India Ginger Processing Market Size, Share, Trends and Forecast by Form, Distribution Channel, End Use, and Region, 2026-2034

India Ginger Processing Market Overview:

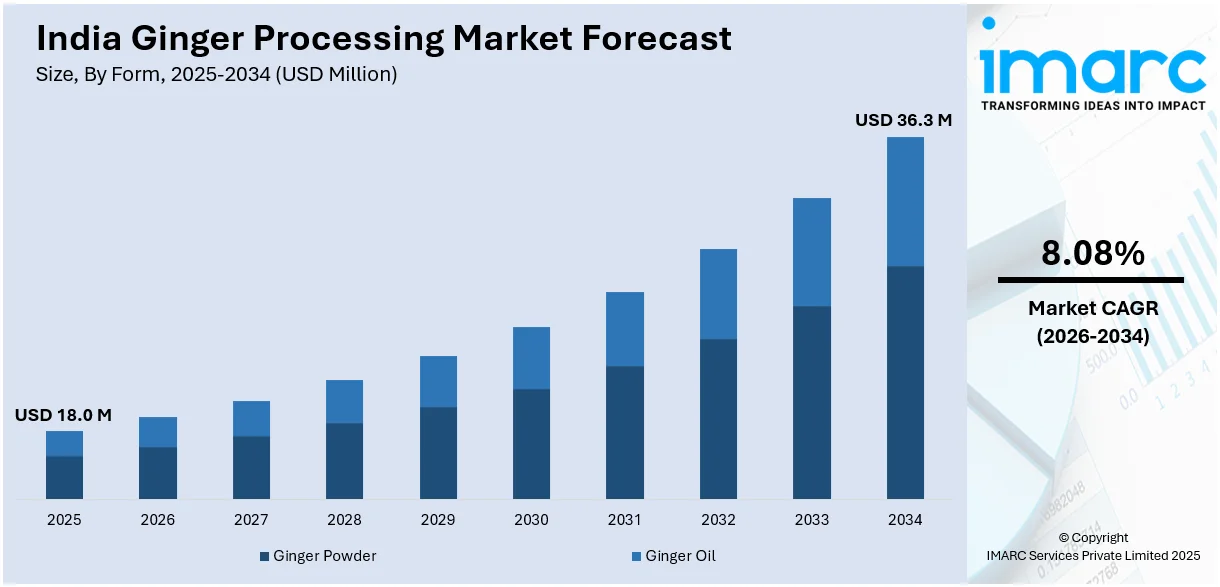

The India ginger processing market size reached USD 18.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 36.3 Million by 2034, exhibiting a growth rate (CAGR) of 8.08% during 2026-2034. The market is witnessing significant growth, driven by the widespread adoption of value-added ginger products and expansion of ginger processing for export markets. Extensive research and development (R&D) activities are contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.0 Million |

| Market Forecast in 2034 | USD 36.3 Million |

| Market Growth Rate (2026-2034) | 8.08% |

India Ginger Processing Market Trends:

Growing Adoption of Value-Added Ginger Products

The India ginger-processing market is changing into value-added powerful products, with increasing consumer preference for convenient and functional food ingredients. On account of their uses in food processing and the pharmaceutical and personal care industries, the demand for ginger processed products such as ginger paste, ginger powder, ginger oil, and ginger extracts is steadily increasing. Food manufacturers use processed ginger in ready-to-eat meals, beverages, and confectionery given its health benefits and pungent flavoring properties. The increasing awareness of ginger's medicinal properties, such as anti-inflammatory and digestive benefits, is further driving its market. E-commerce platforms allow processed ginger products to extend their reach among consumers while providing greater accessibility and wider assortments. For instance, in December 2024, ICAR and IISR introduced India's first vegetable-specific ginger variety, 'IISR Surasa.' This non-pungent, high-yielding variety (24.33 tonnes/hectare) enhances farmer profits with superior organoleptic properties and scientific cultivation methods. Key players are investing in advanced processing technologies to enhance the quality, shelf life, and functional properties of ginger derivatives, catering to both domestic and international markets. With an increasing focus on clean-label ingredients, natural preservatives, and organic formulations, the market is expected to witness sustained expansion. Furthermore, government initiatives supporting agro-processing and export promotion are contributing to the market's growth trajectory, reinforcing India’s position as a leading producer and supplier of processed ginger products.

To get more information on this market Request Sample

Expansion of Ginger Processing for Export Markets

The export-oriented processing of ginger is gaining momentum in India, fueled by the rising global demand for high-quality, processed ginger products. Countries such as the United States, the United Kingdom, Japan, and the Middle East are increasing their imports of Indian ginger in various forms, including dried ginger, oleoresins, essential oils, and dehydrated ginger flakes. For instance, according to industry reports, India exported 24,919 ginger shipments (Mar 2023–Feb 2024), growing 17% annually. In Feb 2024, 1,977 shipments were recorded. The demand is particularly strong in the pharmaceutical, nutraceutical, and food and beverage industries, where Indian ginger is valued for its high gingerol content and strong aromatic properties. Indian exporters are enhancing their processing capabilities to meet stringent international quality and safety standards, including certifications such as HACCP, ISO, and organic labeling requirements. Government policies, including subsidies for food processing units and incentives for export promotion, are further driving the expansion of the sector. The increasing integration of supply chain technologies, cold storage facilities, and efficient logistics networks is improving the competitiveness of Indian ginger in the global market. Moreover, the shift toward sustainable and pesticide-free cultivation practices is strengthening India’s export potential. As global consumers continue to prioritize natural and functional ingredients, India’s processed ginger market is expected to experience steady growth, reinforcing the country’s role as a key supplier in the global supply chain.

India Ginger Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on form, distribution channel, and end use.

Form Insights:

- Ginger Powder

- Ginger Oil

The report has provided a detailed breakup and analysis of the market based on the form. This includes ginger powder and ginger oil.

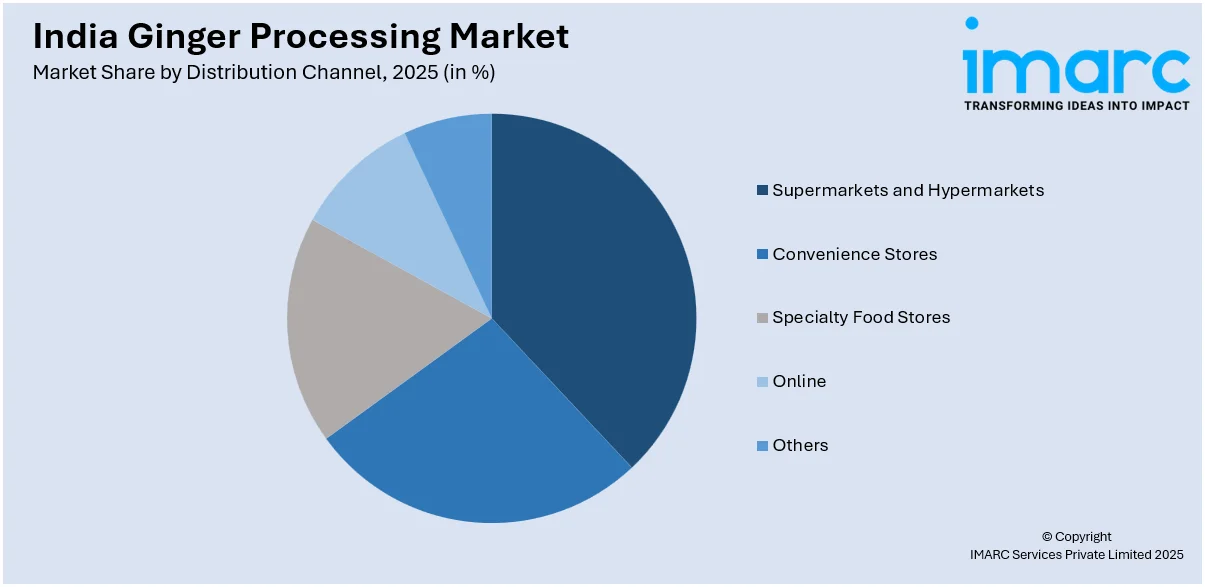

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty food stores, online, and others.

End Use Insights:

- Food Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food industry, pharmaceutical industry, cosmetic industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ginger Processing Market News:

- In July 2024, CURRYiT, one of the most notable food startups in India, announced the launch of India’s first preservative-free/additive-free Ginger Garlic Paste. As per brand representatives, the product is made with traditional homemade techniques, which is similar to the conventional mortar & pestle approach.

- In July 2023, Mother’s Recipe, a notable India brand, announced implementation of measures to maintain the same price for its Ginger Garlic Paste, one of its popular products. This comes as a crucial step, particularly amid the rising retail prices of ginger across the country.

India Ginger Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Ginger Powder, Ginger Oil |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Food Stores, Online, Others |

| End Uses Covered | Food Industry, Pharmaceutical Industry, Cosmetic Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ginger processing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ginger processing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ginger processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ginger processing market in India was valued at USD 18.0 Million in 2025.

The India ginger processing market is projected to exhibit a CAGR of 8.08% during 2026-2034, reaching a value of USD 36.3 Million by 2034.

The market is witnessing significant growth, driven by the widespread adoption of value-added ginger products and expansion of ginger processing for export markets. Extensive research and development (R&D) activities among key players are further contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)