India Halal Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Halal Cosmetics Market Overview:

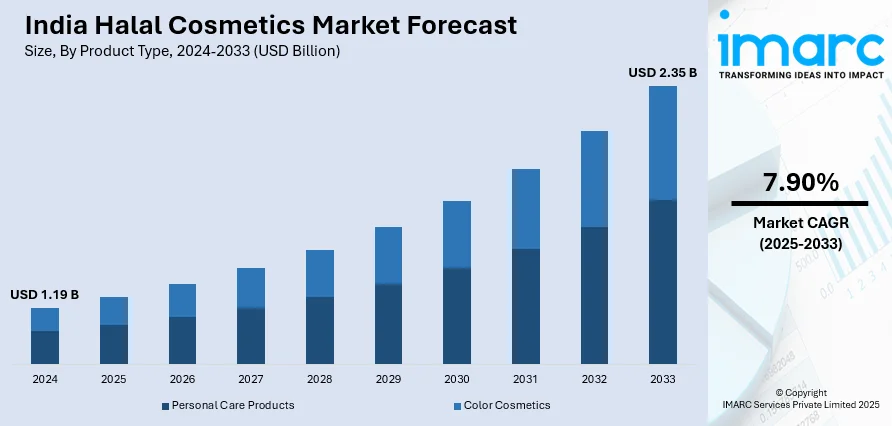

The India halal cosmetics market size reached USD 1.19 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.35 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The market is driven by increasing Muslim consumer demand, rising awareness of ethical and cruelty-free products, growing disposable income, and expanding e-commerce platforms. Moreover, stringent halal certification standards and a shift toward natural, organic ingredients further boost the India halal cosmetics market growth, attracting both domestic and international brands to India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.19 Billion |

| Market Forecast in 2033 | USD 2.35 Billion |

| Market Growth Rate (2025-2033) | 7.90% |

India Halal Cosmetics Market Trends:

Increasing Muslim Consumer Demand

India has a large and growing Muslim population that seeks products aligning with Islamic beliefs. According to industry reports, Muslims make up the largest minority population in the largely Hindu country of India, with almost 200 million living there. Halal cosmetics, free from alcohol, pork-derived ingredients, and animal cruelty, cater to these preferences. Rising religious consciousness and demand for Sharia-compliant products drive the market’s expansion. With greater availability of certified halal beauty products, more consumers are making informed purchasing decisions. Additionally, younger generations are more inclined toward halal-certified cosmetics, seeing them as both religiously appropriate and high-quality. This strong demand from a significant demographic group is a key factor fueling the India halal cosmetics market share.

To get more information on this market, Request Sample

Rising Awareness of Ethical and Cruelty-Free Products

Beyond religious considerations, the halal cosmetics market is benefitting from increasing consumer awareness about ethical and cruelty-free beauty products. As global trends shift toward sustainability, Indian consumers, including non-Muslims, are embracing halal-certified products due to their natural, toxin-free, and environmentally friendly attributes. The demand for vegan and paraben-free cosmetics overlaps with halal beauty, expanding the target audience. Conscious consumerism and ethical buying behavior are driving more brands to offer halal-certified alternatives. Social media and influencer marketing further amplify awareness, encouraging a broader segment of consumers to explore and adopt halal beauty products. For instance, in March 2024, People for the Ethical Treatment of Animals (PETA) India launched a partnership with five Bollywood celebrities' beauty products in advance of International Women's Day. The celebrities have joined the PETA US Global Beauty Without Bunnies program, which accredits brands and firms that do not do animal testing for cosmetics, personal care, and household items. The partnerships include Urvashi Rautela, Masaba Gupta, Jacqueline Fernandez, Aashka Goradia, and Kriti Sanon's beauty brands.

Growing Disposable Income and Changing Lifestyles

With rising disposable income and an expanding middle class, Indian consumers are willing to invest in premium beauty and personal care products, creating a positive India halal cosmetics market outlook. According to industry reports, the government announced a correction to the GDP figures, stating that India's per capita disposable income was projected to be ₹2.14 lakh in 2023-24, up from the previously estimated ₹2.12 lakh. The trend toward luxury halal cosmetics, skincare, and fragrances is increasing, particularly among urban and millennial buyers. Changing lifestyles and global exposure through social media and international beauty standards are influencing purchasing habits. The shift from mass-market beauty to niche and premium segments, including halal-certified brands, reflects the evolving preferences of Indian consumers. As more individuals prioritize high-quality, skin-friendly cosmetics, the market for halal beauty products continues to grow steadily.

India Halal Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Personal Care Products

- Skin Care

- Hair Care

- Fragrances

- Others

- Color Cosmetics

- Face

- Eyes

- Lips

- Nails

The report has provided a detailed breakup and analysis of the market based on the product type. This includes personal care products (skin care, hair care, fragrances, and others) and color cosmetics (face, eyes, lips, and nails).

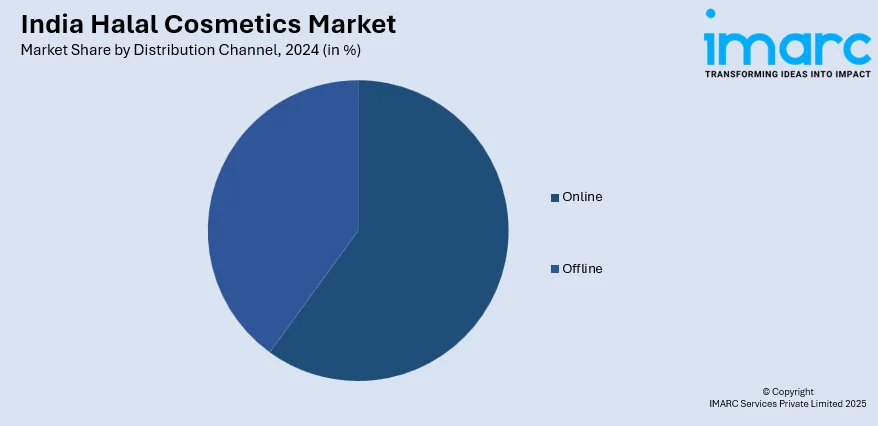

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Halal Cosmetics Market News:

- In August 2024, Actress and businesswoman Sunny Leone's cosmetic line, Star Struck by Sunny Leone, revolutionized the cosmetics sector with its selection of reasonably priced, cruelty-free products. To provide a unique beauty experience, the brand has further broadened its reach by opening a new store in Delhi in partnership with Looks Salon.

- In May 2023, PETA India announced that 82°E's skincare range has been certified by PETA US's "Beauty Without Bunnies" program, following the successful launch of global celebrity Deepika Padukone's self-care brand 82°E. Since its debut, PETA US certified the cruelty-free company as vegan and free of animal testing, which it can advertise on its website to encourage customers to make ethical decisions.

India Halal Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India halal cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India halal cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India halal cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India halal cosmetics market was valued at USD 1.19 Billion in 2024.

The India halal cosmetics market is projected to exhibit a CAGR of 7.90% during 2025-2033, reaching a value of USD 2.35 Billion by 2033.

The India halal cosmetics market is driven by growing Muslim population and rising awareness about ethical, faith-compliant beauty products. Consumers increasingly seeking certified, non-alcoholic and cruelty-free cosmetics, and expanding e-commerce platforms and social media are also boosting product visibility and access. Additionally, global halal beauty trends and supporting government endorsements further underpin market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)