India HMI Sensors in Wearables Market Size, Share, Trends and Forecast by Type, Device, Application, End Use, and Region, 2026-2034

India HMI Sensors in Wearables Market Summary:

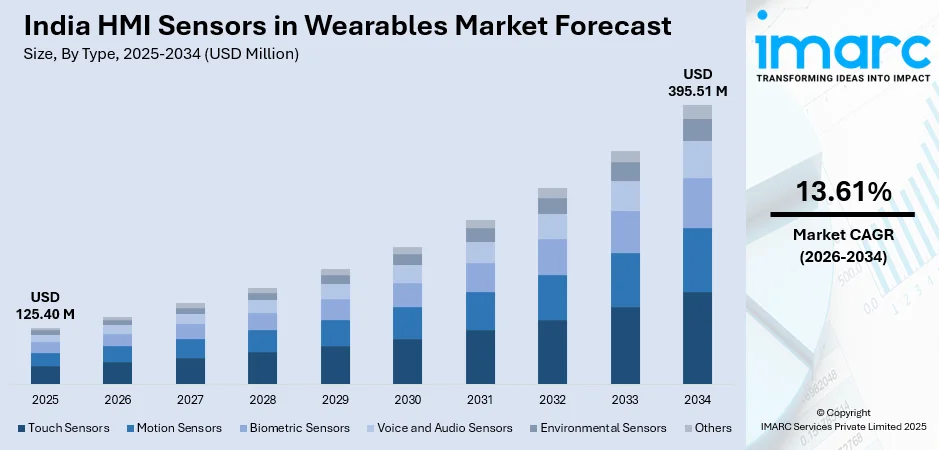

The India HMI sensors in wearables market size was valued at USD 125.40 Million in 2025 and is projected to reach USD 395.51 Million by 2034, growing at a compound annual growth rate of 13.61% from 2026-2034.

The robust expansion is driven by escalating prevalence of chronic diseases requiring continuous health monitoring, government initiatives promoting digital health infrastructure through programs like Ayushman Bharat Digital Mission, and Production-Linked Incentive schemes encouraging local manufacturing of wearable components. The integration of artificial intelligence (AI) and Internet of Things (IoT) technologies in smart wearables is transforming user experiences, while premiumization trends are expanding the India HMI sensors in wearables market share.

Key Takeaways and Insights:

- By Type: Touch sensors lead the market with a share of 31% in 2025, driven by their user-friendliness and widespread adoption in fitness trackers and smartwatches.

- By Device: Smartwatches and fitness bands lead the market with a share of 35% in 2025, propelled by their multifunctionality combining health monitoring, communication capabilities, and lifestyle features in single devices.

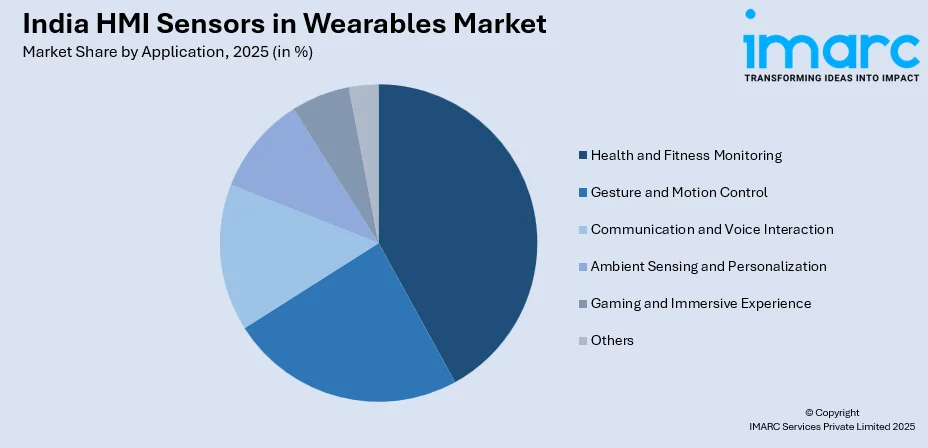

- By Application: Health and fitness monitoring represents the largest segment with a market share of 42% in 2025, reflecting an escalating wellness awareness amid chronic disease epidemic among the masses.

- By End Use: Consumer electronics leads the market with a share of 50% in 2025, underpinned by rising disposable incomes enabling discretionary technology purchases, smartphone penetration.

- By Region: North India represents the largest segment with a market share of 29.6% in 2025, supported by high urbanization rates concentrating population in metropolitan areas with robust consumer purchasing power and technology infrastructure.

- Key Players: Key players are investing in sensor innovation, improving accuracy and comfort, integrating AI-based analytics, strengthening local production, reducing costs, and forming strategic partnerships to expand product reach, enhance user engagement, and stay competitive in India’s growing wearable technology market.

To get more information on this market Request Sample

The market is experiencing transformative growth fueled by the convergence of healthcare and technology. India has emerged as a high-potential market for HMI sensors in wearables, driven by the rising burden of lifestyle diseases affecting 10.5% prevalence of diabetes in adults. Government initiatives have accelerated digital health adoption, with the Ayushman Bharat Digital Mission creating more than 73.98 crore health accounts as of January 2025. The introduction of AI-powered features exemplifies this evolution, as demonstrated by electronics companies launching efficient and accurate devices, featuring AI companion technology that delivers personalized health insights and adaptive watch faces. The market is further bolstered by production incentives, with the Electronics Component Manufacturing Scheme with an outlay of ₹22,919 crore to support component manufacturing including high-density interconnect PCBs essential for wearables, positioning India as a credible alternative in global supply chains.

India HMI Sensors in Wearables Market Trends:

Artificial Intelligence (AI) and Internet of Things (IoT) Integration Transforming User Experiences

The integration of AI and IoT technologies is revolutionizing smart wearables by enabling personalized health insights and seamless connectivity. AI algorithms analyze patterns in sleep, stress levels, and workout efficiency to provide tailored recommendations, while IoT connectivity allows wearables to synchronize with smart home ecosystems. This technological convergence enhances functionality beyond basic tracking, offering adaptive workout plans and predictive health alerts. The government Production-Linked Incentive scheme has encouraged local brands to integrate advanced AI and IoT capabilities, strengthening domestic manufacturing. In January 2025, Indian electronics brand Noise launched its ColorFit Pro 6 Series featuring AI-powered personalization with adaptive watch faces and an AI Companion that provides individualized health guidance, exemplifying how domestic manufacturers are leveraging cutting-edge technologies to compete globally.

Advanced Health Monitoring Capabilities Driving Adoption

Wearables are evolving from fitness trackers to sophisticated health monitoring devices capable of detecting cardiovascular anomalies, monitoring chronic conditions, and providing medical-grade biometric analysis. The proliferation of advanced sensors including optical heart rate monitors, electrocardiogram sensors, blood oxygen sensors, and temperature monitors is expanding clinical applications. This evolution is particularly relevant in India given the escalating chronic disease burden, with specialized sensors enabling continuous glucose monitoring and blood pressure tracking. IMARC Group predicts that the India voice recognition market is projected to attain USD 2,982.4 Million by 2033, exhibiting a growth rate (CAGR) of 23% during 2025-2033, reflecting accelerating demand for multi-parametric health monitoring capabilities that address preventive healthcare needs.

Premiumization and Feature-Rich Devices Gaining Traction

The market is witnessing a strategic shift toward premium wearables offering advanced features, extended battery life, and enhanced durability as consumers increasingly prioritize quality and functionality. Average selling prices for wearables grew 2.2 percent year-over-year to USD 19.2 in the second quarter of 2025, indicating consumer willingness to invest in higher-value products. Companies are differentiating through features such as solar charging, military-grade durability standards, multi-band GPS, and comprehensive health tracking. This premiumization trend is exemplified by international brands targeting affluent segments, as evidenced by Garmin launching its Enduro 3 series GPS smartwatches in India in 2025, priced from INR 105,990, featuring solar charging technology delivering 110 hours of battery life in GPS mode, advanced health metrics, preloaded topographic maps, and military-grade construction standards for outdoor enthusiasts and athletes.

Market Outlook 2026-2034:

The India HMI sensors in wearables market is poised for robust expansion as technological innovation converges with favorable policy frameworks and rising health consciousness. Apart from this, the digital health ecosystem supported by government initiatives will continue facilitating integration between wearables and healthcare infrastructure, while artificial intelligence (AI) capabilities will enable predictive analytics and personalized wellness management. The market generated a revenue of USD 125.40 Million in 2025 and is projected to reach a revenue of USD 395.51 Million by 2034, growing at a compound annual growth rate of 13.61% from 2026-2034. Furthermore, manufacturing incentives will strengthen domestic production capabilities, reducing import dependency and enhancing cost competitiveness.

India HMI Sensors in Wearables Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Touch Sensors |

31% |

|

Device |

Smartwatches and Fitness Bands |

35% |

|

Application |

Health and Fitness Monitoring |

42% |

|

End Use |

Consumer Electronics |

50% |

|

Region |

North India |

29.6% |

Type Insights:

- Touch Sensors

- Motion Sensors

- Biometric Sensors

- Voice and Audio Sensors

- Environmental Sensors

- Others

Touch sensors dominate with a market share of 31% of the total India HMI sensors in wearables market in 2025.

Touch sensors dominate the market owing to their intuitive user interface, high responsiveness, and widespread integration across consumer wearables. They enable seamless navigation through menus, notifications, and applications with minimal learning curve, making them accessible to diverse user demographics. The technology reliability in various environmental conditions and compatibility with compact form factors further reinforces their market leadership. Touch sensors are extensively deployed in smartwatches and fitness bands where quick access to features is essential for user experience.

The segment benefits from continuous technological enhancements including improved accuracy, reduced power consumption, and multi-touch gesture recognition capabilities. These advancements are critical as manufacturers strive to differentiate products in an increasingly competitive landscape. Touch sensor innovation enables features such as water resistance, scratch protection through robust materials, and integration with haptic feedback systems that enhance user interaction quality. The technology maturity and established supply chains contribute to cost advantages, supporting market penetration across price segments from budget-conscious consumers to premium device buyers.

Device Type Insights:

- Smartwatches and Fitness Bands

- Smart Glasses/AR Glasses

- Smart Clothing

- Smart Rings/Wristbands

- Hearables/Earbuds

- Head-Mounted Displays (HMDs)

- Others

Smartwatches and fitness bands leads with a share of 35% of the total India HMI sensors in wearables market in 2025.

Smartwatches and fitness bands represent the largest device category driven by their multifunctionality, affordability across various price tiers, and strong consumer awareness. These devices have evolved from simple step counters to comprehensive health companions offering features including heart rate monitoring, sleep analysis, stress tracking, blood oxygen measurement, and workout guidance. The India fitness tracker market reached USD 436.14 Million in 2024 as per IMARC Group, with smartwatches commanding a major percent share, demonstrating robust consumer adoption. This segment benefits from extensive distribution networks spanning online platforms and retail stores, coupled with aggressive marketing by both international brands and domestic players.

The category growth is propelled by continuous innovation cycles introducing enhanced sensors, extended battery life, cellular connectivity enabling standalone functionality, and integration with digital payment systems. Smartwatches now serve as extensions of smartphones, delivering notifications, controlling music playback, and facilitating voice assistants. The affordability factor has democratized access, with options spanning budget-friendly models to premium offerings. Domestic brands have captured significant market share by offering feature-rich devices at competitive price points, while international players maintain premium positioning through ecosystem integration and brand prestige, collectively expanding the addressable market across income segments.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Health and Fitness Monitoring

- Gesture and Motion Control

- Communication and Voice Interaction

- Ambient Sensing and Personalization

- Gaming and Immersive Experience

- Others

Health and fitness monitoring exhibits a clear dominance with a 42% share of the total India HMI sensors in wearables market in 2025.

Health and fitness monitoring applications dominate driven by escalating chronic disease prevalence and growing wellness consciousness among Indian consumers. With over 101 million individuals living with diabetes and 136 million with prediabetes in India, continuous health parameter tracking has transitioned from luxury to necessity. Wearables enable users to monitor vital signs including heart rate, blood pressure, blood oxygen levels, and physical activity patterns, facilitating early detection of health anomalies and lifestyle modification. Health and fitness features represented a significant percent of smart wearables revenue in 2024, underscoring their commercial significance as primary purchase drivers.

The segment benefits from governmental support for preventive healthcare and digital health infrastructure development. The Ayushman Bharat Digital Mission, provides an ecosystem where wearable health data can integrate with electronic health records, enabling continuity of care and physician access to longitudinal health metrics. This infrastructure facilitates telemedicine consultations informed by wearable-generated data, enhancing diagnostic accuracy. Furthermore, increasing health insurance penetration and wellness programs offered by employers are incentivizing wearable adoption, with some insurers providing premium discounts for meeting activity targets tracked through connected devices, creating financial motivation complementing health consciousness.

End Use Insights:

- Consumer Electronics

- Healthcare

- Enterprise and Industrial Applications

- Others

Consumer electronics leads with a share of 50% of the total India HMI sensors in wearables market in 2025.

Consumer electronics represents the predominant end-use segment as wearables are primarily positioned as personal consumer devices for fitness tracking, communication enhancement, and lifestyle management. The segment encompasses individual purchases for personal use, driven by rising disposable incomes, increasing smartphone penetration exceeding 600 million users, and growing digital literacy. Urban professionals, millennials, and Generation Z consumers constitute core demographics, valuing connectivity, health awareness, and technology integration into daily routines.

The dominance is reinforced by extensive marketing campaigns, celebrity endorsements, and social media influence that normalize wearable usage. E-commerce platforms have democratized access through flexible payment options, competitive pricing due to direct-to-consumer models, and convenient doorstep delivery. Festive sales events and promotional offers further stimulate purchase decisions. Consumer preferences are evolving toward devices offering comprehensive health tracking, extended battery life, aesthetic designs, and seamless ecosystem integration with existing smartphones and applications. Brands are responding with diverse portfolios catering to varied use cases from basic activity tracking to advanced health monitoring, ensuring broad market coverage across income levels and usage requirements, sustaining consumer electronics as the primary end-use category.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29.6% share of the total India HMI sensors in wearables market in 2025.

North India emerges as the leading regional market driven by high urbanization rates, concentration of technology hubs, and robust consumer purchasing power. The region encompasses major metropolitan areas including Delhi NCR, which hosts numerous multinational corporations, technology startups, and research institutions fostering innovation adoption. Uttar Pradesh ranks among the top five states with Ayushman Bharat health account holders, indicating strong digital health infrastructure penetration and government program participation that creates conducive environment for wearable device integration with healthcare systems.

The regional market benefits from well-established retail infrastructure spanning organized retail chains and e-commerce fulfillment networks ensuring product availability and after-sales service. Educational institutions and corporate offices concentrated in cities like Gurugram, Noida, and Faridabad drive demand among students and professionals prioritizing health monitoring and productivity enhancement. The presence of manufacturing facilities and assembly units established under government incentive schemes reduces logistics costs and delivery timelines. Furthermore, health consciousness is rising due to lifestyle disease prevalence in urban populations, air quality concerns prompting fitness activities, and wellness trends promoted through social media platforms, collectively sustaining North India position as the foremost regional market for HMI sensors in wearables.

Market Dynamics:

Growth Drivers:

Why is the India HMI Sensors in Wearables Market Growing?

Escalating Burden of Chronic Diseases Necessitating Continuous Monitoring

India confronts a mounting chronic disease epidemic that is fundamentally reshaping healthcare delivery paradigms and accelerating wearable device adoption for continuous health parameter tracking. The country harbors 101 million individuals with diagnosed diabetes and 136 million with prediabetes as of 2024, representing approximately one-quarter of the global diabetic population. A study from 2025 published in The Lancet disclosed that 19.8 percent of Indians aged 45 and over, totaling nearly 50.4 million individuals, are diabetic, with urban rates being almost twice those in rural regions. This demographic reality creates substantial demand for devices enabling blood glucose monitoring, cardiovascular parameter tracking, and activity level assessment that inform treatment adherence and lifestyle modifications. Wearables facilitate early anomaly detection, reducing complications through timely medical intervention.

Government Initiatives Promoting Digital Health Infrastructure and Ecosystem Development

The Government of India has launched comprehensive initiatives establishing robust digital health infrastructure that facilitates wearable device integration with healthcare ecosystems, creating enabling environment for market growth. The flagship Ayushman Bharat Digital Mission has achieved remarkable traction, generating 730 million unique health identification accounts as of January 2025, creating unified digital identity layer for health records accessible across providers. This federated architecture allows wearable health data to flow between users and healthcare providers, supporting longitudinal health tracking and telemedicine consultations.

Production-Linked Incentive Scheme Stimulating Domestic Manufacturing Capabilities

The Government of India Production-Linked Incentive scheme represents transformative policy intervention designed to boost domestic electronics manufacturing including components essential for wearable devices, reducing import dependency and enhancing global competitiveness. The Electronics Component Manufacturing Scheme launched in April 2025 with substantial outlay of INR 229.19 billion aims to attract investments and generate production over six years. The scheme specifically supports manufacturing of sub-assemblies and foundational components including high-density interconnect printed circuit boards that enable compact high-performance electronic designs essential for wearables, semiconductors, and sensors. This policy framework strengthens entire wearable manufacturing ecosystem from component suppliers to device assemblers, fostering innovation and ensuring sustainable market expansion underpinned by domestic production capacity.

Market Restraints:

What Challenges the India HMI Sensors in Wearables Market is Facing?

Market Saturation in Entry-Level Segment Leading to Consolidation

The entry-level wearable segment has experienced saturation characterized by commoditization and intense price competition, resulting in market contraction. India wearable device market declined year-over-year in 2024, marking the first annual contraction in market history. Smartwatch shipments plummeted in 2024. The proliferation of undifferentiated products offering similar basic features at comparable price points has diluted brand differentiation and eroded profit margins. Extended replacement cycles as consumers retain functional devices longer compound volume pressures. This consolidation phase necessitates strategic shifts toward premium offerings and innovation-driven differentiation to sustain revenue growth.

Limited Product Differentiation Affecting Consumer Demand Momentum

The market faces challenges stemming from insufficient meaningful innovation and technological advancement, leading to muted consumer enthusiasm for upgrades. The lack of groundbreaking features distinguishing new product generations from predecessors diminishes purchase motivation among existing users. Brands are struggling to articulate compelling value propositions beyond incremental improvements in battery life or minor sensor accuracy enhancements. The absence of killer applications or transformative capabilities that justify device replacement at annual or biennial frequencies contributes to demand stagnation. This innovation deficit necessitates renewed emphasis on research and development investments, exploration of novel use cases beyond conventional fitness tracking, and introduction of differentiated technologies that reignite consumer interest and stimulate upgrade cycles.

Data Privacy and Security Concerns Regarding Sensitive Health Information

Wearable devices generate vast quantities of sensitive personal health data including biometric measurements, location tracking, sleep patterns, and behavioral information, raising substantial privacy and security concerns. The absence of comprehensive regulatory frameworks specifically governing wearable health data creates ambiguity regarding data ownership, consent mechanisms, and breach liability. Inadequate user awareness regarding data collection practices, storage locations, and third-party sharing arrangements exacerbates vulnerability to misuse. Potential for targeted advertising based on health conditions, unauthorized insurance premium adjustments, or employment discrimination based on health metrics undermines consumer confidence. Security vulnerabilities exposing data to unauthorized access through cyberattacks or inadequate encryption protocols pose tangible risks. Addressing these concerns requires robust regulatory interventions, industry standardization of security protocols, transparent privacy policies, and consumer education initiatives to build trust essential for sustained market growth.

Competitive Landscape:

The India HMI sensors in wearables market exhibits dynamic competitive landscape characterized by presence of global technology leaders and aggressive domestic players employing differentiated strategies. International corporations leverage advanced sensor technologies, research capabilities, and established supply chains to maintain technological leadership. These companies focus on component innovation, miniaturization, power efficiency enhancements, and integration of multiple sensing modalities into unified platforms. Domestic brands have captured significant market share through value-for-money propositions, aggressive pricing strategies, localized feature development, and extensive distribution networks spanning e-commerce and offline retail. Competition intensity is intensifying as both segments invest in artificial intelligence integration, expand product portfolios across price tiers, and pursue collaborations with healthcare providers to enhance credibility. Market consolidation pressures are evident in the entry-level segment, prompting strategic pivots toward premium offerings and feature differentiation to sustain profitability amid evolving consumer expectations and technological capabilities.

India HMI Sensors in Wearables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Touch Sensors, Motion Sensors, Biometric Sensors, Voice and Audio Sensors, Environmental Sensors, Others |

| Device Types Covered | Smartwatches and Fitness Bands, Smart Glasses/AR Glasses, Smart Clothing, Smart Rings/Wristbands, Hearables/Earbuds, Head-Mounted Displays (HMDs), Others |

| Applications Covered | Health and Fitness Monitoring, Gesture and Motion Control, Communication and Voice Interaction, Ambient Sensing and Personalization, Gaming and Immersive Experience, Others |

| End Uses Covered | Consumer Electronics, Healthcare, Enterprise and Industrial Applications, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India HMI sensors in wearables market size was valued at USD 125.40 Million in 2025.

The India HMI sensors in wearables market is expected to grow at a compound annual growth rate of 13.61% from 2026-2034 to reach USD 395.51 Million by 2034.

Touch sensors held the largest market share of 31%, driven by their user-friendliness, high responsiveness, and widespread integration across smartwatches and fitness bands. Their intuitive interface requiring minimal learning curve makes them accessible to diverse demographics, while technological maturity ensures cost advantages supporting market penetration across price segments.

Key factors driving the India HMI sensors in wearables market include escalating chronic disease prevalence necessitating continuous health monitoring, government digital health infrastructure initiatives creating enabling ecosystem, and Production-Linked Incentive schemes stimulating domestic manufacturing capabilities. Rising health consciousness, artificial intelligence integration, and premiumization trends further propel market expansion across consumer segments.

Major challenges include market saturation in entry-level segment resulting in first-ever annual contraction, limited product differentiation affecting consumer upgrade motivation, and data privacy concerns regarding sensitive health information. The market requires innovation-driven differentiation, robust regulatory frameworks addressing privacy apprehensions, and strategic shifts toward premium offerings to sustain growth momentum.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)