India Healthcare Financing Solution Market Size, Share, Trends and Forecast by Equipment Type, Services, and Region, 2025-2033

India Healthcare Financing Solution Market Overview:

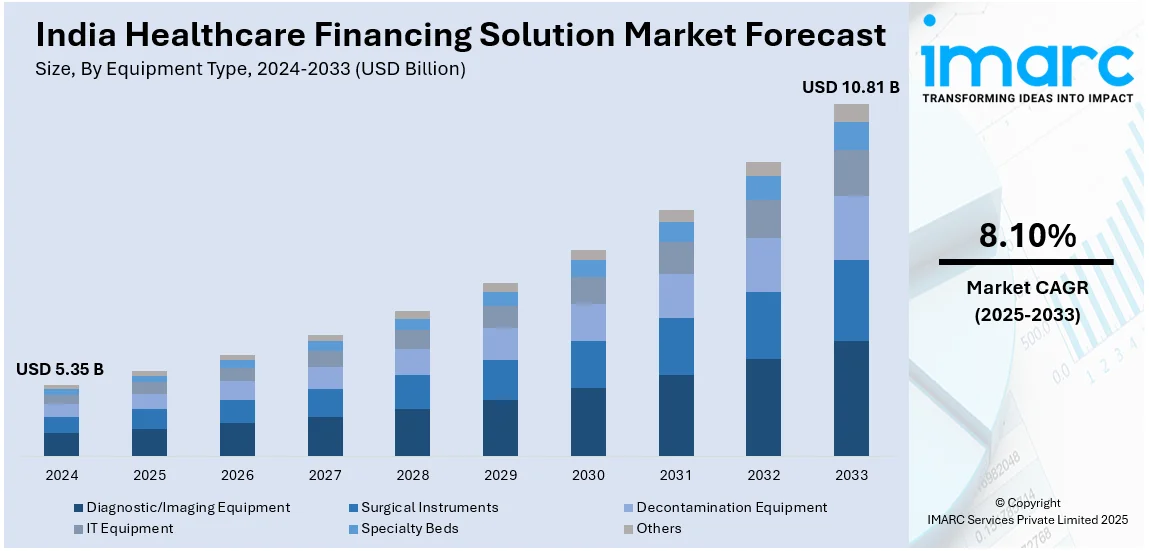

The India healthcare financing solution market size reached USD 5.35 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.81 Billion by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033. The rising medical costs, increasing health insurance penetration, government initiatives, digital lending growth, expanding fintech solutions, higher consumer awareness, and demand for cashless treatment options are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.35 Billion |

| Market Forecast in 2033 | USD 10.81 Billion |

| Market Growth Rate 2025-2033 | 8.10% |

India Healthcare Financing Solution Market Trends:

Digital Healthcare Expansion

The adoption of digital health identities is accelerating, with millions now enrolled in government-backed health programs. More individuals, including a significant proportion of women, are accessing seamless cashless healthcare services. States with high enrollment numbers highlight the growing reliance on digital platforms for medical records and transactions. The integration of technology in public health initiatives is fostering efficiency, accessibility, and financial protection for families. With more healthcare professionals joining the ecosystem, the shift toward a structured, data-driven approach in healthcare services is becoming evident, paving the way for a more inclusive and transparent medical infrastructure. As of January 20, 2025, over 73 Crore Ayushman Bharat Health Accounts (ABHA) have been successfully created, with more than 5 lakh health professionals registered. The top five states with the highest number of ABHA holders are Uttar Pradesh, Rajasthan, Maharashtra, Madhya Pradesh, and Gujarat. Notably, 49.15% of beneficiaries are women, highlighting the scheme's inclusive reach. ABHA facilitates seamless digital health transactions, enabling patients to access cashless healthcare services under government initiatives like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY), which provides INR 5 Lakh annual health coverage per family, benefiting over 50 Crore citizens.

To get more information on this market, Request Sample

Healthcare Financing for Strengthened Infrastructure

Significant financial support is accelerating the enhancement of healthcare infrastructure, focusing on pandemic preparedness, improved service delivery, and equitable medical access. Governments and international institutions are prioritizing large-scale funding to strengthen public health systems, ensuring sustainability and efficiency in response to future crises. This shift emphasizes digital health integration, modernized surveillance systems, and upgraded medical facilities. The approach aims to create robust, accessible, and inclusive healthcare ecosystems, reducing disparities and improving national health security. As investments increase, healthcare frameworks are evolving to withstand global health threats, emphasizing prevention and rapid response mechanisms. This movement reflects a long-term commitment to fostering sustainable medical solutions, ensuring nations are better equipped to handle health emergencies and provide quality care for all. For instance, in March 2023, the World Bank approved two complementary loans of INR 500 Million each to bolster India's healthcare infrastructure. This INR 1 Billion financing supports the Pradhan Mantri-Ayushman Bharat Health Infrastructure Mission (PM-ABHIM), aiming to enhance public health systems for pandemic preparedness and improve health service delivery.

India Healthcare Financing Solution Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on equipment type and services.

Equipment Type Insights:

- Diagnostic/Imaging Equipment

- Surgical Instruments

- Decontamination Equipment

- IT Equipment

- Specialty Beds

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes diagnostic/imaging equipment, surgical instruments, decontamination equipment, IT equipment, specialty beds, and others.

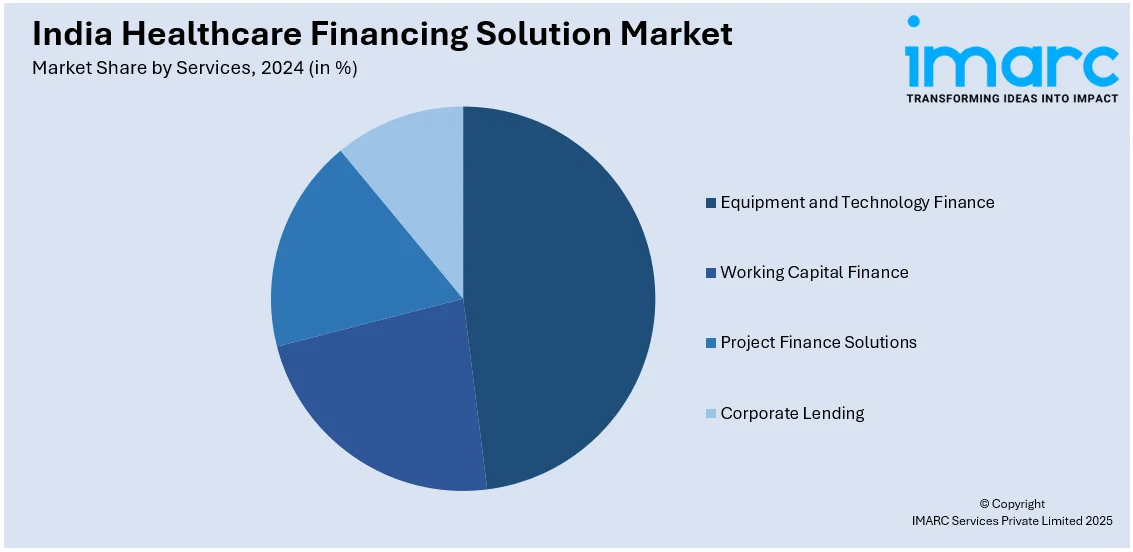

Services Insights:

- Equipment and Technology Finance

- Working Capital Finance

- Project Finance Solutions

- Corporate Lending

A detailed breakup and analysis of the market based on the services have also been provided in the report. This includes equipment and technology finance, working capital finance, project finance solutions, and corporate lending.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Healthcare Financing Solution Market News:

- In May 2024, Emoha, an eldercare provider, partnered with Aditya Birla Health Insurance to offer personalized senior care solutions to corporate clients and group mediclaim policyholders. This collaboration aims to enhance healthcare accessibility for India's aging population, integrating Emoha's services into health insurance offerings.

- In November 2023, the Asian Development Bank (ADB) approved an INR 500 Million loan to enhance medical education and tertiary healthcare in Maharashtra, India. The Maharashtra Tertiary Care and Medical Education Sector Development Program aims to establish four medical colleges with attached teaching hospitals in underserved districts, incorporating climate-resilient and inclusive designs. This initiative seeks to increase hospital bed capacity and recruit at least 500 new doctors, improving access to quality healthcare and medical education in the state.

India Healthcare Financing Solution Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Diagnostic/Imaging Equipment, Surgical Instruments, Decontamination Equipment, IT Equipment, Specialty Beds, Others |

| Services Covered | Equipment and Technology Finance, Working Capital Finance, Project Finance Solutions, Corporate Lending |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India healthcare financing solution market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India healthcare financing solution market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India healthcare financing solution industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare financing solution market in India was valued at USD 5.35 Billion in 2024.

The healthcare financing solution market in India is projected to exhibit a CAGR of 8.10% during 2025-2033, reaching a value of USD 10.81 Billion by 2033.

The rising medical costs, increasing health insurance penetration, government initiatives, growth of digital lending, expanding fintech solutions, higher consumer awareness, and demand for cashless treatment options are driving the growth of the healthcare financing solution market in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)