India Hemodialysis Market Size, Share, Trends and Forecast by Segment, Modality, End User, and Region, 2025-2033

Market Overview:

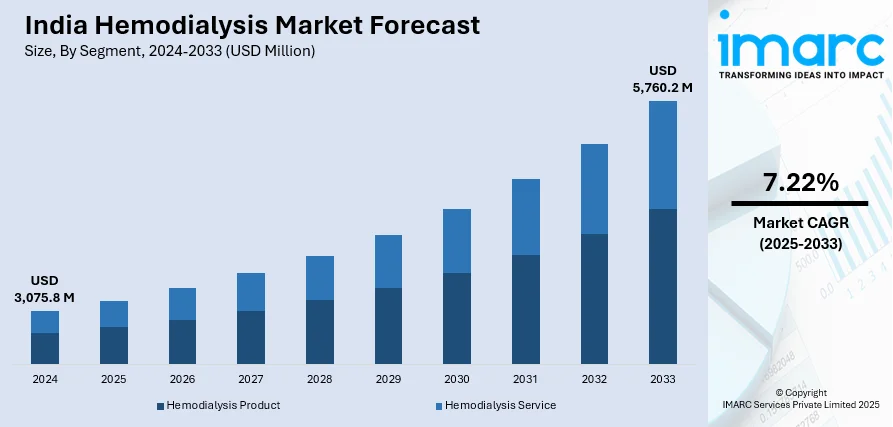

India hemodialysis market size reached USD 3,075.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,760.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. The increasing advances in hemodialysis technology, such as improved dialysis machines, dialyzers, and monitoring systems, which can enhance treatment effectiveness, reduce complications, and improve patient outcomes, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,075.8 Million |

|

Market Forecast in 2033

|

USD 5,760.2 Million |

| Market Growth Rate 2025-2033 | 7.22% |

Hemodialysis is a medical procedure employed to treat individuals with kidney failure by removing waste products and excess fluids from their blood. During hemodialysis, a patient's blood is circulated through a machine known as a dialyzer, which acts as an artificial kidney. The dialyzer filters out toxins and excess fluids, mimicking the kidney's natural filtration process. This process helps maintain a balance of electrolytes and fluid levels in the body, preventing the accumulation of harmful substances that healthy kidneys would normally eliminate. Typically performed several times a week, hemodialysis is a crucial intervention for those with end-stage renal disease, providing a lifeline for individuals whose kidneys are no longer able to perform their vital functions. Although it is an effective therapy, hemodialysis necessitates ongoing medical supervision and lifestyle adjustments to optimize patient outcomes.

To get more information on this market, Request Sample

India Hemodialysis Market Trends:

The hemodialysis market in India is poised for substantial growth, driven by a confluence of factors that underscore its increasing importance in the healthcare landscape. Firstly, the rising regional incidence of chronic kidney diseases (CKD) has propelled the demand for hemodialysis services. As the prevalence of conditions such as diabetes and hypertension escalates, the number of patients requiring renal replacement therapies like hemodialysis is expected to surge. Furthermore, advancements in technology have played a pivotal role in enhancing the efficiency and accessibility of hemodialysis procedures. Innovations in dialysis machines, such as improved monitoring systems and user-friendly interfaces, contribute to the market's expansion by fostering patient compliance and comfort. Additionally, the increasing trend towards home-based hemodialysis solutions has gained momentum, empowering patients to manage their treatment regimens more conveniently. Moreover, the aging regional population contributes significantly to the growth of the hemodialysis market. With an increasing number of elderly individuals susceptible to kidney-related disorders, the demand for hemodialysis services is anticipated to rise correspondingly. In tandem, the burgeoning awareness regarding the importance of early diagnosis and intervention in kidney diseases is expected to drive the hemodialysis market in India during the forecast period.

India Hemodialysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on segment, modality, and end user.

Segment Insights:

- Hemodialysis Product

- Machines

- Dialyzers

- Others

- Hemodialysis Service

- In-center Services

- Home Services

The report has provided a detailed breakup and analysis of the market based on the segment. This includes hemodialysis product (machines, dialyzers, and others) and hemodialysis service (in-center services and home services).

Modality Insights:

- Conventional Hemodialysis

- Short Daily Hemodialysis

- Nocturnal Hemodialysis

A detailed breakup and analysis of the market based on the modality have also been provided in the report. This includes conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis.

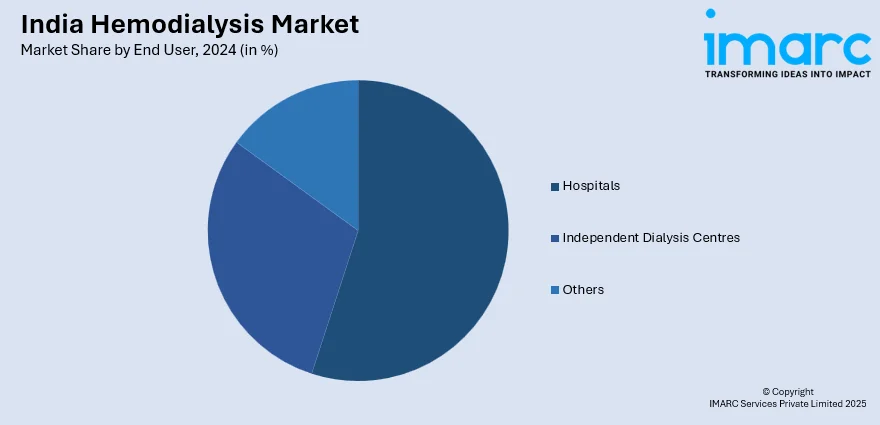

End User Insights:

- Hospitals

- Independent Dialysis Centres

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals. Independent dialysis centres, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hemodialysis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered |

|

| Modalities Covered | Conventional Hemodialysis, Short Daily Hemodialysis, Nocturnal Hemodialysis |

| End Users Covered | Hospitals, Independent Dialysis Centers, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hemodialysis market performed so far and how will it perform in the coming years?

- What is the breakup of the India hemodialysis market on the basis of segment?

- What is the breakup of the India hemodialysis market on the basis of modality?

- What is the breakup of the India hemodialysis market on the basis of end user?

- What are the various stages in the value chain of the India hemodialysis market?

- What are the key driving factors and challenges in the India hemodialysis?

- What is the structure of the India hemodialysis market and who are the key players?

- What is the degree of competition in the India hemodialysis market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hemodialysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hemodialysis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hemodialysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)