India Heavy Machinery Components Market Size, Share, Trends and Forecast by Component Type, Material Type, Machinery Type, Sales Channel, End Use Industry, and Region, 2025-2033

India Heavy Machinery Components Market Overview:

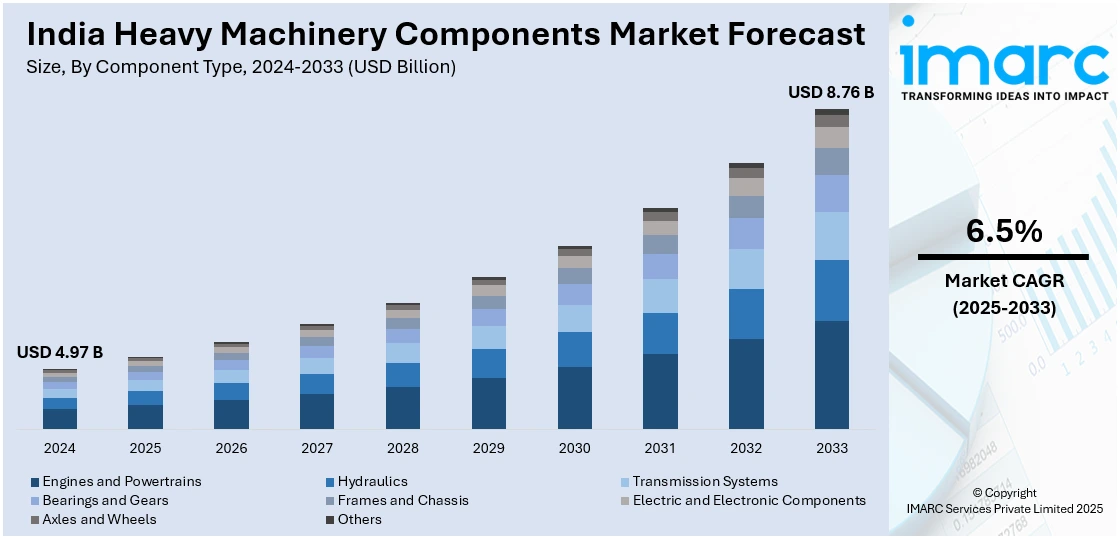

The India heavy machinery components market size reached USD 4.97 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.76 Billion by 2033, exhibiting a growth rate (CAGR) of 6.5% during 2025-2033. Rapid infrastructure development, growing construction activities, increased mining operations, government initiatives, rising demand for automation, and advancements in machinery technology, leading to enhanced productivity and efficiency across industries, are some of the factors contributing to India heavy machinery components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.97 Billion |

| Market Forecast in 2033 | USD 8.76 Billion |

| Market Growth Rate 2025-2033 | 6.5% |

India Heavy Machinery Components Market Trends:

Growth in Demand for Heavy Machinery

The India heavy machinery components market is expanding rapidly, driven by increased demand in the building, mining, and infrastructure sectors. Government efforts and large-scale infrastructure projects, as well as rising mining and construction expenditures, are driving this demand. Partnerships between industry leaders are also aiding the market, as they expand market reach, promote technical advancements, and increase total sales. Key manufacturers are meeting important production and distribution milestones, indicating an expanding client base and deeper market penetration. Furthermore, as companies and sectors seek improved performance and sustainability, there is a visible movement toward more modern and efficient technology. As the industry evolves, there is a greater emphasis on using cutting-edge technology to fulfill increased efficiency and safety requirements. This change to contemporary machinery is not only increasing operating capacities, but it is also critical to the sustained growth of India's heavy machinery sector. These factors are intensifying the India heavy machinery components market growth. For example, in July 2024, Komatsu India celebrated the sale of its 50,000th machine in India, marking a significant milestone in its partnership with Larsen & Toubro.

To get more information on this market, Request Sample

Focus on Safety and Quality in Machinery Components

In India, the heavy machinery components market is experiencing a significant shift toward safety and quality criteria. A new regulation change requires mandatory certification for a wide variety of mechanical and electrical equipment components. This effort, which aims to ensure safety and improve the overall quality of machinery used in important industries, demonstrates the government's commitment to raising industry standards. With the Bureau of Indian Standards handling the certification process, producers must now fulfill stringent safety and performance standards. This move is expected to elevate product reliability and consumer confidence, while promoting innovation in the design and manufacturing of heavy machinery components. As compliance becomes mandatory, there is growing demand for companies to invest in quality assurance processes, which could drive the adoption of advanced technologies and manufacturing practices in India’s machinery sector. For instance, in March 2025, the Ministry of Heavy Industries signed a Quality Control Order for Machinery and Electrical Equipment Safety, mandating compulsory certification for 20 categories of machinery and electrical equipment components by the Bureau of Indian Standards.

India Heavy Machinery Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, material type, machinery type, sales channel, and end use industry.

Component Type Insights:

- Engines and Powertrains

- Hydraulics

- Pumps

- Valves

- Cylinders

- Transmission Systems

- Bearings and Gears

- Frames and Chassis

- Electric and Electronic Components

- Axles and Wheels

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes engines and powertrains, hydraulics (pumps, valves, and cylinders), transmission systems, bearings and gears, frames and chassis, electric and electronic components, axles and wheels, and others.

Material Type Insights:

- Steel

- Aluminum

- Cast Iron

- Composites

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes steel, aluminum, cast iron, composites, and others.

Machinery Type Insights:

- Construction Equipment

- Mining Equipment

- Agriculture Equipment

- Industrial Machinery

- Oil and Gas Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the machinery type. This includes construction equipment, mining equipment, agriculture equipment, industrial machinery, oil and gas equipment, and others.

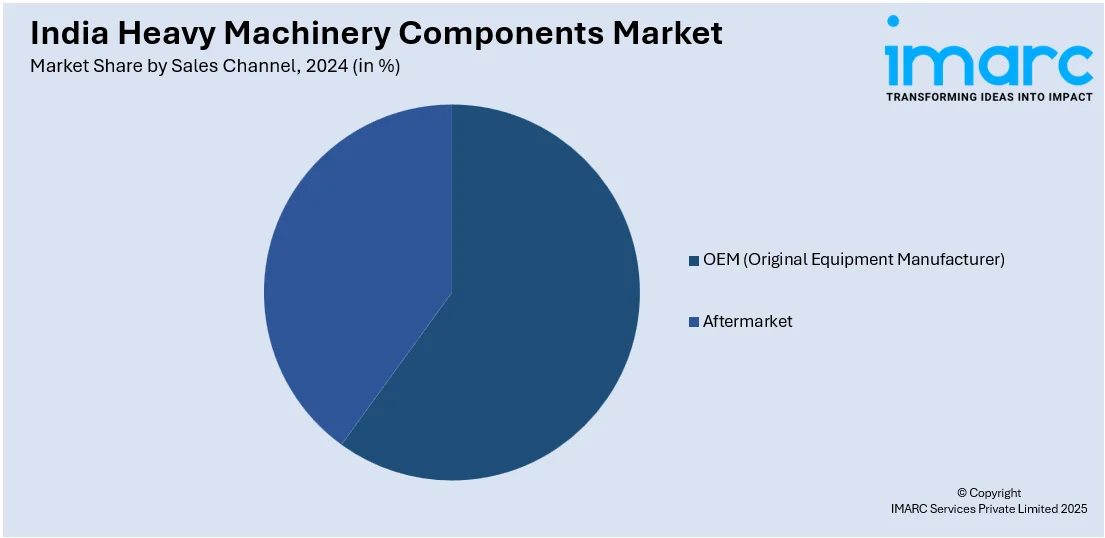

Sales Channel Insights:

- OEM (Original Equipment Manufacturer)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM (original equipment manufacturer) and aftermarket.

End Use Industry Insights:

- Construction and Infrastructure

- Mining and Metallurgy

- Agriculture

- Manufacturing

- Oil and Gas

- Energy and Power

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes construction and infrastructure, mining and metallurgy, agriculture, manufacturing, oil and gas, energy and power, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Heavy Machinery Components Market News:

- In October 2024, Komatsu India participated in the 17th International Mining and Machinery Exhibition (IMME) in Kolkata, showcasing its commitment to sustainable mining solutions. The company, in collaboration with Larsen & Toubro, displayed models like the GD950 HE, GD955 MG, 730E Electric Dump Truck, and PC4000 Electric Shovel. The stall attracted over 350 visitors, including 105 key mining customers from various regions.

India Heavy Machinery Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Steel, Aluminum, Cast Iron, Composites, Others |

| Machinery Types Covered | Construction Equipment, Mining Equipment, Agriculture Equipment, Industrial Machinery, Oil and Gas Equipment, Others |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Construction and Infrastructure, Mining and Metallurgy, Agriculture, Manufacturing, Oil and Gas, Energy and Power, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India heavy machinery components market performed so far and how will it perform in the coming years?

- What is the breakup of the India heavy machinery components market on the basis of component type?

- What is the breakup of the India heavy machinery components market on the basis of material type?

- What is the breakup of the India heavy machinery components market on the basis of machinery type?

- What is the breakup of the India heavy machinery components market on the basis of sales channel?

- What is the breakup of the India heavy machinery components market on the basis of end use industry?

- What is the breakup of the India heavy machinery components market on the basis of region?

- What are the various stages in the value chain of the India heavy machinery components market?

- What are the key driving factors and challenges in the India heavy machinery components market?

- What is the structure of the India heavy machinery components market and who are the key players?

- What is the degree of competition in the India heavy machinery components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India heavy machinery components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India heavy machinery components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India heavy machinery components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)