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India geriatric healthcare products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)