India Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking mode, and Region, 2025-2033

India Glamping Market Overview:

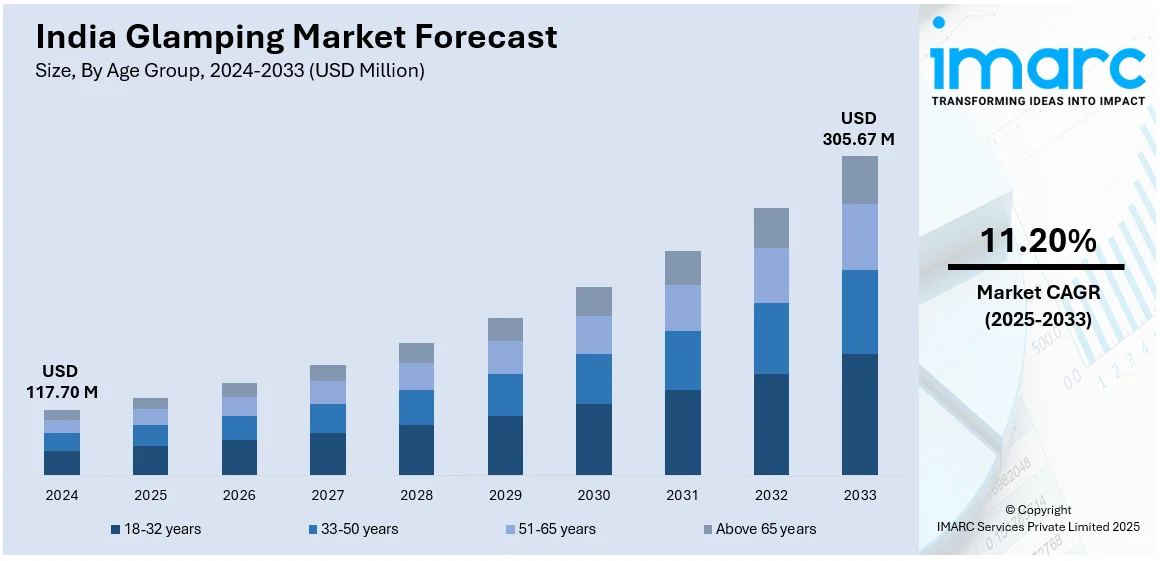

The India glamping market size reached USD 117.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 305.67 Million by 2033, exhibiting a growth rate (CAGR) of 11.20% during 2025-2033. Rising disposable incomes, growing demand for experiential travel, increasing eco-consciousness, preference for luxury outdoor stays, government initiatives promoting sustainable tourism, social media influence, and the expansion of digital booking platforms are key drivers fueling the India glamping market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 117.70 Million |

| Market Forecast in 2033 | USD 305.67 Million |

| Market Growth Rate 2025-2033 | 11.20% |

India Glamping Market Trends:

Rising Demand for Luxury Travel Experiences

The India glamping market share is expanding significantly as travelers seek unique, luxurious, and nature-immersed experiences. Unlike traditional camping, glamping offers premium amenities such as comfortable bedding, private bathrooms, and gourmet dining while maintaining a strong connection to nature. This shift is driven by urban consumers looking for offbeat travel options that combine adventure with comfort. Additionally, social media influence has played a crucial role in popularizing glamping, with travelers sharing aesthetically appealing stays at scenic locations. The rise in disposable incomes and a growing preference for personalized travel experiences further contribute to this trend. For instance, according to updated economic data released by the Indian government on March 2, 2024, per capita disposable income is expected to rise by 8% to INR 2.14 Lakh in the fiscal year 2023–2024. Additionally, the adjustment pointed out that gross national disposable income is predicted to increase by 8.9% in FY24 as opposed to 14.5% in FY23. Furthermore, India's gross savings rate decreased from 30.8% in 2022–2023 to 29.7% in 2022–2023. Hospitality brands and travel startups are increasingly investing in curated glamping experiences, offering themed stays in eco-lodges, treehouses, and waterfront retreats. With the rising interest in sustainable tourism, the demand for eco-friendly glamping accommodations is also growing, making this market a key segment in India's evolving travel industry.

To get more information on this market, Request Sample

Increasing Focus on Sustainable and Eco-Friendly Tourism

Sustainability is becoming a major driving force in the India glamping market as eco-conscious travelers seek accommodations that minimize environmental impact. Many glamping sites are adopting eco-friendly practices such as solar power, rainwater harvesting, and locally sourced materials to offer sustainable yet luxurious stays, which in turn is positively impacting India glamping market outlook. Travelers are increasingly drawn to destinations that promote conservation and responsible tourism, leading to the rise of glamping resorts in remote and ecologically sensitive areas. Government initiatives and industry regulations further support sustainable tourism, encouraging operators to implement green practices. Additionally, the integration of local communities in glamping projects fosters cultural preservation and economic growth. From forest lodges to beachside eco-tents, the emphasis on responsible tourism ensures that travelers can enjoy nature without compromising its integrity. As awareness of environmental issues grows, the demand for sustainable glamping experiences is expected to rise, positioning eco-tourism as a key driver of the glamping market. For instance, Maharashtra Tourism opened its first riverside glamping site near Nashik on February 20, 2025, with 60 tents, including four contemporary pods, tucked away alongside the Gangapur Dam backwaters. This eco-friendly retreat offers guests a combination of luxury and nature, with accommodations categorized into Deluxe, Royal, and Presidential tents, as well as river-view pods that cost ₹6,000 per night for two. Guests can participate in a variety of activities, including Worli Art workshops led by UNESCO World Craft Council awardee Anil Vangad, and take in the tranquil surroundings filled with local wildlife.

India Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

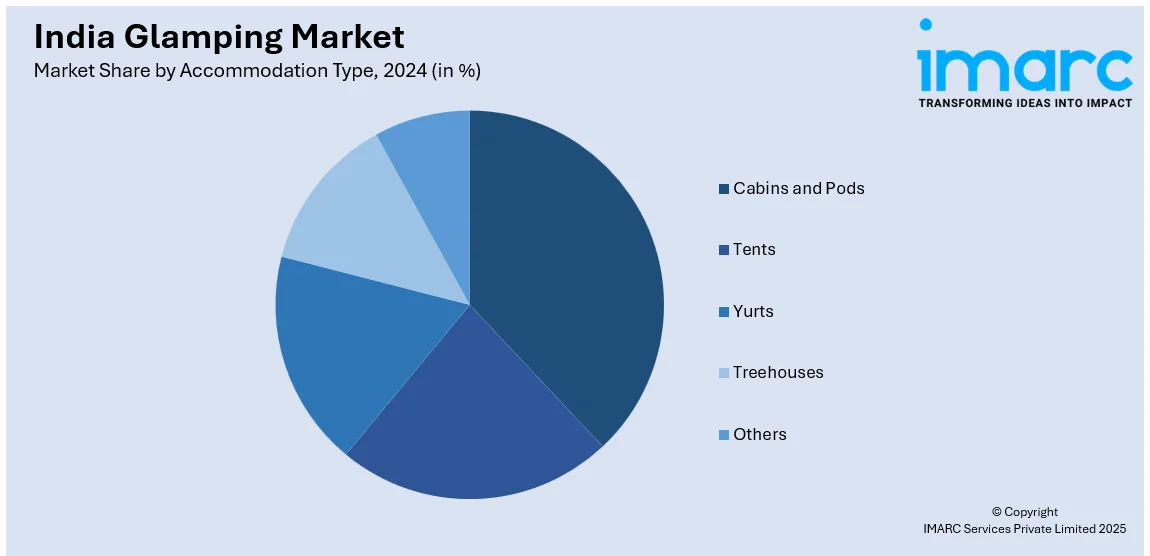

Accommodation Type Insights:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

A detailed breakup and analysis of the market based on the booking mode have also been provided in the report. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Glamping Market News:

- On March 22, 2024, SaffronStays Big Dipper, India's tallest all-weather glamping site, was unveiled. It is located at a height of 9,000 feet in the Bir and Barot Valley mountains. This environmentally friendly hideaway, which was inspired by the Big Dipper constellation, provides visitors with sweeping views of the Milky Way Galaxy, which are visible to the unaided eye because of its immaculate setting. In addition to offering chances for adventure sports like paragliding and trekking, the location blends luxury with sustainability, encouraging introspection and seclusion in the middle of nature.

- On September 10, 2024, a brand-new, environmentally friendly glamping resort with 24 cabins that combine contemporary luxury, and outdoors was opened inside a five-acre mango grove by a division of Loom Crafts, a company renowned for its creative and sustainable design. The resort incorporates environmentally friendly materials and methods into every aspect of its development and management. The resort offers 520 square foot bungalows with outdoor Jacuzzis as part of its lodging options, giving visitors a balanced experience of comfort and environmental responsibility.

India Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India glamping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The glamping market in India reached USD 117.70 Million in 2024.

The India glamping market is projected to exhibit a CAGR of 11.20% during 2025-2033, reaching a value of USD 305.67 Million by 2033.

The market is driven by rising disposable incomes, demand for luxury outdoor stays, experiential travel trends, eco-friendly tourism, government support for sustainable travel, social media influence, and the growth of digital booking platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)