India Heat Exchanger Tubes Market Size, Share, Trends and Forecast by Material Type, Product Type, Tube Configuration, Distribution Channel, End Use Industry, and Region, 2025-2033

India Heat Exchanger Tubes Market Overview:

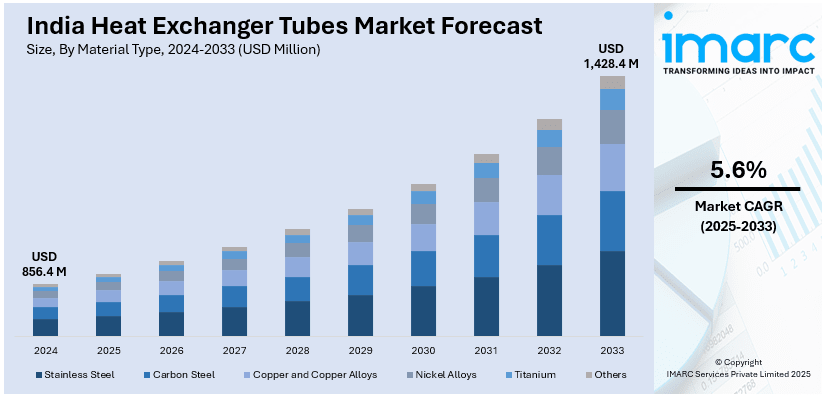

The India heat exchanger tubes market size reached USD 856.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,428.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The growth of the market is supported by the increasing investment in renewable energy projects, technological advancements in materials for enhanced performance and durability, and the rising demand for specialized, energy-efficient heat exchanger solutions across industries like chemicals, petrochemicals, and renewable energy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 856.4 Million |

| Market Forecast in 2033 | USD 1,428.4 Million |

| Market Growth Rate 2025-2033 | 5.6% |

India Heat Exchanger Tubes Market Trends:

Increasing Investment in Renewable Energy Projects

The shift towards renewable energy sources such as solar, wind, and biomass is greatly influencing the heat exchanger tubes market in India. As the nation keeps developing its renewable energy infrastructure, the demand for effective heat management systems is becoming more critical. In renewable energy generation systems, especially in concentrated solar power (CSP) and geothermal facilities, heat exchangers play a vital role in enhancing energy transfer and conversion methods. Heat exchanger tubes enable the movement of thermal energy from the heat source to a storage medium or the power generation system, improving the overall efficiency of renewable energy plants. The growing emphasis on clean energy initiatives is fueling the need for specialized heat exchanger tubes capable of enduring the high temperatures and corrosive settings characteristic of these uses. Additionally, the dedication of the governing body to achieving ambitious renewable energy objectives further encourages the use of advanced heat exchanger technologies. In 2024, SECI (Solar Energy Corporation of India) revealed intentions to initiate a tender for a 500-MW concentrated solar-thermal power initiative, emphasizing continuous green energy. The project, anticipated to be situated in Gujarat, Rajasthan, or Andhra Pradesh, included thermal energy storage utilizing molten salt tanks. This advancement signified an important milestone in India's renewable energy path, catalyzing the demand for effective heat exchanger tubes to optimize energy production and guarantee sustainable power generation.

To get more information on this market, Request Sample

Technological Advancements and Innovation in Materials

Continuous technological improvements in materials and design to enhance functionality are transforming the India heat exchanger tubes market. With a growing focus on durability, heat transfer efficiency, and resistance to corrosion, manufacturers are developing high-quality tubes using innovative materials, including stainless steel, titanium, and copper alloys. These materials offer superior thermal conductivity, resistance to chemical corrosion, and better performance under extreme conditions. Furthermore, innovations in manufacturing techniques, such as the development of multi-functional tubes and the use of advanced welding and bending technologies, are improving the overall performance of heat exchangers. The rising demand for customized heat exchanger solutions, based on specific industry needs, is also prompting continuous research and development (R&D). As sectors demand improved performance and dependability from their systems, the market for heat exchanger tubes keeps progressing, powered by these continuous technological developments and material breakthroughs. In 2023, Alleima officially launched a new state-of-the-art heat exchanger tube facility in Mehsana, Gujarat, marking the completion of its three-phase expansion. The facility would enhance production capacity for advanced alloys in heat exchanger tubing, serving India's chemical, petrochemical, and renewable energy sectors.

India Heat Exchanger Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on material type, product type, tube configuration, distribution channel, and end use industry.

Material Type Insights:

- Stainless Steel

- Carbon Steel

- Copper and Copper Alloys

- Nickel Alloys

- Titanium

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes stainless steel, carbon steel, copper and copper alloys, nickel alloys, titanium, and others.

Product Type Insights:

- Seamless Heat Exchanger Tubes

- Welded Heat Exchanger Tubes

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes seamless heat exchanger tubes and welded heat exchanger tubes.

Tube Configuration Insights:

- U-Tubes

- Straight Tubes

- Finned Tubes

The report has provided a detailed breakup and analysis of the market based on the tube configuration. This includes u-tubes, straight tubes, and finned tubes.

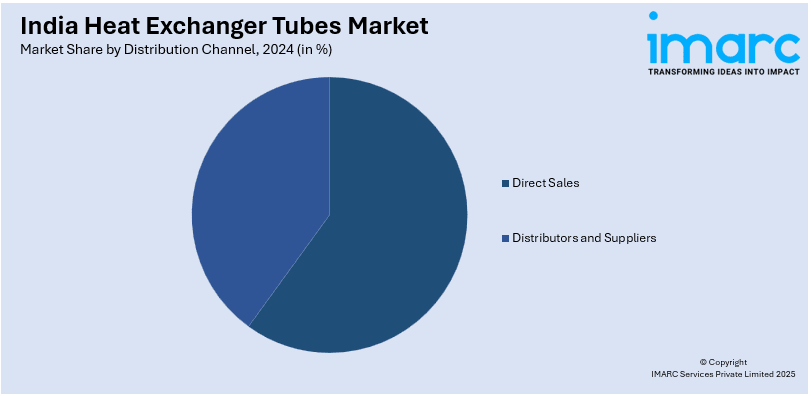

Distribution Channel Insights:

- Direct Sales

- Distributors and Suppliers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales and distributors and suppliers.

End Use Industry Insights:

- Power Generation

- Oil and Gas

- Chemical and Petrochemical

- HVAC and Refrigeration

- Food and Beverage Processing

- Automotive and Aerospace

- Marine and Shipbuilding

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes power generation, oil and gas, chemical and petrochemical, HVAC and refrigeration, food and beverage processing, automotive and aerospace, marine and shipbuilding, pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Heat Exchanger Tubes Market News:

- In October 2024, KRN HVAC signed an MoU with the Rajasthan government to invest Rs 1,000 crore in manufacturing heat exchanger tubes. The investment would be made in phases at its wholly-owned subsidiary. KRN specializes in producing water coils and heat exchangers with copper tubes and aluminum fins for the HVAC&R sector.

- In August 2023, Indian Chemical News (ICN) and Alleima organized a session in Bharuch on "Combating Heat Exchanger Tube Corrosion in the Chemical Industry." The event featured experts from companies like Jubilant Ingrevia, Reliance, Aarti Industries, and Alleima, who discussed the challenges and solutions for corrosion in heat exchanger tubes. The discussion covered material selection, corrosion monitoring, and cost-saving strategies.

India Heat Exchanger Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Carbon Steel, Copper and Copper Alloys, Nickel Alloys, Titanium, Others |

| Product Types Covered | Seamless Heat Exchanger Tubes, Welded Heat Exchanger Tubes |

| Tube Configurations Covered | U-Tubes, Straight Tubes, Finned Tubes |

| Distribution Channels Covered | Direct Sales, Distributors and Suppliers |

| End Use Industries Covered | Power Generation, Oil and Gas, Chemical and Petrochemical, HVAC and Refrigeration, Food and Beverage Processing, Automotive and Aerospace, Marine and Shipbuilding, Pharmaceuticals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India heat exchanger tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India heat exchanger tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India heat exchanger tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in India was valued at USD 856.4 Million in 2024.

The India heat exchanger tubes market is projected to exhibit a CAGR of 5.6% during 2025-2033, reaching a value of USD 1,428.4 Million by 2033.

The market's growth is driven by increasing investments in renewable energy projects, advancements in materials for enhanced performance, and the rising demand for energy-efficient heat exchanger solutions. Technological improvements, particularly in heat transfer efficiency and corrosion resistance, also contribute to market expansion, particularly in industries like chemicals, petrochemicals, and renewable energy.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)