India Government Cloud Market Size, Share, Trends and Forecast by Component, Deployment Model, Service Model, Application, and Region, 2025-2033

India Government Cloud Market Overview:

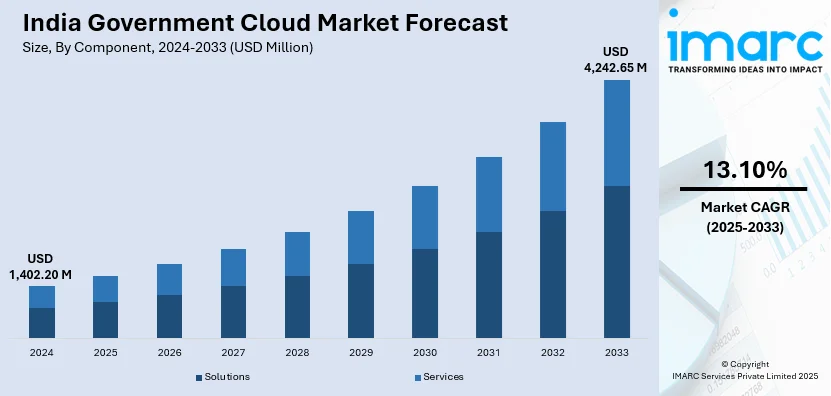

The India government cloud market size reached USD 1,402.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,242.65 Million by 2033, exhibiting a growth rate (CAGR) of 13.10% during 2025-2033. The India government cloud market share is led by initiatives like Digital India and Smart Cities, which foster digital transformation and e-governance. Furthermore, the requirement for cost-effective, scalable IT infrastructure, better data security, and more efficient public service delivery, drives the India government cloud market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,402.20 Million |

| Market Forecast in 2033 | USD 4,242.65 Million |

| Market Growth Rate 2025-2033 | 13.10% |

India Government Cloud Market Trends:

Increasing Adoption of Cloud Services by Government Agencies

One of the key trends in the India government cloud marketplace is growing use of cloud services by numerous government departments at central, state, and local levels. The Indian government is learning the advantages of cloud computing, including cost savings, scalability, and flexibility, and is hence, rapidly embracing cloud technology in public sector functions. Programs like Smart Cities Mission and Digital India have generated immense pressure for government department digital transformation and have encouraged departments to move their applications and storage to cloud infrastructure for services, data, and e-governance. Utilizing cloud-based platforms, central and state governments can organize day-to-day workings, increase ease of services access, and promote enhanced security to data. The cloud enables better management of public services such as education, healthcare, and transportation, making the government systems more transparent, accessible, and accountable. For example, India's data center sector is set for considerable expansion, with projections indicating a notable rise in IT load capacity, currently around 1000 MW. The National Informatics Centre (NIC) has set up advanced National Data Centres (NDC) in locations such as Delhi, Pune, Bhubaneswar, and Hyderabad, offering strong cloud services to government ministries, state administrations, and public sector undertakings (PSUs). At NDC, the storage capacity has been increased to nearly 100PB, encompassing All Flash Enterprise Class Storage, Object Storage, and Unified Storage. Moreover, approximately 5,000 unique servers are utilized to assist different cloud tasks. A new advanced NDC (Tier-III) with 200 Racks that can expand to 400 Racks is being set up in Guwahati, Assam.

To get more information on this market, Request Sample

Rise in Hybrid and Multi-Cloud Strategies in Government IT Infrastructure

Another emerging trend influencing the India government cloud market outlook is the expanding adoption of hybrid and multi-cloud approaches to government IT infrastructure. As governments seek to transform their legacy infrastructure and expand their cloud usage, many are opting for hybrid cloud solutions as a means of retaining control over sensitive information while tapping into the scalability and flexibility of public clouds. A blended model enables the government to hold sensitive information on private clouds or on-premises servers but utilize public cloud services for less critical applications. This model is especially vital for industries such as defense, law enforcement, and healthcare, where the security of the data is of greatest concern. Multi-cloud strategies are also emerging, as they offer greater flexibility and vendor lock-out prevention by leveraging a mix of two or more cloud providers. The growing emphasis on data sovereignty, security, and disaster recovery is driving adoption of these initiatives to enable government agencies to leverage their IT infrastructure optimally while conforming to the regulations and lowering risk. According to industry reports, hybrid multi-cloud continues to be the leading deployment model in India, with 44% of firms utilizing it, outpacing all other ECI nations surveyed. Participants in India ranked data security and ransomware defense as their top concern, with the implementation of AI strategies for 2024 coming next. With AI becoming increasingly prominent for companies, nine out of ten (90%) businesses intend to boost their investment in AI strategy support.

India Government Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, deployment model, service model, and application.

Component Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions, and services.

Deployment Model Insights:

- Hybrid Cloud

- Private Cloud

- Public Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes hybrid cloud, private cloud, and public cloud.

Service Model Insights:

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

The report has provided a detailed breakup and analysis of the market based on the service model. This includes infrastructure as a service, platform as a service, and software as a service.

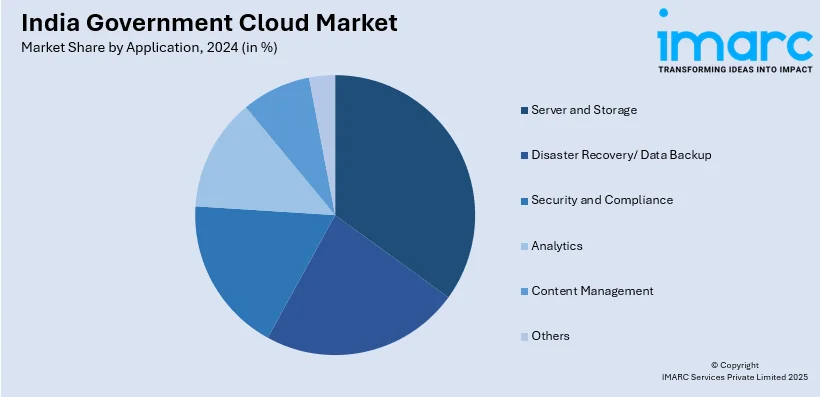

Application Insights:

- Server and Storage

- Disaster Recovery/ Data Backup

- Security and Compliance

- Analytics

- Content Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes server and storage, disaster recovery/data backup, security and compliance, analytics, content management, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Government Cloud Market News:

- In January 2025, Amazon Web Services (AWS) announced its intent to allocate $8.3 billion for cloud infrastructure in the AWS Asia-Pacific (Mumbai) Region of Maharashtra, aiming to enhance cloud computing capacity in India. This investment is projected to add $15.3 billion to India’s gross domestic product (GDP) and sustain over 81,300 full-time positions each year in the local data centre supply chain by 2030.

- In January 2025, Microsoft chairman and CEO Satya Nadella revealed strategic partnerships driven by cloud and AI with the Government of India and major industry leaders from various essential sectors of the Indian economy. This follows a day after Microsoft revealed its intention to invest US $3 billion in cloud and AI infrastructure in India over the next two years, which includes building new data centers.

- In August 2023, Oracle revealed that India’s Ministry of Education selected Oracle Cloud Infrastructure (OCI) to enhance the nation’s education technology initiative 'Digital Infrastructure for Knowledge Sharing' (DIKSHA). This migration will enhance DIKSHA's accessibility and reduce its IT expenses. The platform caters to 1.48 million schools throughout all 35 states and union territories of India and is offered in 36 Indian languages.

India Government Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Deployment Models Covered | Hybrid Cloud, Private Cloud, Public Cloud |

| Service Models Covered | Infrastructure as a Service, Platform as a Service, Software as a Service |

| Applications Covered | Server and Storage, Disaster Recovery/ Data Backup, Security and Compliance, Analytics, Content Management, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India government cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India government cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India government cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India government cloud market was valued at USD 1,402.20 Million in 2024.

The India government cloud market is projected to exhibit a CAGR of 13.10% during 2025-2033, reaching a value of USD 4,242.65 Million by 2033.

The India government cloud market is driven by digital transformation initiatives, data localization policies, and growing demand for secure, scalable infrastructure. Programs like Digital India, smart city development, and e-governance services also boost adoption. Cost efficiency, improved data management, and enhanced citizen service delivery further accelerate market growth across departments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)