India Hiking Gear and Equipment Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034

India Hiking Gear and Equipment Market Summary:

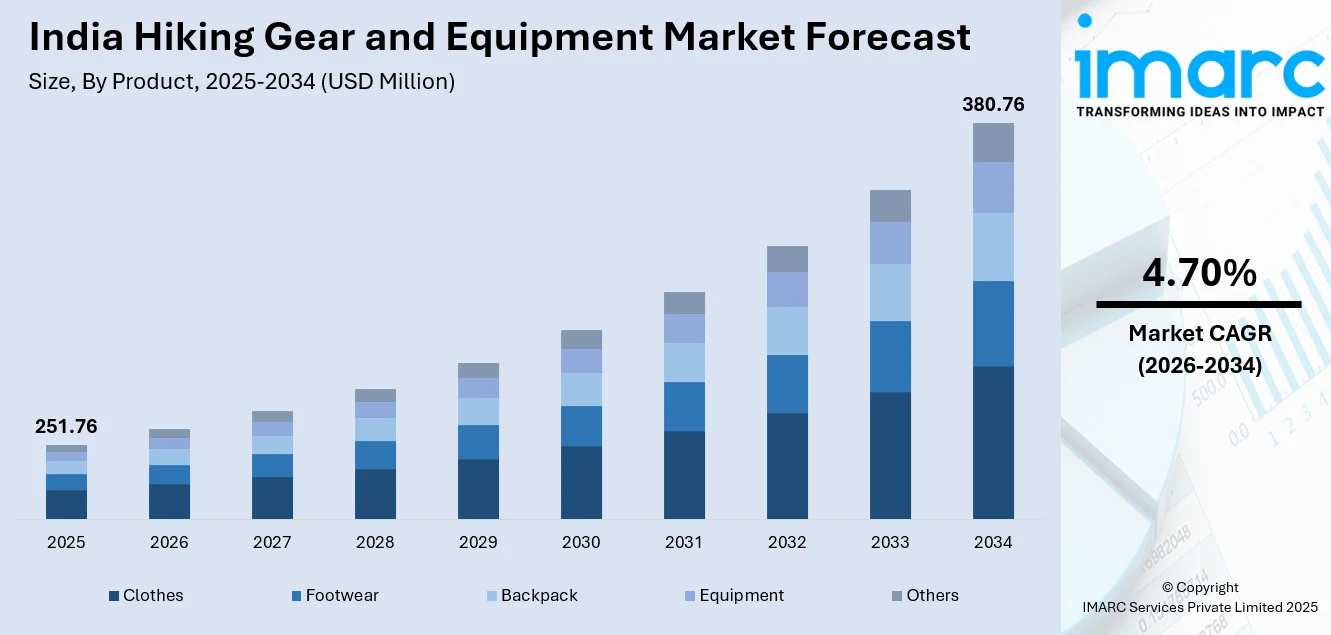

The India hiking gear and equipment market size was valued at USD 251.76 Million in 2025 and is projected to reach USD 380.76 Million by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034.

The India hiking gear and equipment market is experiencing sustained growth, as adventure tourism gains significant momentum across the country. Rising interest in outdoor recreational activities among urban consumers, combined with improved accessibility to trekking destinations, is fueling demand for specialized hiking apparel, footwear, and accessories. The expanding retail infrastructure and growing awareness about fitness benefits are encouraging greater participation in trekking and hiking activities, strengthening the market share.

Key Takeaways and Insights:

- By Product: Clothes dominate the market with a share of 48% in 2025, owing to the essential nature of performance apparel for outdoor activities, advancements in moisture-wicking and breathable fabric technologies, and increasing consumer preferences for versatile hiking clothing.

- By Gender: Men lead the market with a share of 52% in 2025, driven by extensive product variety catering to men and growing engagement in adventure sports among male demographics.

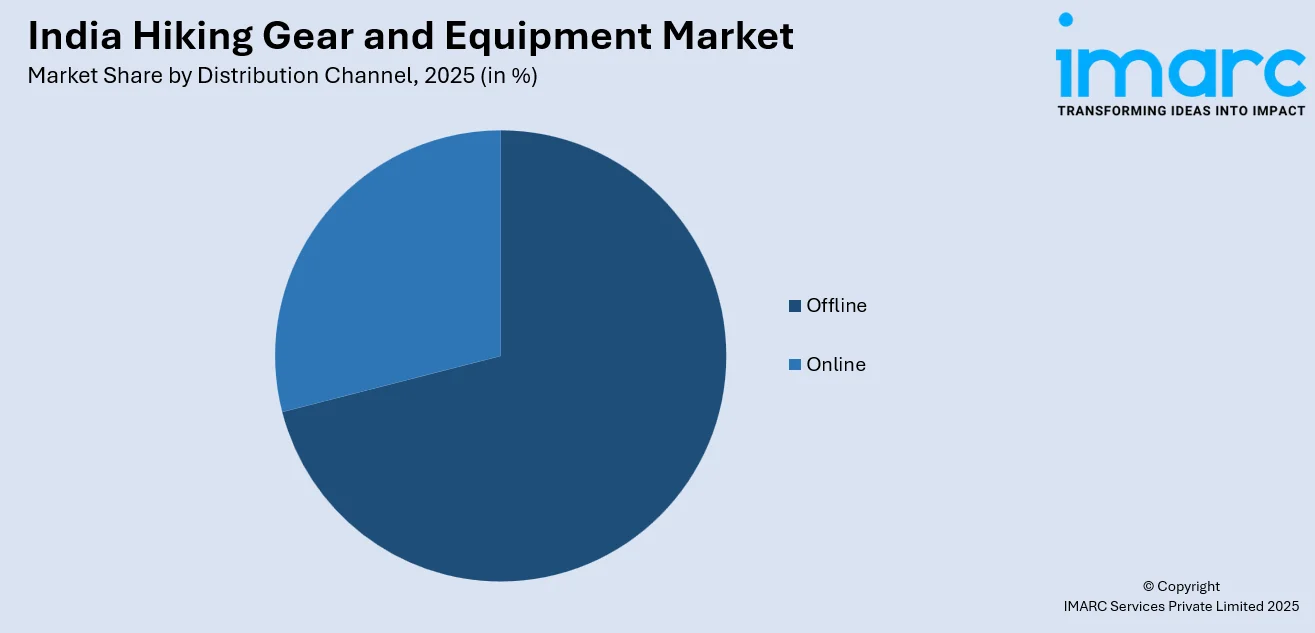

- By Distribution Channel: Offline exhibits clear dominance in the market with 71% share in 2025, reflecting consumer preference for physical trial before purchase, trust in specialty stores for technical gear, and the experiential shopping environment offered by sporting goods retailers.

- By Region: North India represents the largest region with 35% share in 2025, driven by proximity to Himalayan trekking destinations, concentration of adventure tourism activities, and strong presence of outdoor equipment retailers across major cities.

- Key Players: Key players drive the India hiking gear and equipment market by expanding product portfolios, improving fabric technologies and durability standards, and strengthening nationwide distribution networks. Their investments in retail expansion, affordability strategies, and partnerships with adventure tourism operators boost awareness and accelerate adoption.

To get more information on this market Request Sample

The India hiking gear and equipment market is advancing, as consumers increasingly embrace outdoor recreational activities and sustainable lifestyle choices. A major driver shaping this progress is the country's rapidly expanding adventure tourism sector, which supports the growing demand for specialized hiking products. According to IMARC Group, the India adventure tourism market reached USD 16,730.30 Million in 2024 and is projected to expand at a compound annual growth rate of 17.80% through 2033, reflecting robust consumer interest in trekking and outdoor experiences. The proliferation of organized trekking expeditions across Himalayan states, such as Uttarakhand, Himachal Pradesh, and Jammu and Kashmir, has created substantial demand for quality hiking apparel and equipment. Government initiatives promoting eco-tourism and adventure circuits, combined with rising disposable incomes among the urban middle class, are contributing to a more favorable environment for market expansion.

India Hiking Gear and Equipment Market Trends:

Growing Emphasis on Sustainable and Eco-Friendly Products

Indian consumers are increasingly prioritizing environmentally responsible outdoor gear, driving manufacturers to incorporate recycled materials and sustainable production practices. This shift reflects broader awareness about environmental conservation among hiking enthusiasts. Brands are responding by introducing backpacks, jackets, and footwear made from recycled plastics, organic fabrics, and low-impact dyes. Eco-certifications and transparent sourcing practices are becoming key differentiators in marketing strategies. Retailers are highlighting sustainability attributes to appeal to conscious consumers, while product durability ensures long-term value and reduced environmental impact.

Rise of Domestic Manufacturing and Indigenous Brands

The India hiking gear and equipment market growth is supported by expanding domestic manufacturing capabilities and emergence of homegrown brands. Indian manufacturers are investing in quality production to compete with international players while offering affordable alternatives. These domestic brands focus on combining durability, functionality, and cost-effectiveness to attract a wider consumer base. Collaborative efforts with adventure clubs and trekking organizations help in product testing and credibility building, fueling the market expansion.

Integration of Quick Commerce and Omnichannel Retail

In India, hiking gear and equipment retailers are increasingly adopting omnichannel strategies combining physical stores with digital platforms to enhance consumer accessibility. Quick commerce partnerships are transforming how consumers access outdoor equipment in urban centers. In September 2024, Decathlon partnered with Zepto to enable rapid delivery of sports and outdoor equipment across 16 Indian cities, including Mumbai, Bengaluru, Delhi-NCR, and Chennai, allowing customers to receive hiking products within minutes of ordering.

Market Outlook 2026-2034:

The India hiking gear and equipment market is positioned for sustained advancement, supported by growing adventure tourism participation, expanding retail infrastructure, and rising consumer awareness about outdoor recreational benefits. The market generated a revenue of USD 251.76 Million in 2025 and is projected to reach a revenue of USD 380.76 Million by 2034, growing at a compound annual growth rate of 4.70% from 2026-2034. Increasing domestic manufacturing capabilities, combined with government initiatives supporting eco-tourism development, are expected to drive higher revenue streams and foster a more competitive market environment. The proliferation of trekking organizations and adventure tourism operators is creating sustained demand for quality hiking products.

India Hiking Gear and Equipment Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Clothes |

48% |

|

Gender |

Men |

52% |

|

Distribution Channel |

Offline |

71% |

|

Region |

North India |

35% |

Product Insights:

- Clothes

- Footwear

- Backpack

- Equipment

- Others

Clothes dominate with a market share of 48% of the total India hiking gear and equipment market in 2025.

Clothes lead the market in India, as consumers prioritize functional clothing that offers moisture management, breathability, and weather protection during outdoor activities. Advancements in fabric technology have enabled manufacturers to develop lightweight, quick-dry materials that enhance comfort during extended treks. Brands are also incorporating antimicrobial treatments and odor-resistant fabrics, ensuring hygiene and freshness during multi-day hikes. Customizable layering systems allow hikers to adapt efficiently to changing temperatures, boosting the overall appeal of technical apparel.

Indian consumers increasingly seek versatile hiking clothing suitable for diverse weather conditions encountered across Himalayan and Western Ghats terrain. Performance features, including ultraviolet (UV) protection, insulation capabilities, and stretchable fabrics are driving product innovations and consumer adoption. Additionally, eco-friendly and recycled fabrics are gaining traction across the country, reflecting growing environmental awareness among outdoor enthusiasts. Collaborations with adventure guides and trekking experts further enhance product credibility and functional relevance.

Gender Insights:

- Men

- Women

- Kids

Men lead with a share of 52% of the total India hiking gear and equipment market in 2025.

Men maintain leadership in the India hiking gear and equipment market, driven by traditionally higher male participation in adventure tourism and trekking activities. Product manufacturers offer extensive variety in men's hiking apparel, footwear, and accessories, catering to diverse requirements across difficulty levels. Brands are increasingly introducing specialized gear designed for extreme weather and rugged terrains. Innovations in lightweight, durable materials and ergonomic designs further enhance performance and comfort for male hikers.

Indian men demonstrate strong engagement with organized trekking expeditions, corporate adventure outings, and weekend hiking activities. The segment benefits from established product distribution networks and comprehensive sizing options across major brands. E-commerce platforms and outdoor specialty stores are expanding access to premium and mid-range products nationwide. Growing awareness about safety and injury prevention is encouraging the adoption of technical gear, such as trekking poles, hydration packs, and high-traction footwear.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline exhibits a clear dominance with a 71% share of the total India hiking gear and equipment market in 2025.

Offline maintains overwhelming dominance in the India hiking gear and equipment market as consumers prefer physical examination and trial of technical equipment before purchase. Specialty sporting goods stores offer expert guidance on product selection, sizing, and suitability for specific trekking conditions. Consumers value personalized advice from trained staff who can recommend gear based on trekking difficulty, terrain, and climate conditions. In-store promotions and seasonal campaigns help build brand loyalty and encourage repeat purchases. Many retailers also provide after-sales support, including gear maintenance and warranty services, enhancing consumer trust in offline channels.

Offline benefits from the experiential nature of hiking gear purchases where fit, comfort, and quality require hands-on assessment. Retailers are enhancing store experiences through interactive trial zones and specialized product demonstrations. As of July 2025, Decathlon operated 132 stores across 55 Indian cities and aims to grow to more than 90 cities by 2030, reflecting continued commitment to physical retail expansion supporting hiking gear and equipment accessibility nationwide.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents the leading region with a 35% share of the total India hiking gear and equipment market in 2025.

North India dominates the market, owing to its proximity to premier Himalayan trekking destinations across Uttarakhand, Himachal Pradesh, and Jammu and Kashmir. The region hosts numerous popular trails, including Kedarkantha, Valley of Flowers, and Roopkund that attract thousands of trekkers annually. According to government data, tourism experienced a rise in Uttarakhand, attracting more than 23 Crore visitors between 2022 and 2025, indicating substantial adventure tourism activities driving demand for hiking gear and equipment.

The concentration of trekking organizations, adventure tourism operators, and outdoor equipment retailers in North Indian cities supports strong market accessibility. Delhi-NCR serves as a major consumption hub with multiple specialty stores and organized trekking departures. The state government initiatives aimed at promoting adventure tourism, including development of trekking circuits under schemes like Swadesh Darshan, are strengthening infrastructure and boosting participation. Additionally, increasing investments in accommodation, transport connectivity, and safety infrastructure across the region are enhancing trekking accessibility and supporting sustained demand for quality hiking gear and equipment.

Market Dynamics:

Growth Drivers:

Why is the India Hiking Gear and Equipment Market Growing?

Rising Adventure Tourism and Domestic Travel

The India adventure tourism industry is experiencing remarkable expansion, as domestic travelers increasingly seek experiential outdoor activities beyond conventional destinations. Adventure-based travel bookings on EaseMyTrip witnessed moderate double-digit growth in 2025 compared to 2024. The growing accessibility of previously remote trekking locations, combined with improved transport infrastructure, has democratized adventure travel participation. As first-time trekkers and casual explorers enter the market, there is growing emphasis on entry-level yet durable products, such as trekking shoes, backpacks, jackets, and walking poles. Organized trekking groups and adventure tour operators increasingly recommend standardized gear checklists, encouraging participants to invest in appropriate equipment. Social media exposure, fitness trends, and corporate wellness initiatives are further motivating urban consumers to explore hiking, expanding the customer base beyond traditional enthusiasts. Additionally, the rise of weekend treks and short-duration trails near major cities is driving repeat purchases and upgrades of hiking gear and equipment.

Expanding Retail Infrastructure and Distribution Networks

The systematic expansion of specialized sporting goods retail infrastructure is significantly improving hiking equipment accessibility across Indian cities. Major retailers are investing substantially in physical store networks while integrating omnichannel capabilities to serve diverse consumer preferences. For instance, Decathlon India reported operational revenue of INR 4,008.26 Crore in FY24, reflecting aggressive growth targets supported by retail expansion. Retail development is spreading beyond the urban cities of the country to tier 2 and tier 3 markets where interest in the outdoor activities has started to develop as well. Retailers are setting up stores at locations like Prayagraj, Kolhapur, Solan, and Udaipur to tap into the newly growing demand in tier 2 and tier 3 cities. Quick commerce partnerships combined with advanced digital platforms are further helping to augment the retail development in the market, in order to enable faster product distribution and easier consumer accessibility.

Government Initiatives Supporting Eco-Tourism Development

Indian government programs promoting adventure tourism and eco-friendly travel are creating favorable conditions for hiking gear and equipment market expansion. Infrastructure investments in trekking routes, camping facilities, and safety protocols are enhancing adventure destination viability. These initiatives are encouraging broader participation in trekking and hiking activities across diverse age groups and experience levels, directly supporting demand for quality hiking gear and equipment. Improved trail infrastructure and safety standards increase consumer confidence, motivating first-time hikers to invest in appropriate footwear, apparel, backpacks, and safety accessories. Government-backed eco-tourism programs also emphasize responsible travel, pushing consumers and tour operators to prefer durable, reusable, and environmentally sustainable gear. The development of certified trekking routes and guided programs creates structured demand cycles, where participants follow recommended equipment standards. Additionally, partnerships between local authorities and private adventure operators are expanding organized trekking events, further stimulating gear purchases.

Market Restraints:

What Challenges the India Hiking Gear and Equipment Market is Facing?

High Upfront Costs of Quality Equipment

Premium hiking gear from international brands remains significantly expensive for price-sensitive Indian consumers, creating affordability barriers particularly among first-time trekkers and budget-conscious demographics. Quality technical apparel, waterproof footwear, and specialized equipment often require substantial investment that many recreational hikers find prohibitive. The cost differential between domestic alternatives and imported products further complicates purchasing decisions, limiting market penetration among mainstream consumers who prioritize value over performance features.

Competition from Unorganized Sector and Counterfeit Products

In India, the market faces significant competition from unorganized retailers offering low-cost imitation products that undermine demand for authentic branded hiking gear and equipment. Counterfeit equipment lacking proper quality standards poses safety risks while creating unfair price competition for legitimate manufacturers and retailers. Consumers unable to differentiate between genuine and replica products may inadvertently purchase substandard gear, potentially leading to negative experiences that discourage continued participation in hiking activities and repeat purchases from established brands.

Limited Awareness and Outdoor Culture Adoption

Hiking remains a niche recreational activity in many parts of India, particularly outside metropolitan areas. Limited awareness about trekking opportunities, safety practices, and the benefits of high-quality gear restricts consumer adoption. Many potential hikers are unfamiliar with essential equipment, trail preparedness, and technical apparel requirements. This knowledge gap reduces willingness to invest in premium hiking products, slowing market growth and constraining expansion beyond established outdoor enthusiasts and urban adventure communities.

Competitive Landscape:

The India hiking gear and equipment market is becoming increasingly competitive, as international retailers expand their presence alongside emerging domestic manufacturers. Companies are focusing on diversifying product portfolios, improving material technologies, and enhancing affordability to attract broader consumer segments. Competition is driven by investments in retail expansion, omnichannel integration, and localized manufacturing capabilities enabling faster delivery and competitive pricing. Strategic partnerships between equipment manufacturers and adventure tourism operators are fostering product innovations and improving market visibility. Domestic players are gaining traction by offering quality alternatives at accessible price points while emphasizing indigenous production credentials that resonate with value-conscious Indian consumers.

Recent Developments:

- In January 2025, Tripole Gears, an outdoor and hiking gear manufacturing firm based in India, secured investment on Shark Tank India Season 4, receiving INR 75 Lakhs for 1.15% equity plus INR 25 Lakh debt from investor Ritesh Agarwal. The homegrown brand specializes in manufacturing rucksacks, backpacks, and hiking apparel entirely in-house, targeting the affordable outdoor gear segment.

India Hiking Gear and Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Clothes, Footwear, Backpack, Equipment, Others |

| Genders Covered | Men, Women, Kids |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India hiking gear and equipment market size was valued at USD 251.76 Million in 2025.

The India hiking gear and equipment market is expected to grow at a compound annual growth rate of 4.70% from 2026-2034 to reach USD 380.76 Million by 2034.

Clothes dominated the market with a share of 48%, driven by essential demand for functional hiking apparel featuring moisture-wicking fabrics, weather protection, and comfortable design suitable for diverse outdoor conditions.

Key factors driving the India hiking gear and equipment market include rising adventure tourism participation, expanding retail infrastructure, government eco-tourism initiatives, growing health consciousness, and increasing domestic manufacturing capabilities.

Major challenges include high upfront costs of quality equipment, limited retail accessibility in non-metropolitan areas, competition from unorganized sector, counterfeit products affecting brand trust, and consumer awareness gaps regarding technical gear requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)