India Hair Loss Treatment Market Size, Share, Trends and Forecast by Product Type, Type, Route of Administration, Gender, Distribution Channel, and Region, 2025-2033

India Hair Loss Treatment Market Overview:

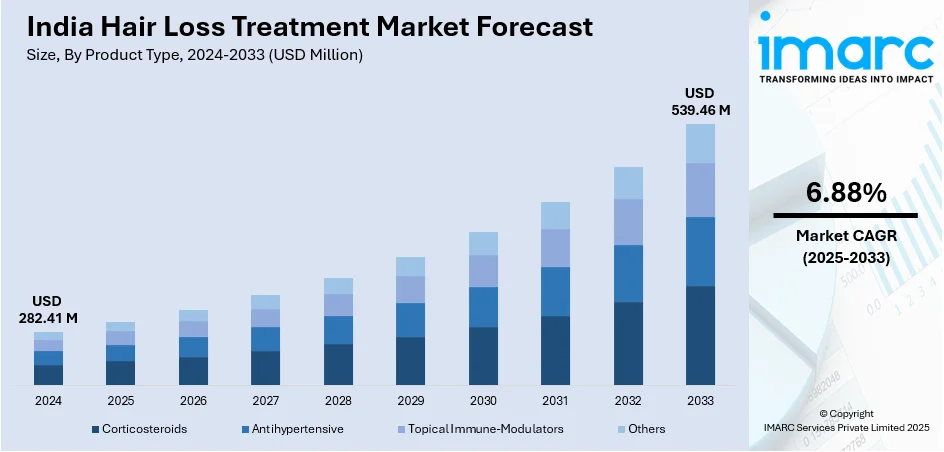

The India hair loss treatment market size reached USD 282.41 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 539.46 Million by 2033, exhibiting a growth rate (CAGR) of 6.88% during 2025-2033. The market is witnessing significant growth, driven by escalating demand for advanced non-invasive hair loss treatments and the growing influence of nutraceuticals. Rising concerns over physical appearance is also acting as another major factor driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 282.41 Million |

| Market Forecast in 2033 | USD 539.46 Million |

| Market Growth Rate (2025-2033) | 6.88% |

India Hair Loss Treatment Market Trends:

Rising Demand for Advanced Non-Invasive Hair Loss Treatments

The non-invasive and minimally invasive treatments for hair-related problems are the most dynamic today in the India hair loss treatment market. Consumers currently favor non-invasive treatments like platelet-rich plasma (PRP) therapy, low-level laser therapy (LLLT), and topical medications that provide results with minimal recovery time. PRP therapy leverages a patient’s own blood platelets to stimulate hair growth but has recently gained traction for being natural and having promising clinical outcomes. For instance, in January 2025, VCare introduced Exosome Therapy in India, launching ExoGro, an autologous hair loss treatment using growth factors, proteins, and mRNA from patients' cells without foreign substances or chemicals. Similarly, LLLT devices, including laser combs and helmets, are experiencing increased adoption as they offer a painless and FDA-approved solution for hair thinning. Additionally, pharmaceutical advancements have led to the introduction of novel topical formulations, including minoxidil-based solutions combined with bioactive ingredients such as peptides and plant-based extracts, enhancing efficacy and consumer appeal. The availability of prescription and over-the-counter (OTC) treatments through e-commerce platforms has further accelerated market expansion. Increasing awareness, combined with aggressive marketing by dermatology clinics and hair care brands, is driving greater acceptance of these treatments. As consumers seek convenient and scientifically backed solutions, the demand for advanced non-invasive hair loss treatments is expected to grow, positioning this segment as a key driver of market growth in India.

To get more information on this market, Request Sample

Growing Influence of Nutraceuticals and Functional Foods in Hair Restoration

The increasing consumer preference for holistic and long-term hair loss solutions is driving demand for nutraceuticals and functional foods. Indian consumers are becoming more aware of the role of nutrition in hair health, leading to a surge in demand for biotin, collagen peptides, omega-3 fatty acids, and herbal supplements such as amla, ashwagandha, and fenugreek. These products are widely marketed as effective solutions to combat hair thinning and promote follicle regeneration.

The expansion of the nutraceutical sector, coupled with increasing disposable income, is fueling the adoption of premium hair supplements. Brands are leveraging digital marketing strategies and direct-to-consumer (DTC) models to reach health-conscious individuals seeking non-pharmaceutical alternatives. Additionally, scientific research supporting the efficacy of key ingredients is strengthening consumer trust in these products. Functional foods enriched with essential vitamins and minerals, such as fortified hair gummies and protein-based drinks, are also gaining traction. With rising health consciousness and demand for preventive care, nutraceuticals are becoming an integral part of hair loss management strategies. For instance, as per industry reports, in December 2024, India's hair restoration market is witnessing 30% annual growth, driven by increasing adoption of nutraceuticals and functional foods. Cities like Delhi lead, offering advanced clinics integrating nutrition-based solutions for hair regrowth. As Indian consumers shift towards proactive hair health maintenance, the segment’s growth is set to accelerate, offering significant opportunities for companies in the hair loss treatment market.

India Hair Loss Treatment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, type, route of administration, gender, and distribution channel.

Product Type Insights:

- Corticosteroids

- Antihypertensive

- Topical Immune-Modulators

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corticosteroids, antihypertensive, topical immune-modulators, and others.

Type Insights:

- Non Cicatricial

- Telogen Effluvium

- Androgenetic Alopecia

- Alopecia Areata

- Cicatricial

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes non cicatricial (telogen effluvium, androgenetic alopecia, and alopecia areata), cicatricial, and others.

Route of Administration Insights:

- Oral

- Topical

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes oral and topical.

Gender Insights:

- Male

- Female

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes male and female.

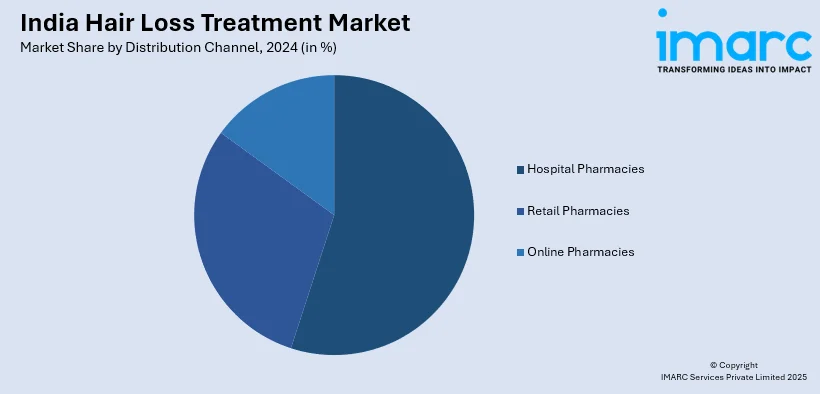

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacies, retail pharmacies, and online pharmacies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hair Loss Treatment Market News:

- In September 2024, Sculpt Clinics, a premier cosmetic treatment provider in Delhi, introduced a cutting-edge laser hair removal technology that reduces treatment time by half. This advanced device offers faster, more efficient, and virtually painless hair removal, catering to busy individuals seeking convenient and effective aesthetic solutions.

- In April 2024, Dr Batra’s Group of Companies announced the launch of XOGEN, aimed at treating and even curing hair loss caused due to hereditary issues. The treatment is said to be a targeted one with each session lasting 45 minutes.

India Hair Loss Treatment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corticosteroids, Antihypertensive, Topical Immune-Modulators, Others |

| Types Covered |

|

| Route of Administrations Covered | Oral, Topical |

| Genders Covered | Male, Female |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hair loss treatment market performed so far and how will it perform in the coming years?

- What is the breakup of the India hair loss treatment market on the basis of product type?

- What is the breakup of the India hair loss treatment market on the basis of type?

- What is the breakup of the India hair loss treatment market on the basis of route of administration?

- What is the breakup of the India hair loss treatment market on the basis of gender?

- What is the breakup of the India hair loss treatment market on the basis of distribution channel?

- What is the breakup of the India hair loss treatment market on the basis of region?

- What are the various stages in the value chain of the India hair loss treatment market?

- What are the key driving factors and challenges in the India hair loss treatment?

- What is the structure of the India hair loss treatment market and who are the key players?

- What is the degree of competition in the India hair loss treatment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hair loss treatment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hair loss treatment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hair loss treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)