India Health Check-up Market Size, Share, Trends and Forecast by Type, Test Type, Application, Service Provider, End User and Region, 2025-2033

India Health Check-up Market Overview:

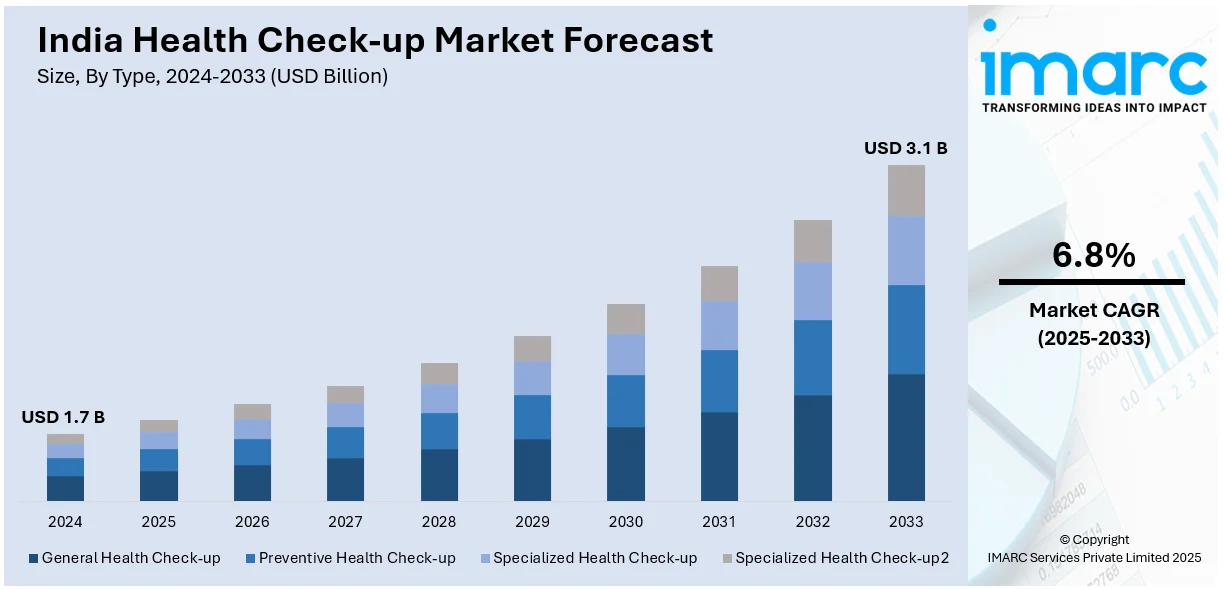

The India health check-up market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. The market share is fueled by growing health consciousness, rising disposable incomes, and expanding emphasis on preventive healthcare. Government policies, increased prevalence of lifestyle diseases, growth of diagnostic centers and corporate wellness programs are also escalating the demand for health check-ups across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Market Growth Rate 2025-2033 | 6.8% |

India Health Check-up Market Trends:

Shift Toward Preventive Healthcare and Wellness Programs

The significant shift toward preventive healthcare is fueling the India health check-up market growth. There is growing concern regarding the role of early diagnosis and lifestyle illnesses, and due to this increased awareness, an increasing number of people are visiting health check-ups on a routine basis to assess their health. Preventive care assists in detection of risk elements like high blood pressure, diabetes, and high cholesterol levels when they are yet to turn into severe illnesses. Corporate wellness initiatives are also encouraging this trend, with companies providing health check-ups to employees as part of their medical benefits. The programs aim at disease prevention and overall well-being, which aligns with the increasing trend of health-conscious living. Furthermore, with the development of digital health platforms and telemedicine services, people are now able to book and receive health check-ups conveniently from their homes, thereby increasing preventive healthcare for a larger section of the population. A significant change has occurred in the median benefits provided by Indian firms to their workforce, which features an increased emphasis on preventive care, wellness initiatives, and customized benefits, as per a report by Prudent Insurance Brokers, based on information from more than 3,000 organizations, encompassing 30 lakhs employees. Businesses are quickly transitioning to outpatient department (OPD) advantages, focusing on preventive screenings, yearly checkups, and mental health assistance. Additionally, mental wellness has become a crucial component of employee well-being initiatives, with 74% of employers integrating mental health support services.

To get more information on this market, Request Sample

Growth of Home-Based and On-Demand Health Check-Ups

The growing need for convenience is driving one of the significant trends in India's health check-up market: home-based and on-demand health check-up services. With hectic lifestyles, individuals are seeking more flexible and convenient methods of keeping tabs on their health. Home-based check-ups, where doctors go to individuals at home to take tests, are gaining popularity. This trend is particularly attractive to senior citizens, working professionals, and those staying in far-flung locations where visiting clinics or hospitals might be a challenge. The surge in demand for health checkups, specifically, is also contributing to a rise in average order value (AOV), which increased by 35% in January 2024. The greatest increase was noted in Apollo 24/7, which experienced a 40% rise in overall checkout volume in January 2024 compared to January 2023. Furthermore, on-demand services are becoming popular through mobile applications and websites, enabling people to schedule appointments for a variety of health check-ups at their convenience. Such services typically provide customized health packages, such as tests for certain conditions or wellness tests. Since there is increasing demand for convenient and customized healthcare experience, the trend is likely to accelerate more innovations influencing the overall India health check-up market outlook.

India Health Check-up Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, test type, application, service provider, and end user.

Type Insights:

- General Health Check-up

- Preventive Health Check-up

- Specialized Health Check-up

- Routine and Wellness Check-up

The report has provided a detailed breakup and analysis of the market based on the type. This includes general health check-up, preventive health check-up, specialized health check-up, and routine and wellness check-up.

Test Type Insights:

- Blood Glucose Tests

- Kidney Function Tests

- Bone Profile

- Electrolytes

- Liver Function Tests

- Lipid Profile

- Cardiac Biomarkers

- Special Biochemistry

- Hormones and Vitamins

- Tumor Biomarkers

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes blood glucose tests, kidney function tests, bone profile, electrolytes, liver function tests, lipid profile, cardiac biomarkers, special biochemistry, hormones and vitamins, tumor biomarkers, and others.

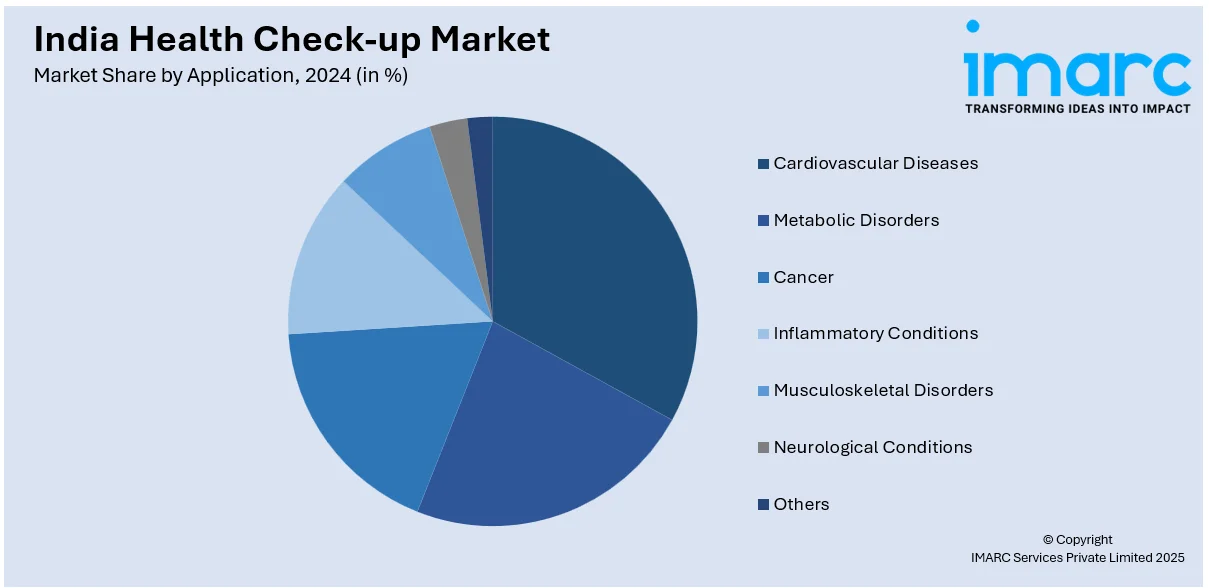

Application Insights:

- Cardiovascular Diseases

- Metabolic Disorders

- Cancer

- Inflammatory Conditions

- Musculoskeletal Disorders

- Neurological Conditions

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cardiovascular diseases, metabolic disorders, cancer, inflammatory conditions, musculoskeletal disorders, neurological conditions, and others.

Service Provider Insights:

- Hospital-Based Laboratories

- Central Laboratories

- Stand-Alone Laboratories

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes hospital-based laboratories, central laboratories and stand-alone laboratories.

End User Insights:

- Enterprise

- Individuals

The report has provided a detailed breakup and analysis of the market based on the end user. This includes enterprise, and individuals.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Health Check-up Market News:

- In December 2024, Metropolis Healthcare revealed its intentions to broaden its testing options to include oncology and other specialty fields, incorporating core diagnostics, with cancer testing emerging as a significant element of its offerings. On December 9, the board of directors of the medical diagnostics firm based in Mumbai sanctioned the purchase of Core Diagnostics, headquartered in Delhi-NCR, for ₹246.83 crore.

India Health Check-up Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | General Health Check-up, Preventive Health Check-up, Specialized Health Check-up, Routine and Wellness Check-up |

| Test Types Covered | Blood Glucose Tests, Kidney Function Tests, Bone Profile, Electrolytes, Liver Function Tests, Lipid Profile, Cardiac Biomarkers, Special Biochemistry, Hormones and Vitamins, Tumor Biomarkers, Others |

| Applications Covered | Cardiovascular Diseases, Metabolic Disorders, Cancer, Inflammatory Conditions, Musculoskeletal Disorders, Neurological Conditions, Others |

| Service Providers Covered | Hospital-Based Laboratories, Central Laboratories, Stand-Alone Laboratories |

| End Users Covered | Enterprise, Individual |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India health check-up market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India health check-up market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India health check-up industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health check-up market in India was valued at USD 1.7 Billion in 2024.

The India health check-up market is projected to exhibit a CAGR of 6.8% during 2025-2033, reaching a value of USD 3.1 Billion by 2033.

The India health check-up market is growing because of rising health awareness, increasing lifestyle-related illnesses, and a shift toward preventive healthcare. Technological advancements, improved healthcare infrastructure, and supportive government initiatives further support the market growth. Additionally, inflating disposable incomes and expanding insurance coverage contribute to the growing demand for regular health assessments across various population segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)