India Heavy Construction Equipment Market Size, Share, Trends, and Forecast by Equipment Type, End User, and Region, 2025-2033

India Heavy Construction Equipment Market Overview:

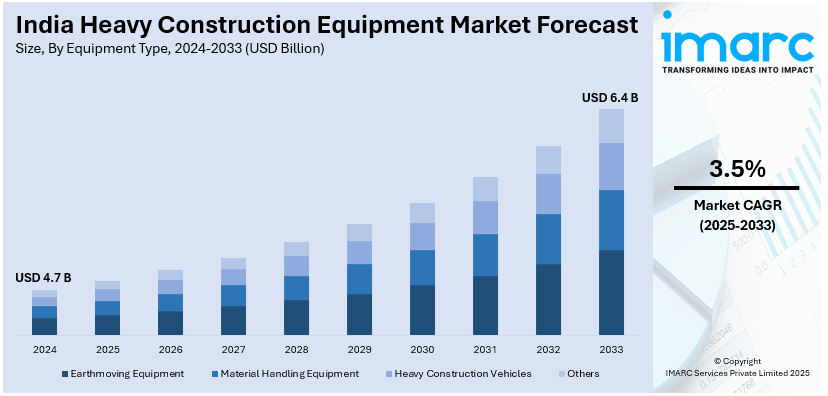

The India heavy construction equipment market size reached USD 4.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. The market is expanding due to infrastructure projects, urbanization, and government initiatives like PM Gati Shakti. Rising investments in roads, railways, and smart cities drive the demand for excavators, loaders, and cranes, with automation and telematics adoption increasing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.7 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Market Growth Rate 2025-2033 | 3.5% |

India Heavy Construction Equipment Market Trends:

Increased Adoption of Advanced Telematics and Automation in Heavy Equipment

The India heavy construction equipment industry is currently experiencing a sharp inclination toward digitalization with the rapid incorporation of both automation technologies and telematics. Construction companies are increasingly investing in GPS-enabled equipment, remote monitoring systems, and IoT-based predictive maintenance solutions to enhance operational efficiency. These technologies provide real-time data on fuel consumption, equipment utilization, and machine health, reducing downtime and maintenance costs. The demand for autonomous and semi-autonomous machinery is also rising, driven by labor shortages and the need for precision in large-scale infrastructure projects. OEMs are partnering with technology firms to integrate AI-driven analytics, enabling predictive maintenance and remote troubleshooting. Additionally, the push for sustainable construction practices is encouraging the adoption of smart equipment with energy-efficient features. Government initiatives such as ‘Digital India’ and incentives for infrastructure modernization further support this trend, making technologically advanced heavy machinery a key differentiator in the competitive construction sector. For instance, as per the Press Information Bureau, India emerged as the 3rd biggest digitalized nation globally in 2024. In line with this, digital economy contributed significantly to nation's growth, accounting for USD 402 Billion or 11.74% of the total GDP during 2022 to 2023.

To get more information on this market, Request Sample

Rising Need for Electric and Hybrid Heavy Construction Equipment

The shift toward sustainable construction practices is driving requirement for electric and hybrid heavy construction equipment in India. With stricter emission regulations and rising fuel costs, construction companies are exploring alternatives to conventional diesel-powered machinery. For instance, in June 2024, the government announced price elevation for diesel and petrol by INR 3.5 and 3 per liter respectively in Karnataka. Furthermore, global equipment manufacturers are introducing battery-electric excavators, loaders, and dump trucks with lower operational costs and reduced carbon footprints. Hybrid models, combining internal combustion engines with electric propulsion, are also gaining traction for their improved fuel efficiency and extended operating hours. Government policies promoting clean energy utilization, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) initiative, further support this transition. Infrastructure projects aiming for sustainability certifications, such as green buildings and smart cities, are prioritizing eco-friendly equipment.

India Heavy Construction Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on equipment type and end user.

Equipment Type Insights:

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Vehicles

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes earthmoving equipment, material handling equipment, heavy construction vehicles, and others.

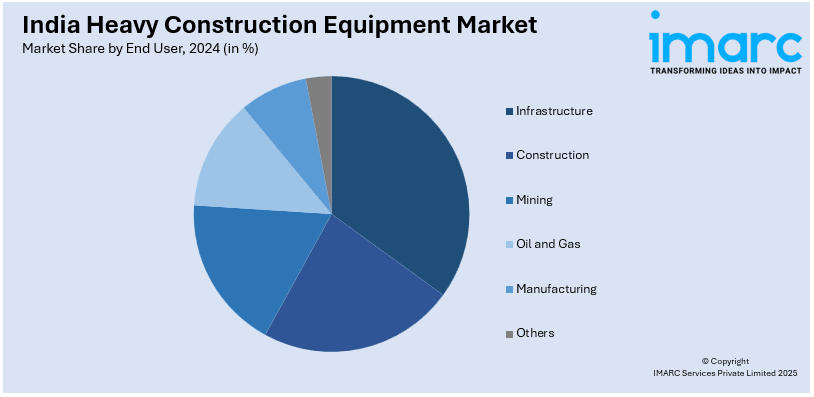

End User Insights:

- Infrastructure

- Construction

- Mining

- Oil and Gas

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes infrastructure, construction, mining, oil and gas, manufacturing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Heavy Construction Equipment Market News:

- In December 2024, Action Construction Equipment Ltd., an Indian-based company, launched its new backhoe loader BS-V(CE-V) AX124, powered by TATA engine. This loader is designed to cater to the strict emission policies and offers premium cabin and muscular bonnet, along with delivering excellent fuel efficacy and reduced emissions.

- In December 2024, Greaves Retail introduced its new product line for electrified, high-performance light construction equipment. This range incorporates leading-edge electrification techniques to offer zero-emission services, improving performance while minimizing operational expenditure.

India Heavy Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Type Covered | Earthmoving Equipment, Material Handling Equipment, Heavy Construction Vehicles, Others |

| End User Covered | Infrastructure, Construction, Mining, Oil and Gas, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India heavy construction equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India heavy construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India heavy construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The heavy construction equipment market in India was valued at USD 4.7 Billion in 2024.

The India heavy construction equipment market is projected to exhibit a CAGR of 3.5% during 2025-2033, reaching a value of USD 6.4 Billion by 2033.

The market is driven by a growing focus on mechanized construction, labor cost optimization, and demand for faster project execution. Equipment such as excavators, cranes, and loaders are becoming essential across varied terrains. Leasing and rental models are gaining traction, allowing contractors to scale operations without high upfront investment in machinery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)