India Helicopter Leasing Market Size, Share, Trends and Forecast by Helicopter, Light Helicopter, Medium Helicopter, Lease Type, Application and Region, 2025-2033

India Helicopter Leasing Market Overview:

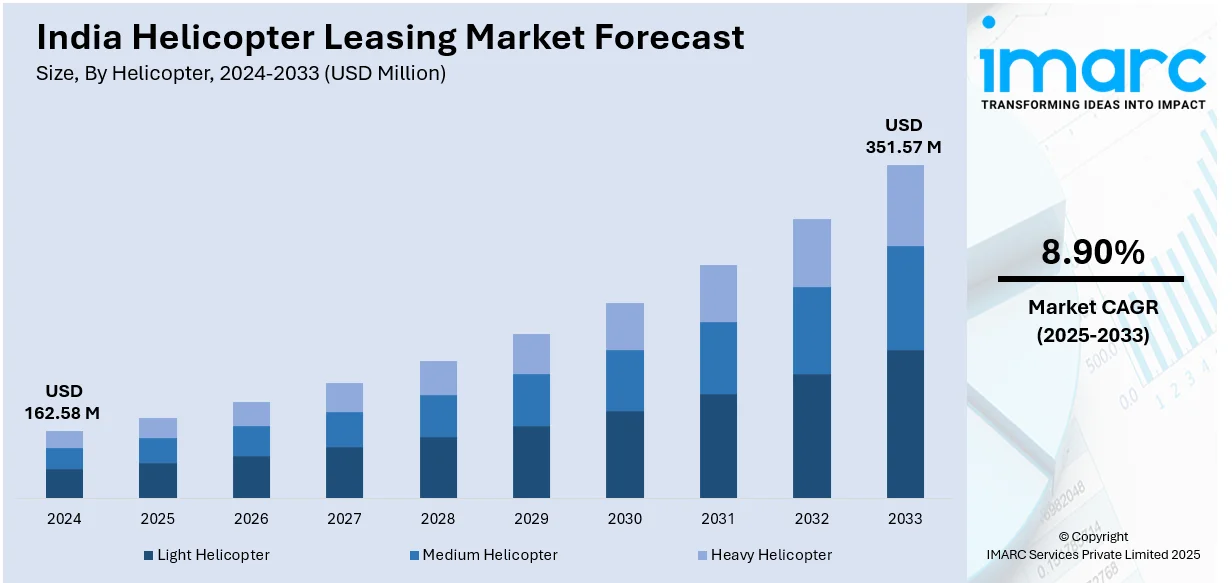

The India helicopter leasing market size reached USD 162.58 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 351.57 Million by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. The India helicopter leasing market share is fueled by the increasing demand in the oil and gas industry for offshore activities, tourism growth, particularly in pilgrimage and luxury travel, government policies such as the UDAN scheme to enhance regional connectivity, and the cost-effectiveness of leasing compared to ownership.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 162.58 Million |

| Market Forecast in 2033 | USD 351.57 Million |

| Market Growth Rate 2025-2033 | 8.90% |

India Helicopter Leasing Market Trends:

Growth in Demand for Helicopter Leasing in the Oil & Gas Sector

The India helicopter leasing market outlook is experiencing impressive growth, mainly in the oil and gas sector. The business needs helicopters for the transportation of people and machinery to offshore drilling locations, most notably in the Andaman Sea and the Bay of Bengal. As offshore exploration and production expand, the requirement for efficient and cost-effective aerial transport is booming. Helicopter leasing is an appealing option since it enables oil and gas companies to escape the huge capital outlay of acquiring helicopters. Rather, they lease aircraft according to their operational requirements, enhancing cost-effectiveness and operational flexibility. The trend is also driven by the government's initiative to promote domestic oil production, thus heightening the demand for regular offshore operations. According to reports, the government also aims to lower aircraft leasing expenses in India by 10% with new laws, potentially leading to a considerable decrease in airfares for travelers and training fees for future pilots. This trend is likely to keep increasing as the Indian energy market evolves and new exploration ventures emerge, further fueling the India helicopter leasing market growth.

To get more information on this market, Request Sample

Rise in Tourism-Driven Helicopter Leasing

The tourism industry in India is also leading the expansion of the helicopter leasing market. Due to the rising popularity of helicopter tours for pilgrimages, luxury travel, and scenic tours, tourism-based demand for helicopter leasing is growing. Tourist places such as Vaishno Devi, Kedarnath, and the Himalayas receive a constant stream of helicopter services to carry tourists, particularly where road connectivity is poor. Helicopter leasing companies are taking advantage of this expanding market by providing flexible leasing terms for tour operators so that they can accommodate fluctuating demand throughout the year without having to own helicopters. Furthermore, luxury tourism is expanding rapidly with affluent tourists wanting private helicopter service for smooth transportation between locations. The Indian government's initiatives for regional connectivity under the UDAN scheme are also helping to fuel growing demand for short-term helicopter rentals for tourism. According to industry reports, India presently operates 829 aircraft, and with more than 1,700 new aircraft orders made, the nation will need approximately 30,000 pilots over the next 15-20 years to support industry expansion.

India Helicopter Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on helicopter, light helicopter, medium helicopter, lease type and application .

Helicopter Insights:

- Light Helicopter

- Medium Helicopter

- Heavy Helicopter

The report has provided a detailed breakup and analysis of the market based on the helicopter. This includes light helicopter, medium helicopter, and heavy helicopter.

Light Helicopter Insights:

- HAL ALH Dhruv (CHF)

- Hindustan Dhruv (CS)

- HAL LUH Helicopter

- AW-109

- Bell 407

- AS-350

- H-125

- AW-119

- Others

The report has provided a detailed breakup and analysis of the market based on the light helicopter. This includes HAL ALH Dhruv (CHF), Hindustan Dhruv (CS), HAL LUH Helicopter, AW-109, Bell 407, AS-350, H-125, AW-119, and Others.

Medium Helicopter Insights:

- Bell 412

- Dauphin 365

- Others

The report has provided a detailed breakup and analysis of the market based on the medium helicopter. This includes Bell-412, Dauphin 365, and others.

Lease Type Insights:

- Dry Lease

- Wet Lease

The report has provided a detailed breakup and analysis of the market based on the lease type. This includes dry lease, and wet lease.

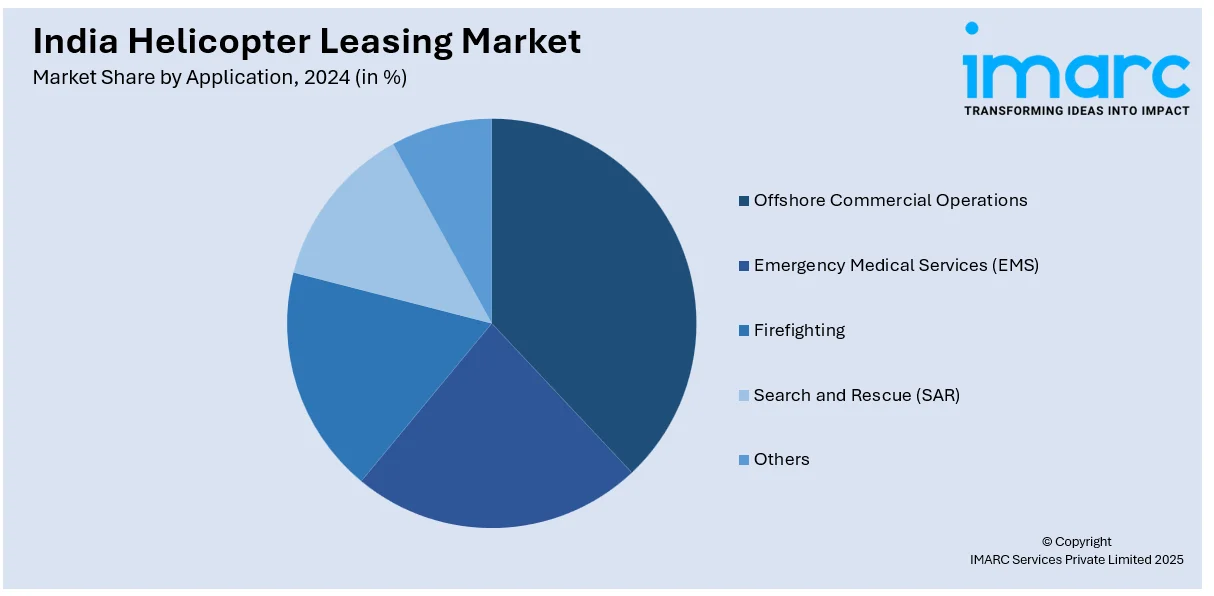

Application Insights:

- Offshore Commercial Operations

- Emergency Medical Services (EMS)

- Firefighting

- Search and Rescue (SAR)

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes offshore commercial operations, emergency medical services (EMS), firefighting, search and rescue (SAR), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Helicopter Leasing Market News:

- In December 2024, following several efforts to privatize the government’s helicopter service, Pawan Hans Limited (PHL) presented a plan to the Centre to acquire 23 new helicopters to update its old fleet of 42 helicopters.

- In May 2024, Airbus Helicopters and the Small Industries Development Bank of India (SIDBI), which is the main financial body of the Government of India aimed at promoting, funding, and developing the Micro, Small and Medium Enterprise (MSME) sector, entered into a Memorandum of Understanding (MoU) to finance the acquisition of Airbus helicopters in India.

India Helicopter Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Helicopters Covered | Light Helicopter, Medium Helicopter, Heavy Helicopter |

| Light Helicopters Covered | HAL ALH Dhruv (CHF), Hindustan Dhruv (CS), HAL LUH Helicopter, AW-109, Bell 407, AS-350, H-125, AW-119, Others |

| Medium Helicopters Covered | Bell 412, Dauphin 365, Others |

| Lease Types Covered | Dry Lease, Wet Lease |

| Applications Covered | Offshore Commercial Operations, Emergency Medical Services (EMS), Firefighting, Search and Rescue (SAR), Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India helicopter leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the India helicopter leasing market on the basis of helicopter?

- What is the breakup of the India helicopter leasing market on the basis of light helicopter?

- What is the breakup of the India helicopter leasing market on the basis of medium helicopter?

- What is the breakup of the India helicopter leasing market on the basis of lease type?

- What is the breakup of the India helicopter leasing market on the basis of application?

- What is the breakup of the India helicopter leasing market on the basis of region?

- What are the various stages in the value chain of the India helicopter leasing market?

- What are the key driving factors and challenges in the India helicopter leasing market?

- What is the structure of the India helicopter leasing market and who are the key players?

- What is the degree of competition in the India helicopter leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India helicopter leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India helicopter leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India helicopter leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)