India Gin Market Size, Share, Trends and Forecast by Type, Price Point, Distribution Channel, and Region, 2025-2033

India Gin Market Overview:

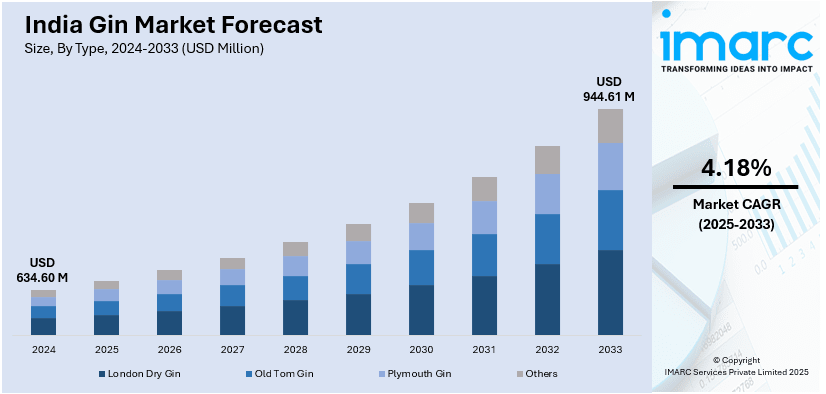

The India gin market size reached USD 634.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 944.61 Million by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. The rising premiumization, increasing consumer preference for craft and flavored gins, expanding cocktail culture, urbanization, growing disposable incomes, changing lifestyle trends, innovative marketing strategies, and the emergence of homegrown gin brands catering to evolving tastes and preferences are some of the factors fueling the India gin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 634.60 Million |

| Market Forecast in 2033 | USD 944.61 Million |

| Market Growth Rate 2025-2033 | 4.18% |

India Gin Market Trends:

Premiumization and Craft Gin Boom

India's gin market is experiencing rapid premiumization, with consumers increasingly opting for high-quality, artisanal, and craft gins over mass-produced alternatives. The rise of homegrown craft distilleries focusing on unique botanicals and local ingredients has fueled this trend. The emerging Indian gin market has leading companies like Stranger & Sons, Hapusa, and Greater Than which create separate taste experiences that follow modern consumer preferences. Additionally, as disposable incomes rise, more consumers are willing to spend on premium spirits, elevating gin’s status from a niche spirit to a mainstream choice, thereby creating a positive India gin market outlook. This shift has significantly contributed to the growth and diversification of the Indian gin market. For instance, in January 2024, Radico Khaitan unveiled the Jaisalmer Indian Craft Gin 'Gold Edition', setting a new standard of luxury and elegance in the Indian gin industry. Jaisalmer Indian Craft Gin 'Gold Edition' is set to be released in a 500 ml bottle, priced between Rs 4,000 and Rs 7,000 based on the state and its respective excise regulations. Starting its journey with a launch in Uttar Pradesh, this remarkable product will progressively extend its reach to Delhi, Rajasthan, Maharashtra, and Karnataka from July, serving gin enthusiasts in India’s major markets.

To get more information on this market, Request Sample

Growing Cocktail and Bar Culture

The expansion of India’s cocktail culture is driving the India gin market growth. Urban consumers, especially millennials and Gen Z, are increasingly experimenting with cocktails in bars, restaurants, and home settings. The influence of global mixology trends and the rise of speakeasies and gin-focused bars have further strengthened gin’s foothold in India. Social media and digital platforms have also played a role in educating consumers about gin-based cocktails, making gin a versatile and trendy spirit. As more people seek experiential drinking, gin’s botanical complexity makes it an ideal choice for mixology-driven consumption. For instance, in September 2023, Himmaleh Spirits, India's first traceable distillery dedicated to artisanal spirits, revealed the introduction of its inaugural product, Kumaon & I - a local dry Gin that honors the distinct terroir and vibrant flavors of Uttarakhand's Kumaon area. Ansh Khanna and Samarth Prasad established Himmaleh Spirits, a family-run, independent artisanal spirits distillery that places a major emphasis on farm-to-bottle and sustainable sourcing. By creating a legacy of social and environmental responsibility in addition to spirits, the brand hopes to inspire customers to drink more responsibly. Its hyperlocal strategy encourages sustainable development for the area by limiting its efforts to Uttarakhand botanicals.

India Gin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, price point, and distribution channel.

Type Insights:

- London Dry Gin

- Old Tom Gin

- Plymouth Gin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes London dry gin, old tom gin, Plymouth gin, and others.

Price Point Insights:

- Standard

- Premium

- Luxury

A detailed breakup and analysis of the market based on the price point have also been provided in the report. This includes standard, premium, and luxury.

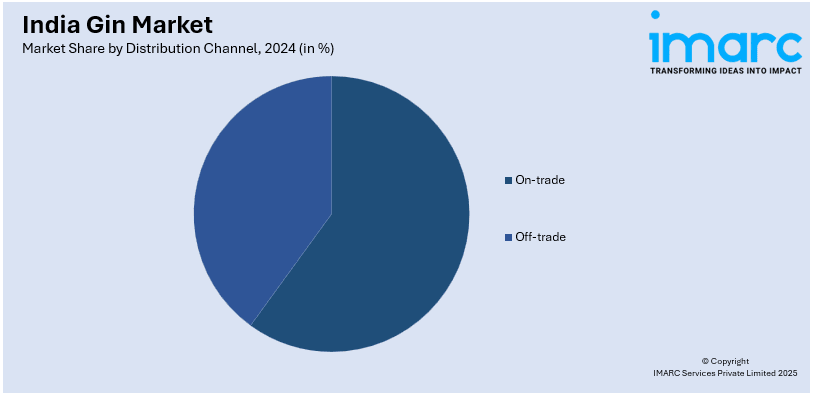

Distribution Channel Insights:

- On-trade

- Off-trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gin Market News:

- In December 2024, The Bagh Explorations series introduced TERAI India Craft Gin - Litchi & Mulberries, a new craft gin. Made with mulberries, litchis, and other botanicals, it celebrates India's heritage and exemplifies the Grain-to-Glass philosophy.

- In February 2025, Allied Blenders and Distillers announced it had purchased all brands and other Intellectual Property rights from Fullarton Distilleries Private, producer of Pumori gin and Woodburns whiskey for approximately Rs40 crore.

India Gin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | London Dry Gin, Old Tom Gin, Plymouth Gin, Others |

| Price Points Covered | Standard, Premium, Luxury |

| Distribuion Channels Covered | On-Trade, Off-Trade |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India gin market was valued at USD 634.60 Million in 2024.

The India gin market is projected to exhibit a CAGR of 4.18% during 2025-2033, reaching a value of USD 944.61 Million by 2033.

The rising premiumization, increasing consumer preference for craft and flavored gins, expanding cocktail culture, urbanization, growing disposable incomes, changing lifestyle trends, innovative marketing strategies, and the emergence of homegrown gin brands catering to evolving tastes and preferences are some of the factors fueling the India gin market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)