India Graphite Electrodes Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Graphite Electrodes Market Overview:

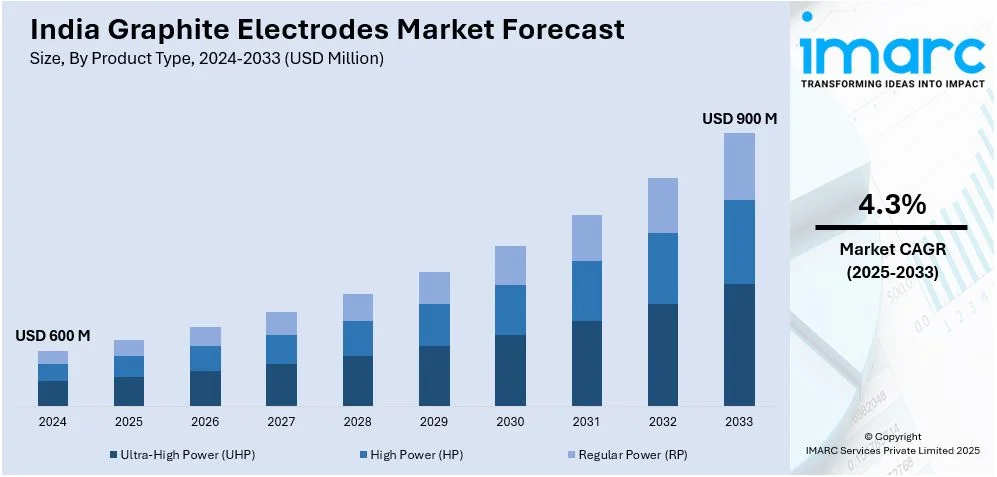

The India graphite electrodes market size reached USD 600 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 900 Million by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033. The market is driven by rising steel production, fueled by infrastructure development and urbanization. The shift to electric arc furnaces for cost-effective and eco-friendly steelmaking further augments the India graphite electrodes market share. The implementation of supportive government initiatives, including "Make in India" and stricter environmental regulations promoting sustainable manufacturing practices, also contribute significantly to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 600 Million |

| Market Forecast in 2033 | USD 900 Million |

| Market Growth Rate 2025-2033 | 4.3% |

India Graphite Electrodes Market Trends:

Increasing Demand from the Steel Industry

The rising demand from the steel industry is significantly supporting the India graphite electrodes market growth. Graphite electrodes are essential components in electric arc furnaces (EAFs), which are widely used for steel production. According to a research report by IMARC Group, the steel market in India reached a volume of 144.43 Million Tons in 2024. In the given projection, the market is expected to reach 256.73 million tons by the year 2033, with a CAGR of 6.20% from 2025 to 2033. India has made infrastructure development and urbanization a priority, leading to an increased steel demand, which, in turn, influences graphite electrode consumption. Moreover, the traditional blast furnace vs. Electric Arc Furnace (EAF) shift due to their cost-effectiveness and environmentally friendly nature is also propelling the growth of the market. The other critical enabler in this trend has been the focus of the government on enhancing domestic steel production through schemes such as "Make in India". With steel manufacturers expanding their production capacities, the requirement for high-quality graphite electrodes is expected to grow continuously, providing lucrative opportunities for stakeholders in this market.

To get more information on this market, Request Sample

Growing Emphasis on Sustainable Manufacturing Practices

The increasing focus on sustainable and eco-friendly manufacturing processes is creating a positive India graphite electrodes market outlook. With global concerns over carbon emissions and environmental degradation, manufacturers are adopting greener technologies to produce graphite electrodes. This includes using recycled materials and optimizing energy consumption during production. Additionally, stricter environmental regulations imposed by the Indian government are pushing companies to innovate and reduce their carbon footprint. The rise of renewable energy sources, such as solar and wind power, is also influencing the market, as these technologies require high-purity graphite for energy storage solutions. According to industry reports, India's solar power generation, with a capacity of 92.12 GW, and wind generation, with a capacity of 47.72 GW, has successfully achieved 200 GW-plus of renewable capacity, currently representing over 46.3% of the total power generation in the country. The country has an ambitious target of achieving 500 GW from non-fossil fuel sources by 2030. The rapid growth of the sector has led to significant demand for critical industrial materials, particularly graphite electrodes that are critical to energy storage and grid infrastructure. With increasing demand for renewable energy, the graphite electrodes market in India will witness significant growth to support clean energy progress. As sustainability becomes a priority for industries, the graphite electrodes market is expected to align with these changing demands, fostering long-term growth and innovation.

India Graphite Electrodes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Ultra-High Power (UHP)

- High Power (HP)

- Regular Power (RP)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ultra-high power (UHP), high power (HP), and regular power (RP).

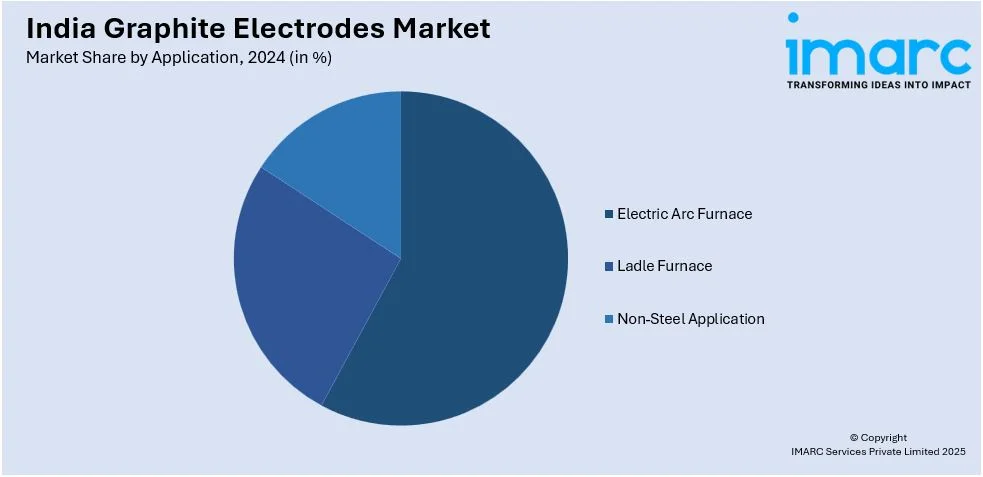

Application Insights:

- Electric Arc Furnace

- Ladle Furnace

- Non-Steel Application

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes electric arc furnace, ladle furnace, and non-steel application.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Graphite Electrodes Market News:

- January 14, 2025: HEG Ltd's subsidiary, TACC Ltd, signed a joint venture agreement with Ceylon Graphene Technologies (CGT) to set up the graphene production plant in India. The project will use Sri Lanka's high-quality vein graphite together with TACC's synthetic graphite expertise. To do this, the facility will help increase the scale of graphene production for global markets, incentivizing development in energy storage, electronics, and composite materials. This strategic development further consolidates HEG's position in the graphite electrodes space while expanding India’s footprint in advanced materials.

India Graphite Electrodes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ultra-High Power (UHP), High Power (HP), Regular Power (RP) |

| Applications Covered | Electric Arc Furnace, Ladle Furnace, Non-Steel Application |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India graphite electrodes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India graphite electrodes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India graphite electrodes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The graphite electrodes market in India was valued at USD 600 Million in 2024.

The India graphite electrodes market is projected to exhibit a (CAGR) of 4.3% during 2025-2033, reaching a value of USD 900 Million by 2033.

Heavy steel production through electric arc furnaces, rising investments in infrastructure, and rising demand for specialty graphite in lithium-ion batteries are key drivers. Supportive government policies for local manufacturing and the shift towards electric vehicles also spur demand. Moreover, variations in needle coke supply across the world impact local graphite electrode making trends in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)