India Healthcare Cold Chain Logistics Market Size, Share, Trends and Forecast by Product, Segment, and Region, 2025-2033

India Healthcare Cold Chain Logistics Market Overview:

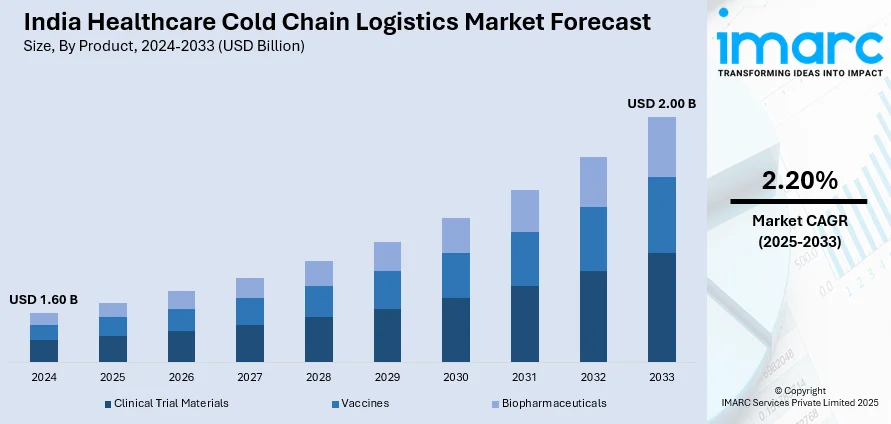

The India healthcare cold chain logistics market size reached USD 1.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.00 Billion by 2033, exhibiting a growth rate (CAGR) of 2.20% during 2025-2033. The market is driven by the rising demand for vaccines, biologics, and temperature-sensitive drugs, along with expanding immunization programs. Government initiatives, stricter regulatory compliance, and technological advancements including IoT and AI further enhance the India healthcare cold chain logistics market share. Increasing chronic diseases and the need to reduce spoilage also propel market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.60 Billion |

| Market Forecast in 2033 | USD 2.00 Billion |

| Market Growth Rate 2025-2033 | 2.20% |

India Healthcare Cold Chain Logistics Market Trends:

Rising Demand for Temperature-Sensitive Pharmaceutical Products

The India healthcare cold chain logistics market growth can be attributed to the increasing demand for temperature-sensitive pharmaceutical products, including vaccines, biologics, and specialty drugs. A research report released by IMARC Group indicates that the pharmaceutical market in India was valued at USD 61.36 Billion in 2024. It is projected to grow to USD 174.31 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 11.32% from 2025 to 2033. The expansion of immunization programs, such as the Universal Immunization Programme (UIP) and COVID-19 vaccination drives, has magnified the need for reliable cold chain storage and transportation. Moreover, the flow of chronic diseases has increased the demand for biologics and insulin need to maintain strict temperatures. Firms are investing extensively in cutting-edge refrigerated warehouses, temperature-monitoring technologies, and last-mile delivery systems to protect quality. Infrastructure development is further supported by the rollout of plans such as the National Cold Chain and Vaccine Management Plan by the government. Beyond pharmaceutical companies growing their product line-ups, the cold chain logistics market is expected to continue to grow due to regulatory requirements and the demand to lower spoilage risk.

To get more information on this market, Request Sample

Adoption of Advanced Cold Chain Technologies

The market is rapidly adopting advanced technologies to enhance efficiency and reduce wastage. IoT-enabled temperature monitoring systems, RFID tracking, and blockchain for real-time data logging are gaining traction, ensuring transparency and compliance with regulatory standards. On 9th October 2024, the Central Drugs Standard Control Organization (CDSCO) announced plans to implement QR codes on the packaging of medicines sold in India. After launching this technology on 300 leading brands, including Allegra and Calpol, the initiative aims to enhance drug authenticity by providing key information such as manufacturer details and expiration dates. This action is part of a continuous effort to combat fraudulent drugs and enhance quality assurance within the industry. Solar-powered cold storage units and electric refrigerated vehicles are emerging as sustainable solutions, particularly in rural areas with unreliable electricity supply. Additionally, AI-driven predictive analytics is being used to optimize routes and prevent temperature excursions during transit. The government’s push for digitization under schemes including the Digital India initiative is further accelerating tech adoption, thus creating a positive India healthcare cold chain logistics market outlook. As logistics providers and pharmaceutical companies prioritize automation and real-time monitoring, the market is shifting toward smarter, more resilient cold chain solutions, ensuring safe and efficient delivery of healthcare products across the country.

India Healthcare Cold Chain Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product and segment.

Product Insights:

- Clinical Trial Materials

- Vaccines

- Biopharmaceuticals

The report has provided a detailed breakup and analysis of the market based on the product. This includes clinical trial materials, vaccines, and biopharmaceuticals.

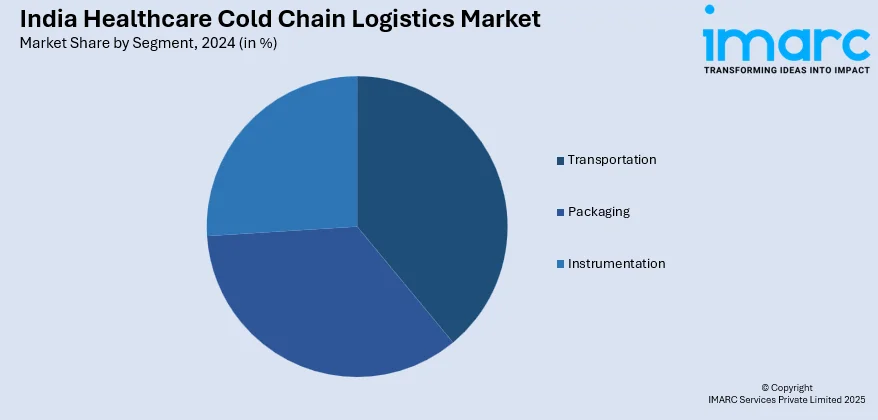

Segment Insights:

- Transportation

- Packaging

- Instrumentation

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes transportation, packaging, and instrumentation.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Healthcare Cold Chain Logistics Market News:

- February 27, 2025: Apollo Hospitals and TECHEAGLE announced the launch of India's first 10-minute Diagnostic Drone Delivery (D3) service with AI-based autonomous drones transporting liquid biopsy samples, also enabling real-time air traffic control and 5 G-enabled tracking. The launch of this service seeks to reduce vital diagnostic hold-ups in cancer care, enabling faster deliveries that underpin the healthcare cold chain, rain or shine.

- October 04, 2024: UPS launched a temperature-controlled human life cross-dock at Hyderabad. This facility is able to hold 15 pallets between +15°C and +25°C, seven pallets between +2°C and +8°C and 50 pallets at ambient temperature. It greatly enhances cold chain preciseness for biologics, specialty pharmaceuticals, and personalized medicine by strictly following GDP-compliant healthcare logistics. This addition enhances India’s position in the precision medical logistics landscape as a part of UPS Healthcare’s wider global network, with 216 facilities and 10 million square feet of cold chain capacity worldwide.

India Healthcare Cold Chain Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Clinical Trial Materials, Vaccines, Biopharmaceuticals |

| Segments Covered | Transportation, Packaging, Instrumentation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India healthcare cold chain logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the India healthcare cold chain logistics market on the basis of product?

- What is the breakup of the India healthcare cold chain logistics market on the basis of segment?

- What is the breakup of the India healthcare cold chain logistics market on the basis of region?

- What are the various stages in the value chain of the India healthcare cold chain logistics market?

- What are the key driving factors and challenges in the India healthcare cold chain logistics market?

- What is the structure of the India healthcare cold chain logistics market and who are the key players?

- What is the degree of competition in the India healthcare cold chain logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India healthcare cold chain logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India healthcare cold chain logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India healthcare cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)