India Healthcare Analytics Market Size, Share, Trends and Forecast by Component, Deployment Mode, Type, Application, End User, and Region, 2025-2033

India Healthcare Analytics Market Overview:

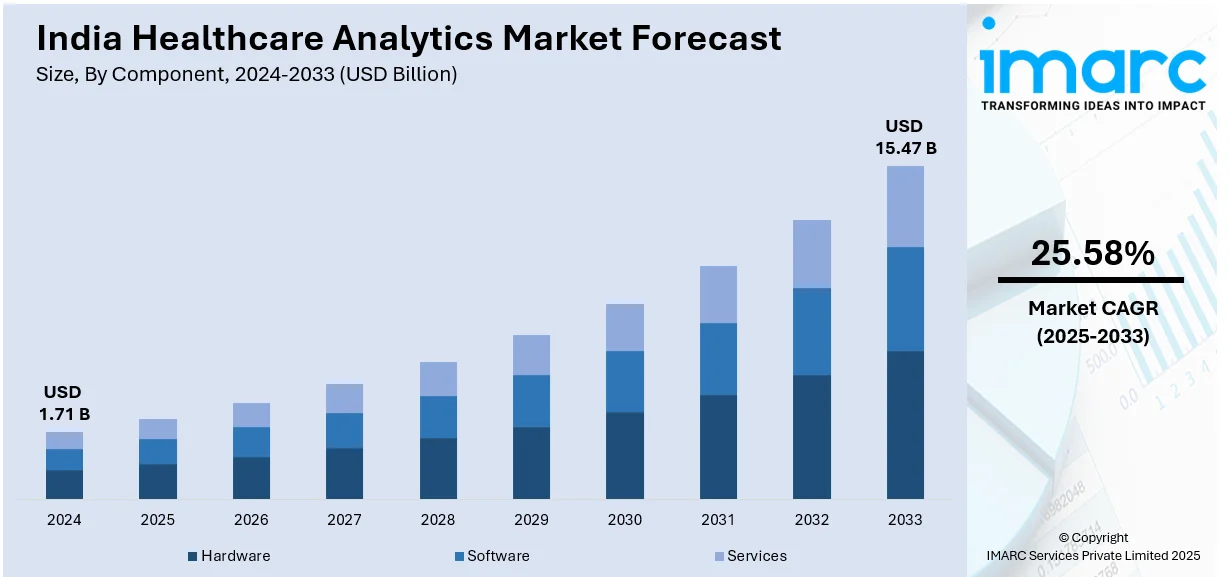

The India healthcare analytics market size reached USD 1.71 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.47 Billion by 2033, exhibiting a growth rate (CAGR) of 25.58% during 2025-2033. The India healthcare analytics market share is growing due to rising healthcare expenditure, government initiatives like Ayushman Bharat, and increasing adoption of artificial intelligence (AI)-driven analytics for personalized medicine, predictive diagnostics, and operational efficiency across hospitals, insurers, and pharmaceutical firms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.71 Billion |

| Market Forecast in 2033 | USD 15.47 Billion |

| Market Growth Rate 2025-2033 | 25.58% |

India Healthcare Analytics Market Trends:

Increasing Healthcare Expenditure

Rising healthcare expenditure is substantially influencing the India healthcare analytics market outlook by enabling investment in solutions that are driven by data, reduce costs, and improve patient outcomes. Higher private and government healthcare expenditure on health infrastructure, hospitals, and health technologies is further propelling the use of analytics software for more informed decisions. As healthcare costs rise, hospitals and clinics are utilizing analytics to enhance resource allocation, patient flow, and operational effectiveness. Predictive analytics helps reduce hospital readmission rates, maximize staff utilization, and streamline supply chain management. Drug firms are also investing more in analytics to enhance drug discovery, monitor market trends, and streamline clinical trials, reducing R&D costs. In line with this trend, Pfizer Inc. inaugurated its first independent commercial analytics facility in India, the 'Analytics Gateway,' in September 2024. This is aimed at augmenting data-driven decision-making using powerful analytics to fuel Pfizer's commercial business, proving the company's emphasis on technology-facilitated healthcare improvements. Health insurance companies are also using analytics to detect fraud, manage claims, and assess risks, improving financial performance and customer service.

To get more information on this market, Request Sample

Government Initiatives

Government efforts are supporting the India healthcare analytics market growth through the drive of digitalization, increased healthcare access, and data-driven decision-making. Initiatives such as Ayushman Bharat, National Digital Health Mission (NDHM), and Make in India are boosting the usage of analytics solutions among public and private healthcare segments. Ayushman Bharat, the country's biggest health insurance program, has authenticated around 36 crore beneficiaries and sanctioned 8.39 crore hospital admissions worth over ₹1.16 lakh crore till November 2024. This massive data creation is creating a growing demand for analytics to enhance claims management, fraud detection, and healthcare planning. Likewise, the National Digital Health Mission is developing an integrated digital ecosystem for healthcare, allowing hospitals, clinics, and insurers to leverage analytics for effective management of patient records, interoperability, and customized treatment. The push from the government for telemedicine and digital healthcare infrastructure is also driving demand for predictive analytics to enhance remote consultations, monitor patient health trends, and aid in clinical decision-making. In addition, efforts aimed at healthcare startups and AI-based solutions are fueling innovation in early disease detection, population health management, and drug discovery. With growth in investments in healthcare technology, analytics is being increasingly relied on to enhance efficiency, cut costs, and improve patient outcomes in India's healthcare system.

India Healthcare Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, deployment mode, type, application, and end user.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Deployment Mode Insights:

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud.

Type Insights:

- Predictive Analytics

- Prescriptive Analytics

- Descriptive Analytics

The report has provided a detailed breakup and analysis of the market based on the type. This includes predictive analytics, prescriptive analytics, and descriptive analytics.

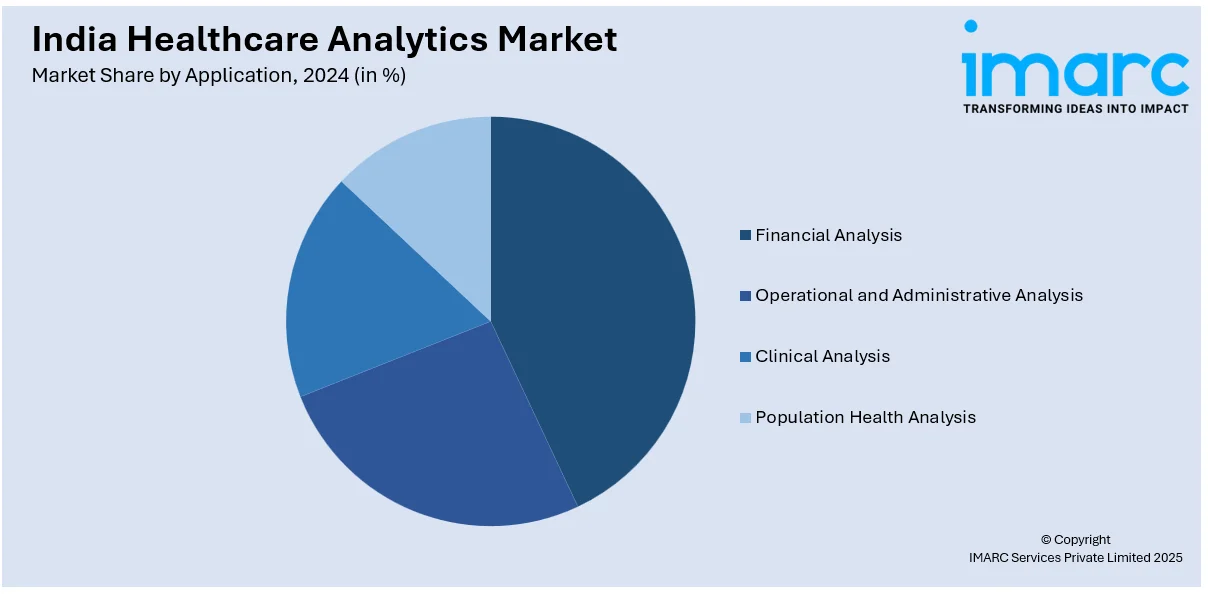

Application Insights:

- Financial Analysis

- Operational and Administrative Analysis

- Clinical Analysis

- Population Health Analysis

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes financial analysis, operational and administrative analysis, clinical analysis, and population health analysis.

End User Insights:

- Healthcare Payers

- Healthcare Providers

- Third Party Administrators

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes healthcare payers, healthcare providers, third party administrators, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Healthcare Analytics Market News:

- In January 2025, Innovaccer acquired Humbi AI, a Nashville-based actuarial software firm, strengthening its analytics capabilities for healthcare providers, payers, and life sciences organizations. This marks Innovaccer’s third major acquisition in 2024, following Cured and Pharmacy Quality Solutions (PQS). By integrating Humbi AI, Innovaccer plans to launch Actuarial Copilot, enhancing risk management and analytics for healthcare entities in India and beyond.

- In December 2024, Hyderabad-based health tech startup Aciana introduced "Ciana," an AI-powered healthcare platform integrating advanced genetic insights. This innovative platform is designed to transform personalized medicine by analyzing genetic data to deliver tailored health recommendations and treatments. Utilizing AI, Ciana processes extensive genetic information, empowering healthcare providers with data-driven insights for proactive care. This breakthrough marks a significant step in merging technology with healthcare, enhancing patient outcomes through customized medical solutions.

India Healthcare Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Deployment Modes Covered | On-Premises, Cloud |

| Types Covered | Predictive Analytics, Prescriptive Analytics, Descriptive Analytics |

| Applications Covered | Financial Analysis, Operational and Administrative Analysis, Clinical Analysis, Population Health Analysis |

| End Users Covered | Healthcare Payers, Healthcare Providers, Third Party Administrators, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India healthcare analytics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India healthcare analytics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India healthcare analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare analytics market in India was valued at USD 1.71 Billion in 2024.

The India healthcare analytics market is projected to exhibit a CAGR of 25.58% during 2025-2033, reaching a value of USD 15.47 Billion by 2033.

The growing adoption of digital health solutions, increasing healthcare data generation, and the need for improved decision-making is bolstering the healthcare analytics market in India. Rising government initiatives, a shift towards value-based care, and advancements in AI and ML technologies also contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)