India Geyser Market Size, Share, Trends, and Forecast by Type of Geyser, Capacity, Energy Source, Application, and Region, 2025-2033

India Geyser Market Overview:

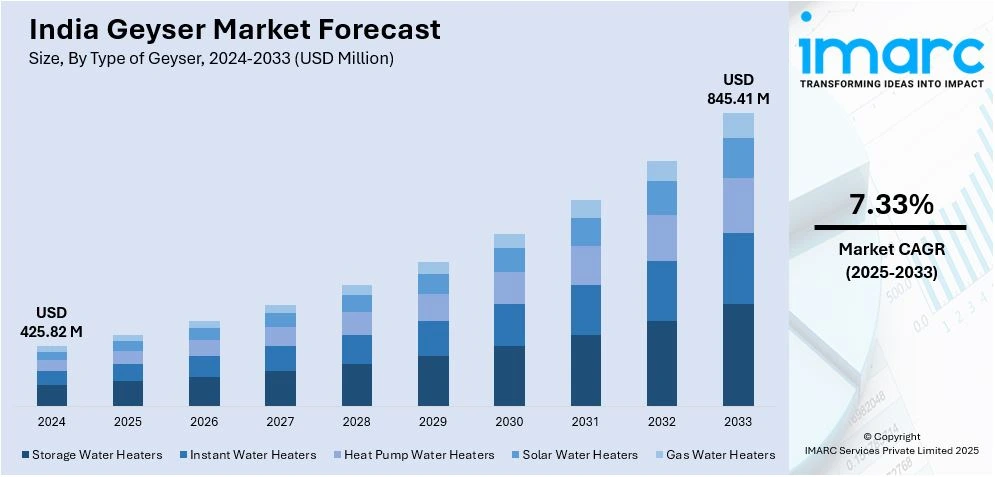

The India geyser market size reached USD 425.82 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 845.41 Million by 2033, exhibiting a growth rate (CAGR) of 7.33% during 2025-2033. The market is driven by rapid urbanization, rising disposable incomes, growing demand for hot water, and increased awareness of energy efficiency. Expansion in residential construction, rural electrification, and the popularity of smart home appliances also contribute to the India geyser market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 425.82 Million |

| Market Forecast in 2033 | USD 845.41 Million |

| Market Growth Rate 2025-2033 | 7.33% |

India Geyser Market Trends:

Urbanization and Rising Disposable Incomes

India's accelerating urbanization and increasing middle class are major geyser market drivers. More people relocating to cities contribute to higher demand for contemporary domestic appliances, including water heaters. Higher disposable incomes allow consumers to invest in technologically sophisticated and quality geysers. Additionally, improved living standards and changing lifestyle preferences have made geysers a necessity rather than a luxury, creating a positive India geyser market outlook. This trend is particularly strong in metro cities and tier-2 and tier-3 cities, where infrastructure development and access to reliable electricity support higher adoption rates of water heating solutions. As consumer expectations evolve, manufacturers are responding with innovative technologies tailored to health, efficiency, and lifestyle needs. For instance, in January 2025, Symphony Ltd., introduced a line of water heaters featuring its innovative 9-layer PuroPod Technology. This technology effectively filters out sediments and harmful chemicals that can contribute to hair loss, converting hard water into soft water. In this new venture, Symphony launched three models—nine variations—available in 10, 15, and 25-liter capacities: Symphony Spa, Symphony Sauna, and Symphony Soul.

To get more information on this market, Request Sample

Increasing Awareness of Energy Efficiency

With growing concerns about electricity consumption and environmental sustainability, consumers are opting for energy-efficient geysers. The Indian government has introduced energy efficiency ratings, such as the Bureau of Energy Efficiency (BEE) star ratings, encouraging manufacturers to produce eco-friendly and cost-effective models. Energy-efficient water heaters help reduce electricity bills, making them a preferred choice among households and businesses. Advanced technologies such as instant water heaters, solar-powered geysers, and smart geysers with temperature control features are gaining popularity, further fueling the India geyser market share in both residential and commercial sectors. This shift toward energy efficiency is also attracting new players into the market with innovative product offerings. For instance, in October 2023, Voltas announced the launch of its Voltas Water Heaters, marking its entry into the water heater market. The product line will be offered nationwide. With this growth, Voltas enters the water heater sector and advances its goal of being a one-stop shop for all household appliance solutions.

India Geyser Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on the type of geyser, capacity, energy source, and application.

Type of Geyser Insights:

- Storage Water Heaters

- Instant Water Heaters

- Heat Pump Water Heaters

- Solar Water Heaters

- Gas Water Heaters

The report has provided a detailed breakup and analysis of the market based on the type of geyser. This includes storage water heaters, instant water heaters, heat pump water heaters, solar water heaters, and gas water heaters.

Capacity Insights:

- Below 10 Liters

- 10 to 25 Liters

- 25 to 50 Liters

- 50 to 100 Liters

- Above 100 Liters

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes below 10 liters, 10 to 25 liters, 25 to 50 liters, 50 to 100 liters, and above 100 liters.

Energy Source Insights:

- Electric

- Gas

- Solar

- Heat Pump

- Hybrid

A detailed breakup and analysis of the market based on the energy source have also been provided in the report. This includes electric, gas, solar, heat pump, and hybrid.

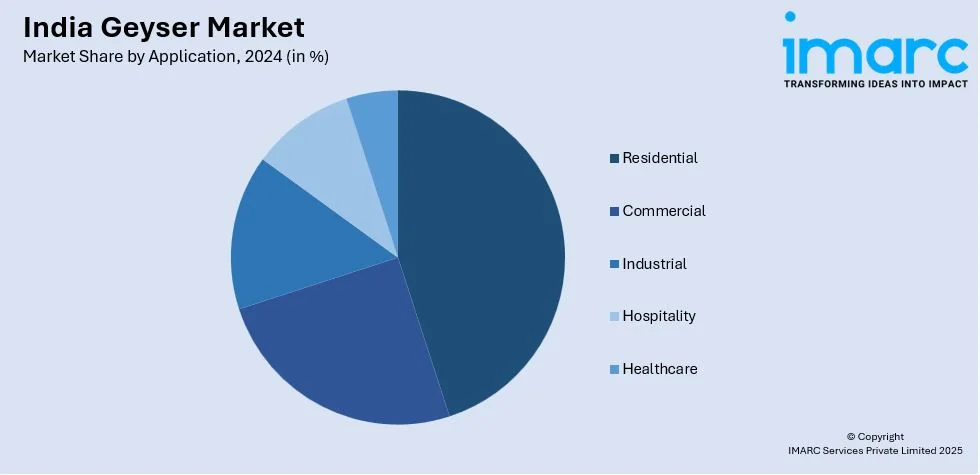

Application Insights:

- Residential

- Commercial

- Industrial

- Hospitality

- Healthcare

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, industrial, hospitality, and healthcare.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Geyser Market News:

- In October 2023, Racold, a domestic home appliance business, introduced a premium line of water heaters, broadening its product line. The new Omnis and Altro water heater models for 2023 have been introduced by the firm. Renowned Italian designer Umberto Palermo created this new line of water heaters.

India Geyser Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Geysers Covered | Storage Water Heaters, Instant Water Heaters, Heat Pump Water Heaters, Solar Water Heaters, Gas Water Heaters |

| Capacities Covered | Below 10 Liters, 10 to 25 Liters, 25 to 50 Liters, 50 to 100 Liters, Above 100 Liters |

| Energy Sources Covered | Electric, Gas, Solar, Heat Pump, Hybrid |

| Applications Covered | Residential, Commercial, Industrial, Hospitality, Healthcare |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India geyser market performed so far and how will it perform in the coming years?

- What is the breakup of the India geyser market on the basis of type of geyser?

- What is the breakup of the India geyser market on the basis of capacity?

- What is the breakup of the India geyser market on the basis of energy source?

- What is the breakup of the India geyser market on the basis of application?

- What is the breakup of the India geyser market on the basis of region?

- What are the various stages in the value chain of the India geyser market?

- What are the key driving factors and challenges in the India geyser market?

- What is the structure of the India geyser market and who are the key players?

- What is the degree of competition in the India geyser market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India geyser market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India geyser market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India geyser industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)