India Home Textile Market Size, Share, Trends, and Forecast by Product, Distribution Channel, and Region, 2026-2034

India Home Textile Market Summary:

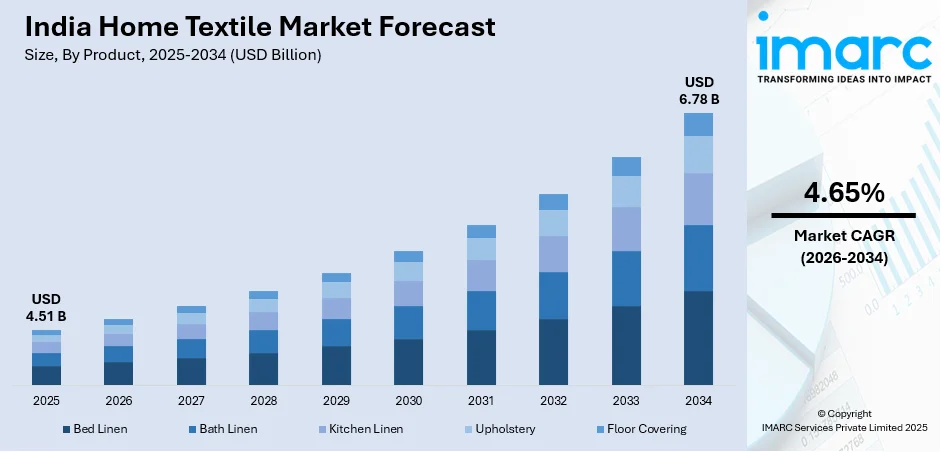

The India home textile market size was valued at USD 4.51 Billion in 2025 and is projected to reach USD 6.78 Billion by 2034, growing at a compound annual growth rate of 4.65% from 2026-2034.

The India home textile market is experiencing robust expansion, driven by rising urbanization, increasing disposable incomes, and changing consumer preferences for aesthetically appealing home decor. The country's growing middle class is increasingly investing in quality bed linen, bath products, and furnishing fabrics to enhance living spaces. The booming real estate sector, coupled with government initiatives aimed at promoting affordable housing, is creating substantial demand for home textile products. Additionally, the expansion of hospitality and healthcare sectors continues to fuel commercial demand, while e-commerce platforms are democratizing access to premium home textile offerings across urban and semi-urban regions.

Key Takeaways and Insights:

-

By Product: Bed linen dominates the market with a share of 41.05% in 2025, owing to its universal demand across residential and commercial segments, continuous product innovations incorporating organic fabrics, and increasing consumer preferences for premium bedding solutions that enhance sleep quality and bedroom aesthetics.

-

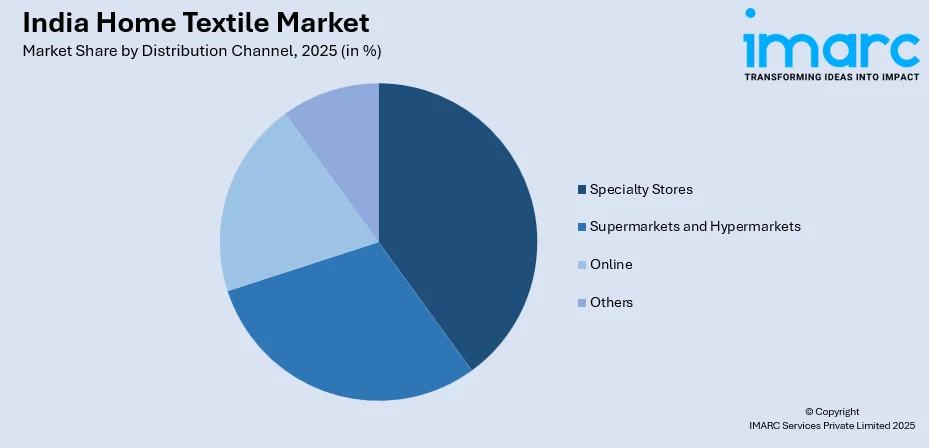

By Distribution Channel: Specialty stores lead the market with a share of 37.16% in 2025. This dominance is driven by their ability to offer curated product assortments, personalized customer service, expert guidance on fabric selection, and tactile shopping experiences that allow consumers to evaluate texture and quality before purchase.

-

By Region: North India comprises the largest region with 30% share in 2025, due to the concentration of major metropolitan centers, including Delhi-NCR, higher purchasing power among urban populations, presence of established textile manufacturing clusters in states like Uttar Pradesh and Haryana, and strong retail infrastructure supporting home textile sales.

-

Key Players: Key players drive the India home textile market by expanding production capacities, investing in sustainable manufacturing practices, and strengthening distribution networks across tier-two and tier-three cities. Their focus on product innovations, quality improvement, and strategic partnerships with domestic and international retailers ensures consistent market growth and enhanced brand visibility.

To get more information on this market Request Sample

The India home textile industry stands as a significant contributor to the country's manufacturing sector and export economy. The market benefits from India's position as one of the world's largest cotton producers, providing domestic manufacturers with abundant raw material access and cost advantages. According to the Cotton Association of India (CAI), the total production for the 2023-24 season was recorded at 336.45 Lakh bales. Consumer awareness regarding home aesthetics has evolved considerably, with households increasingly viewing home textiles as essential elements of interior design rather than mere functional necessities. The proliferation of organized retail formats and digital commerce platforms has expanded market reach, enabling brands to connect with diverse consumer segments across geographic and economic strata. The government's supportive textile policies, including production-linked incentive schemes, continue to strengthen the industry's foundation for sustained expansion throughout the forecast period.

India Home Textile Market Trends:

Rising Demand for Sustainable and Organic Home Textiles

Environmental consciousness is reshaping consumer preferences in the India home textile market, driving substantial demand for products manufactured using organic cotton, bamboo fibers, and hemp materials. Consumers increasingly prioritize eco-friendly certifications and sustainable sourcing practices when selecting bed linen, towels, and furnishing fabrics. Manufacturers are responding by introducing Global Organic Textile Standard (GOTS)-certified collections and implementing transparent supply chain practices. For instance, in January 2024, Malako released a new collection of luxurious bedroom and bathroom essentials, produced from organic cotton and bamboo, featuring sophisticated designs with up to 800TC thread count.

Digital Commerce Transformation Accelerating Market Access

E-commerce platforms are fundamentally transforming home textile distribution dynamics across India, enabling consumers in semi-urban and rural regions to access diverse product portfolios previously available only in metropolitan markets. As per IMARC Group, the India e-commerce market size reached USD 107.7 Billion in 2024. Online retailers offer extensive catalogs spanning budget-friendly options to premium luxury collections, empowering consumers with comparison shopping capabilities and doorstep delivery convenience. Major platforms have developed dedicated home textile verticals featuring virtual visualization tools and detailed product specifications that facilitate informed purchasing decisions without physical store visits.

Premium and Luxury Segment Witnessing Accelerated Expansion

The premium home textile segment is experiencing notable growth, as affluent Indian consumers increasingly invest in high-quality bedding, silk drapes, and handcrafted textiles to elevate their living spaces. Rising disposable incomes among urban professionals and growing exposure to international design trends are fueling demand for Egyptian cotton sheets, high-thread-count linens, and artisanal products. As per Trading Economics, in 2023, disposable personal income in India rose to 296383300 INR Million. Both domestic manufacturers and international brands are introducing designer collaborations and limited-edition collections featuring intricate embroidery and exclusive craftsmanship to capture this discerning consumer segment.

Market Outlook 2026-2034:

The India home textile market is poised for sustained broadening throughout the forecast period, due to favorable demographic trends, urbanization momentum, and evolving consumer lifestyles. The industry's growth trajectory will be supported by continued government investments in housing infrastructure, expanding hospitality sector requirements, and increasing penetration of organized retail formats in emerging urban centers. The market generated a revenue of USD 4.51 Billion in 2025 and is projected to reach a revenue of USD 6.78 Billion by 2034, growing at a compound annual growth rate of 4.65% from 2026-2034. Manufacturers focusing on product innovations, sustainable practices, and omnichannel distribution strategies are well-positioned to capitalize on emerging opportunities.

India Home Textile Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Bed Linen |

41.05% |

|

Distribution Channel |

Specialty Stores |

37.16% |

|

Region |

North India |

30% |

Product Insights:

- Bed Linen

- Bath Linen

- Kitchen Linen

- Upholstery

- Floor Covering

Bed linen dominates with a market share of 41.05% of the total India home textile market in 2025.

The bed linen segment maintains commanding market leadership, driven by universal household demand and the essential nature of bedding products across residential and commercial applications. Indian consumers are increasingly upgrading from basic cotton sheets to premium offerings, featuring higher thread counts, superior fabric blends, and contemporary designs that complement modern interior aesthetics. The segment benefits from consistent replacement cycles, as households regularly refresh bedding to maintain hygiene and comfort standards.

Product innovations continue to propel the segment growth, with manufacturers introducing specialized offerings, including temperature-regulating fabrics, antimicrobial treatments, and hypoallergenic materials, catering to health-conscious consumers. The hospitality sector's expansion further amplifies the demand for commercial-grade bed linen meeting international quality benchmarks. As per IBEF, the hospitality industry market in India is expected to be USD 24.61 Billion in 2024 and is predicted to grow to USD 31.01 Billion by 2029.

Distribution Channel Insights:

To get more information on this market Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Specialty stores lead with a share of 37.16% of the total India home textile market in 2025.

Specialty stores maintain market leadership through their distinctive ability to offer curated product assortments, expert guidance, and immersive shopping experiences that enable consumers to physically evaluate fabric quality, texture, and color accuracy before purchase. These dedicated retail formats house comprehensive home textile collections spanning multiple price points, allowing shoppers to compare options and receive personalized recommendations from trained staff. The tactile nature of textile purchases particularly favors specialty retail environments.

Major home textile brands continue to expand their exclusive retail footprints across metropolitan and tier-two cities to strengthen direct consumer engagement and brand positioning. For instance, in January 2025, Jaipur Rugs announced the opening of its first store in Raipur, marking its expansion into Chhattisgarh and increasing its total store count to nineteen locations. Specialty retailers are enhancing store experiences through interactive displays, design consultation services, and customization options to differentiate from online competition.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 30% share of the total India home textile market in 2025.

North India's market leadership stems from the concentration of major metropolitan centers, including Delhi-NCR, which collectively house a substantial portion of India's urban population with high purchasing power. The region benefits from proximity to established textile manufacturing clusters in Panipat, known as the Manchester of India, which facilitates efficient distribution networks and competitive pricing. Strong real estate development activities across residential and commercial segments continue to generate sustained demand for home textile products.

The region's well-developed retail infrastructure encompasses modern shopping malls, organized retail chains, and traditional market centers that provide diverse purchasing options for consumers across economic segments. Additionally, the hospitality sector in North India, including luxury hotels, business accommodations, and tourist facilities, generates significant commercial demand for quality bed and bath linen. Growing urbanization in tier-two cities like Jaipur, Lucknow, and Chandigarh is creating new growth avenues as these urban centers witness rising consumer aspirations for quality home furnishings. As per macrotrends, the metro area population of Lucknow in 2025 is 4,133,000, reflecting a 2.35% rise from 2024.

Market Dynamics:

Growth Drivers:

Why is the India Home Textile Market Growing?

Expansion of Organized Retail and E-Commerce Platforms

The expansion of organized retail and e-commerce platforms is transforming the India home textile market. India's organized retail industry is expected to hit INR 19,70,870 Crore (USD 230 Billion) by the year 2030 from INR 11,31,108 Crore (USD 132 Billion) in the year 2024. Large-format home furnishing stores, specialty retailers, and branded outlets improve product visibility and consumer trust. Organized retail offers standardized quality, wider assortments, and professional merchandising that enhances purchasing confidence. E-commerce platforms enable consumers to compare designs, prices, and materials conveniently, expanding reach beyond metropolitan cities. Digital platforms also support customization, doorstep delivery, and easy returns, improving overall shopping experience. Discount-driven online sales and festive promotions stimulate volume growth. Small manufacturers gain broader market access through online marketplaces, increasing product diversity. Influencer marketing and digital advertising further raise awareness about new trends and collections. The integration of online and offline channels strengthens distribution efficiency and accelerates consumption, making organized retail expansion a key growth driver for India’s home textile market.

Growth of Hospitality and Real Estate Sectors

The growth of India’s hospitality and real estate industries is a strong driver of the home textile market. Expansion of hotels, resorts, serviced apartments, and vacation rentals increases bulk demand for bed linens, towels, curtains, and upholstery fabrics. Rising domestic tourism and business travel encourage continuous refurbishment and replacement cycles within hospitality properties. India noted around 56 Lakh Foreign Tourist Arrivals (FTAs) and 303.59 Crore Domestic Tourist Visits by August 2025. Commercial real estate growth, including offices and co-living spaces, also drives demand for functional and durable textile products. Developers increasingly focus on interior quality to enhance property value and tenant appeal, supporting premium textile adoption. Customized and branded textile solutions gain traction in hospitality projects seeking differentiation. Long-term supply contracts provide stable demand for manufacturers. As tourism infrastructure and real estate investments expand nationwide, institutional consumption continues to significantly support the market growth.

Focus on Sustainability and Natural Fiber Preference

Growing awareness about sustainability is driving the demand for eco-friendly home textiles in India. Consumers increasingly prefer products made from natural fibers, such as cotton, linen, and bamboo due to comfort, breathability, and environmental considerations. Rising concerns over health and indoor air quality encourage avoidance of synthetic materials and chemical-heavy finishes. Manufacturers respond by offering organic, low-impact dyed, and ethically sourced textile products. Sustainability certifications and transparent sourcing strengthen brand appeal. Export-oriented production capabilities also influence domestic offerings, raising quality standards. Government support for the textile sector and promotion of sustainable practices further encourage innovations. As environmentally conscious purchasing decisions grow across income groups, sustainability-driven demand becomes a long-term growth factor shaping the India home textile market.

Market Restraints:

What Challenges the India Home Textile Market is Facing?

Raw Material Price Volatility

Cotton price fluctuations significantly impact manufacturing costs and profit margins across the home textile value chain in India. Global commodity market dynamics, domestic crop yields, and international trade policies create pricing uncertainty that complicates production planning and inventory management for manufacturers dependent on cotton as their primary raw material.

Intense Market Competition

In India, the fragmented market structure, featuring numerous domestic manufacturers alongside international entrants, intensifies competitive pressure on pricing and margins. Smaller players often compete primarily through aggressive pricing strategies, compelling established brands to balance quality maintenance with cost competitiveness while investing in differentiation through innovation and branding.

Counterfeit and Unorganized Sector Challenges

The prevalence of counterfeit products and unorganized sector offerings undermines brand value propositions and consumer trust in the home textile category across the country. These lower-priced alternatives, often lacking quality consistency and consumer protection, create market distortions that particularly affect organized sector players investing in quality standards and brand building.

Competitive Landscape:

The India home textile market exhibits a fragmented competitive structure, characterized by the coexistence of large vertically integrated manufacturers, regional players, and emerging direct-to-consumer (D2C) brands. Established companies leverage scale advantages, comprehensive distribution networks, and brand recognition to maintain market positions, while focusing on product innovations, sustainability initiatives, and capacity expansion to capture growing demand. Competition increasingly centers on differentiation through quality, design innovation, and sustainable manufacturing practices rather than price alone. Manufacturers are strengthening retail presence through exclusive brand outlets while simultaneously expanding e-commerce capabilities to address evolving consumer shopping preferences. Strategic investments in technology upgradation, backward integration, and international certifications enhance competitive positioning in both domestic and export markets.

Recent Developments:

-

In January 2025, Alok Industries, a leading vertically integrated textile company in India, revealed its new bed and bath linen collections at Heimtextil 2025, showcasing high-performance, premium, and luxury designs designed for durability, comfort, and contemporary consumer tastes. The collections used eco-friendly materials, such as recycled polyester and organic cotton.

India Home Textile Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bed Linen, Bath Linen, Kitchen Linen, Upholstery, Floor Covering |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India home textile market size was valued at USD 4.51 Billion in 2025.

The India home textile market is expected to grow at a compound annual growth rate of 4.65% from 2026-2034 to reach USD 6.78 Billion by 2034.

Bed linen dominated the market with a share of 41.05%, driven by universal household demand, continuous product innovations featuring organic and premium fabrics, and increasing consumer preference for quality bedding solutions.

Key factors driving the India home textile market include accelerating urbanization, rising disposable incomes among the expanding middle class, robust real estate and housing sector expansion, and growing hospitality industry demand.

Major challenges include raw material price volatility particularly for cotton, intense competition from fragmented market players, counterfeit products affecting brand value, supply chain constraints, and the need for continuous investment in sustainable manufacturing practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)