India Grid Energy Storage Market Size, Share, Trends and Forecast by Battery Chemistry, Ownership, Application, and Region, 2025-2033

India Grid Energy Storage Market Overview:

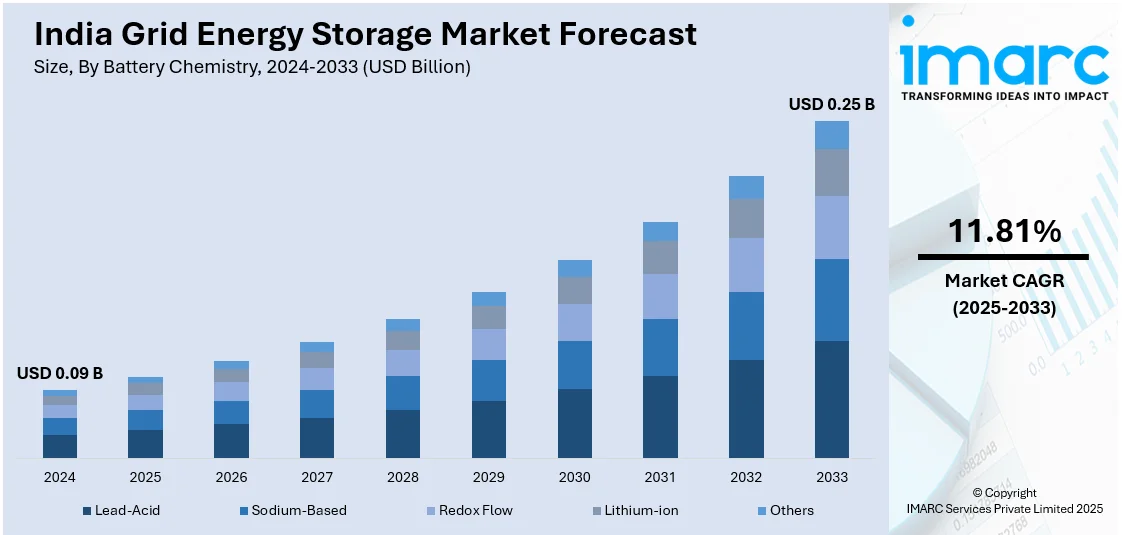

The India grid energy storage market size reached USD 0.09 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.25 Billion by 2033, exhibiting a growth rate (CAGR) of 11.81% during 2025-2033. India's grid energy storage market is growing rapidly, driven by renewable energy adoption and government investments. Battery Energy Storage Systems (BESS) and Pumped Storage Projects (PSP) enhance grid stability, reduce fossil fuel reliance, and support the country's goal of achieving 60 GW storage capacity by FY32, contributing overall market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.09 Billion |

| Market Forecast in 2033 | USD 0.25 Billion |

| Market Growth Rate 2025-2033 | 11.81% |

India Grid Energy Storage Market Trends:

Innovation in Battery Energy Storage Solutions

India's grid energy storage market has experienced notable advancements, with a growing emphasis on clean energy and sustainable technologies. As the nation accelerates its renewable energy goals, battery energy storage systems (BESS) have emerged as essential for maintaining grid stability and ensuring a reliable power supply. The increasing demand for cost-effective and long-lasting energy storage solutions has further driven the need for innovation in this sector. In January 2025, LICO Materials launched LiGRID, a second-life Battery Energy Storage System (BESS) designed to reduce operational expenses by 60% compared to conventional technologies. With a lifespan four times longer than lead-acid batteries, LiGRID offers a practical, sustainable alternative for residential, commercial, and industrial applications. Its intelligent thermal management system and multi-layer safety features have further enhanced operational efficiency. This development not only supports the circular economy by repurposing used batteries but also minimizes e-waste and contributes to cleaner energy consumption. By offering reliable energy storage during peak demand hours, LiGRID has strengthened the resilience of India's energy grid. Such technological advancements are essential as the nation moves toward reducing its carbon footprint and achieving long-term energy security.

To get more information on this market, Request Sample

Strategic Investments in Energy Storage Expansion

India's commitment to renewable energy has intensified, with large-scale investments supporting the development of energy storage infrastructure. To ensure grid reliability and optimize renewable energy use, the government has prioritized expanding Battery Energy Storage Systems (BESS) and Pumped Storage Projects (PSP). The emphasis on achieving energy independence and reducing fossil fuel reliance has positioned energy storage as a critical enabler of the clean energy transition. In November 2024, the Indian government announced an ambitious plan to increase its energy storage capacity to 60 GW by FY32 through an INR 5 Trillion investment. The strategy involves scaling up both BESS and PSP to manage renewable energy fluctuations effectively. BESS will provide rapid-response storage, while PSP will ensure long-duration storage, complementing the grid's stability. This initiative has attracted both public and private sector investments, stimulating the growth of domestic manufacturing and technological innovation. It also supports the creation of employment opportunities across the energy sector. Additionally, the widespread adoption of advanced storage systems will enhance the integration of renewable energy into the grid, reducing dependence on fossil fuels. With this large-scale investment, India moves closer to its clean energy targets, reinforcing its leadership in the global energy transition.

India Grid Energy Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on battery chemistry, ownership, and application.

Battery Chemistry Insights:

- Lead-Acid

- Sodium-Based

- Redox Flow

- Lithium-ion

- Others

The report has provided a detailed breakup and analysis of the market based on the battery chemistry. This includes lead-acid, sodium-based, redox flow, lithium-ion, and others.

Ownership Insights:

- Third-party Owned

- Utility Owned

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes third-party owned and utility owned.

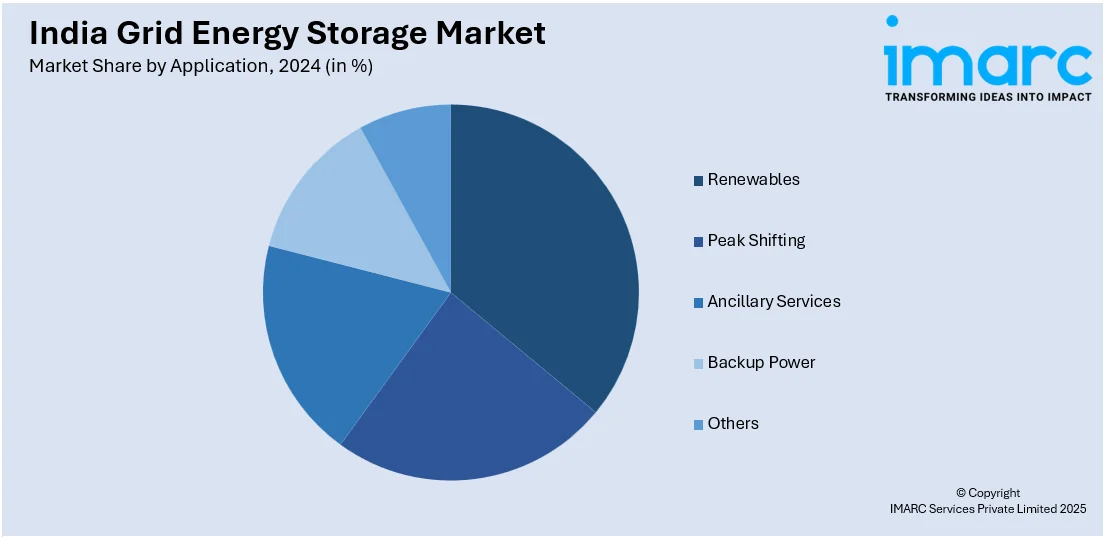

Application Insights:

- Renewables

- Peak Shifting

- Ancillary Services

- Backup Power

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes renewables, peak shifting, ancillary services, backup power, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Grid Energy Storage Market News:

- March 2025: PURE introduced the PuREPower energy storage line in India to accelerate the energy transition. Offering reliable, scalable solutions for homes and businesses, it enhanced grid stability, reduced fossil fuel dependency, and supported the nation’s renewable energy goals, promoting sustainable energy storage adoption.

- February 2025: NHPC Ltd launched a tender for 500 MW/1,000 MWh standalone battery energy storage systems (BESS) in Andhra Pradesh under the VGF scheme. This initiative aimed to enhance grid reliability, meet peak power demands, and support renewable energy integration, driving energy storage industry growth.

India Grid Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Chemistries Covered | Lead-Acid, Sodium-Based, Redox Flow, Lithium-ion, Others |

| Ownerships Covered | Third-party Owned, Utility Owned |

| Applications Covered | Renewables, Peak Shifting, Ancillary Services, Backup Power, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India grid energy storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India grid energy storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India grid energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The grid energy storage market in India was valued at USD 0.09 Billion in 2024.

The India grid energy storage market is projected to exhibit a CAGR of 11.81% during 2025-2033, reaching a value of USD 0.25 Billion by 2033.

The expansion of the grid energy storage market in India is fueled by the rising shift toward renewable energy sources, the government's supportive policies for energy storage, growing electricity consumption, advancements in battery technology, and the need to maintain grid balance and stability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)