India HDMI Cables Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033

India HDMI Cables Market Overview:

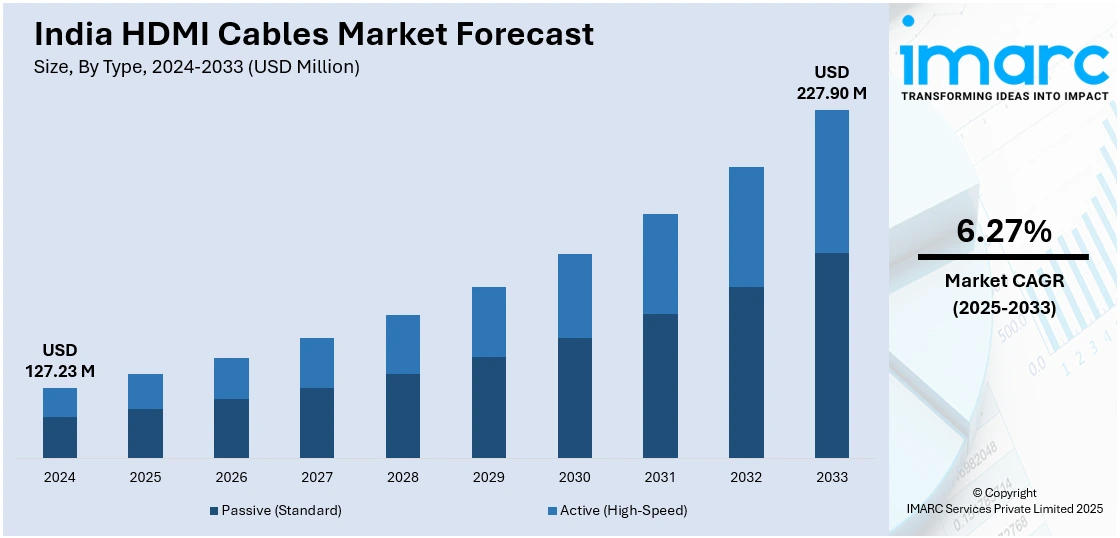

The India HDMI cables market size reached USD 127.23 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 227.90 Million by 2033, exhibiting a growth rate (CAGR) of 6.27% during 2025-2033. The rising demand for high-definition content, increasing adoption of smart TVs and gaming consoles, growing digital connectivity in home entertainment and office setups, the surge in OTT platforms and 4K/8K content consumption, and the emergence of hybrid work models are bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 127.23 Million |

| Market Forecast in 2033 | USD 227.90 Million |

| Market Growth Rate 2025-2033 | 6.27% |

India HDMI Cables Market Trends:

Proliferation of High-Definition Content and Advanced Display Technologies

The rising consumption of high-definition (HD) and ultra-high-definition (UHD) content in India is significantly fueling the growth of the HDMI cables market. With the increasing adoption of 4K and 8K televisions, gaming consoles, and digital streaming devices, there is a growing need for reliable connectivity solutions that can support high data transfer rates. HDMI cables are essential for transmitting the high-bandwidth signals required by these sophisticated audiovisual systems. Aside from that, increasing penetration of digital multimedia devices and increased consumer desire for immersive, high-quality viewing experiences are driving market growth. The gaming sector is also playing an important role, with a rise in the number of gamers and growing use of consoles that allow HD and UHD output. As consumer expectations shift toward more dynamic and seamless visual experiences, the need for enhanced HDMI cables that support higher resolutions, quicker refresh rates, and greater audio-visual performance grows.

To get more information on this market, Request Sample

Integration of HDMI Interfaces in Automotive Infotainment Systems

India's automotive industry is rapidly embracing modern infotainment systems as a major differentiator to improve the in-car experience, resulting in significant demand for HDMI connections. Modern automobiles now include integrated entertainment systems that offer HD video and music playback, real-time navigation, and seamless communication to external devices. HDMI connections are critical to these systems, allowing for high-speed, high-quality data transfer between components. This transition is consistent with the general trend of vehicle digitalization and the advent of linked automobiles, in which HDMI ports are increasingly being integrated into infotainment systems to enable multimedia functions. As Indian consumers grow more tech-savvy, automakers are leveraging such features to stay competitive, further accelerating HDMI cable adoption. The convergence of automotive technology with consumer electronics not only highlights the evolving expectations of car buyers but also expands the application of HDMI interfaces well beyond traditional consumer electronics, propelling the market forward.

India HDMI Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, grade, and application.

Type Insights:

- Passive (Standard)

- Active (High-Speed)

The report has provided a detailed breakup and analysis of the market based on the type. This includes passive (standard) and active (high-speed).

Grade Insights:

- HDMI 1.4

- HDMI 2.0

- HDMI 2.1

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes HDMI 1.4, HDMI 2.0, and HDMI 2.1.

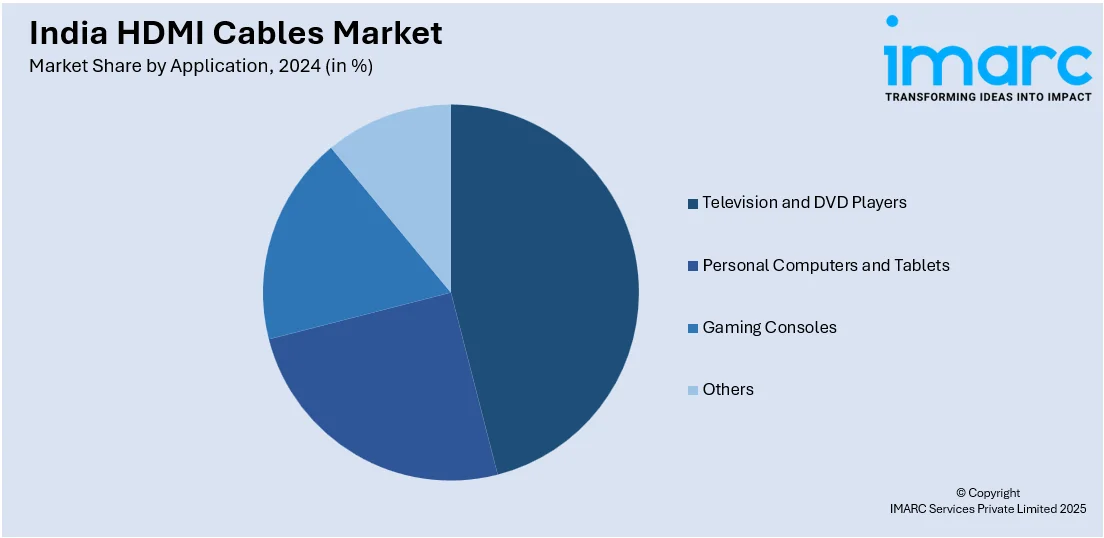

Application Insights:

- Television and DVD Players

- Personal Computers and Tablets

- Gaming Consoles

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes television and DVD players, personal computers and tablets, gaming consoles, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India HDMI Cables Market News:

- January 2025: HDMI Forum unveiled the HDMI 2.2 specification, offering a substantial bandwidth increase to 96 gigabits per second (Gbps). This enhancement supports higher resolutions up to 16K and faster refresh rates, necessitating the development of new, higher-capacity cables to accommodate these advancements.

- June 2024: Samsung launched its Odyssey G8 and G6 OLED gaming monitors in India, both featuring HDMI 2.1 ports for high-speed connectivity. The Odyssey G6 offers a 27-inch QHD display with a 360 Hz refresh rate, while the G8 provides a 32-inch 4K UHD screen at 240Hz.

India HDMI Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passive (Standard), Active (High-Speed) |

| Grades Covered | HDMI 1.4, HDMI 2.0, HDMI 2.1 |

| Applications Covered | Television and DVD Players, Personal Computers and Tablets, Gaming Consoles, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India HDMI cables market performed so far and how will it perform in the coming years?

- What is the breakup of the India HDMI cables market on the basis of type?

- What is the breakup of the India HDMI cables market on the basis of grade?

- What is the breakup of the India HDMI cables market on the basis of application?

- What are the various stages in the value chain of the India HDMI cables market?

- What are the key driving factors and challenges in the India HDMI cables market?

- What is the structure of the India HDMI cables market and who are the key players?

- What is the degree of competition in the India HDMI cables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India HDMI cables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India HDMI cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India HDMI cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)