India Home Cleaning Equipment Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Home Cleaning Equipment Market Size and Share:

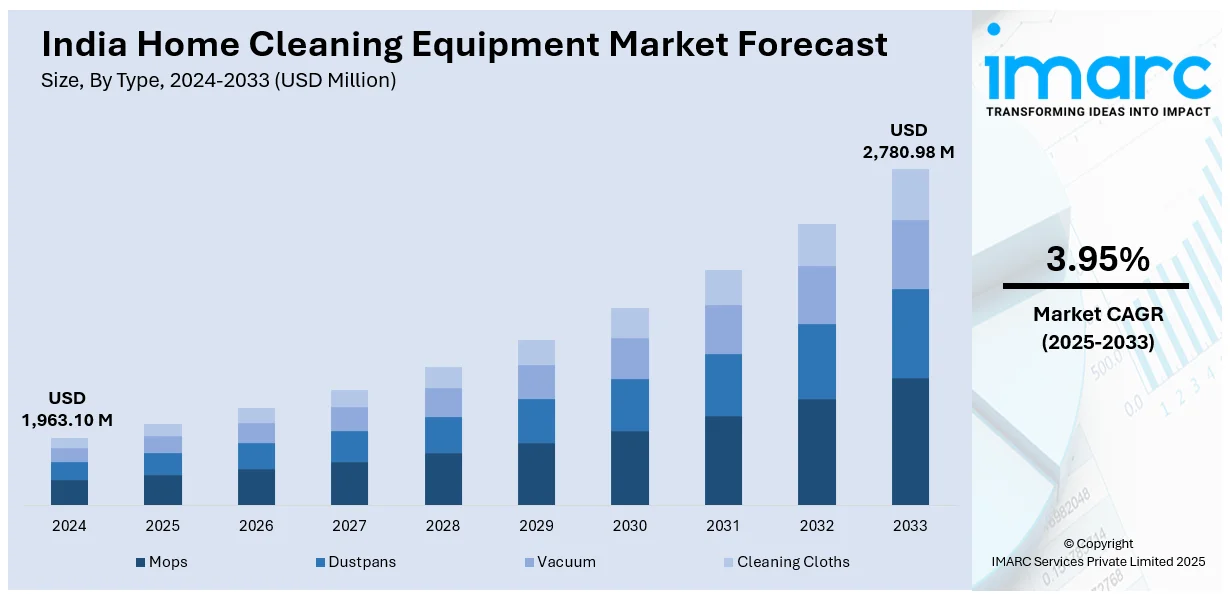

The India home cleaning equipment market size reached USD 1,963.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,780.98 Million by 2033 exhibiting a growth rate (CAGR) of 3.95% during 2025-2033 The India home cleaning equipment market share is expanding, driven by the growing busy lifestyles that necessitate the adoption of multi-functional and user-friendly cleaning tools, along with the rising expansion of retail shops that provide in-store demonstrations, aiding people in understanding the usage and efficiency of various cleaning devices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,963.10 Million |

| Market Forecast in 2033 | USD 2,780.98 Million |

| Market Growth Rate (2025-2033) | 3.95% |

India Home Cleaning Equipment Market Trends:

Increasing demand for time-saving cleaning solutions

The rising demand for time-saving cleaning solutions is impelling the India home cleaning equipment market growth. People look for faster and more efficient ways to maintain cleanliness. With busy lifestyles and an increasing working population, many individuals do not have the time or energy for traditional and labor-intensive cleaning methods. As per the most recent report from the Periodic Labour Force Survey (PLFS) concerning the urban sector in India, the Labour Force Participation Rate (LFPR) and Worker Population Ratio (WPR) for those aged 15 years and above at Current Weekly Status rose to 50.2% and 46.9%, respectively, during January-March 2024. People seek modern cleaning tools like vacuum cleaners, cordless mops, and high-powered steam cleaners that reduce effort and conserve time. Many cleaning devices come with reliable and effective features, allowing users to clean their homes with minimal manual intervention. Households with dual-income earners especially prefer these items, as they make daily chores easier and free up time for other activities. The trend is further supported by increasing urbanization activities where smaller apartments require compact and efficient cleaning solutions. Brands are continuously innovating to offer lightweight, multi-functional, and user-friendly equipment that caters to this growing need. As time becomes more valuable, the preference for quick and effective cleaning tools grows, making them a crucial part of modern homes.

To get more information on this market, Request Sample

Expansion of retail channels

The expansion of retail outlets is offering a favorable India home cleaning equipment market outlook. According to the Retailers Association of India (RAI), retailers in India recorded a modest 7% increase in sales during the 2024 festive season compared to 2023. Supermarkets, hypermarkets, specialty shops, and online platforms contribute to enhancing the visibility of cleaning equipment, such as vacuum cleaners, mops, and steam cleaners. As more retail stores offer a range of cleaning items, shoppers enjoy greater options and can effortlessly compare features, brands, and prices. Numerous shops provide in-store demonstrations, assisting customers in understanding the functionality of various cleaning devices and motivating them to buy. The broadening of e-commerce sites also enhances this trend by offering convenience, home delivery, and customer reviews that influence purchasing choices. Retailers also entice users with discounts, package deals, and financing alternatives, rendering premium cleaning equipment more budget friendly. The availability of cleaning products in both physical and online shops allows them to target various user types, ranging from individuals who enjoy in-person shopping to those who favor the ease of online transactions.

India Home Cleaning Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Mops

- Dustpans

- Vacuum

- Cleaning Cloths

The report has provided a detailed breakup and analysis of the market based on the types. This includes mops, dustpans, vacuum, and cleaning cloths.

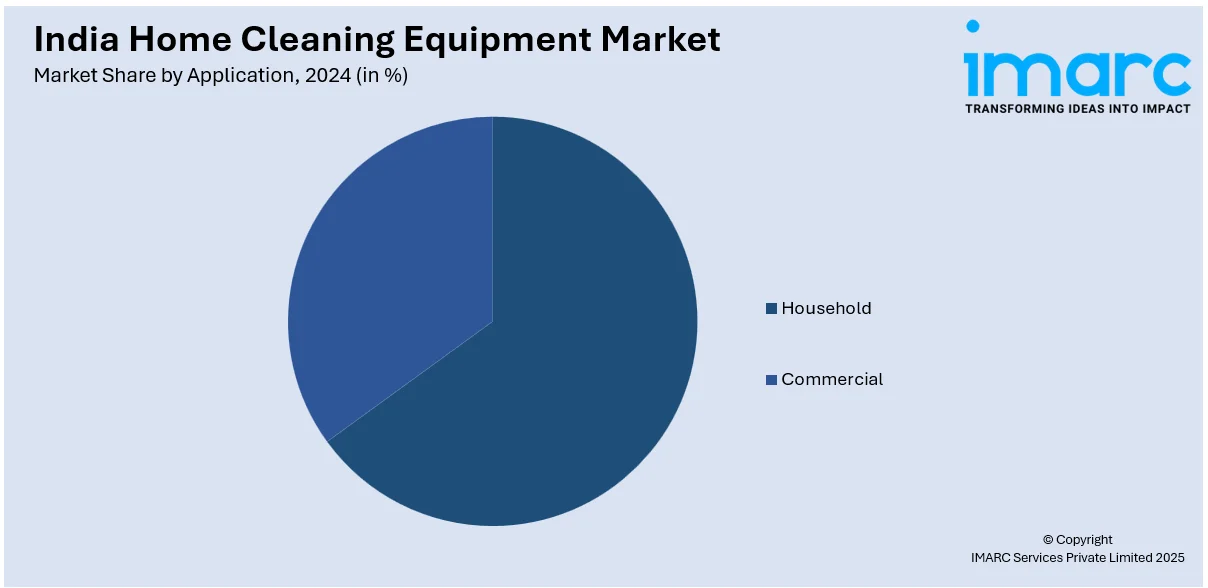

Application Insights:

- Household

- Commercial

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes household and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Home Cleaning Equipment Market News:

- In October 2024, Dyson, a multinational household appliances company, unveiled the ‘Big Ball vacuum cleaner’ in India, priced at INR 29,900. It included a carbon-fiber cleaning head designed for various floor surfaces, along with a mattress tool and a combination/crevice tool.

- In March 2024, BSH Home Appliances launched the ‘Bosch Unlimited 7 Handstick Vacuum Cleaner’ for homes in India. This vacuum cleaner could effectively collect more than 99.9% of dust, guaranteeing a tidy space.

India Home Cleaning Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mops, Dustpans, Vacuum, Cleaning Cloths |

| Applications Covered | Household, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home cleaning equipment market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home cleaning equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home cleaning equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home cleaning equipment market in India was valued at USD 1,963.10 Million in 2024.

The India home cleaning equipment market is projected to exhibit a CAGR of 3.95% during 2025-2033, reaching a value of USD 2,780.98 Million by 2033.

Busy lifestyles, especially in metro cities, are motivating households to invest in efficient and time-saving cleaning equipment like vacuum cleaners, robotic cleaners, and steam mops. Additionally, the growing number of nuclear families and dual-income households is driving the demand for convenient and user-friendly cleaning solutions. The influence of digital media and advertisements has also enhanced user knowledge about the benefits of automated and advanced home cleaning devices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)