India High-Pressure Pumps Market Size, Share, Trends, and Forecast by Type, Pressure, End-User Industry, and Region, 2025-2033

India High-Pressure Pumps Market Overview:

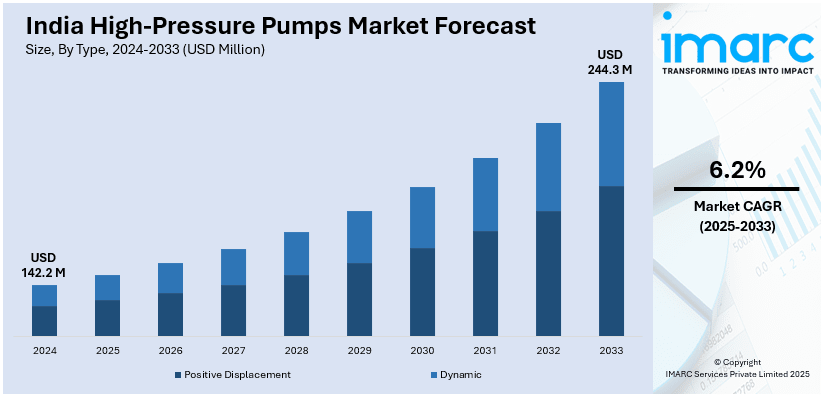

The India high-pressure pumps market size reached USD 142.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 244.3 Million by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The market is driven by increasing demand across industries such as manufacturing, automotive, and construction for applications requiring precision and efficiency. With a focus on energy efficiency, technological advancements, and growing industrialization, the market is poised for steady growth, supported by infrastructure development and rising industrial output.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 142.2 Million |

| Market Forecast in 2033 | USD 244.3 Million |

| Market Growth Rate 2025-2033 | 6.2% |

India High-Pressure Pumps Market Trends:

Rising Demand in Industrial and Infrastructure Applications

India’s high-pressure pump market is expanding due to increasing demand across key industrial sectors, including oil and gas, power generation, chemicals, and manufacturing. These pumps are essential for boiler feed, chemical processing, hydroblasting, and pressure boosting applications, making them indispensable in large-scale operations. Rapid industrialization, coupled with infrastructure development, is accelerating demand, especially in sectors requiring efficient water management, energy production, and material processing. The oil and gas industry are a major growth driver, utilizing high-pressure pumps in refineries, offshore drilling, and enhanced oil recovery operations. For instance, in February 2025, ONGC announced a partnership with bp, appointing it as the Technical Services Provider for Mumbai High, India’s largest offshore oil field. bp will optimize reservoir management and enhance oil recovery, further driving the demand for high-pressure pumps. Additionally, India's expanding power generation sector, including thermal, hydro, and nuclear plants, relies on these pumps for high-pressure fluid handling in steam and cooling systems. Government-led industrial corridors and smart city projects further support the adoption of high-pressure pumps in water supply and construction applications. As industries continue to scale, the demand for durable, high-performance pumps will remain strong, reinforcing their role in India's industrial infrastructure.

To get more information on this market, Request Sample

Growing Applications in Water and Wastewater Treatment

India’s increasing urban population and water scarcity issues are driving significant investment in water and wastewater treatment facilities, boosting demand for high-pressure pumps. These pumps are crucial in reverse osmosis (RO), ultrafiltration, and desalination plants, helping to provide clean drinking water in both urban and rural areas. Additionally, the governments’ initiative and policies promoting water conservation and reuse are further supporting the expansion of wastewater treatment infrastructure. For instance, in August 2024, the Government of India (GOI) announced plans to invest USD 300 Million over two years to address flooding and improve water conservation in seven cities, including Mumbai, Chennai, and Bengaluru. The plan includes building drainage systems and restoring lakes and rivers to enhance rainwater retention, which will require the high-pressure pumps. Additionally, smart city projects are integrating advanced water management systems, requiring reliable high-pressure pumping solutions for efficient distribution and purification. The growing focus on industrial wastewater recycling in sectors like textiles, pharmaceuticals, and food processing is another factor fueling demand. As India strengthens its water management infrastructure, the high-pressure pump market will see continued growth, playing a key role in sustainable water use and environmental conservation.

India High-Pressure Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, pressure, and end-user industry.

Type Insights:

- Positive Displacement

- Dynamic

The report has provided a detailed breakup and analysis of the market based on the type. This includes positive displacement and dynamic.

Pressure Insights:

- 30 bar to 100 bar

- 100 bar to 500 bar

- Above 500 bar

A detailed breakup and analysis of the market based on the pressure have also been provided in the report. This includes 30 bar to 100 bar, 100 bar to 500 bar, and above 500 bar.

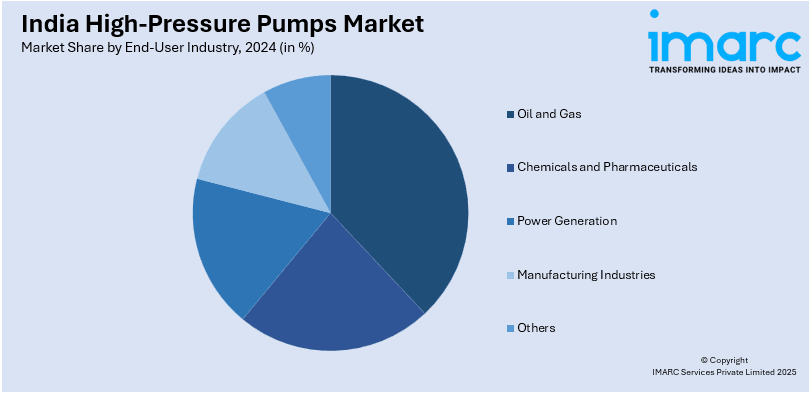

End-User Industry Insights:

- Oil and Gas

- Chemicals and Pharmaceuticals

- Power Generation

- Manufacturing Industries

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes oil and gas, chemicals and pharmaceuticals, power generation, manufacturing industries, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India High-Pressure Pumps Market News:

- In October 2024, Ingersoll Rand acquired UT Pumps & Systems, an Indian manufacturer of high-pressure screw and triplex plunger pumps. This acquisition strengthens the portfolio of Ingersoll Rand by increasing its presence within water, wastewater, food, pharmaceuticals, industrial, and chemical industries.

India High-Pressure Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Positive Displacement, Dynamic |

| Pressures Covered | 30 bar to 100 bar, 100 bar to 500 bar, Above 500 bar |

| End-User Industries Covered | Oil and Gas, Chemicals and Pharmaceuticals, Power Generation, Manufacturing Industries, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India high-pressure pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the India high-pressure pumps market on the basis of type?

- What is the breakup of the India high-pressure pumps market on the basis of pressure?

- What is the breakup of the India high-pressure pumps market on the basis of end-user industry?

- What is the breakup of the India high-pressure pumps market on the basis of region?

- What are the various stages in the value chain of the India high-pressure pumps market?

- What are the key driving factors and challenges in the India high-pressure pumps market?

- What is the structure of the India high-pressure pumps market and who are the key players?

- What is the degree of competition in the India high-pressure pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India high-pressure pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India high-pressure pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India high-pressure pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)