India Grid Energy Storage Solutions Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

India Grid Energy Storage Solutions Market Overview:

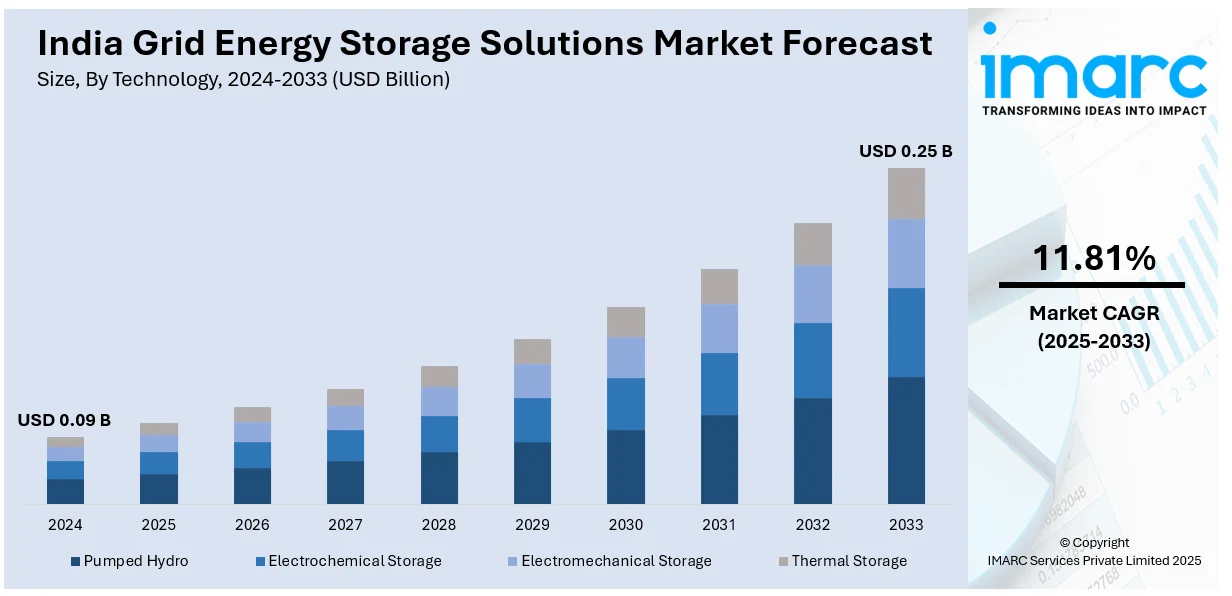

The India grid energy storage solutions market size reached USD 0.09 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.25 Billion by 2033, exhibiting a growth rate (CAGR) of 11.81% during 2025-2033. The rising renewable energy adoption, government initiatives, increasing investments, advancements in battery technologies, pumped storage projects, grid modernization, policy mandates for energy storage in solar and wind projects, growing demand for stability, foreign collaborations, and the push for a sustainable energy transition are driving the India grid energy storage market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.09 Billion |

| Market Forecast in 2033 | USD 0.25 Billion |

| Market Growth Rate 2025-2033 | 11.81% |

India Grid Energy Storage Solutions Market Trends:

Rising Adoption of Battery Energy Storage Systems (BESS)

India’s grid energy storage market growth is driven by a significant shift towards Battery Energy Storage Systems (BESS) due to increasing renewable energy integration. For instance, according to a report published on February 28, 2025, Kilokri, South Delhi, will host India's first commercial utility-scale battery energy storage system (BESS) when it goes online in March 2025. Developed in partnership with Reliance Group and the Delhi government, this INR 120 Crore (nearly USD 14 Million) initiative intends to promote the integration of renewable energy sources and improve grid stability. Ten megawatt-hours of storage capacity will be made available by the BESS, allowing for effective energy management and a steady supply of electricity in the area. With government initiatives like the National Energy Storage Mission, lithium-ion and advanced battery technologies are gaining traction, which in turn is expanding India Grid energy storage market share. The declining costs of battery storage, along with regulatory support, are driving investments in large-scale energy storage projects. Companies are collaborating to develop giga-scale manufacturing units to meet the rising demand. BESS is crucial for stabilizing the grid, reducing peak load stress, and ensuring uninterrupted power supply, positioning it as a key driver of India’s energy transition.

To get more information on this market, Request Sample

Expansion of Pumped Hydro Storage Projects

Pumped hydro storage is emerging as a crucial component of India’s energy storage landscape due to its long-duration storage capability and cost-effectiveness. For instance, a non-binding agreement was signed on February 23, 2025, by NTPC Ltd and EDF India to jointly construct, own, operate, and maintain hydropower and pumped storage facilities, including those combined with renewable energy sources. These projects will be carried out by the proposed 50:50 joint venture firm (JVC) in India and its adjacent countries, with the possibility of establishing more JVs or subsidiaries as required. In order to support regional energy stability and sustainability, this partnership seeks to improve energy storage options and investigate distribution-related potential. Government policies promoting renewable energy have encouraged investments in hydro-based storage infrastructure. States like Maharashtra and Andhra Pradesh are leading in pumped hydro developments. The technology’s ability to store excess renewable energy and ensure grid stability makes it a preferred choice, thereby positively impacting the India grid energy storage market outlook. With increasing grid fluctuations from solar and wind power, pumped hydro projects are expected to expand significantly, helping India achieve its renewable energy targets while maintaining a reliable power supply.

India Grid Energy Storage Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Pumped Hydro

- Electrochemical Storage

- Electromechanical Storage

- Thermal Storage

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pumped hydro, electrochemical storage, electromechanical storage, and thermal storage.

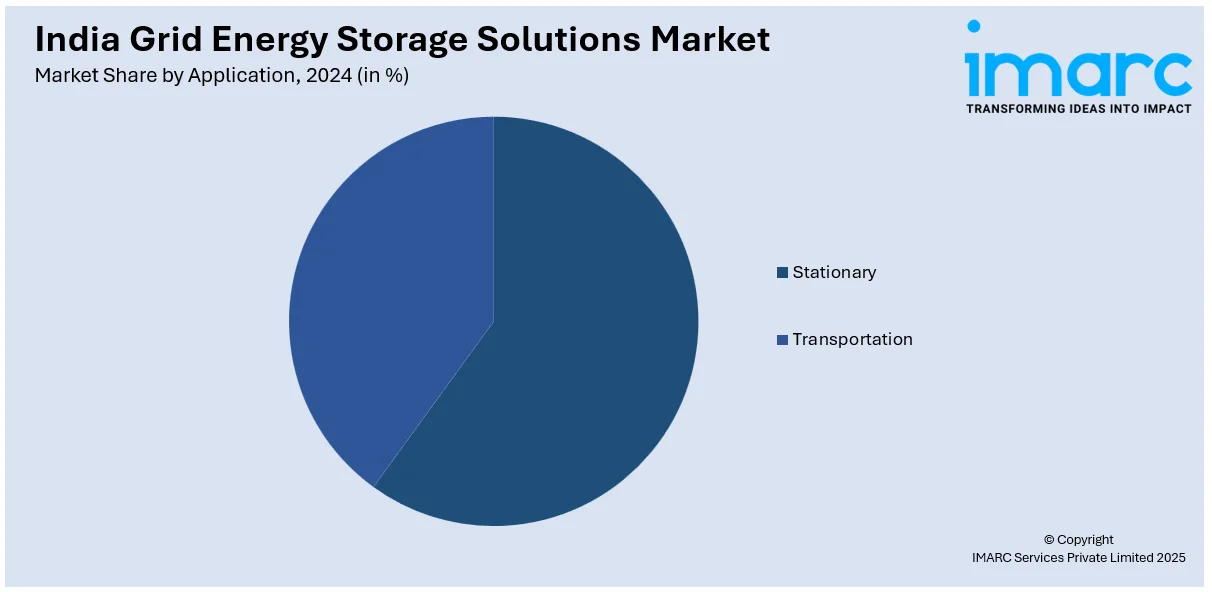

Application Insights:

- Stationary

- Transportation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes stationary and transportation.

End User Insights:

- Residential

- Non-Residential

- Utilities

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, non-residential, and utilities.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Grid Energy Storage Solutions Market News:

- On November 13, 2024, India Grid Trust (IndiGrid) announced the launch of EnerGrid, a platform created in collaboration with British International Investment (BII) and the Norwegian Climate Investment Fund during COP29 in Baku, Azerbaijan. EnerGrid can now pursue projects worth up to USD1.2 Billion in greenfield transmission and standalone battery energy storage systems throughout India thanks to the approximately USD 100 Million commitments made by each partner, for a total of USD 300 Million. By improving grid infrastructure and storage capacity, this project seeks to assist India in achieving its renewable energy targets.

India Grid Energy Storage Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pumped Hydro, Electrochemical Storage, Electromechanical Storage, Thermal Storage |

| Applications Covered | Stationary, Transportation |

| End Users Covered | Residential, Non-Residential, Utilities |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India grid energy storage solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India grid energy storage solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India grid energy storage solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The grid energy storage solutions market in India was valued at USD 0.09 Billion in 2024.

The India grid energy storage solutions market is projected to exhibit a (CAGR) of 11.81% during 2025-2033, reaching a value of USD 0.25 Billion by 2033.

Growing deployment of renewable energy, grid modernization initiatives, and load balancing requirements propel India's grid energy storage solutions market. Battery storage incentives from the government, solar and wind power integration, and electrification targets fuel demand. Improvements in lithium-ion and flow batteries and declining prices enhance large-scale use across geographies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)