India Graphene Market Size, Share, Trends and Forecast by Type, Application, End-Use Industry, and Region, 2025-2033

India Graphene Market Size and Share:

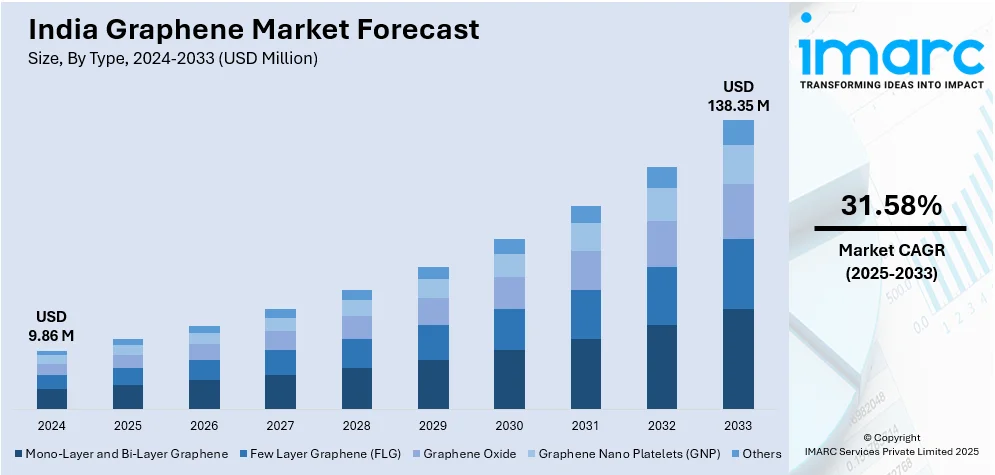

The India graphene market size reached USD 9.86 Million in 2024. The market is expected to reach USD 138.35 Million by 2033, exhibiting a growth rate (CAGR) of 31.58% during 2025-2033. The market growth is attributed to the rising demand for advanced materials in electronics and energy storage, increasing investments in research and development, expanding applications in aerospace and defense, government initiatives for nanotechnology, growing adoption in biomedical and healthcare sectors, and a focus on sustainability and lightweight materials.

Market Insights:

- Based on region, the market is divided into North India, South India, East India, and West India.

- On the basis of type, the market is segmented into mono-layer and bi-layer graphene, Few Layer Graphene (FLG), graphene oxide, Graphene Nano Platelets (GNP), and others.

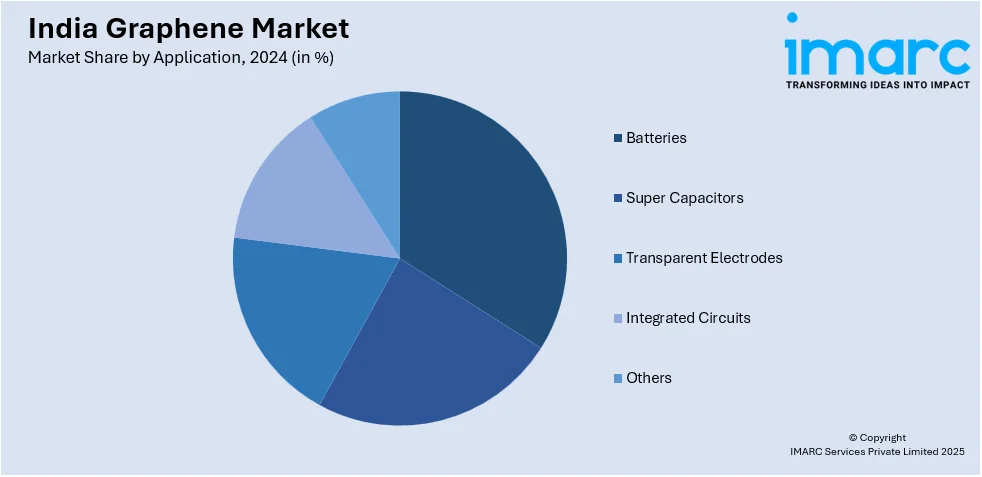

- Based on the application, the market is categorized as batteries, super capacitors, transparent electrodes, integrated circuits, and others.

- On the basis of end-use industry, the market is segmented into electronics and telecommunication, bio-medical and healthcare, energy, aerospace and defense, and others.

Market Size and Forecast:

- 2024 Market Size: USD 9.86 Million

- 2033 Projected Market Size: USD 138.35 Million

- CAGR (2025-2033): 31.58%

India Graphene Market Trends:

Growing Demand for Graphene in Electronics and Energy Storage

The India graphene market growth is driven by the increasing demand in electronics, energy storage, and telecommunications. Graphene’s superior conductivity and lightweight properties make it ideal for applications in batteries, supercapacitors, and flexible electronics. With India's push for renewable energy and electric vehicles, graphene-based batteries and energy storage solutions are gaining traction. For instance, Tivolt Electric Vehicles Private Limited, an EV venture of the Murugappa Group, and Tata Power Renewable Energy Limited (TPREL) inked a Memorandum of Understanding on December 11, 2024, to improve e-mobility for commercial vehicles throughout India. Through this partnership, Tivolt's growing statewide network of small electric commercial cars and TPREL's experience in a variety of EV charging solutions will be combined to create a strong EV charging ecosystem. The project lowers carbon footprints and consumer charging costs by integrating solar energy systems at Tivolt dealerships and client sites, demonstrating a dedication to sustainability. Government initiatives promoting research in nanotechnology and advanced materials are further fueling market expansion. Additionally, major industry players are investing in graphene production and R&D to enhance its commercial viability, making it a key material in India’s technological advancements over the coming years.

To get more information on this market, Request Sample

Advancements in Biomedical and Healthcare Applications

Graphene’s biocompatibility, high surface area, and antimicrobial properties are driving its adoption in the biomedical sector in India. This trend is significantly expanding the India graphene industry size. Researchers are exploring graphene-based biosensors for early disease detection, drug delivery systems, and tissue engineering applications. The rise in healthcare investments and government support for medical technology innovation are accelerating market penetration. Notably, the PGIM India Healthcare Fund, an open-ended equity strategy aimed at investments in the pharmaceutical and healthcare industries, was unveiled by PGIM India Mutual Fund on November 20, 2024. The fund will be open for subscriptions from November 19 to December 3, 2024, and it will start selling and repurchasing continuously on December 11, 2024. The fund, which targets long-term investors, aims to profit from India's growing healthcare sector, which is being propelled by rising income levels, heightened awareness of preventative healthcare, and government healthcare spending that is expected to account for 2.5% of the country's GDP by 2025. Furthermore, graphene oxide is being utilized in water purification and antimicrobial coatings, promoting sustainability. Indian startups and research institutions are increasingly collaborating to develop cost-effective graphene solutions, paving the way for its integration into mainstream healthcare, diagnostics, and medical device manufacturing in the near future, which in turn will positively impact the India graphene market outlook.

Increasing Applications and Production

The market is witnessing rapid diversification of applications across sectors such as construction, automotive, textiles, and water treatment. In infrastructure, graphene-enhanced concrete offers improved tensile strength, reduced material usage, and greater durability, while in the automotive sector, its incorporation in tires enhances wear resistance and fuel efficiency. In textiles, graphene-infused fabrics provide thermal regulation and antibacterial properties, and in water purification, graphene-based membranes enable higher filtration efficiency. However, scaling up production remains challenging due to the high cost of chemical vapor deposition (CVD) processes and inconsistencies in the quality of graphene nanoplatelets. This has created a pressing need for Bureau of Indian Standards (BIS)-grade benchmarks and certification frameworks to ensure material reliability for industrial adoption. Moreover, new e-commerce platforms are emerging as distribution channels in the graphene industry in India, alongside sustainable production models leveraging biomass and waste carbon sources, aligning with India’s broader environmental and circular economy goals.

Expanding Government Support and Strategic Partnerships

Government initiatives and collaborative ventures are significantly shaping the Indian graphene ecosystem. Under the “Atmanirbhar Bharat” program, central and state-level policies are fostering domestic manufacturing, research, and commercialization of graphene-based products. Moreover, regional hubs are emerging with specialized focuses, for instance, Karnataka is promoting graphene applications in electric vehicles, Kerala is positioning itself as a research and development center, and Gujarat is advancing industrial uses such as protective coatings. Apart from this, India graphene market forecast, academic–industry partnerships are set to drive innovation, with notable examples including IIT Madras collaborating with Log 9 Materials for scalable applications. Digital platforms like Hiyka.com are connecting researchers, suppliers, and buyers, enabling knowledge exchange and market access. State governments, particularly in Kerala and Karnataka, are providing infrastructure, incubation support, and funding for graphene startups, creating a conducive environment for innovation. These coordinated efforts are accelerating the translation of graphene research into commercially viable products, strengthening India’s competitive position in the global advanced materials market.

India Graphene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, application, and end-use industry.

Type Insights:

- Mono-Layer and Bi-Layer Graphene

- Few Layer Graphene (FLG)

- Graphene Oxide

- Graphene Nano Platelets (GNP)

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes mono-layer and bi-layer graphene, Few Layer Graphene (FLG), graphene oxide, Graphene Nano Platelets (GNP), and others.

Application Insights:

- Batteries

- Super Capacitors

- Transparent Electrodes

- Integrated Circuits

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the India graphene market research report. This includes batteries, super capacitors, transparent electrodes, integrated circuits, and others.

End-Use Industry Insights:

- Electronics and Telecommunication

- Bio-medical and Healthcare

- Energy

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes electronics and telecommunication, bio-medical and healthcare, energy, aerospace and defense, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Graphene Market News:

- In July 2025, TACC Limited, a graphene and synthetic graphite innovator within the LNJ Bhilwara Group, signed a Memorandum of Understanding (MoU) with the National Council for Cement and Building Materials (NCB). The agreement aims to harness TACC’s graphene-based additives and NCB’s concrete-technology expertise to develop sustainable, high-performance concrete with improved strength, durability, and reduced carbon emissions, supporting India’s net-zero ambitions. This collaboration marks a strategic step in the graphene market in India and denotes a move towards climate-resilient infrastructure in India.

- In June 2025, Black Swan Graphene Inc. entered into a non-exclusive distribution and sales agreement with METCO Resources, a leading Indian supplier of specialty materials and polymers, to supply its graphene nanoplatelets and GEM™ advanced masterbatch products across India’s industrial, packaging, automotive, and construction sectors. This strategic collaboration aligns with Black Swan’s broader objective to expand its global footprint by partnering with regionally experienced distributors with strong commercial and technical capacity.

- In January 2025, TACC Ltd., signed a non-binding Memorandum of Understanding (MoU) with Sri Lanka–based Ceylon Graphene Technologies (CGT) to jointly establish a state-of-the-art graphene manufacturing facility in India. This strategic collaboration will leverage CGT’s expertise in processing premium Sri Lankan vein graphite alongside TACC’s synthetic graphite capabilities to support large-scale production of high-quality graphene and its derivatives. The initiative aims to drive sustainable, innovative graphene solutions catering to global markets, thereby expanding the graphene industry size in India.

- On November 25, 2024, Asian Paints debuted their newest ad campaign which showcases the launch of graphene-enhanced Apex Ultima Protek. Asian Paints demonstrates its dedication to sustainability and innovation in offering long-lasting solutions for Indian houses by utilizing graphene, a substance renowned for its strength and tenacity.

- On September 5, 2024, the Ministry of Electronics and Information Technology (MeitY) announced that the India Graphene Engineering and Innovation Centre (IGEIC) will be established in Kerala with the goal of making the state a pioneer in cutting-edge materials. The non-profit IGEIC will encourage partnerships between startups, SMEs, industry, government, and academics in order to create a strong graphene ecosystem. Strategically, Kerala's dedication to sustainability and technical innovation would be highlighted by the R&D center located in Thiruvananthapuram and the production plant located in Palakkad.

India Graphene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mono-Layer and Bi-Layer Graphene, Few Layer Graphene (FLG), Graphene Oxide, Graphene Nano Platelets (GNP), Others |

| Applications Covered | Batteries, Super Capacitors, Transparent Electrodes, Integrated Circuits, Others |

| End-Use Industries Covered | Electronics and Telecommunication, Bio-medical and Healthcare, Energy, Aerospace and Defense, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India graphene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India graphene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India graphene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The graphene market in the India was valued at USD 9.86 Million in 2024.

The India graphene market is projected to exhibit a CAGR of 31.58% during 2025-2033, reaching a value of USD 138.35 Million by 2033.

Key factors driving the India graphene market include rising demand for advanced materials in electronics, energy storage, and composites. Government support for nanotechnology research, growing interest from automotive and aerospace sectors, and the push for lightweight, high-strength, and conductive materials are accelerating graphene adoption across industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)