India Health Ingredients Market Size, Share, Trends and Forecast by Type, Source, Application, Function, and Region, 2025-2033

India Health Ingredients Market Overview:

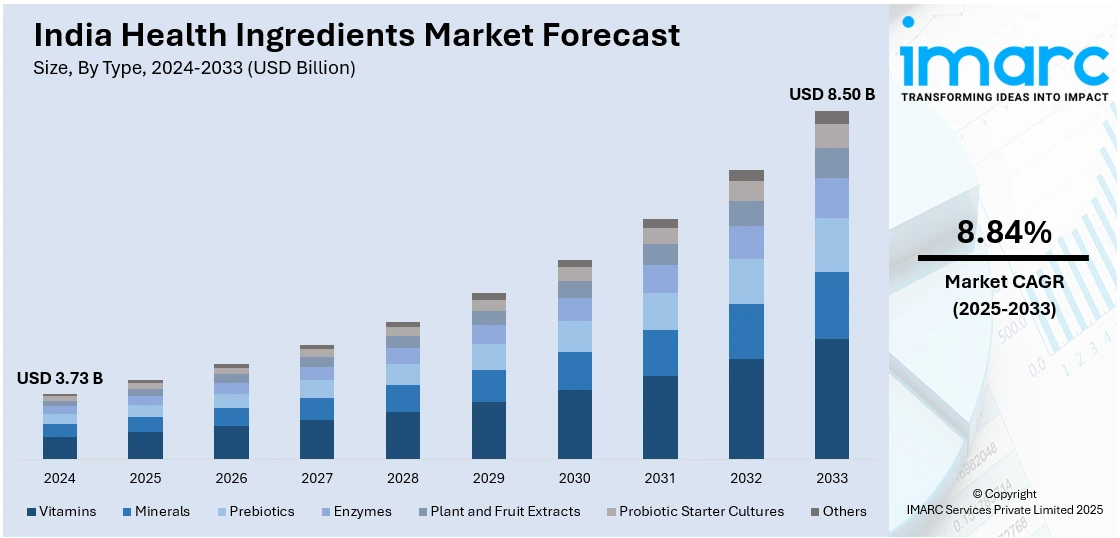

The India health ingredients market size reached USD 3.73 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.50 Billion by 2033, exhibiting a growth rate (CAGR) of 8.84% during 2025-2033. The market is propelled by growing health awareness, greater consumer demand for functional foods, and an expanded preference for natural and plant products. Urban living, higher disposable incomes, trends in preventive healthcare, and technology advances in food processing also propel market growth, in addition to government support programs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.73 Billion |

| Market Forecast in 2033 | USD 8.50 Billion |

| Market Growth Rate 2025-2033 | 8.84% |

India Health Ingredients Market Trends:

Growing Demand for Plant-Based and Natural Ingredients

The growing trend towards plant-based foods and natural ingredients is propelling demand for health ingredients in India. Clean-label products that are free from artificial additives and preservatives are being sought actively by consumers. Plant proteins, herbal extracts, and functional botanicals are popular ingredients in dietary supplements, fortified foods, and beverages. Also, the expanding awareness of the advantages of Ayurvedic and herbal formulations has spurred innovation in plant-based ingredient solutions. They are responding with new product launches aimed at vegetarian, vegan, and flexitarian consumers, further cementing the industry's dependence on natural and sustainable health ingredients. For instance, in December 2024, BASF agreed to sell its Food and Health Performance Ingredients business to Louis Dreyfus Company (LDC). The divestment aligns with BASF’s strategic focus on core areas like vitamins, carotenoids, and feed enzymes. Around 300 employees will transfer to LDC, which sees the acquisition as a step toward expanding its presence in the plant-based ingredients market.

To get more information on this market, Request Sample

Increasing Popularity of Functional and Fortified Foods

Functional and fortified foods are witnessing significant growth in India, driven by the emphasis on preventive healthcare. Consumers are opting for products enriched with vitamins, minerals, probiotics, and antioxidants to address specific health concerns. Fortified dairy products, functional beverages, and nutrient-enhanced snacks are becoming mainstream. The demand for personalized nutrition is also leading to the development of specialized health ingredients that cater to different age groups and dietary needs. With advancements in ingredient technology, companies are introducing bioactive components that enhance immunity, improve digestion, and support cardiovascular health, promoting overall well-being. For instance, in March 2025, GNC India launched GNC Pro Performance 100% Whey + Nitro Surge, India’s first whey protein with a cardio-protective formulation. Developed in collaboration with leading physicians, it features L-arginine silicate and L-citrulline to support heart health and enhance muscle performance. The supplement targets fitness enthusiasts seeking both cardiovascular benefits and improved athletic performance.

India Health Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, source, application, and function.

Type Insights:

- Vitamins

- Minerals

- Prebiotics

- Enzymes

- Plant and Fruit Extracts

- Probiotic Starter Cultures

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes vitamins, minerals, prebiotics, enzymes, plant and fruit extracts, probiotic starter cultures, and others.

Source Insights:

- Synthetic

- Plant

- Animal

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes synthetic, plant, animal, and others.

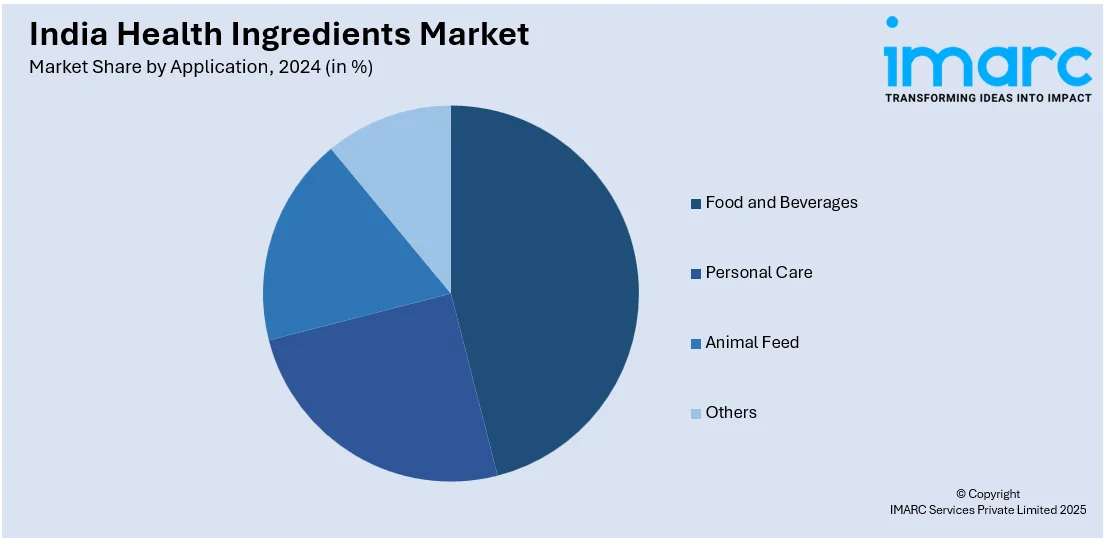

Application Insights:

- Food and Beverages

- Personal Care

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, personal care, animal feed, and others.

Function Insights:

- Gut Health Management

- Eye Health Management

- Immunity Enhancement

- Brain Health Management

- Heart/Cardiovascular Health Management

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes gut health management, eye health management, immunity enhancement, brain health management, heart/cardiovascular health management, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Health Ingredients Market News:

- In November 2024, OmniActive Health Technologies, a Mumbai-based nutraceutical company, acquired ENovate Biolife, a developer of proprietary botanical ingredients. This acquisition, funded through internal accruals, marks OmniActive's second strategic expansion. The company aims to double its revenue to ₹2,000 crores within the next 5 to 6 years, with this acquisition expected to contribute significantly to that growth.

- In April 2024, Nestlé India and Dr. Reddy’s Laboratories formed a joint venture to introduce Nestlé Health Science's nutraceutical products to consumers across India and selected regions. The collaboration will combine Nestlé's global expertise in nutritional health solutions with Dr. Reddy’s established market presence. Key brands like Nature's Bounty, Optifast, and Peptamen from Nestlé, and Celevida and Becozinc from Dr. Reddy’s, will be licensed to the joint venture.

India Health Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vitamins, Minerals, Prebiotics, Enzymes, Plant and Fruit Extracts, Probiotic Starter Cultures, Others |

| Sources Covered | Synthetic, Plant, Animal, Others |

| Applications Covered | Food and Beverages, Personal Care, Animal Feed, Others |

| Functions Covered | Gut Health Management, Eye Health Management, Immunity Enhancement, Brain Health Management, Heart/Cardiovascular Health Management, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India health ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India health ingredients market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India health ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health ingredients market in India was valued at USD 3.73 Billion in 2024.

The India health ingredients market is projected to exhibit a CAGR of 8.84% during 2025-2033, reaching a value of USD 8.50 Billion by 2033.

The India health ingredients market is primarily driven by the rising awareness about preventive healthcare, increasing need for functional food products and dietary supplements, and the growing prevalence of lifestyle-related diseases. Additionally, technological advancements in ingredient extraction and formulation are enhancing product quality and expanding application areas across the food and beverage (F&B) sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)