India Gynecology Surgical Devices Market Size, Share, Trends, and Forecast by Product, Application, End User, and Region, 2025-2033

India Gynecology Surgical Devices Market Overview:

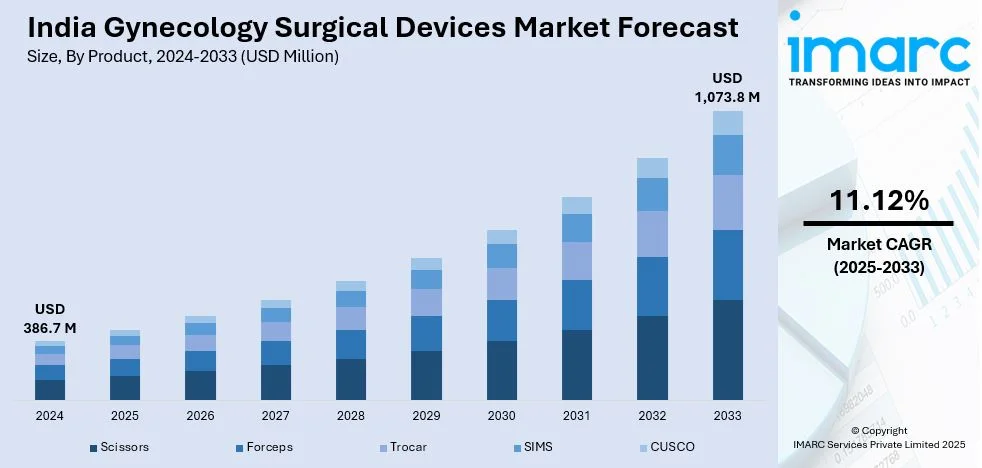

The India gynecology surgical devices market size reached USD 386.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,073.8 Million by 2033, exhibiting a growth rate (CAGR) of 11.12% during 2025-2033. The increasing gynecological disorders, rising demand for minimally invasive procedures, technological advancements, expanding healthcare infrastructure, growing medical tourism, rising awareness, and government initiatives promoting women's health are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 386.7 Million |

| Market Forecast in 2033 | USD 1,073.8 Million |

| Market Growth Rate 2025-2033 | 11.12% |

India Gynecology Surgical Devices Market Trends:

Rise of Robotic-Assisted Gynecological Surgeries

Robotic-assisted devices are increasingly being used in gynecological surgeries throughout India. Hospitals are using sophisticated surgical robots to increase precision, minimize invasiveness, and shorten recovery periods. These technologies provide improved precision in sensitive surgeries including hysterectomies and myomectomies, resulting in fewer problems and shorter hospital stays. Surgeons gain from improved visibility and dexterity, resulting in better patient outcomes. With increased investment in medical technology, more healthcare institutions are focusing on robotic-assisted solutions to address the growing need for minimally invasive operations. This transition is part of a larger trend toward automation and technology integration in surgical care, which will improve access to cutting-edge therapies. As healthcare practitioners continue to implement these tools, the landscape of gynecological procedures shifts toward more efficiency and better patient outcomes. For example, in August 2023, CK Birla Hospital collaborated with Intuitive India to introduce the latest da Vinci Surgical Robot, enhancing precision in gynecological surgeries. This initiative underscores the hospital's commitment to advanced medical technologies, aiming to improve patient outcomes and recovery times.

To get more information on this market, Request Sample

Advancements in Robotic Technology for Gynecological Surgeries

Robotic-assisted technology is becoming a key innovation in gynecological procedures, offering enhanced precision and improved patient recovery. Minimally invasive robotic systems are being used for complex surgeries like hysterectomies, ensuring reduced blood loss, fewer complications, and shorter hospital stays. Surgeons are leveraging these advanced tools for better visualization and control, particularly in challenging cases such as adenomyosis treatment. The increasing adoption of robotic-assisted platforms highlights a growing focus on integrating cutting-edge medical solutions into routine surgical care. As healthcare institutions invest in these technologies, accessibility to high-precision procedures is improving, leading to better outcomes for patients. The shift toward automation and minimally invasive approaches is shaping the future of gynecological surgery, making it safer and more efficient. For instance, in September 2022, CARE Hospitals in Hyderabad achieved a significant milestone by performing the first gynecological procedure in the Asia-Pacific region using Medtronic's Hugo robotic-assisted surgery system. The team conducted a robotic-assisted total hysterectomy on a 46-year-old patient with adenomyosis. This advancement underscores CARE Hospitals' dedication to incorporating cutting-edge technology in gynecological surgeries, enhancing precision and patient outcomes.

India Gynecology Surgical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Scissors

- Forceps

- Trocar

- SIMS

- CUSCO

The report has provided a detailed breakup and analysis of the market based on the product. This includes scissors, forceps, trocar, SIMS, and CUSCO.

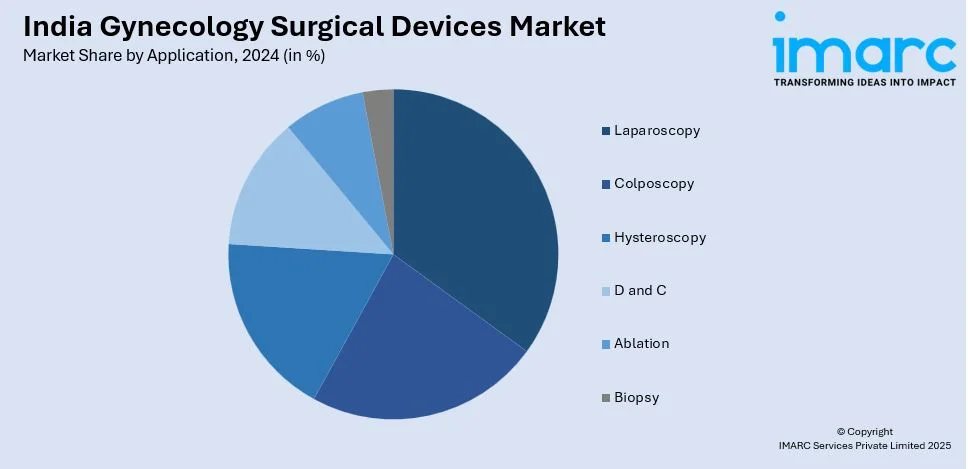

Application Insights:

- Laparoscopy

- Colposcopy

- Hysteroscopy

- D and C

- Ablation

- Biopsy

The report has provided a detailed breakup and analysis of the market based on the application. This includes laparoscopy, colposcopy, hysteroscopy, D and C, ablation, and biopsy.

End User Insights:

- Hospitals and Clinics

- Fertility Clinics and Centers

- Ambulatory Care Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, fertility clinics and centers, and ambulatory care centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Gynecology Surgical Devices Market News:

- In March 2025, SS Innovations International successfully hosted the 2nd Global Multi-Specialty Robotic Surgery Conference (SMRSC 2025) in Gurugram, Delhi NCR, from March 7 to 9. The event showcased the SSi Mantra 3 Robotic Surgical System, which enabled over 3,200 surgeries in 70+ hospitals. Live gynecological surgeries highlighted its capabilities. The conference also introduced the SSi Mantra Mobile Unit to enhance access to robotic surgical care.

- In March 2025, the Institute of Post Graduate Medical Education and Research (IPGMER) in Kolkata became the first government hospital in eastern India to introduce robotic surgery. The state health department sanctioned INR 6.4 Crore for the installation of this advanced surgical system, which would enhance precision in gynecological and other surgeries. The hospital plans to commence procedures in general surgery, urology, and gynecology by the end of May.

India Gynecology Surgical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Scissors, Forceps, Trocar, SIMS, CUSCO |

| Applications Covered | Laparoscopy, Colposcopy, Hysteroscopy, D and C, Ablation, Biopsy |

| End Users Covered | Hospitals and Clinics, Fertility Clinics and Centers, Ambulatory Care Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India gynecology surgical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India gynecology surgical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India gynecology surgical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gynecology surgical devices market in India was valued at USD 386.7 Million in 2024.

The India gynecology surgical devices market is projected to exhibit a CAGR of 11.12% during 2025-2033, reaching a value of USD 1,073.8 Million by 2033.

The India gynecology surgical devices market is driven by a growing prevalence of gynecological conditions, increased awareness about women’s health, rising preference for minimally invasive surgeries, and expanding access to advanced healthcare facilities across urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)