India Handicrafts Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End Use, and Region, 2026-2034

India Handicrafts Market Summary:

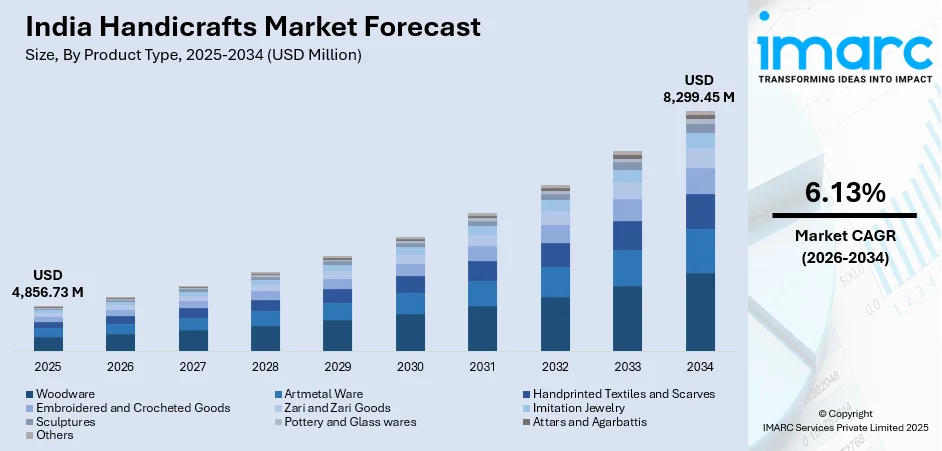

The India handicrafts market size was valued at USD 4,856.73 Million in 2025 and is projected to reach USD 8,299.45 Million by 2034, growing at a compound annual growth rate of 6.13% from 2026-2034.

The India handicrafts market is experiencing steady growth driven by rising domestic and international demand for artisanal products, expanding e-commerce platforms, and strong government support through various export promotion schemes. The sector benefits significantly from increasing tourism activities, growing consumer preference for sustainable handmade goods, and seamless integration of traditional craftsmanship with contemporary designs appealing to modern and discerning consumers.

Key Takeaways and Insights:

-

By Product Type: Woodware dominates the market with a share of 18% in 2025, driven by enduring appeal of wood-based decorative items combining aesthetic appeal with functionality.

-

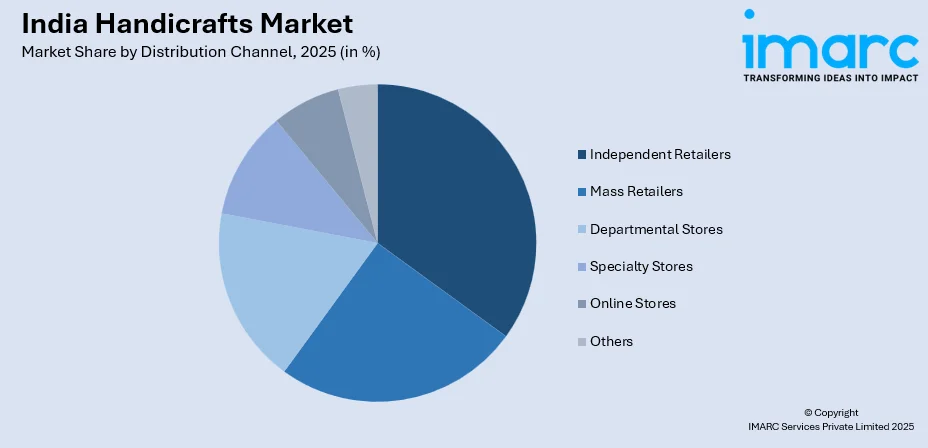

By Distribution Channel: Independent retailers lead the market with a share of 26% in 2025, owing to personalized customer service and curated product selections appealing to discerning buyers.

-

By End Use: Residential represents the largest segment with a market share of 64% in 2025, reflecting homeowners seeking unique artisanal products to personalize living spaces.

-

By Region: West and Central India leads with a share of 31% in 2025, supported by established craft clusters in Gujarat, Maharashtra, and Madhya Pradesh.

-

Key Players: The India handicrafts market exhibits a fragmented competitive structure with numerous small-scale artisans and regional manufacturers. Some of the key players operating in the market include Anokhi, Asian Handicrafts Private Limited, Gangamani Fashions (Art & Crafts), HN Handicrafts, Indian Handicrafts Company, Kalagya Arts & Crafts, Nirmala Handicrafts, and Varnam Craft Collective.

To get more information on this market Request Sample

The India handicrafts market represents one of Asia's most vibrant artisanal sectors, characterized by rich cultural heritage and diverse regional craft traditions spanning woodwork, metalware, textiles, pottery, and jewelry. Customer demand is increasingly shifting toward sustainable, eco-friendly products as environmental consciousness rises among domestic and international consumers seeking authentic handcrafted alternatives. The market benefits substantially from India's expanding tourism industry, with visitors seeking genuine souvenirs reflecting the country's artistic traditions and cultural identity. Government initiatives including the Pehchan artisan identification programme have registered over 32 lakh artisans as of 2024, formalizing the sector and enabling access to welfare schemes.

India Handicrafts Market Trends:

Rising Emphasis on Sustainable and Eco-Friendly Products

Sustainability has become a defining trend in the handicrafts sector as consumers increasingly reject mass-produced synthetic goods in favour of environmentally conscious alternatives. Indian handicrafts made from natural materials including jute, bamboo, clay, and reclaimed wood align with this eco-conscious mindset. In October 2024, the Andhra Pradesh Handicrafts Development Corporation announced a targeted training programme empowering artisans in water-hyacinth craft techniques, transforming invasive weeds into eco-friendly baskets, mats, and home decor items.

Digital Transformation and E-Commerce Expansion

Digital transformation is reshaping market access for traditional artisans through e-commerce platforms and online marketplaces enabling global reach without intermediaries. Technology facilitates communication across borders, allowing craftspersons from remote regions to connect directly with international buyers. In November 2024, Tulip, a digital portal, was introduced by the Union Social Justice and Empowerment Minister with the goal of enhancing market access for artisans from marginalized communities, safai karmacharis, people with disabilities, and minority groups.

Fusion of Traditional Craftsmanship with Contemporary Design

The blending of traditional craftsmanship with modern aesthetics is gaining significant momentum as artisans create pieces appealing to contemporary sensibilities while preserving age-old techniques passed through generations. This fusion allows handicrafts to transcend ethnic patterns toward contemporary trends in furnishings and furniture segments. Collaborations between modern designers and traditional artisans are producing innovative products combining cultural heritage with functional contemporary design, attracting both domestic consumers and international luxury markets seeking authentic handcrafted pieces.

Market Outlook 2026-2034:

The India handicrafts market demonstrates robust growth potential underpinned by expanding travel and tourism, rising export opportunities, and continued government support through targeted schemes and policy interventions. With over seven hundred handicraft clusters employing approximately two hundred twelve thousand artisans nationwide, the sector offers significant employment generation potential in rural and semi-urban areas while preserving traditional craft heritage. International recognition through Geographical Indication tags is strengthening the authenticity and global appeal of region-specific crafts, enabling Indian artisans to command premium pricing in competitive international markets. The market generated a revenue of USD 4,856.73 Million in 2025 and is projected to reach a revenue of USD 8,299.45 Million by 2034, growing at a compound annual growth rate of 6.13% from 2026-2034.

India Handicrafts Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Woodware |

18% |

|

Distribution Channel |

Independent Retailers |

26% |

|

End Use |

Residential |

64% |

|

Region |

West and Central India |

31% |

Product Type Insights:

- Woodware

- Artmetal Ware

- Handprinted Textiles and Scarves

- Embroidered and Crocheted Goods

- Zari and Zari Goods

- Imitation Jewelry

- Sculptures

- Pottery and Glass wares

- Attars and Agarbattis

- Others

The woodware dominates with a market share of 18% of the total India handicrafts market in 2025.

Woodware maintains its leading position in the India handicrafts market owing to the enduring appeal of wood-based decorative items, furniture, and utensils that combine aesthetic appeal with functional durability. These products are crafted with exceptional hand-eye coordination and intense concentration by skilled artisans across regions including Saharanpur, Jodhpur, and Kerala. The segment benefits from growing consumer preference for eco-friendly products made from renewable or recycled wood materials.

The segment encompasses diverse product categories including carved furniture, decorative showpieces, kitchen utensils, and home accessories featuring intricate detailing and traditional techniques passed through generations of skilled craftspersons. Manufacturers are increasingly aligning traditional designs with contemporary consumer preferences, introducing minimalist aesthetics while preserving artisanal authenticity and cultural heritage. The availability of technology upgradation centres, equipped with imported machinery meeting international standards, is significantly enhancing production quality, operational efficiency, and export competitiveness in global markets.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Mass Retailers

- Departmental Stores

- Independent Retailers

- Specialty Stores

- Online Stores

- Others

The independent retailers lead with a share of 26% of the total India handicrafts market in 2025.

Independent retailers dominate the handicrafts distribution landscape by offering personalized customer service, curated product selections, and authentic artisanal goods that resonate with discerning buyers seeking unique pieces. These retailers maintain direct relationships with artisan communities, ensuring product authenticity and fair compensation for craftspersons. The segment benefits substantially from consumer preference for specialized shopping experiences where knowledgeable staff can explain craft origins, traditional techniques, and cultural significance, creating meaningful connections between buyers and India's rich heritage.

Independent retailers are strategically positioned across tourist destinations, urban craft markets, and cultural centres where footfall from domestic and international visitors remains consistently high throughout the year. These establishments frequently collaborate with local artisan cooperatives and self-help groups, supporting sustainable livelihoods while maintaining competitive product assortments. The online stores segment is witnessing rapid growth as e-commerce platforms enable craftspersons to bypass traditional intermediaries and connect directly with global consumers seeking handcrafted products.

End Use Insights:

- Residential

- Commercial

The residential exhibits a clear dominance with a 64% share of the total India handicrafts market in 2025.

The residential segment maintains commanding market leadership as homeowners increasingly seek unique artisanal products to personalize living spaces with cultural richness and distinctive character. Handcrafted items add exceptional aesthetic value to homes, reflecting personal style preferences and deep heritage appreciation among discerning consumers. The rise of eco-conscious buyers has substantially boosted demand for sustainable handmade goods in residential settings, with environmentally aware households prioritizing natural materials and traditional craftsmanship over synthetic alternatives.

Consumer preference for handcrafted home decor is driven by growing appreciation for artisanal quality over mass-produced alternatives. The segment encompasses diverse product categories including wooden furnishings, metal sculptures, pottery items, textile wall hangings, and decorative showpieces suitable for various interior design styles ranging from traditional to contemporary. Rising disposable incomes among urban households and expanding middle-class populations are enabling increased spending on premium handcrafted home accessories across metropolitan and tier-two cities.

Regional Insights:

- North India

- West and Central India

- South India

- East India

West and Central India dominates with a market share of 31% of the total India handicrafts market in 2025.

West and Central India leads the handicrafts market driven by established craft clusters in Gujarat, Maharashtra, Rajasthan, and Madhya Pradesh producing diverse products including wooden furniture, textiles, and metalwork. The region benefits from robust export infrastructure and well-developed logistics networks facilitating international trade. Rajasthan contributes significantly to national handicraft exports through renowned clusters in Jaipur, Jodhpur, and Udaipur, each specializing in distinctive craft traditions attracting global buyers and collectors.

The region's competitive advantage stems from centuries-old craft traditions, skilled artisan communities, and proactive government support through state-level handicraft policies and welfare schemes. Gujarat's Kutch region is renowned globally for intricate embroidery work, while Maharashtra contributes Warli paintings and Kolhapuri leather goods to domestic and international markets. Madhya Pradesh's Chanderi and Maheshwari textiles enjoy strong demand, with these heritage fabrics representing exceptional weaving traditions passed through generations of master craftspersons.

Market Dynamics:

Growth Drivers:

Why is the India Handicrafts Market Growing?

Expanding Tourism and Rising Demand for Authentic Souvenirs

The expanding travel and tourism industry across India is creating substantial growth opportunities for local artisans and handicraft manufacturers nationwide. Tourists consistently demonstrate willingness to invest significantly in souvenirs and craft items reflecting the essence of vibrant Indian art and culture. This trend particularly benefits regions with established tourism infrastructure including Rajasthan, Kerala, and Uttar Pradesh, where visitors seek authentic handcrafted mementos. The uniqueness and cultural significance of handicraft products make them preferred choices over mass-produced alternatives among discerning domestic and international travelers.

Government Support Through Export Promotion and Artisan Welfare Schemes

The Government of India has demonstrated sustained commitment to supporting the handicrafts sector through dedicated schemes and policy interventions including the National Handicraft Development Programme and Pehchan artisan identification initiative. These comprehensive programmes provide infrastructure development, skill training, marketing support, design upgradation, and financial assistance to artisan communities nationwide. Such interventions enable craftspersons to enhance production capabilities, access domestic and international markets, improve overall livelihoods, and preserve traditional craft techniques for future generations while meeting contemporary quality standards.

Global Shift Toward Sustainable and Eco-Friendly Products

The global push toward sustainability is substantially contributing to handicrafts market development as consumers increasingly reject mass-produced synthetic goods favoring environmentally conscious alternatives. Indian handicrafts crafted using natural, recycled, or upcycled materials align perfectly with this eco-conscious consumer mindset. The sector's reliance on the natural and local resources ensures low-carbon footprint production processes appealing to environmentally aware buyers in domestic and international markets. Growing awareness about Geographical Indication tags is further strengthening the authenticity and global appeal of region-specific crafts.

Market Restraints:

What Challenges the India Handicrafts Market is Facing?

Price Competition from Machine-Made Products

The handicrafts sector faces intense competition from cheaper mass-produced machine-made alternatives that replicate traditional designs at significantly lower price points. This price disparity challenges artisan communities competing for cost-conscious consumer segments, particularly in domestic markets where handmade premiums are difficult to justify against factory-manufactured imitations.

Lack of Organized Supply Chain and Standardization

Despite substantial growth potential, the sector is hindered by lack of organized supply chains with artisans frequently facing difficulties sourcing raw materials and transporting finished products efficiently. The predominantly unorganized nature of handicraft production leads to inconsistent product quality and delayed delivery timelines affecting competitiveness.

Limited Access to Modern Design and Marketing Expertise

Many traditional artisans lack access to contemporary design trends, modern marketing techniques, and digital commerce platforms necessary for reaching broader consumer segments. This expertise gap limits their ability to adapt products to evolving consumer preferences and compete effectively in increasingly sophisticated domestic and international markets.

Competitive Landscape:

The India handicrafts market exhibits a fragmented competitive structure characterized by numerous small-scale artisans, regional manufacturers, and organized players operating across diverse product categories nationwide. The sector encompasses extensive handicraft clusters employing substantial artisan communities across rural and semi-urban regions. Competition is intensifying in the e-commerce segment as both established players and artisan cooperatives develop robust online presence to capture emerging digital consumer segments. To improve their competitive posture in both home and foreign markets, market players are putting more emphasis on product differentiation, quality improvement, and sustainable practices.

Some of the key players include:

- Anokhi

- Asian Handicrafts Private Limited

- Gangamani Fashions (Art & Crafts)

- HN Handicrafts

- Indian Handicrafts Company

- Kalagya Arts & Crafts

- Nirmala Handicrafts

- Varnam Craft Collective

Recent Developments:

-

February 2025: The European Union and India's Ministry of Textiles jointly launched seven new initiatives, backed by EUR 9.5 Million grant, on the sidelines of the Bharat Tex event to strengthen the Indian handicraft industry, directly benefitting thirty-five thousand participants including MSMEs, artisans, and farmer-producers across nine states.

India Handicrafts Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Type Covered | Woodware, Artmetal Ware, Handprinted Textiles and Scarves, Embroidered and Crocheted Goods, Zari and Zari Goods, Imitation Jewelry, Sculptures, Pottery and Glass wares, Attars and Agarbattis, Others |

| Product Type Covered | Departmental Stores, Independent Retailers, Specialty Stores, Online Stores, Others |

| End Use Covered | Residential, Commercial |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India handicrafts market size was valued at USD 4,856.73 Million in 2025.

The India handicrafts market is expected to grow at a compound annual growth rate of 6.13% from 2026-2034 to reach USD 8,299.45 Million by 2034.

Woodware dominated the market with 18% share in 2025, driven by enduring appeal of wood-based decorative items combining aesthetic appeal with functionality and growing consumer preference for eco-friendly products.

Key factors driving the India handicrafts market include expanding tourism and rising demand for authentic souvenirs, government support through export promotion and artisan welfare schemes, and global shift toward sustainable eco-friendly products.

Major challenges include price competition from cheaper machine-made products, lack of organized supply chains and product standardization, and limited artisan access to modern design and marketing expertise.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)