India Graphene-enhanced Plastics Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2026-2034

India Graphene-enhanced Plastics Market Summary:

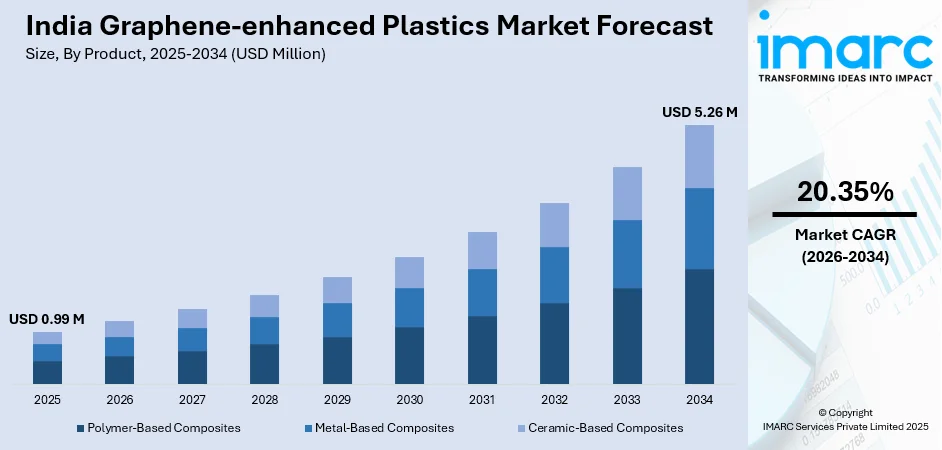

The India graphene-enhanced plastics market size was valued at USD 0.99 Million in 2025 and is projected to reach USD 5.26 Million by 2034, growing at a compound annual growth rate of 20.35% from 2026-2034.

The Indian market is propelled by rapid industrial innovation in automotive and electronics sectors demanding lightweight yet durable materials with superior thermal management properties. West India's established manufacturing infrastructure in Maharashtra and Gujarat, combined with government initiatives accelerating graphene technology commercialization, is supporting the market growth. Additionally, the rise in electric vehicle (EV) production and implementation of strategic government policies is expanding the India graphene-enhanced plastics market share.

Key Takeaways and Insights:

-

By Product: Polymer-based composites dominate the market with a share of 46.6% in 2025, driven by ease of integration into existing thermoplastic production lines and superior performance enhancement ratios.

-

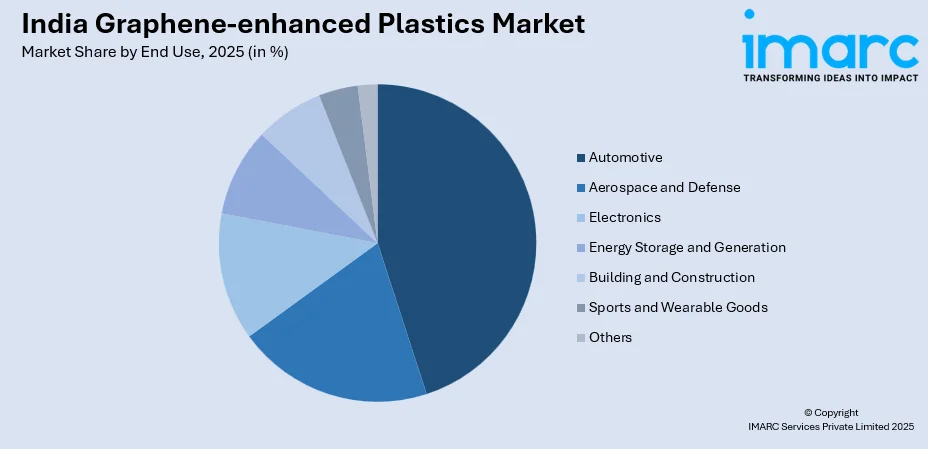

By End Use: Automotive leads the market with a share of 44.2% in 2025, fueled by electric vehicle manufacturing expansion and stringent emission regulations requiring structural weight reduction solutions.

-

By Region: West India represents the largest segment with a market share of 35.9% in 2025, supported by concentrated automotive manufacturing clusters in Pune and robust chemical production capabilities across Gujarat's industrial corridors.

-

Key Players: The India market exhibits moderate competitive intensity with both multinational advanced materials corporations and domestic polymer manufacturers competing across application-specific segments.

To get more information on this market Request Sample

The automotive sector's transition toward electrification creates substantial opportunities for graphene-enhanced plastics that simultaneously reduce vehicle weight while improving battery thermal management efficiency. Electric vehicle (EV) production requires materials delivering exceptional heat dissipation properties to prevent thermal runaway incidents while maintaining structural integrity under varying operational conditions. Graphene's unique two-dimensional structure enables these dual performance requirements at minimal material addition ratios. The electronics industry's pursuit of miniaturization and higher processing speeds generates parallel demand for thermally conductive polymers that enable compact device architectures without compromising reliability. In September 2024, the Ministry of Electronics and Information Technology established the India Graphene Engineering and Innovation Centre under the Graphene Aurora program with INR 94.85 crore outlay, creating comprehensive infrastructure spanning research and development (R&D) facilities to fast-track technology transfer from laboratory research to commercial production scales.

India Graphene-enhanced Plastics Market Trends:

EV Integration Accelerating Material Adoption

The EV revolution fundamentally reshapes material requirements in automotive manufacturing as battery weight necessitates aggressive mass reduction across all other vehicle components to maintain acceptable range performance. Graphene-enhanced plastics address this challenge by delivering strength-to-weight ratios previously unattainable with conventional polymers while simultaneously providing electrical shielding properties protecting sensitive electronic systems from electromagnetic interference. As per IBEF, India is on the path to become the largest EV market by 2030, with increment in investment over the next five years. This manufacturing scale creates sustained demand for advanced composite materials capable of meeting both structural performance specifications and thermal management requirements in battery enclosures and under-hood applications.

Government-Led Technology Commercialization Infrastructure

Strategic government intervention accelerates the transition from academic research to industrial implementation through dedicated institutions bridging the notorious valley of death between laboratory demonstrations and commercial viability. India's approach combines public funding with private sector participation to establish vertically integrated capabilities spanning fundamental research through pilot production and market development activities. The government is also taking proactive measures to set up research and development (R&D) centers in the country to implement research applications of graphene into industrial procedures. IMARC Group predicts that the India graphene market is projected to attain USD 138.35 Million by 2033.

Manufacturing Process Innovations Reducing Production Costs

Industrial viability of graphene-enhanced plastics depends critically on achieving cost structures compatible with high-volume manufacturing while maintaining consistent material performance across production batches. Advances in dispersion technologies and masterbatch formulation methodologies enable effective graphene integration at lower concentration levels, reducing raw material consumption while preserving mechanical and thermal property enhancements. In 2025, Black Swan Graphene Inc. announced that it has signed a non-exclusive distribution and sales agreement with METCO Resources, a prominent Indian supplier of specialty materials and polymers, to provide Black Swan's graphene-enhanced masterbatches known as GEM™ for various polymer applications.

Market Outlook 2026-2034:

The India graphene-enhanced plastics market demonstrates robust expansion potential as manufacturing sectors increasingly prioritize materials enabling simultaneous performance enhancement and environmental sustainability objectives. The market generated a revenue of USD 0.99 Million in 2025 and is projected to reach a revenue of USD 5.26 Million by 2034, growing at a compound annual growth rate of 20.35% from 2026-2034. The convergence of supportive government policies, expanding domestic manufacturing capabilities, and rising end-user awareness regarding graphene's transformative material properties create favorable conditions for accelerated market penetration during the forecast period.

India Graphene-enhanced Plastics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Polymer-Based Composites |

46.6% |

|

End Use |

Automotive |

44.2% |

|

Region |

West India |

35.9% |

Product Insights:

- Polymer-Based Composites

- Metal-Based Composites

- Ceramic-Based Composites

Polymer-based composites dominate with a market share of 46.6% of the total India graphene-enhanced plastics market in 2025.

Polymer-based composites represent the most commercially mature segment within India's graphene-enhanced plastics landscape due to straightforward integration pathways into existing polymer processing infrastructure and demonstrated performance benefits across diverse application requirements. Graphene addition at concentration levels between 0.1 to 5 percent by weight delivers substantial improvements in tensile strength, thermal conductivity, and barrier properties without necessitating fundamental modifications to established manufacturing processes like injection molding or extrusion. In 2024, Scientists at BITS Pilani, Hyderabad Campus, asserted that they created a graphene-like film with improved electrical conductivity utilizing a natural polymer, which may be crucial for developing flexible and wearable electronic devices.

The automotive and electronics industries particularly favor polymer-based graphene composites for applications requiring tailored combinations of mechanical strength, electrical conductivity, and thermal management capabilities. Masterbatch formulations enable precise control over graphene dispersion quality and concentration levels, ensuring consistent material properties across production runs. Apart from this, the product's commercial introduction through distribution partnership with various international key market players validates scalability of graphene-polymer integration technologies for global supply chain deployment.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Electronics

- Energy Storage and Generation

- Building and Construction

- Sports and Wearable Goods

- Others

Automotive leads with a share of 44.2% of the total India graphene-enhanced plastics market in 2025.

The automotive sector's dominance reflects fundamental industry transformation as manufacturers respond to stringent emission regulations and electric vehicle range optimization requirements through systematic component lightweighting initiatives. Graphene-enhanced plastics enable replacement of metal components in non-structural applications while delivering superior thermal management properties essential for battery system reliability and longevity. Automakers are manufacturing vehicle components with 0.5% graphene content, achieving plastic strength. This proven track record demonstrates commercial viability and encourages broader adoption across automotive supply chains.

India's automotive manufacturing landscape undergoes substantial capacity expansion with estimated INR 70,000 crore investment committed by leading passenger vehicle OEMs including Suzuki Motor Corporation across manufacturing facilities over the next three to five to six years. In 2025, BTcorp Generique Nano PVT LTD has introduced ARMI® Graphene Coating, an innovative advancement in nanotechnology and automotive protection that enhances surface protection by providing superior durability, shine, and performance. ARMI® is the world's first of its kind featuring cutting-edge nano graphene architecture, representing a revolutionary advancement in automobile detailing and protection.

Regional Insights:

- North India

- South India

- East India

- West India

West India exhibits a clear dominance with a 35.9% share of the total India graphene-enhanced plastics market in 2025.

West India's market leadership stems from Maharashtra and Gujarat's position as India's premier manufacturing states with comprehensive industrial ecosystems spanning automotive assembly, component manufacturing, and chemical production capabilities. Gujarat's gross value addition in manufacturing grew 15.9 percent annually between FY 2012 and FY 2020 to reach INR 5.11 lakh crore, surpassing Maharashtra to become India's largest manufacturing state according to Reserve Bank of India data. The state witnessed the highest cumulative capital investment at INR 5.85 lakh crore over this period, demonstrating sustained industrial expansion and infrastructure development supporting advanced manufacturing activities.

Pune in Maharashtra functions as India's automotive manufacturing center hosting major production facilities for Tata Motors, Mercedes-Benz, and Bajaj Auto, creating concentrated demand for advanced materials throughout automotive supply chains. Maharashtra and Gujarat together account for a major percent of India's automotive production and exports, establishing critical mass necessary for commercial viability of specialized material suppliers. Gujarat additionally leads in chemicals, petrochemicals, and plastics manufacturing with industrial zones concentrated in Ahmedabad, Surat, and Vadodara. Industrial areas near Ahmedabad and Valsad produce packaging materials for both domestic consumption and export markets. Proximity to major ports at Mumbai and Mundra facilitates efficient material imports and finished goods exports, reducing logistics costs and enabling competitive participation in global supply chains.

Market Dynamics:

Growth Drivers:

Why is the India Graphene-enhanced Plastics Market Growing?

Stringent Emission Standards Driving Automotive Lightweighting

Government regulations mandating progressive reductions in vehicular emissions create powerful economic incentives for automakers to pursue aggressive weight reduction strategies across entire vehicle platforms as mass directly correlates with fuel consumption and carbon dioxide output. Graphene-enhanced plastics enable replacement of heavier materials in suitable applications while maintaining or exceeding original equipment performance specifications, delivering measurable improvements in corporate average fuel economy compliance without compromising safety standards or operational reliability. The EV segment particularly benefits from component lightweighting as battery pack mass necessitates compensatory reductions throughout vehicle structure to achieve acceptable range performance between charging cycles. Japanese automotive giants Toyota, Honda, and Suzuki are together investing almost Rs. 97,504 crore (US$ 11 billion) in India, representing one of the most significant foreign investment pledges in the nation’s automotive industry. Suzuki, possessing approximately 40% of India's automotive market, plans to invest Rs. 70,912 crore (US$ 8 billion) to expand yearly output to four million vehicles. Toyota will increase Rs. 26,592 crore (US$ 3 billion) to enhance its hybrid component supply chain and establish a new facility in Maharashtra. Honda is setting up India as an export hub for its forthcoming Zero Series electric vehicles, with manufacturing starting in 2027. These initiatives are demonstrating scale of manufacturing transformation underway and creating sustained demand for advanced materials enabling design objectives previously unattainable with conventional polymer systems.

Electronics Industry Thermal Management Requirements

Consumer electronics evolution toward higher processing speeds and greater functional density within progressively smaller device form factors generate increasingly challenging thermal management requirements as miniaturization concentrates heat generation within reduced surface areas available for passive cooling. Graphene's exceptional thermal conductivity enables efficient heat dissipation through plastic housings and internal structural components, permitting aggressive device miniaturization without compromising reliability or requiring bulky active cooling systems that increase cost and power consumption. In 2024, Samsung, the largest electronics brand in India, introduced its 2024 collection of Odyssey OLED gaming monitors, Smart Monitors, and ViewFinity monitors, showcasing features that enable enhanced experiences and innovative AI capabilities for consumers. The Odyssey OLED G6 and the Smart Monitor series elevate enjoyment with improved entertainment functionalities, while the AI-driven Smart Monitor M8 and the ViewFinity series enhance connectivity for a fully equipped workstation.

Strategic Regional Manufacturing Infrastructure Development

India's industrial policy framework actively promotes manufacturing sector expansion through infrastructure investments, regulatory streamlining, and financial incentives designed to attract domestic and foreign direct investment into targeted sectors including automotive, electronics, and advanced materials production. Gujarat's business-friendly regulatory environment, robust infrastructure including 42 ports and 65 notified special economic zones, and proximity to major export markets contribute to sustained industrial expansion. Maharashtra and Gujarat together account for approximately 25% of India's automotive production and exports, creating critical mass necessary for economically viable specialized material supplier ecosystems. Major ports at Mumbai and Mundra enable efficient material imports and finished goods exports, reducing logistics costs and supporting competitive participation in global value chains essential for advanced materials market development.

Market Restraints:

What Challenges the India Graphene-enhanced Plastics Market is Facing?

High Production Costs and Complex Integration Processes

Graphene-enhanced plastics remain expensive to produce in India due to the need for advanced compounding equipment, precise processing controls, and high-quality graphene inputs. Achieving uniform dispersion within polymer matrices is technically demanding, and even minor deviations can reduce strength, conductivity, or durability. Manufacturers must invest heavily in melt compounding systems, dispersion aids, testing instruments, and pilot trials before commercial production. These costs raise product prices and reduce competitiveness against conventional plastics or alternative fillers. For small and mid-sized processors, the financial risk is often too high, slowing capacity expansion and limiting wider market participation.

Limited Standardization and Quality Control Protocols

The lack of clear standards for graphene-enhanced plastics creates uncertainty across the value chain. Graphene varies widely in terms of purity, flake thickness, surface chemistry, and defect levels, which directly affects composite performance. Differences in sourcing, processing methods, and dispersion techniques further increase variability between batches. End-use manufacturers in automotive, electronics, or packaging require predictable material behavior to meet safety and performance requirements, but inconsistent properties make qualification difficult. Without widely accepted testing methods, material grades, and certification norms, buyers remain cautious, delaying large-scale adoption and long-term supply agreements.

Skilled Workforce and Technical Knowledge Gaps

Developing graphene-enhanced plastics demands expertise in nanomaterials, polymer chemistry, processing techniques, and performance testing. India faces a shortage of professionals with hands-on experience in graphene handling, dispersion control, and composite design. Many plastic processors rely on traditional filler systems and lack exposure to nanomaterial-based formulations. Training programs, applied research, and industry-academia collaboration are still limited, which slows troubleshooting and process optimization. As a result, product development cycles become longer and commercialization risks increase. Until practical skills and applied knowledge spread across the ecosystem, market growth is likely to remain gradual.

Competitive Landscape:

The India graphene-enhanced plastics market exhibits fragmented competitive structure with multinational advanced materials corporations competing alongside domestic polymer manufacturers and specialty chemical companies across differentiated application segments. Leading global players leverage established graphene production capabilities and extensive intellectual property portfolios to capture premium market segments requiring validated material performance and consistent supply reliability. Domestic manufacturers increasingly develop application-specific formulations targeting cost-sensitive market segments through strategic partnerships with automotive and electronics original equipment manufacturers. Technology commercialization efforts receive substantial support from government-funded research institutions and innovation centers facilitating knowledge transfer from academic research to industrial implementation. Competition increasingly centers on achieving optimal balance between material performance enhancement, production cost competitiveness, and supply chain reliability as market maturity progresses and end-user specifications become more stringent across diverse application requirements.

India Graphene-enhanced Plastics Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Products Covered |

Polymer-Based Composites, Metal-Based Composites, Ceramic-Based Composites |

|

End Uses Covered |

Automotive, Aerospace and Defense, Electronics, Energy Storage and Generation, Building and Construction, Sports and Wearable Goods, Others |

|

Regions Covered |

North India, South India, East India, West India |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India graphene-enhanced plastics market size was valued at USD 0.99 Million in 2025.

The India graphene-enhanced plastics market is expected to grow at a compound annual growth rate of 20.35% from 2026-2034 to reach USD 5.26 Million by 2034.

Polymer-based composites dominated the market with 46.6% share, driven by ease of integration into existing thermoplastic production lines and superior performance enhancement ratios across diverse applications. The segment benefits from established masterbatch formulation technologies enabling precise control over graphene dispersion quality and consistent material properties across production runs.

Key factors driving the India graphene-enhanced plastics market include stringent emission standards propelling automotive lightweighting initiatives as manufacturers respond to electrification mandates and fuel efficiency regulations, electronics industry thermal management requirements necessitating advanced materials for heat dissipation in miniaturized devices, and strategic regional manufacturing infrastructure development particularly in Gujarat and Maharashtra creating concentrated industrial clusters with supporting supply chain ecosystems.

Major challenges include high production costs and complex integration processes requiring specialized equipment and technical expertise for achieving uniform nanomaterial dispersion, limited standardization and quality control protocols creating material property inconsistencies across production batches, and skilled workforce and technical knowledge gaps hampering successful graphene integration as interdisciplinary expertise spanning materials science, chemical engineering, and polymer processing remains scarce in the domestic manufacturing ecosystem.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)