India Home Security Systems Market Size, Share, Trends and Forecast by Product, Residence Type, and Region, 2025-2033

India Home Security Systems Market Overview:

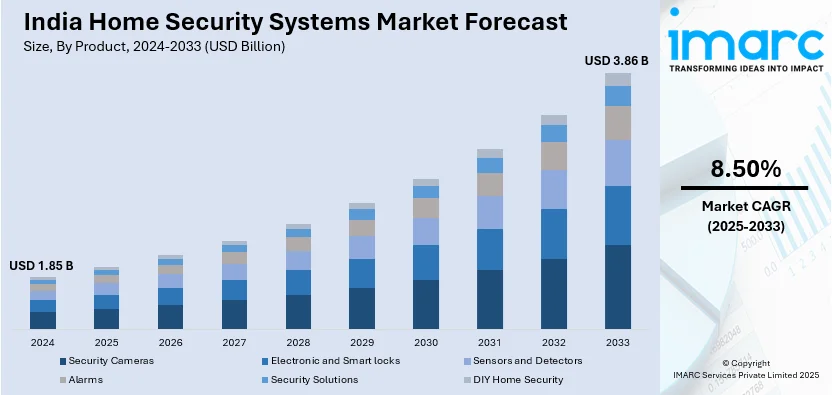

The India home security systems market size reached USD 1.85 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.86 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The rising crime rates, increasing urbanization, smart home adoption, growing awareness about safety, higher disposable incomes, government initiatives for smart cities, and technological advancements like AI and IoT are some of the other factors driving the India home security systems market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.86 Billion |

| Market Growth Rate (2025-2033) | 8.50% |

India Home Security Systems Market Trends:

Rising Crime Rates and Safety Concerns

The increasing crime rates, including burglaries, home invasions, and thefts, are a significant driver for the home security systems market in India. As per the 2023 report, the 19 metropolitan areas house 8.12 percent of India's populace but account for 14.65 percent of all cognizable offenses. This also indicates that crime rates in major cities significantly surpass the national average for crime rates.The rise of urban areas and the increasing prevalence of single-family homes drives homeowners to select safety technologies including CCTV cameras and smart locks along with alarm systems. The increasing reports of security incidents in residential zones have made people want to spend money on protective measures. Additionally, the demand for round-the-clock monitoring has surged, with advanced security solutions offering real-time alerts and remote access. As safety concerns rise, both urban and semi-urban populations are embracing home security technologies to ensure protection for their families and assets, thus fueling the India home security systems market share.

To get more information on this market, Request Sample

Increasing Adoption of Smart Home Technologies

The integration of home security systems with smart home technology is rapidly gaining traction in India. Consumers are adopting IoT-based security solutions, allowing them to monitor and control security devices remotely via smartphones and voice assistants. Features like motion detection, facial recognition, and AI-powered alerts enhance security efficiency. The popularity of connected devices like smart doorbells, automated locks, and security cameras has grown due to their convenience and real-time surveillance capabilities. With increased digital literacy and improved internet connectivity, more Indian households are integrating smart security systems as part of their modern home automation setup, thus creating a positive India home security systems market outlook. For instance, in September 2024, ABB India, a worldwide frontrunner in electrification and automation, introduced ABB-free@home in India, a smart home automation solution featuring improved interoperability. This innovative and all-encompassing wireless home automation system aims to improve comfort, security, and energy efficiency for households. It enables users to manage and integrate extra components like white goods, third-party devices, and EV chargers, all through one interface.

Government Initiatives and Smart City Projects

The Indian government’s push toward smart cities and digital infrastructure has accelerated the adoption of home security systems. Programs such as Smart Cities Mission encourage the installation of surveillance systems, AI-based security solutions, and emergency response mechanisms in residential areas. The rise of public-private partnerships in security infrastructure is promoting better awareness and access to security solutions for homeowners. Additionally, regulatory frameworks emphasizing data protection and cybersecurity for surveillance devices are fostering trust in smart security systems. As urban development continues, residential societies and gated communities are increasingly integrating advanced security measures to comply with government safety standards. For instance, in August 2024, India sanctioned 12 new smart industrial cities, along with additional infrastructure initiatives designed to enhance the country's manufacturing ecosystem. The smart city initiatives within the National Industrial Corridor Development Programme (NICDP) will involve an investment of US$3.41 billion, whereas three railway projects spanning four states will aim to enhance logistics networks. Ultimately, a new hydroelectric project aims to improve the power infrastructure in the Northeast area of the nation.

India Home Security Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product and residence type.

Product Insights:

- Security Cameras

- Electronic and Smart locks

- Sensors and Detectors

- Alarms

- Security Solutions

- DIY Home Security

The report has provided a detailed breakup and analysis of the market based on the product. This includes security cameras, electronic and smart locks, sensors and detectors, alarms, security solutions, and DIY home security.

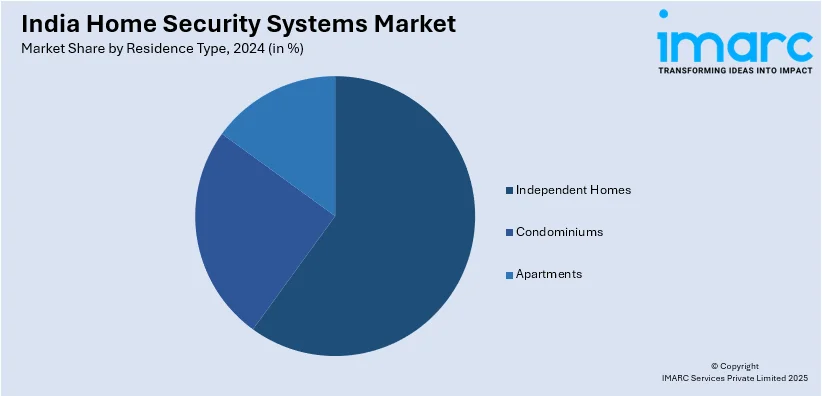

Residence Type Insights:

- Independent Homes

- Condominiums

- Apartments

A detailed breakup and analysis of the market based on the residence type have also been provided in the report. This includes independent homes, condominiums and apartments.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Home Security Systems Market News:

- In March 2024, Hikvision introduced the AX HOME series wireless alarm system tailored to satisfy the requirements of homeowners. The AX HOME Series enhances Hikvision's dedication to providing advanced, dependable alarm systems that are both affordable and easy to use.

- In August 2024, Bosch Building Technologies, a top provider of cutting-edge safety and security solutions, inaugurated its assembly line in India for video systems and solutions featuring FLEXIDOME IP Starlight 5000i cameras. This strategic effort reinforces Bosch India’s ongoing commitment to localization, solidifying its presence in various product categories.

India Home Security Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Security Cameras, Electronic and Smart locks, Sensors and Detectors, Alarms, Security Solutions, DIY Home Security |

| Residence Types Covered | Independent Homes, Condominiums, Apartments |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India home security systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India home security systems market on the basis of product?

- What is the breakup of the India home security systems market on the basis of residence type?

- What is the breakup of the India home security systems market on the basis of region?

- What are the various stages in the value chain of the India home security systems market?

- What are the key driving factors and challenges in the India home security systems market?

- What is the structure of the India home security systems market and who are the key players?

- What is the degree of competition in the India home security systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India home security systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India home security systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India home security systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)