India Gift Packaging Market Size, Share, Trends and Forecast by Product Type, Material, Packaging, and Region, 2025-2033

India Gift Packaging Market Overview:

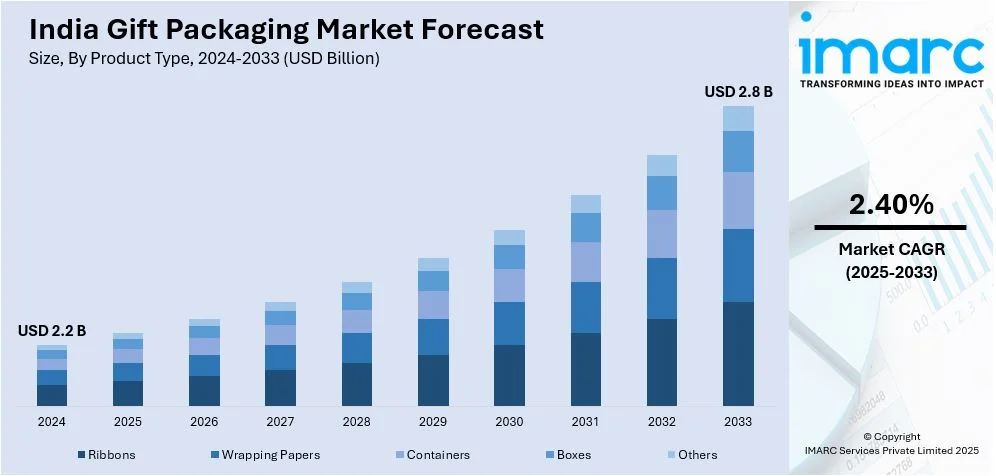

The India gift packaging market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2033, exhibiting a growth rate (CAGR) of 2.40% during 2025-2033. Growing disposable income, rising e-commerce penetration, and the expanding trend for premium and customized packaging are fueling the market. The impact of social media, corporate gifting expansion, and increased demand during festive periods further drive growth. Adoption of sustainable packaging and design innovations also help expand the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Market Growth Rate 2025-2033 | 2.40% |

India Gift Packaging Market Trends:

Rise of Sustainable and Eco-Friendly Packaging

The Indian gift packaging industry is rapidly adopting sustainable materials due to rising environmental awareness and stricter regulatory frameworks promoting eco-friendly practices. Manufacturers are shifting toward biodegradable, recyclable, and reusable packaging solutions, incorporating materials such as kraft paper, jute, and plant-based inks. The emphasis on reducing plastic usage has led to innovations like seed-infused wrapping paper and fabric-based gift wraps, catering to consumer preferences for sustainable gifting. Corporate entities are integrating eco-friendly packaging into their gifting strategies to enhance their brand image and align with global sustainability goals. A notable example is Gifts World Expo 2024, that took place at Pragati Maidan, New Delhi, in July 2024. Organized by MEX Exhibitions, the event featured a dedicated Sustainable Products Zone, showcasing biodegradable packaging, luxury gifts, and AI-driven innovations. This exhibition underscores the industry's commitment to environmentally responsible packaging, fostering collaborations that drive sustainability-focused advancements.

To get more information on this market, Request Sample

Growth of Personalization and Customization in Gift Packaging

Customization is becoming a key driver in India’s gift packaging market, with businesses and consumers seeking tailor-made solutions to enhance gifting experiences. Advanced digital printing enables intricate designs, personalized messages, and branding elements, catering to both personal and corporate needs. The demand for luxury packaging, including monogrammed boxes, bespoke ribbons, and embossed wrapping papers, is growing, particularly for weddings and high-end corporate gifts. E-commerce and small businesses are leveraging customization to improve customer engagement, offering unique unboxing experiences. For instance, in January 2025, Paperworld India and Corporate Gifts Show 2025 showcased innovations in stationery, paper products, and corporate gifting, with a focus on sustainability and customization. The event featured segments such as educational toys, pharma packaging, and eco-friendly gifting. With rising demand for personalized gifting in India, exhibitors presented creative solutions, including digital learning tools and green stationery.

India Gift Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, material, and packaging.

Product Type Insights:

- Ribbons

- Wrapping Papers

- Containers

- Boxes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ribbons, wrapping papers, containers, boxes, and others.

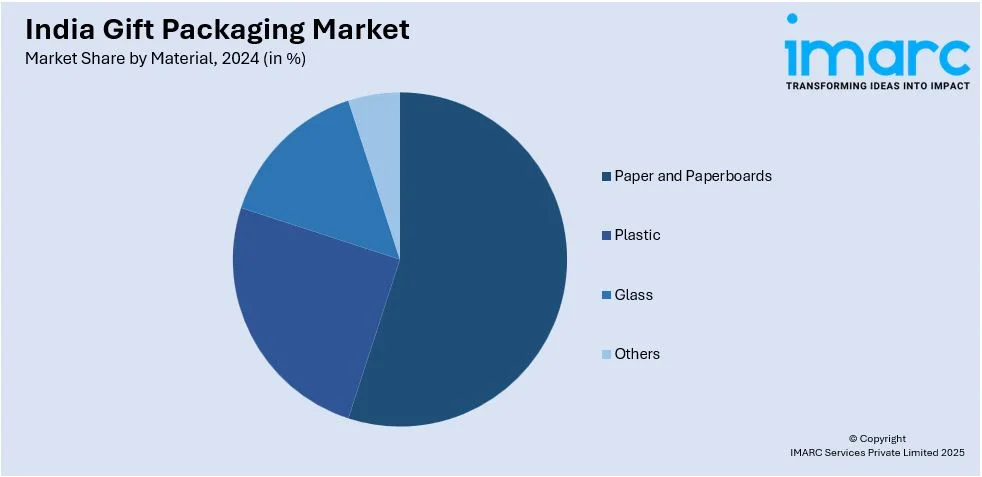

Material Insights:

- Paper and Paperboards

- Plastic

- Glass

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes paper and paperboards, plastic, glass, and others.

Packaging Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes primary, secondary, and tertiary packaging.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gift Packaging Market News:

- In August 2024, DCGpac launched premium festive gift packaging, catering to businesses and individuals. The range includes customizable options with modern and traditional designs, emphasizing aesthetics and sustainability. The eco-friendly packaging enhances the unboxing experience while reflecting brand identity or personal style.

India Gift Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ribbons, Wrapping Papers, Containers, Boxes, Others |

| Materials Covered | Paper and Paperboards, Plastic, Glass, Others |

| Packagings Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India gift packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the India gift packaging market on the basis of product type?

- What is the breakup of the India gift packaging market on the basis of material?

- What is the breakup of the India gift packaging market on the basis of packaging?

- What are the various stages in the value chain of the India gift packaging market?

- What are the key driving factors and challenges in the India gift packaging?

- What is the structure of the India gift packaging market and who are the key players?

- What is the degree of competition in the India gift packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gift packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gift packaging market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gift packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)