India Hair Transplant Market Size, Share, Trends and Forecast by Type, Gender, End User, and Region, 2025-2033

India Hair Transplant Market Overview:

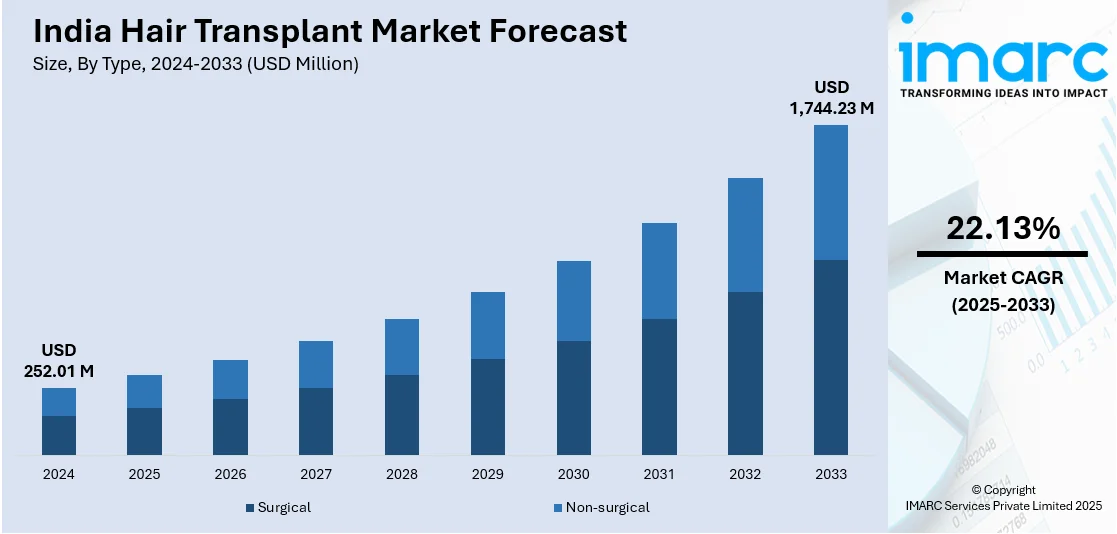

The India hair transplant market size reached USD 252.01 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,744.23 Million by 2033, exhibiting a growth rate (CAGR) of 22.13% during 2025-2033. The market is driven by rising cases of hair loss due to stress, pollution, and genetics, increasing awareness about aesthetic procedures, advancements in transplantation techniques, and affordability compared to Western countries. Moreover, rapid growth of medical tourism, celebrity influence, higher disposable incomes, and growing preference for minimally invasive cosmetic treatments are some of the other factors fueling the India hair transplant market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 252.01 Million |

| Market Forecast in 2033 | USD 1,744.23 Million |

| Market Growth Rate (2025-2033) | 22.13% |

India Hair Transplant Market Trends:

Rising Cases of Hair Loss

Hair loss is becoming increasingly common in India due to factors like stress, pollution, poor diet, hormonal imbalances, and genetic predisposition. Up to 40% of Indian women report experiencing hair loss by the time they are 40, according to surveys. Moreover, in February 2025, more than 190 individuals, aged 4 and up, from 12 villages in the Shegaon taluka of Buldhana district, Maharashtra, have been impacted by a hair loss disorder known as anagen effluvium since the initial week of January 2025. The growing prevalence of androgenetic alopecia among both men and women has fueled demand for hair restoration solutions. Additionally, sedentary lifestyles, excessive use of hair styling products, and environmental damage contribute to hair thinning, making hair transplant procedures a preferred option for those seeking a permanent solution. As awareness about hair health increases, more individuals are exploring advanced procedures such as follicular unit transplantation (FUT) and follicular unit extraction (FUE), boosting the overall India hair transplant market growth.

To get more information on this market, Request Sample

Advancements in Hair Transplant Technology

The hair transplant market in India has significantly benefited from technological advancements, making procedures more efficient, less invasive, and with higher success rates. The introduction of robotic hair transplant systems, improved precision tools, and innovations in follicular extraction have enhanced patient satisfaction. Techniques like direct hair implantation (DHI) offer better results with minimal downtime, attracting a larger consumer base. These innovations have also reduced complications and scarring, encouraging more people to opt for transplants. As clinics continue to adopt cutting-edge methods, the overall credibility and accessibility of hair transplant procedures in India are steadily increasing, thus creating a positive India hair transplant market outlook. For instance, in July 2023, DHI International, a prominent global player in hair restoration and transplant clinics, planned to extend its reach with the imminent launch of a new clinic in Noida. Set to open in July 2023, this cutting-edge facility will provide DHI's exceptional hair loss solutions to all individuals in Noida experiencing hair loss issues and surrounding regions. The clinic will showcase innovations in hair restoration and hair transplant procedures, guaranteeing that patients obtain top-quality care and attain exceptional outcomes.

Growing Medical Tourism Industry

India has become a global hub for affordable and high-quality medical treatments, including hair transplants. For instance, medical tourism in India rose by approximately 33% annually in 2023, with predictions to exceed the pre-pandemic figure of 700,000 visitors noted in 2019 during the calendar year 2024, according to credit rating agency ICRA. The agency noted that this increase is due to the central government's effort to expand e-medical visa services to citizens of 167 nations, which is expected to further enhance medical tourism visits. The cost of hair transplantation in India is significantly lower than in Western countries while maintaining high medical standards. International patients, particularly from the Middle East, Africa, and Southeast Asia, travel to India for these procedures due to skilled surgeons, state-of-the-art clinics, and cost-effectiveness. Many clinics offer comprehensive medical tourism packages, including accommodation and aftercare services. The combination of affordability and advanced medical expertise continues to drive foreign patient inflow, strengthening India's position in the global hair transplant market.

India Hair Transplant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, gender, and end user.

Type Insights:

- Surgical

- Non-surgical

The report has provided a detailed breakup and analysis of the market based on the type. This includes surgical and non-surgical.

Gender Insights:

- Male

- Female

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes male and female.

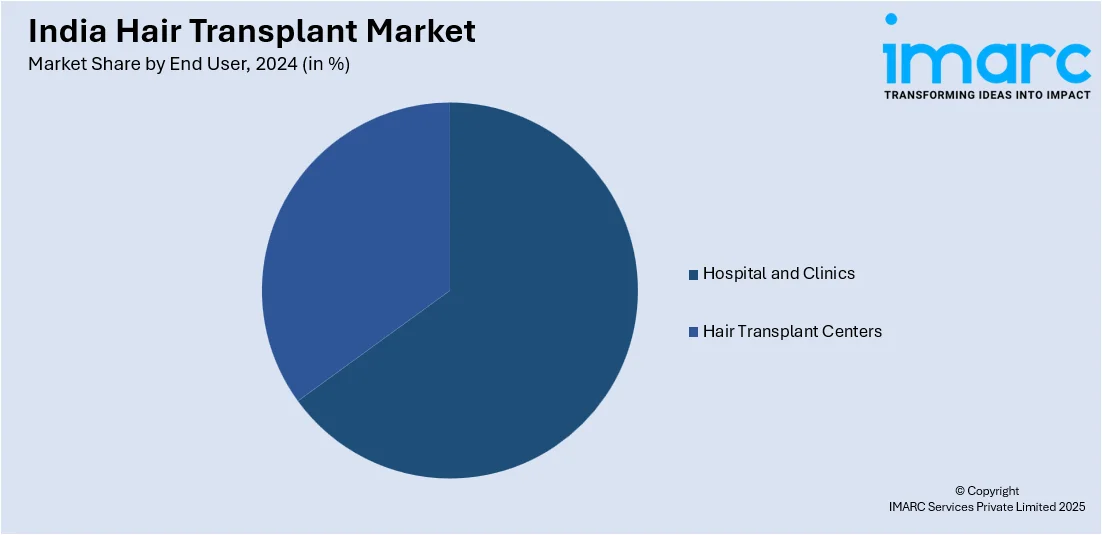

End User Insights:

- Hospital and Clinics

- Hair Transplant Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospital and clinics, and hair transplant centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hair Transplant Market News:

- In August 2023, Levo Spa and Salon, a prominent brand in the beauty and wellness sector, revealed its collaboration with Australia’s prestigious Evolved Hair Restoration, marking the debut of an advanced hair transplant clinic. This innovative partnership introduced a new age of sophisticated hair restoration options in Gurgaon and beyond

India Hair Transplant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Surgical, Non-Surgical |

| Genders Covered | Male, Female |

| End Users Covered | Hospital And Clinics, Hair Transplant Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hair transplant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hair transplant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hair transplant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hair transplant market in India was valued at USD 252.01 Million in 2024.

The hair transplant market in India is projected to reach USD 1,744.23 Million by 2033, exhibiting a growth rate (CAGR) of 22.13% during 2025-2033.

Rising cases of hair loss, increasing awareness about aesthetic procedures, advancements in transplant technology, affordability, and the rapid growth of medical tourism are key drivers of the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)