India High Modulus Low Shrinkage Polyester Yarn Market Size, Share, Trends and Forecast by Denier, Type, End User, and Region, 2026-2034

India High Modulus Low Shrinkage Polyester Yarn Market Overview:

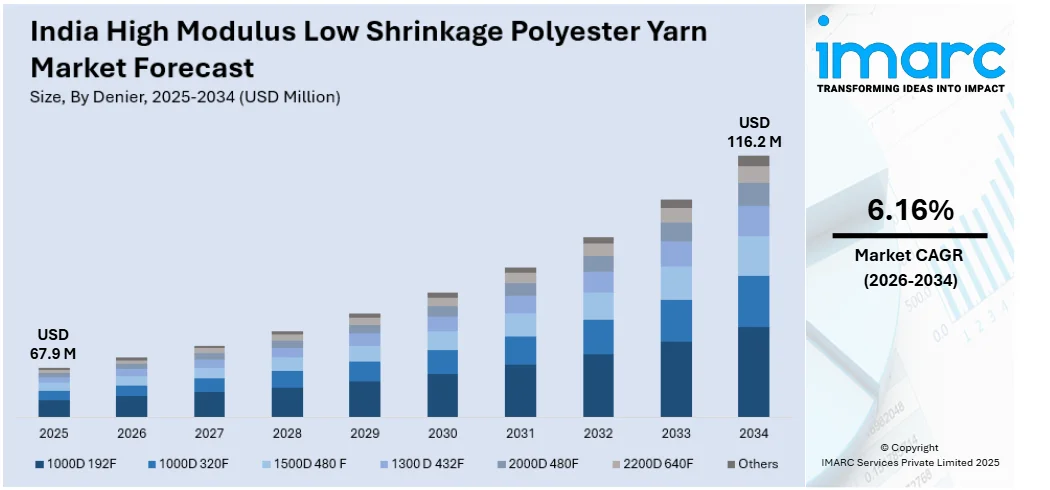

The India high modulus low shrinkage polyester yarn market size reached USD 67.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 116.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.16% during 2026-2034. The market is driven by growing demand from the automotive and industrial sectors, rising adoption in technical textiles, increasing investments in domestic manufacturing, expanding applications in tire cord fabrics, and technological advancements enhancing yarn durability, strength, and thermal stability for high-performance uses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 67.9 Million |

| Market Forecast in 2034 | USD 116.2 Million |

| Market Growth Rate (2026-2034) | 6.16% |

India High Modulus Low Shrinkage Polyester Yarn Market Trends:

Growth in Technical Textiles and Industrial Applications

The growth of India's technical textile industry is greatly impacting the demand for HMLS polyester yarn. With industries seeking high-strength, low-shrinkage materials for geotextiles, seat belts, conveyor belts, and coated fabrics, manufacturers are turning to sophisticated polyester yarns to achieve rigorous performance requirements. The government's emphasis on encouraging technical textiles via the National Technical Textiles Mission (NTTM) is also speeding up innovation and investment in high-performance yarn manufacturing. Furthermore, the growing application of HMLS polyester yarn in industrial sectors like ropes, tarpaulins, and reinforcement fabrics is propelling market growth. The growth of the textile industry towards the use of synthetic substitutes with improved mechanical properties is also bolstering the use of HMLS polyester yarn in varied industrial applications. For instance, as per industry reports, as of 2024, India's technical textiles market has grown at an average annual rate of 12% since 2013, now comprising 13% of the country's textile and clothing sector. India, the world's second-largest polyester yarn producer, is seeing increased demand for high-quality industrial yarns, particularly in geotextiles and automotive applications.

To get more information on this market, Request Sample

Expansion of Domestic Production and Technological Advancements

India's increasing emphasis on self-reliance in the textile industry is leading to significant investments in domestic production of HMLS polyester yarn. For instance, India’s textiles and apparel exports increased by 7% during April-October FY24, rising to USD 21.35 Billion from USD 20 Billion the previous year. Man-made textiles accounted for 15% of total exports, valued at USD 3.1 Billion. In 2023, India was the world’s sixth-largest textile exporter. With growing demand from both domestic and export markets, manufacturers are adopting advanced spinning and polymerization technologies to enhance yarn strength, thermal stability, and adhesion properties. Companies are also expanding production capacities to reduce reliance on imports and meet the rising demand from key industries. The integration of automation and digital technologies in polyester yarn manufacturing is improving efficiency, ensuring consistent quality, and minimizing production costs. As Indian manufacturers enhance their technological capabilities, they are better positioned to compete with global players in supplying high-performance HMLS polyester yarn for various industrial and automotive applications.

India High Modulus Low Shrinkage Polyester Yarn Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on denier, type, and end user.

Denier Insights:

- 1000D 192F

- 1000D 320F

- 1500D 480 F

- 1300 D 432F

- 2000D 480F

- 2200D 640F

- Others

The report has provided a detailed breakup and analysis of the market based on the denier. This includes 1000D 192F, 1000D 320F, 1500D 480 F, 1300 D 432F, 2000D 480F, 2200D 640F , and others.

Type Insights:

- Regular Adhesive Type

- Super Low Shrinkage

- High Count Filaments

- High Tenacity

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes regular adhesive type, super low shrinkage, high count filaments, high tenacity, and others.

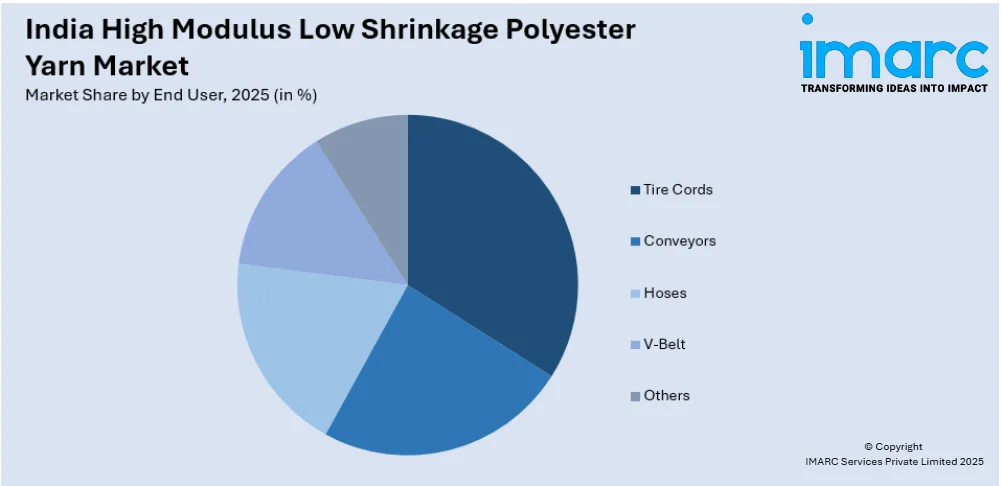

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Tire Cords

- Conveyors

- Hoses

- V-Belt

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes tire cords, conveyors, hoses, V-belt, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India High Modulus Low Shrinkage Polyester Yarn Market News:

- In December 2024, Indian Oil Corporation (IOCL) approved an investment of Rs 657 crore in a joint venture with MCPI for a yarn project in Odisha. The Rs 4,382 crore project, located in Bhadrak’s Bhandaripokhari textile park, will include a 900-tonne-per-day continuous polymerization plant, producing draw textured yarn, fully drawn yarn, and polyester chips. The project, approved by the state government last year, is expected to generate 4,300 jobs and significantly boost Odisha’s economy.

- In August 2024, the Southern Gujarat Chamber of Commerce and Industry (SGCCI) hosted YARN Expo - 2024 in Surat. The event, spanning 1,16,000 square feet, featured over 80 exhibitors from India and attracted international buyers. It showcased diverse yarn varieties, including polyester, cotton, antibacterial, and recycled yarns.

India High Modulus Low Shrinkage Polyester Yarn Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deniers Covered | 1000D 192F, 1000D 320F, 1500D 480 F, 1300 D 432F, 2000D 480F, 2200D 640F, Others |

| Types Covered | Regular Adhesive Type, Super Low Shrinkage, High Count Filaments, High Tenacity, Others |

| End Users Covered | Tire Cords, Conveyors, Hoses, V-Belt, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India high modulus low shrinkage polyester yarn market performed so far and how will it perform in the coming years?

- What is the breakup of the India high modulus low shrinkage polyester yarn market on the basis of denier?

- What is the breakup of the India high modulus low shrinkage polyester yarn market on the basis of type?

- What is the breakup of the India high modulus low shrinkage polyester yarn market on the basis of end user?

- What are the various stages in the value chain of the India high modulus low shrinkage polyester yarn market?

- What are the key driving factors and challenges in the India high modulus low shrinkage polyester yarn market?

- What is the structure of the India high modulus low shrinkage polyester yarn market and who are the key players?

- What is the degree of competition in the India high modulus low shrinkage polyester yarn market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India high modulus low shrinkage polyester yarn market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India high modulus low shrinkage polyester yarn market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India high modulus low shrinkage polyester yarn industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)