India Glass Market Size, Share, Trends and Forecast by Product Type, End-User Industry, and Region, 2025-2033

India Glass Market Overview:

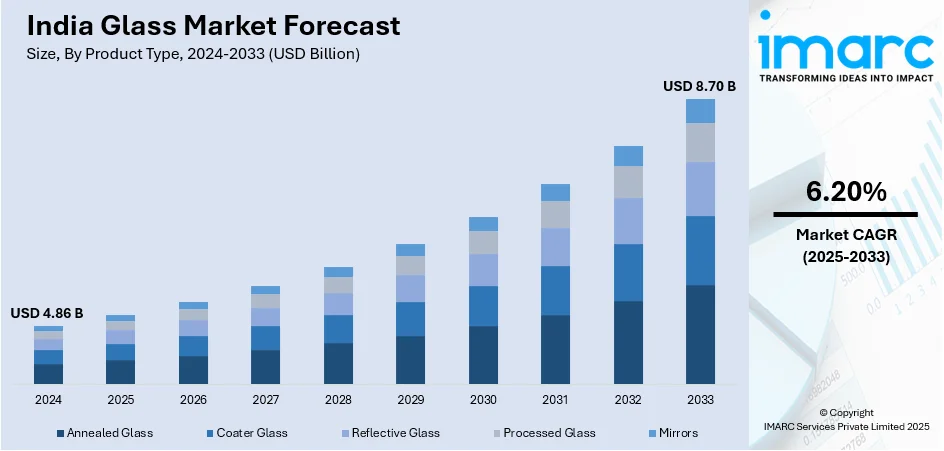

The India glass market size reached USD 4.86 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.70 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is expanding due to rising sustainability efforts and growing demand for decorative applications. Manufacturers are adopting green hydrogen for low-emission production, while customized glass designs in home appliances are driving innovation. These trends enhance energy efficiency, aesthetic appeal, and market growth across sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.86 Billion |

| Market Forecast in 2033 | USD 8.70 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

India Glass Market Trends:

Rising Adoption of Sustainable Glass Production

The growing need to lower carbon emissions and increase energy efficiency is causing a major movement in the market toward sustainable manufacturing processes. Cleaner energy sources are being adopted by the glass industry, especially in the float glass segment, in order to comply with more stringent environmental standards and global sustainability goals. The industry is transforming as a result of the emphasis on green energy options like hydrogen-based production, which reduces industrial emissions and dependency on fossil fuels. In May 2024, Asahi India Glass and INOX Air Products partnered to establish India's first Green Hydrogen Plant for float glass manufacturing at AIS' Chittorgarh facility. This initiative enhances sustainability, reduces carbon emissions by 1,250 MTPA, and strengthens renewable energy adoption in the glass manufacturing sector. This innovation sets a standard for other producers to incorporate green hydrogen technology into their operations and represents a major turning point in India's shift to low-emission glass production. It is anticipated that the move to renewable energy sources will eventually lower production costs while maintaining adherence to environmental regulations. Similarly, this action strengthens India's standing as a pioneer in green industrialization by promoting both domestic and foreign investments in the sustainable glass production ecosystem.

To get more information on this market, Request Sample

Growing Demand for Decorative Glass Applications

The market in India is changing due to rising demand for glass applications that are decorative and design-focused. Manufacturers are introducing modern glass designs with unique finishes as a result of consumers' increasing emphasis on visual appeal in interior spaces and home appliances. Additionally, the trend is especially noticeable in the home appliance industry, where glass is utilized to improve aesthetics in addition to utility. More, glassmakers are concentrating on color variations, patterns, and premium finishes to meet changing market tastes as modern consumers desire personalized designs. In April 2024, Haier India launched the Vogue Series Glass Door Refrigerators, offering customizable glass finishes in multiple colors. This innovation boosts demand for decorative glass in appliances, enhancing design versatility and reinforcing glass applications in premium home appliances, transforming modern kitchen aesthetics in India. This trend is expanding the role of decorative glass beyond traditional applications such as architecture and automotive sectors, increasing its penetration in consumer appliances and lifestyle products. The growing adoption of glass in home decor and appliances is also fostering technological advancements in glass processing, durability enhancements, and scratch-resistant coatings. As demand for premium and personalized home products continues to rise, manufacturers are investing in glass innovation, further driving the growth of India's decorative glass market.

India Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and end-user industry.

Product Type Insights:

- Annealed Glass

- Coater Glass

- Reflective Glass

- Processed Glass

- Mirrors

The report has provided a detailed breakup and analysis of the market based on the product type. This includes annealed glass, coater glass, reflective glass, processed glass, and mirrors.

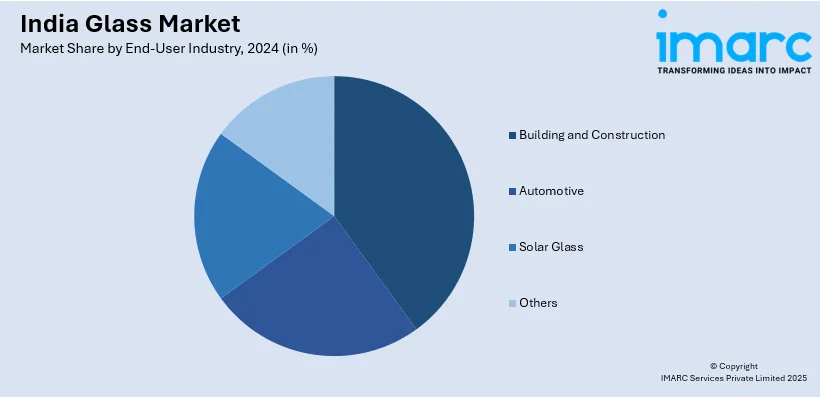

End-User Industry Insights:

- Building and Construction

- Automotive

- Solar Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes building and construction, automotive, solar glass, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Glass Market News:

- September 2024: Corning announced plans to manufacture Gorilla Glass in India by 2025, partnering with Bharat Innovative Glass Technologies. The USD 100 Million Chennai plant will boost local glass production for mobile devices, enhancing supply chain efficiency and strengthening India’s role in the advanced glass industry.

- July 2024: Whirlpool of India launched the Ice Magic Pro Glass Door Refrigerator Range, featuring aesthetic glass door designs inspired by Indian heritage. This innovation enhances demand for decorative glass applications, driving growth in glass-based appliance design and elevating modern home aesthetics in India.

India Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Annealed Glass, Coater Glass, Reflective Glass, Processed Glass, Mirrors |

| End-User Industries Covered | Building and Construction, Automotive, Solar Glass, and Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India glass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The glass market in India was valued at USD 4.86 Billion in 2024.

The India glass market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of USD 8.70 Billion by 2033.

Rising construction activities in residential and commercial sectors are significantly driving the India glass market. Increasing demand for energy-efficient glass in buildings, along with the growth of the automotive and solar industries, is also fueling consumption. Technological advancements in glass processing further support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)