India Herbal Tea Market Size, Share, Trends and Forecast by Type, Pack Type, Pack Size, Distribution Channel, and Region, 2026-2034

India Herbal Tea Market Summary:

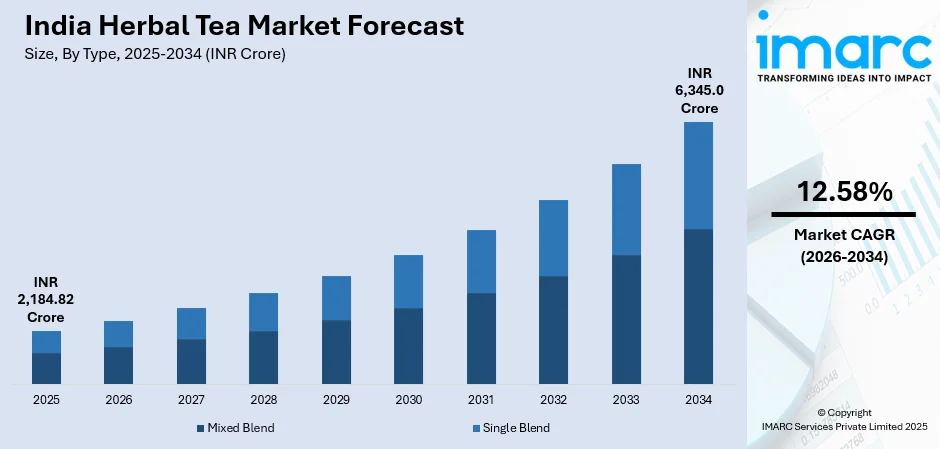

The India herbal tea market size was valued at INR 2,184.82 Crore in 2025 and is projected to reach INR 6,345.0 Crore by 2034, growing at a compound annual growth rate of 12.58% from 2026-2034.

Currently, the demand for herbal tea in the Indian market is witnessing outstanding growth due to the increasing awareness levels among the consumer community regarding health; in addition, the demand for herbal teas for their wellness attributes is increasing endlessly in the market. Moreover, the development of new flavor combinations, easy packaging, and widespread distribution networks is acting as an added advantage for market development in the urban as well as semi-urban sectors.

Key Takeaways and Insights:

- By Type: Mixed blend dominates the market with a share of 63% in 2025, driven by consumer preference for combination ingredients that deliver enhanced flavor profiles and synergistic health benefits through blends of herbs, flowers, and fruits offering comprehensive wellness properties.

- By Pack Type: Pouches leads the market with a share of 50% in 2025, attributed to their affordability, convenience, resealability features, and extended freshness retention capabilities that appeal to value-conscious consumers seeking practical storage solutions for daily consumption.

- By Pack Size: 250 grams dominates the market with a share of 38% in 2025, reflecting optimal balance between value proposition and consumption frequency that suits household requirements while enabling trial of premium herbal tea varieties.

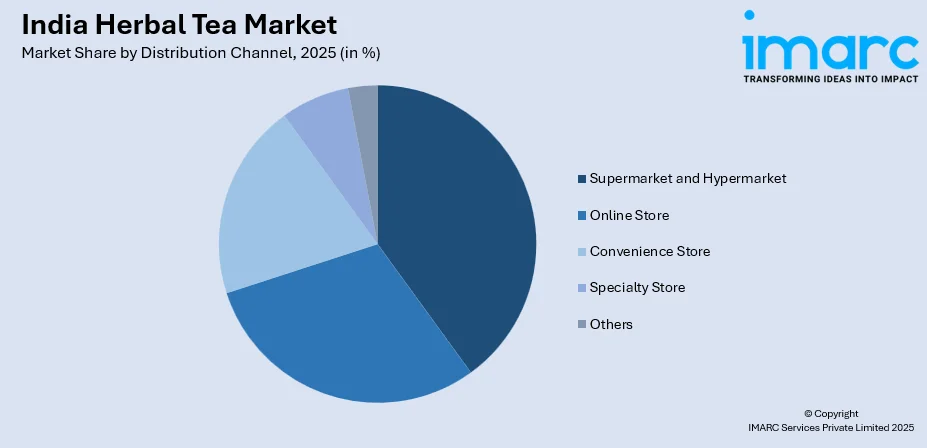

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 35% in 2025, supported by extensive product assortments, competitive pricing strategies, attractive shelf displays, and the convenience of one-stop shopping experiences across organized retail formats.

- By Region: North India dominates the market with a share of 30% in 2025, driven by higher urbanization rates, increased health awareness, strong e-commerce penetration, and cultural affinity toward traditional herbal remedies across Delhi NCR, Uttar Pradesh, and Punjab.

- Key Players: The India herbal tea market exhibits a fragmented competitive landscape with established multinational corporations competing alongside domestic wellness brands and emerging specialty tea companies. Market participants emphasize product innovation, organic certifications, and traditional Ayurvedic formulations to differentiate their offerings. Some of the key players operating in the market include Associated British Foods PLC, Dabur India Limited, Dharmsala Tea Company, Goodwyn Tea, Hain Celestial Group, Hindustan Unilever Ltd., Organic India Pvt. Ltd., Sresta Natural Bioproducts Pvt. Ltd., Tata Consumer Products, Teabox, Typhoo India Tea Limited, and Yogi Tea.

To get more information on this market Request Sample

The Indian herbal tea market is a dynamic segment of the beverage industry rooted in the country’s rich Ayurvedic and wellness traditions. Consumers are increasingly shifting from conventional caffeinated drinks to natural alternatives offering functional health benefits without artificial additives. Indian herbal tea brand Blue Tea experienced a surge in domestic revenues after appearing on Shark Tank India and expanded its presence across India and into 11 international markets, reflecting rising demand for wellness-oriented beverage options. Rising disposable incomes, urbanization and lifestyle trends favoring preventive healthcare support market growth. Innovative products that incorporate botanicals such as tulsi, ashwagandha and turmeric appeal to health conscious buyers seeking natural solutions. Expanding organized retail and e commerce platforms enhance accessibility, allowing brands to reach diverse consumers across metropolitan and tier two cities while strengthening distribution networks.

India Herbal Tea Market Trends:

Rising Preference for Functional and Immunity-Boosting Blends

Indian consumers are increasingly gravitating toward herbal teas that offer targeted health benefits beyond basic refreshment. For instance, Delhi‑based brand Chull Wali Chai launched three new herbal variants in July 2025, featuring blends for relaxation, mental clarity, and vitality, with vibrant packaging appealing to younger, health‑focused consumers. Blends with adaptogenic herbs, immunity‑boosting ingredients, and stress‑relieving botanicals are gaining traction. This trend mirrors lifestyle shifts toward preventive wellness and natural remedies, prompting manufacturers to create specialized formulations addressing digestive health, cognitive function, and sleep quality.

Premiumization and Artisanal Product Offerings

The Indian herbal tea market is seeing increased consumer willingness to pay premium prices for high‑quality, single‑origin, and certified organic offerings. For example, wellness brand Heiland, known for its loose‑leaf blends based on traditional kadha recipes supporting immunity, digestion, and relaxation, was recognized in Forbes DGEMS 2025, reflecting its growing stature among quality‑focused brands and strong consumer interest in artisanal teas. Artisanal brands using traditional preparation, rare botanicals, and authentic sourcing are gaining traction. This premiumization trend also includes sustainable, gift‑worthy packaging that enhances perceived value and appeals to urban affluent consumers.

Digital Commerce and Direct-to-Consumer Expansion

E‑commerce platforms are reshaping herbal tea distribution by giving consumers across India access to a wide range of products once limited to metropolitan areas. The India e‑commerce market, valued at USD 129.72 billion in 2025 and expected to reach USD 651.10 billion by 2034, highlights the rapid growth of online retail that herbal tea brands can leverage to expand reach and sales. Direct‑to‑consumer brands use digital channels for personalized marketing, subscription services, and customized blend recommendations. Social media and wellness‑focused content further drive brand discovery and educate younger consumers about herbal tea benefits while offering convenient online purchasing options.

Market Outlook 2026-2034:

The India herbal tea market has huge growth potential due to steady interest in natural health remedies and Ayurvedic products. Contributing factors for its growth include a growing awareness level regarding healthy living and rising lifestyle diseases among the younger generation. Favorable government policies that encourage traditional Indian medicine practices fuel growth for herbal teas. New products that combine innovative flavors with Ayurvedic flavors entice consumers cutting across various age groups. The market generated a revenue of INR 2,184.82 Crore in 2025 and is projected to reach a revenue of INR 6,345.0 Crore by 2034, growing at a compound annual growth rate of 12.58% from 2026-2034.

India Herbal Tea Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Mixed Blend |

63% |

|

Pack Type |

Pouches |

50% |

|

Pack Size |

250 Grams |

38% |

|

Distribution Channel |

Supermarket and Hypermarket |

35% |

|

Region |

North India |

30% |

Type Insights:

- Mixed Blend

- Herbs and Herbs

- Herbs and Flower Tea

- Herbs and Fruits

- Others

- Single Blend

- Flower Tea

- Herbs

- Fruit

The mixed blend dominates with a market share of 63% of the total India herbal tea market in 2025.

Mixed blend herbal teas combine multiple botanicals to offer complex flavors and enhanced functional benefits. For instance, House of Veda launched eight organic tea and infusion variants, including Amla Tulsi, Amla Ginger, Fat Burn Tea, Calming Infusion, and Digestive Tea, each targeting wellness benefits such as immunity, digestion, memory, and stress relief. Popular combinations mix herbs with flowers, fruits, or other herbs, reflecting consumer demand for comprehensive wellness solutions that address multiple health concerns while delivering enjoyable taste experiences.

The segment benefits from continuous product innovation, with manufacturers introducing contemporary flavor combinations featuring traditional Indian botanicals alongside globally popular ingredients. Blends like chamomile-hibiscus, lemon-ginger formulation, and lemongrass-blue pea tisane attract consumers looking for variety and novelty. Mixed blends also offer manufacturers flexibility in making formulation adjustments to achieve an optimal balance between taste, functionality, and cost considerations at different price points.

Pack Type Insights:

- Pouches

- Jars/Cans

- Tea Bag

The pouches lead with a share of 50% of the total India herbal tea market in 2025.

Pouch packaging accounts for the leading share in the Indian herbal tea market because of its economic viability, lightweight, and practical features targeted at value-conscious consumers. Resealable pouch designs preserve product freshness and provide a convenient storage solution to households that have different consumption patterns. The cost-effectiveness of manufacturing processes related to pouch packaging is considered to ensure competitive retail pricing, further expanding market accessibility.

It has also introduced various innovations, such as stand-up designs, zip-lock closures, and multi-layer barrier materials that increase shelf life and provide better aesthetics to the pouch. Vendors are increasingly adopting eco-friendly pouch material in response to rising environmental awareness among urban consumers. The flexibility in pouch formats accommodates different pack sizes ranging from trial portions to family packs, meeting diverse needs at various market segments.

Pack Size Insights:

- Upto 120 Grams

- 250 Grams

- Others

The 250 grams dominates with a market share of 38% of the total India herbal tea market in 2025.

The demand for moderate package size serves as an indication of the consumers’ needs to balance between value for money and worries about freshness. This volume satisfies the demand for daily usage without compromising the quality of the product. The pricing strategy of the category presents a more appealing value for money than the smaller volume for trial purchases but not involving heavy usage associated with the larger economic volume.

Frequent shoppers prefer this pack size because it helps customers test different herbal teas without requiring heavy upfront investment. This segment is attractive to new buyers upgrading from trial packs as well as loyal shoppers converting to more suitable pack sizes for household use. Retailers are attracted to profitable margins that come with this high-demand pack size segment.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarket and Hypermarket

- Online Store

- Convenience Store

- Specialty Store

- Others

The supermarket and hypermarket lead with a share of 35% of the total India herbal tea market in 2025.

Supermarkets and Hypermarkets are at the forefront in the herbal tea market with their broad product lines, competitive pricing, and convenient retailing. These establishments offer a variety of brands, from economy to high-end, giving consumers the opportunity to compare and decide on their products. Additionally, promotional activities and customer loyalty initiatives increase consumer preference, making these establishments and their products an essential conduit for the purchase of herbal tea.

The development of modern shopping infrastructure is increasing accessibility of herbal teas. Supermarkets and hypermarkets are setting up health drink sections, which increase the visibility of health beverages and motivate consumers to purchase. Modern shopping infrastructure is rapidly developing health drink shelves, which show effective health drink benefits and motivate health drink manufacturers or suppliers to increase market penetration of health drink products or increase market share of herbal teas.

Regional Insights:

- North India

- Delhi NCR

- Uttar Pradesh

- Haryana

- Rajasthan

- Punjab

- Others

- West and Central India

- Maharashtra

- Gujarat

- Madhya Pradesh

- Others

- South India

- Tamil Nadu

- Karnataka

- Andhra Pradesh

- Others

- East India

- West Bengal

- Orissa

- Jharkhand

- Bihar

- Others

North India exhibits a clear dominance with a 30% share of the total India herbal tea market in 2025.

North India exhibits a clear dominance in the Indian herbal tea market, driven by its rich agricultural base and long-standing tea cultivation traditions. States like Himachal Pradesh, Uttarakhand, and Punjab provide ideal conditions for growing high-quality herbs and botanicals used in teas. The region’s established supply chains and tea processing units ensure consistent production, meeting both domestic demand and export requirements. Consumer awareness of herbal wellness further reinforces North India’s market leadership.

The growing preference for herbal and Ayurvedic teas in North India is fueled by rising health consciousness and urbanization. Retail chains, e-commerce platforms, and specialty tea stores have made herbal teas easily accessible to consumers. Additionally, innovations featuring local herbs like tulsi, ashwagandha, and chamomile cater to preventive healthcare trends. This combination of quality production, distribution infrastructure, and evolving consumer habits positions North India as the dominant hub in the herbal tea sector.

Market Dynamics:

Growth Drivers:

Why is the India Herbal Tea Market Growing?

Rising Health Consciousness and Wellness-Oriented Lifestyle Adoption

Indian consumers are increasingly prioritizing preventive healthcare approaches and natural wellness solutions in their daily routines. This shift is reflected in the broader wellness beverage trend in India, where herbal infusions are being embraced for their holistic benefits such as improved digestion, stress relief, and immunity support, with consumers actively incorporating them into everyday self‑care practices. Growing awareness about the health benefits of herbal teas, including antioxidant properties, digestive support, and immune system enhancement, drives sustained market adoption. The polyphenols and bioactive compounds present in herbal infusions are recognized for their potential to reduce inflammation and support overall wellbeing.

Growing Preference for Caffeine-Free and Natural Beverage Alternatives

Consumer concerns about excessive caffeine consumption and artificial additives in conventional beverages accelerate the shift toward herbal tea alternatives. For instance, in July 2025, startups and beverage makers in India are actively promoting caffeine‑free herbal drinks as alternatives to traditional caffeinated teas, using locally sourced botanicals to appeal to health‑minded consumers looking for natural, stimulant‑free options. Health-conscious individuals seeking natural hydration options without stimulant effects find herbal teas appealing for consumption throughout the day including evening hours. The absence of added sugars and artificial flavors in quality herbal tea products addresses growing demand for clean-label beverages.

Expanding Distribution Networks and E-Commerce Penetration

The rapid growth of organized retail and digital commerce is greatly improving herbal tea accessibility across India. A Deloitte–FICCI report notes that Tier‑II and Tier‑III cities now account for over 60% of e‑commerce transactions, highlighting how online channels are connecting specialty herbal teas with a wider consumer base beyond major metros. Modern trade offers diverse product portfolios, while e‑commerce enables nationwide distribution. Online reviews, ratings, and personalized recommendations educate consumers, and subscription‑based direct‑to‑consumer models build loyalty. Omnichannel strategies combine offline and online experiences to cater to varied shopping preferences.

Market Restraints:

What Challenges the India Herbal Tea Market is Facing?

Price Sensitivity and Premium Product Affordability Concerns

Herbal teas typically command higher price points compared to conventional tea products, limiting adoption among price-sensitive consumer segments. The premium positioning of quality herbal tea products creates accessibility barriers for middle-income households despite growing health awareness. Economic considerations often override wellness preferences when consumers face budget constraints during purchasing decisions.

Limited Awareness in Rural and Semi-Urban Markets

Consumer education about herbal tea benefits remains concentrated in metropolitan areas, leaving significant market potential untapped in smaller towns and rural regions. Traditional beverage consumption habits and limited exposure to organized retail channels constrain market penetration beyond urban centers. Distribution infrastructure limitations further impede product availability in these underserved markets.

Quality Inconsistency and Ingredient Standardization Challenges

Variations in raw material quality, sourcing practices, and manufacturing standards across different producers create inconsistent consumer experiences. The absence of uniform quality benchmarks for herbal ingredients complicates consumer product evaluation and brand comparison. Regulatory frameworks governing health claims and ingredient labeling require ongoing refinement to enhance market transparency.

Competitive Landscape:

The herbal tea market in India is observed to be a fragmented market with major multinational soft beverage companies, major homegrown FMCG brands, wellness brands, and up-and-coming boutique tea brands. Companies are focusing on differentiated product offerings with enhanced functionality through ingredients, organic certifications, and Ayurvedic herbal properties. Functionality innovation in flavor creation, herbal ingredients, and eco-friendly packaging is proving to be prime areas for competition in the herbal tea consumer segment. Competitive strength and visibility investments in brands and pricing are factors that are shaping competition among different consumer types in the herbal tea business environment with easy entry barriers that are assisting startups in entering the herbal tea market space.

Some of the key players include:

- Associated British Foods PLC

- Dabur India Limited

- Dharmsala Tea Company

- Goodwyn Tea

- Hain Celestial Group

- Hindustan Unilever Ltd.

- Organic India Pvt. Ltd.

- Sresta Natural Bioproducts Pvt. Ltd.

- Tata Consumer Products

- Teabox

- Typhoo India Tea Limited

- Yogi Tea

Recent Developments:

- In March 2025, Unilever has launched UK‑based herbal infusions brand Pukka in India with its new wellness campaign “Self Care in a Cup”, featuring an ASMR‑inspired film to promote relaxation and mindful self‑care through curated herbal blends like chamomile and lavender. The debut marks Unilever’s entry into India’s herbal tea market.

India Herbal Tea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Crore |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Pack Types Covered | Pouches, Jars/Cans, Tea Bag |

| Pack Sizes Covered | Upto 120 Grams, 250 Grams, Others |

| Distribution Channels Covered | Supermarket and Hypermarket, Online Stores, Convenience Stores, Specialty Stores, Others |

| Regions Covered | South India, North India, West and Central India, East India |

| States Covered | Delhi, NCR, Uttar Pradesh, Haryana, Rajasthan, Punjab, Others, Maharashtra , Gujarat, Madhya Pradesh, Others, Tamil Nadu, Karnataka, Andhra Pradesh, Others, West Bengal, Orissa, Jharkhand, Bihar, Others |

| Companies Covered | Associated British Foods PLC, Dabur India Limited, Dharmsala Tea Company, Goodwyn Tea, Hain Celestial Group, Hindustan Unilever Ltd., Organic India Pvt. Ltd., Sresta Natural Bioproducts Pvt. Ltd., Tata Consumer Products, Teabox, Typhoo India Tea Limited, Yogi Tea, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India herbal tea market size was valued at INR 2,184.82 Crore in 2025.

The India herbal tea market is expected to grow at a compound annual growth rate of 12.58% from 2026-2034 to reach INR 6,345.0 Crore by 2034.

Mixed blend dominated the market with 63% share, driven by consumer preference for combination ingredients offering enhanced flavor profiles and synergistic health benefits through diverse botanical formulations combining herbs, flowers, and fruits.

Key factors driving the India herbal tea market include rising health consciousness among consumers, growing preference for caffeine-free natural beverages, expanding organized retail and e-commerce distribution networks, increasing awareness about Ayurvedic wellness benefits, and product innovations featuring functional ingredients.

Major challenges include high price sensitivity among consumers limiting premium product adoption, limited awareness and distribution infrastructure in rural markets, quality inconsistency across different producers, ingredient standardization difficulties, and competition from established conventional tea brands with stronger market presence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)