India Green Hydrogen Market Size, Share, Trends and Forecast by Technology, Application, Distribution Channel, and Region 2026-2034

India Green Hydrogen Market Summary:

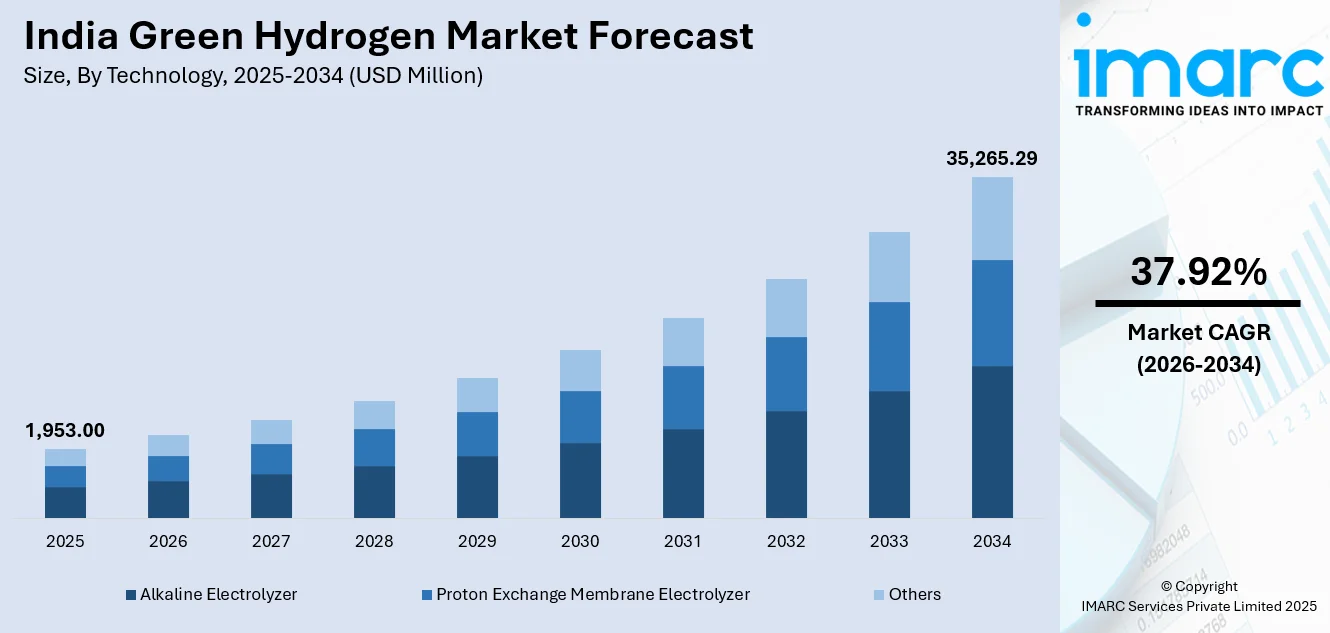

The India green hydrogen market size was valued at USD 1,953.00 Million in 2025 and is projected to reach USD 35,265.29 Million by 2034, growing at a compound annual growth rate of 37.92% from 2026-2034.

The India green hydrogen market is driven by strong government policy support, decarbonisation targets, and the need to reduce dependence on imported fossil fuels. National initiatives promoting clean energy adoption encourage investments across production, storage, and distribution. Falling renewable energy costs improve project viability, while demand from refining, fertilizers, steel, and heavy transport sectors supports market uptake. The growing private sector participation, pilot projects, and infrastructure development further accelerate green hydrogen deployment across industrial and mobility applications.

Key Takeaways and Insights:

- By Technology: Alkaline electrolyzer dominates the market with a share of 46% in 2025, driven by its established technology base, lower capital costs compared to PEM alternatives, and proven suitability for large-scale hydrogen production applications.

- By Application: Transport leads the market with a share of 40% in 2025, owing to increasing adoption of hydrogen fuel cell vehicles, government initiatives promoting clean mobility, and the growing investments in hydrogen refueling infrastructure.

- By Distribution Channel: Pipeline represents the largest segment with a market share of 55% in 2025. This dominance is because of the existing natural gas pipeline network and authorized infrastructure providing potential pathways for hydrogen transport.

- By Region: North India dominates the market with a share of 28% in 2025, supported by proximity to industrial demand centers, favorable renewable energy resources, and strategic government initiatives for hydrogen hub development.

- Key Players: The India green hydrogen market exhibits moderate competitive intensity, with major public sector undertakings and private conglomerates competing across production, distribution, and technology development segments.

To get more information on this market Request Sample

The India green hydrogen market is driven by the combined push for energy security, emission reduction, and industrial modernization. Reducing dependence on imported fossil fuels and decarbonizing energy-intensive sectors are elevating green hydrogen as a strategic priority. Large renewable energy capacity enables cost-efficient production, while declining electrolyzer costs enhance project viability. Policy backing under national clean energy programs, along with coordinated planning for storage and transport infrastructure, lowers execution and investment risk. This direction is reflected in 2026, as India’s green hydrogen production facility for its first hydrogen-powered train approaches start-up, supplying continuous fuel for the Northern Railway’s Jind–Sonipat route and supporting regular rail operations. Such sectoral integration demonstrates operational readiness and expands demand beyond industry. The growing private investment, domestic manufacturing, and research-driven innovation further influence the market, creating conditions for large-scale deployment and sustained growth.

India Green Hydrogen Market Trends:

Expansion of Domestic Electrolyzer Manufacturing Capacity

Scaling domestic electrolyzer manufacturing is bolstering the India green hydrogen market growth by improving supply availability, cost control, and deployment speed. Local production reduces dependence on imports, shortens project timelines, and strengthens technology self-reliance. Manufacturing scale also supports standardization and learning efficiencies across large hydrogen projects. This momentum was evident in 2024 when Ohmium International commissioned a 2 GW electrolyzer gigafactory near Bengaluru, expandable to 4 GW, to produce hyper-modular PEM electrolyzers for global deployment, with potential to abate up to four million tons of CO₂ annually. Such capacity expansion strengthens India’s manufacturing base and underpins long-term growth of large-scale green hydrogen projects.

Institutional Capacity Building and Certification Frameworks

Government-led capacity building and standard-setting initiatives are strengthening confidence in India green hydrogen market. Structured engagement with small and medium enterprises (SMEs) increases participation across manufacturing, services, and supply chain activities, reducing concentration risk and improving scalability. Market credibility is further enhanced through formal certification systems that assure transparency, traceability, and product integrity. This direction was evident in 2025, when the Ministry of New and Renewable Energy conducted a national workshop in New Delhi and launched the Green Hydrogen Certification Scheme of India, reinforcing MSMEs as core contributors under the National Green Hydrogen Mission. Such institutional support improves investor trust, accelerates supplier readiness, and contributes to the market growth.

Advancement of Green Hydrogen Applications in Transport and Mobility

Deployment of fuel cell technology in transport segments supports decarbonization goals while creating new, high-visibility use cases beyond industrial usage. Progress in domestic engineering and system integration improves confidence in hydrogen as a reliable energy carrier. This momentum was reinforced in 2026 when India launched its first indigenously built hydrogen fuel cell vessel for inland waterways, operating with zero direct emissions under the National Green Hydrogen Mission. Such developments validate technological readiness, stimulate downstream demand, and encourage investment in production, storage, and refueling infrastructure, supporting the market growth.

Market Outlook 2026-2034:

The India green hydrogen market demonstrates exceptional growth potential throughout the forecast period, supported by long-term policy commitments and rapid expansion of renewable energy capacity. Strong emphasis on decarbonizing hard-to-abate sectors, reducing energy imports, and building domestic clean fuel capabilities is accelerating project development. Investments in electrolyzer manufacturing, pilot projects, and hydrogen hubs further strengthen the market growth. The market generated a revenue of USD 1,953.00 Million in 2025 and is projected to reach a revenue of USD 35,265.29 Million by 2034, growing at a compound annual growth rate of 37.92% from 2026-2034.

India Green Hydrogen Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Technology |

Alkaline Electrolyzer |

46% |

|

Application |

Transport |

40% |

|

Distribution Channel |

Pipeline |

55% |

|

Region |

North India |

28% |

Technology Insights:

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Others

Alkaline electrolyzer dominates with a market share of 46% of the total India green hydrogen market in 2025.

Alkaline electrolyzer holds the biggest market share because of its cost efficiency, technical maturity, and long operating history across industrial applications. This system uses established materials and manufacturing processes, resulting in lower capital expenditure compared to newer technologies. Its ability to operate reliably at large scales makes it suitable for early-stage hydrogen projects linked to refineries, fertilizers, and chemical plants. Proven performance under Indian operating conditions further supports adoption by developers seeking stable returns and lower project risk.

This dominance is reinforced by the availability of domestic manufacturing capabilities and compatibility with existing infrastructure. Support from government-backed pilot projects and industrial decarbonization initiatives continues to favor alkaline technology as the preferred choice during the initial scale-up phase of India’s green hydrogen ecosystem. For instance, in 2024, Bharat Petroleum Corporation Ltd (BPCL), in partnership with the Bhabha Atomic Research Centre, unveiled India’s first indigenous alkaline electrolyzer at India Energy Week 2024 in Goa. This development supported India’s goal to build 5 million tons of annual green hydrogen capacity by 2030.

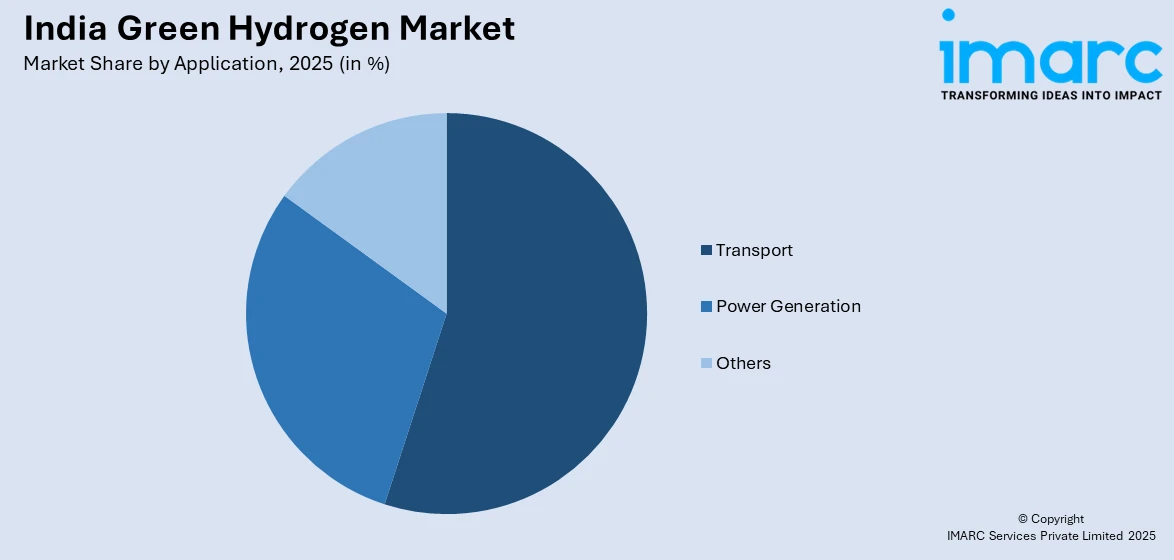

Application Insights:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Transport

- Others

Transport leads with a market share of 40% of the total India green hydrogen market in 2025.

Transport represents the largest segment owing to the growing need to decarbonize heavy-duty and long-haul mobility segments where battery electrification faces practical limitations. Green hydrogen offers high energy density and faster refueling, making it suitable for buses, trucks, rail, and future shipping applications. National clean mobility targets and pilot deployments of hydrogen-powered vehicles support early demand. Public transport fleets and logistics operators view hydrogen as a viable pathway to reduce emissions without compromising operational range or payload capacity.

This leadership is bolstered by initiatives led by the government that promote hydrogen corridors, refueling infrastructure, and demonstration projects along key transport routes. Investing in hydrogen fuel cell buses and trains boosts market presence and promotes private involvement. In 2026, Concord Control Systems obtained a ₹470 million contract from NTPC to deliver a 3,100 HP green hydrogen hybrid locomotive, marking a global first in high-horsepower hydrogen rail propulsion. The initiative encompasses updating a hydrogen system based on fuel cells for freight operations at NTPC's Sipat site, with implementation scheduled for 18 months. Marketed as a large-scale commercial solution, the locomotive aids India's rail decarbonization efforts and net-zero objectives before 2030.

Distribution Channel Insights:

- Pipeline

- Cargo

Pipeline exhibits a clear dominance with a 55% share of the total India green hydrogen market in 2025.

Pipeline dominates the market due to its ability to transport large volumes of hydrogen efficiently and at lower operating costs over long distances. As green hydrogen production scales up near renewable energy hubs, pipelines provide a continuous and reliable delivery method to industrial users, refineries, and mobility clusters. This mode reduces dependence on road transport, lowers emissions associated with logistics, and improves supply consistency, making it suitable for supporting steady, high-demand applications across energy-intensive sectors.

The dominance of pipelines is further supported by their compatibility with existing natural gas infrastructure and long-term energy planning strategies. Blending hydrogen into gas networks and repurposing pipelines helps lower capital expenditure while accelerating deployment. Pipeline also enhances safety through controlled transport conditions and real-time monitoring. Government focus on hydrogen corridors and integrated energy infrastructure encourages pipeline development, ensuring secure distribution, lower unit transport costs, and scalable delivery as India’s green hydrogen market growth.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with a market share of 28% of the total India green hydrogen market in 2025.

North India leads the market owing to policy backing, industrial density, and access to large renewable energy resources. States including Rajasthan, Haryana, and Uttar Pradesh benefit from strong solar potential, supporting cost-efficient hydrogen production. Concentration of refineries, fertilizer facilities, and steel plants ensures stable demand for hydrogen as a clean fuel and feedstock. This momentum was reinforced in 2025 when Uttar Pradesh commissioned its first green hydrogen plant in Gorakhpur, producing around 72 tons annually for blending with city gas networks. Supported by the state’s Green Hydrogen Policy 2024, the project strengthened regional leadership.

This regional leadership is reinforced by central government initiatives, pilot hydrogen hubs, and public sector investments concentrated in North India. Availability of land for large-scale renewable projects, coupled with improving transmission connectivity, supports integrated production facilities. Research institutions, public-sector undertakings, and private developers actively collaborate on demonstration projects, accelerating commercialization. Early adoption by industrial clusters and transport applications strengthens demand visibility, positioning North India as a focal point for green hydrogen deployment and long-term market growth.

Market Dynamics:

Growth Drivers:

Why is the India Green Hydrogen Market Growing?

Research-Driven Technology Optimization and Policy Alignment

Advancement in academic and applied research is strengthening the technological foundation of India’s green hydrogen market. Evidence-based studies improve understanding of lifecycle emissions, efficiency trade-offs, and material requirements, enabling informed technology selection and long-term planning. This alignment between research outputs and policy design reduces investment risk and supports scalable deployment pathways. In 2025, researchers at IIT Madras published a comprehensive roadmap in Energy & Fuels examining the role of Proton Exchange Membrane electrolyzers in sustainable hydrogen production, addressing emissions performance, resource security, and scalability. Such research-led guidance enhances policy clarity, supports domestic innovation, and accelerates market maturation through scientifically grounded decision-making.

Deployment of Green Hydrogen in Port and Maritime Infrastructure

Integration of green hydrogen into port operations is emerging as a crucial growth driver by creating anchored, long-term demand within energy-intensive maritime hubs. Ports require reliable fuel for equipment, logistics, and auxiliary power, making them suitable early adopters of clean hydrogen. This shift was demonstrated in 2025 when India inaugurated a 1 MW green hydrogen plant at Deendayal Port Authority, Kandla, as part of a planned 10 MW project producing around 140 metric tons annually to support port decarbonization. Such infrastructure-led adoption validates commercial use, encourages replication across ports, and strengthens the investment case for large-scale domestic hydrogen production.

Development of Integrated Hydrogen Innovation Clusters

Creation of end-to-end hydrogen ecosystems is impelling the market growth by reducing fragmentation across the value chain. Integrated clusters enable coordinated development of production, storage, transport, and end-use infrastructure, improving cost efficiency and technology learning. Concentrating activity within defined zones supports faster commercialization, skill development, and supply chain integration. This approach was reinforced in 2025 when India announced four Hydrogen Valley Innovation Clusters with a combined investment of ₹485 crore under the National Green Hydrogen Mission, supported by industry partners. By enabling full-scale demonstrations and industrial collaboration, such clusters strengthen innovation capacity, improve global competitiveness, and create scalable templates for nationwide expansion of the green hydrogen market.

Market Restraints:

What Challenges the India Green Hydrogen Market is Facing?

High Production Costs Limiting Commercial Viability

High production costs continue to limit the commercial viability of green hydrogen across key applications. The substantial green premium makes green hydrogen nearly two to four times more expensive than conventional hydrogen or fossil fuel alternatives. This cost gap restricts widespread adoption and creates dependence on long-term policy incentives, subsidies, and demand mandates to support market growth.

Inadequate Storage and Transportation Infrastructure

Limited development of dedicated hydrogen pipelines, storage facilities, and refueling networks continues to restrict market growth and create distribution bottlenecks. Infrastructure for transportation, storage, and grid integration remains capital intensive and underdeveloped. Substantial long-term investment is required to support rising production capacity and ensure efficient, reliable delivery of hydrogen to industrial, mobility, and power sector end users.

Technology Risk and Electrolyzer Efficiency Challenges

Electrolyzer technology still requires further improvement in efficiency and durability to support large-scale deployment. Uncertainty around operating life, maintenance needs, repair expenses, and long-term performance increases perceived technology risk. These concerns affect lender confidence, complicate financing structures, and contribute to cautious investment decisions, slowing the pace of green hydrogen project development.

Competitive Landscape:

The India green hydrogen market exhibits moderate competitive intensity characterized by the presence of major public sector undertakings alongside private conglomerates competing across production, technology development, and infrastructure segments. Market dynamics reflect strategic positioning, ranging from large-scale integrated hydrogen hubs to specialized electrolyzer manufacturing facilities. The competitive landscape is increasingly shaped by technology partnerships with global electrolyzer providers, joint ventures for renewable energy integration, and strategic investments in export-oriented green ammonia production. Companies are differentiating through domestic manufacturing capabilities, end-to-end project development expertise, and strategic positioning across the hydrogen value chain.

Recent Developments:

- January 2026: India announced a new INR 100 crore funding programme under the National Green Hydrogen Mission to support pilot-scale hydrogen production from biomass and alternative feedstocks. Led by BIRAC, the scheme prioritizes biomass-based routes, wastewater use, and floating solar integration, offering up to INR 25 crore per project for TRL 5–6 technologies.

- January 2026: Andhra Pradesh Chief Minister N. Chandrababu Naidu declared Kakinada as the “Green Hydrogen Valley of India” during the foundation ceremony of AM Green’s ₹15,600-crore green hydrogen and green ammonia complex. Backed by the National Green Hydrogen Mission, the facility is positioned as one of the world’s largest and is expected to place Kakinada on the global clean energy map.

India Green Hydrogen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Others |

| Applications Covered | Power Generation, Transport, Others |

| Distribution Channels Covered | Pipeline, Cargo |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India green hydrogen market size was valued at USD 1,953.00 Million in 2025.

The India green hydrogen market is expected to grow at a compound annual growth rate of 37.92% from 2026-2034 to reach USD 35,265.29 Million by 2034.

Alkaline electrolyzer dominates the market with 46% market share in 2025, driven by its established technology base, lower capital costs, and proven suitability for large-scale hydrogen production applications.

Key factors driving the India green hydrogen market include increasing investment in domestic electrolyzer manufacturing, cost control, and faster deployment. In 2024, Ohmium commissioned a 2 GW Bengaluru gigafactory, expandable to 4 GW, producing PEM electrolyzers with potential to abate about 4 million tons of CO2 annually.

Major challenges include high production costs making green hydrogen two to four times more expensive than grey hydrogen, inadequate storage and transportation infrastructure, electrolyzer technology efficiency limitations, substantial capital requirements, and uncertainty regarding long-term demand signals.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)