India Haircare Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Haircare Market Size and Share:

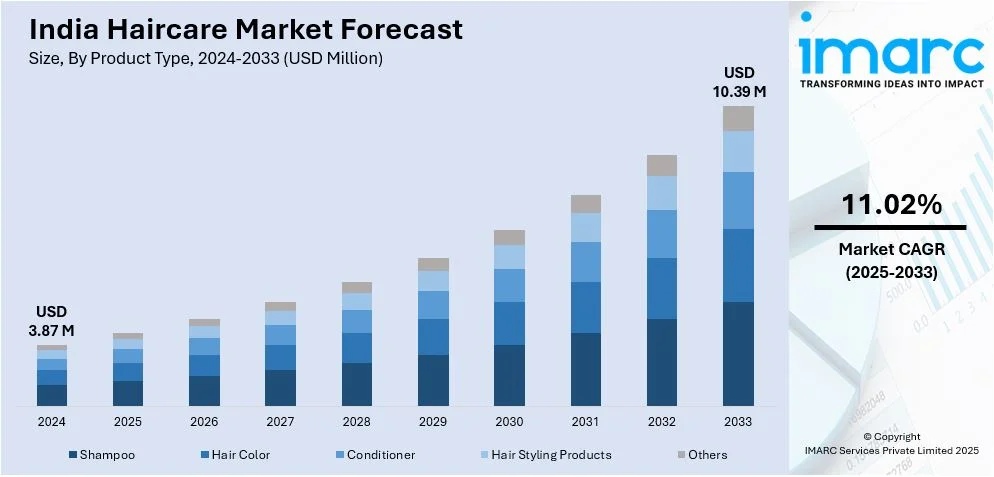

The India haircare market size was valued at USD 3.87 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.39 Million by 2033, exhibiting a CAGR of 11.02% during 2025-2033. North India currently dominates the market, holding a significant market share of 32.7% in 2024. The market is propelled by rapid urbanization, growing disposable incomes, and a widening middle class, prompting increased demand for premium and specialized offerings. Consumers highly value personal grooming and are receptive to trying out contemporary as well as traditional hair care solutions. Popularity of herbal and Ayurvedic offerings is also indicative of the nation's cultural leanings toward natural products. Increasing penetration of social media and internet platforms has increased awareness and accessibility, defining purchasing behavior in both rural and urban areas, which further fuels the India haircare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.87 Million |

| Market Forecast in 2033 | USD 10.39 Million |

| Market Growth Rate (2025-2033) | 11.02% |

One of the major forces driving the Indian hair care market is the fast rate of urbanization and growth of the middle class in the country. With increasing numbers of individuals relocating to urban areas, there is greater exposure to worldwide standards and trends in beauty, which spurs the use of disciplined hair care regimens. Growing disposable incomes have given consumers the confidence to look beyond rudimentary hair oils and soaps to more varied and high-end hair care products. Such economic transition permits increased experimentation with items like shampoos, conditioners, serums, and styling treatments. Furthermore, aspirational spending habits, driven by a desire for individualized grooming and appearance enhancement, are also emerging. The middle class, with its growing purchasing power and receptivity to new products, is playing a large part in business growth. While lifestyle upgrade continues in semi-urban and rural regions, demand for quality and branded haircare products is expected to increase, offering plenty of scope for domestic and foreign brands alike.

To get more information on this market, Request Sample

According to the India haircare market forecast, the country’s long-standing cultural susceptibility to traditional medicine has contributed to the popularity of herbal and natural hair care products. Customers are now looking for hair care that is thought to be safe, gentle, and effective, resorting to amla, bhringraj, neem, and hibiscus, all of which have been used in Indian hair care rituals for centuries. It has encouraged companies to introduce Ayurvedic and herbal formulations into their portfolios, addressing a segment that believes in well-being and sustainability. Meanwhile, digital media and influencer marketing have both heavily influenced consumer consciousness and demand. Social media is now a large medium by which consumers learn about haircare regimen, product critiques, and tutorials, continuing to fuel interest in niche haircare treatments. The intersection of digital presence and conventional wellness is assisting companies in positioning themselves better. Coupled with the greater accessibility enabled by e-commerce and retail growth, these technological and cultural drivers are all pushing the Indian haircare industry forward.

India Haircare Market Trends:

Increased Focus on Personal Beauty and Grooming

The Indian market for haircare is primarily driven by growing awareness about personal grooming and beauty. The beauty and personal care market in India is expanding at a CAGR of 5.60% during 2025-2033 and is forecasted to reach USD 48.3 Billion by 2033, as per a report published by the IMARC Group. Consumers, particularly in cities and semi-cities, are focusing on appearance and personal care as part of their everyday lives. Hair care has emerged as an integral part of this transition, with individuals looking for general hygiene along with remedies to specific issues such as hair loss, frizz, dandruff, and premature graying. The rise of beauty bloggers, online marketing, and greater visibility to international trends have been instrumental in spearheading this awareness. Men are also becoming actively involved in the grooming domain, looking for niche hair products. This increasing consumer base is promoting brands to diversify their portfolios. Hence, the increased emphasis on grooming and beauty is significantly impacting product innovation and marketing strategies, while further contributing to the India haircare market growth.

Increasing Disposable Incomes and Growing Middle Class

The increasing middle class and disposable incomes in India are critical forces driving the changing haircare market. With increased purchasing power, consumers no longer have to stick to mass-market, low-cost haircare items. Rather, consumers are seeking upscale and specialist goods that support their changing needs and desires. This economic empowerment is seen in the hike in demand for salon-grade shampoos, organic conditioners, hair serums, and treatments hitherto reserved for luxury salons. According to industry reports, the middle class accounted for 31% of the population of India in 2023. This number is expected to rise to 38% by 2031 and 60% by 2047. Moreover, customers are also more open to trying new forms like scalp treatments, hair masks, and leave-in conditioners. The increasing penetration of organized retail and online retail has also ensured greater availability of a variety of products. As affordability is decreasing as a deterrent, brand loyalties are increasingly decided by the effectiveness of the product, brand principles, and transparency of ingredients. This transition is redefining the competitive dynamic and challenging both local and global brands to more sensitively serve this active and expanding consumer base.

Ayurvedic and Herbal Product Preferences

The long-standing cultural affinity for Ayurveda and traditional health practices continues to shape the India haircare market outlook. There is a strong preference for products using herbal and natural components like amla, shikakai, neem, and bhringraj. These ingredients were trusted long ago in Indian homes, and they provide an element of comfort and certainty that many contemporary consumers seek in the midst of fears from chemical-intensive products. As per industry reports, 71% of consumers in India reported a preference for natural beauty products in comparison to synthetic products. Hence, the popularity of herbal remedies stems from their perceived safety, long-term effects, and compatibility with sustainable, conscious living. Several homegrown brands have been able to sweep sizeable market share by highlighting these conventional formulations, while even multinational brands are now adding natural ingredients to stay in the game. The trend is also a consequence of a general consumer attitude that mixes contemporary efficacy with ancient wisdom. As health-consciousness increases, the demand for clean-label, green, and ethically sourced ingredients will further dictate buying behavior in the haircare category in urban as well as rural markets.

India Haircare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India haircare market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Shampoo

- Hair Color

- Conditioner

- Hair Styling Products

- Others

Shampoo stands as the largest component in 2024, holding 46.5% of the market. Shampoo is the highest-selling product category in the Indian haircare segment, fueled by its vital function in daily grooming routines. It is the basis of hair cleanliness for shoppers in urban as well as rural geographies and is thus a household essential across all economic groups. The beauty of shampoo is in its versatility, with a broad spectrum of formulations addressing various hair issues such as dryness, dandruff, hair loss, and scalp sensitivity. The market has transitioned from simple cleaning agents to specialized ingredient-centric products such as herbal, organic, and sulfate shampoos. This change mirrors shifting consumer trends toward healthy and environmentally friendly options. Besides, robust brand visibility, intense promotion, and extensive availability across both offline and online channels have contributed to shampoo's stronghold. Its ubiquity, coupled with ongoing innovation, makes shampoo the best-known and most used product in the larger Indian haircare space.

Analysis by Distribution Channel:

.webp)

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

Supermarkets and hypermarkets lead the market with 38.7% of market share in 2024. Supermarkets and hypermarkets are the dominant distribution channels of India's haircare market, driven by their large reach and broad product assortment. The large retail formats offer customers the benefit of a single stop shopping culture, where they are exposed to a variety of haircare products offered by multiple brands at one place. Their spacious store designs and strategic locations in urban and suburban areas ensure that they are within easy reach of a wide customer base. Moreover, supermarkets and hypermarkets tend to indulge in promotions, providing discounts and combo offers appealing to price-conscious consumers. The availability of private-label products adds to their popularity, offering consumers cheap substitutes without much sacrifice in quality. This synergy of value, convenience, and variety has entrenched the image of supermarkets and hypermarkets as the destination of choice for haircare items in India.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

In 2024, North India accounted for the largest market share of 32.7%. North India is the prime regional segment in the Indian haircare market, with high levels of urbanization, increasing disposable incomes, and an expanding middle class. Delhi, Chandigarh, and Lucknow are the urban centers that have emerged as significant centers for the consumption of hair care products, as residents increasingly embrace new-style hair care habits. The region's heterogeneous consumer base, both rural and urban, has driven heavy demand for numerous hair care products, such as oils, shampoos, conditioners and serums. Moreover, growing awareness about the health of the hair and a desire for higher-quality, branded products are driving growth in the hair care market across North India. Having a sizeable middle-class base, complemented by a rising interest in personal care, has turned this area into a prime market for hair care products. In addition, the region's connectivity with global beauty trends as well as contemporary channels of retailing further strengthened its market position.

Competitive Landscape:

Several major companies are aggressively pursuing growth through product diversification, targeted brand strategies, and strategic innovation. Large brands are focusing on research and development to launch solutions based on specific hair types as well as regional tastes, as they identify the heterogeneity and particularities of Indian consumers. They are introducing niche products like anti-hair fall shampoos, scalp treatments, and herbal preparations that appeal to the increasing desire for customized and natural hair care. Alliance with dermatologists and beauty professionals adds credibility, while influencer endorsements and online campaigns are being leveraged to address younger, more technology-driven consumers. Companies are also increasing their reach in tier 2 and tier 3 cities through strong distribution channels and local brand building strategies. E-commerce sites are being utilized to provide a hassle-free shopping experience and visibility of a greater variety of products. Sustainability measures, like green packaging and cruelty-free ingredients, are also being implemented to catch the attention of ethical consumers. Through these efforts together, major players are staying relevant and building loyalty in a crowded market. Their focus on innovation, diversity, and accessibility continues to define the vibrant haircare environment of India, one of the fastest-growing segments in the beauty and personal care space.

The report provides a comprehensive analysis of the competitive landscape in the India haircare market with detailed profiles of all major companies, including:

Latest News and Developments:

- May 2025: KT Professional announced a partnership with JioStar Consumer Products in order to introduce KT Kids, a haircare line created exclusively for children aged 3-12 years. The range includes shampoos, conditioners, and detangling sprays, addressing issues like tangling and dryness with toxin-free formulations.

- February 2025: Karmic Beauty introduced a luxury haircare line featuring up to 91.8% naturally derived ingredients, including USDA-certified organic Moroccan Argan Oil and 92% pure hydrolysed keratin. Backed by ECOCERT and IFRA certifications, the brand emphasizes sustainability through eco-friendly packaging and a 'Reuse, Repurpose, Reimagine' approach.

- February 2025: Minimalist launched a variant of Anti-Dandruff Shampoo in India, formulated with Piroctone Olamine, Climbazole and Salicylic Acid to tackle flakes at the root while nourishing scalp health. Sulfate-, fragrance- and dye-free, it delivers visible relief from the very first wash and maintains optimal pH (5.0–6.0).

- January 2025: Mermade Hair, a hair styling company based in Australia, established a partnership with Tira, an omnichannel beauty platform from Reliance Retail, to launch its haircare products in India. With this partnership, consumers in India will be able to access the entire product collection of Mermade Hair, which includes hair tools, haircare formulas, and various accessories, exclusively on Tira’s online shopping site.

- January 2025: Soulflower launched a rosemary redensyl hair growth serum, which was created utilizing the tetragain formula, broadening the brand’s collection of haircare products. The new product prevents premature greying, encourages regeneration, and remedies hair loss.

India Haircare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoo, Hair Color, Conditioner, Hair Styling Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retailers, Other |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India haircare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India haircare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India haircare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India haircare market was valued at USD 3.87 Million in 2024.

The India haircare market is projected to exhibit a CAGR of 11.02% during 2025-2033, reaching a value of USD 10.39 Million by 2033.

India's haircare market is driven by rising disposable incomes, increased awareness of hair health, and a growing demand for natural and herbal products. Urbanization, social media influence, and expanding e-commerce access also contribute, enabling consumers to explore a wide variety of products tailored to diverse hair types and concerns.

North India currently dominates the India haircare market, driven by urbanization and rising disposable incomes in cities like Delhi, Chandigarh, and Lucknow which has led to increased adoption of modern grooming habits. Consumers in this region are increasingly aware of hair health, driving demand for specialized products. Additionally, the influence of traditional practices such as Ayurveda and herbal remedies has led to a preference for natural ingredients like amla and brahmi.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)