India Hospital Equipment Market Size, Share, Trends and Forecast by Equipment Type, Distribution Channel, End User, and Region, 2025-2033

India Hospital Equipment Market Overview:

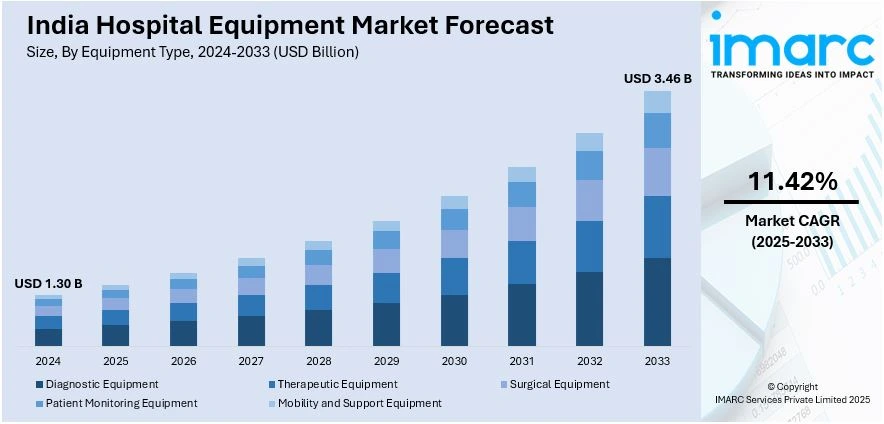

The India hospital equipment market size reached USD 1.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.46 Billion by 2033, exhibiting a growth rate (CAGR) of 11.42% during 2025-2033. The market is expanding because of increased healthcare investments, modern medical technologies, and the rising need for high-quality patient care that is boosting innovation, enhanced hospital infrastructure, and the implementation of advanced diagnostic, therapy, and monitoring equipment across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.30 Billion |

| Market Forecast in 2033 | USD 3.46 Billion |

| Market Growth Rate 2025-2033 | 11.42% |

India Hospital Equipment Market Trends:

Adoption of Advanced Patient Monitoring Systems

The India healthcare equipment market is witnessing tremendous growth in patient monitoring systems due to increasing demands for real-time health monitoring and better clinical decision support. Contemporary hospitals are increasingly using artificial intelligence (AI) based monitoring devices, wireless sensors, and Internet of Things (IoT) based systems to provide better patient care by conducting ongoing health checks. These technologies find special significance in intensive care units, where real-time monitoring of vital signs supports timely medical interventions, minimizing mortality rates and improving recovery rates. The growth of telemedicine has also stimulated the use of remote monitoring solutions, allowing healthcare professionals to monitor patient conditions outside hospital environments. Wearable monitoring devices are also becoming increasingly important, supporting early detection of severe health conditions and reducing hospital readmission. The change towards digital healthcare transformation has set patient monitoring devices as the linchpin of contemporary care, guaranteeing augmented efficiency, accuracy, and convenience in hospitals within India.

To get more information on this market, Request Sample

Expansion of Robotic-Assisted Surgical Equipment

Robotic surgical devices are finding greater use in Indian hospitals, transforming surgery with greater precision, less invasiveness, and better patient care. These newer systems are picking up pace in orthopedic, neurological, and cardiovascular surgery specialties, enabling surgeons to undertake complex surgeries with higher accuracy and lower risks. For instance, in August 2023, Devadoss Hospital in Madurai was the first in South Tamil Nadu to adopt the CUVIS Joint Robot System for joint replacement surgery, adding precision, lowering recovery time, and lessening surgical side effects through cutting-edge 3D pre-planning and robotic support. Moreover, the fusion of AI and machine learning (ML) in robotic surgery platforms further boosts procedural efficacy through real-time instruction, predictive analytics, and adaptive automation. Through this, patients enjoy less invasive incisions, quicker recovery times, and shorter hospitalization stays, hence overall enhanced healthcare experiences. Moreover, increasing focus on surgeon training programs and simulation education is making sure that medical professionals have the skills needed to optimize the capabilities of robotic-assisted technology. With the development of healthcare infrastructure in India, robotic-assisted surgical machines are redefining the benchmarks of surgical accuracy, operational speed, and patient care in hospitals across the country.

Growth of Smart Hospital Infrastructure

The development of intelligent hospital infrastructure in India is revolutionizing healthcare facilities by incorporating advanced medical devices that improve operational effectiveness, patient protection, and resource allocation. Hospitals are increasingly using AI-based diagnostic imaging devices, intelligent infusion pumps, and auto-dispensing drug dispensers to maximize treatment precision and minimize human errors. For example, in November 2024, Philips launched the new Azurion in India, improving interventional procedures with cutting-edge imaging, AI-driven remote monitoring, and enhanced workflow efficiency to aid neurovascular, cardiovascular, and surgical interventions, maximizing patient care and clinical results. Further, real-time location systems (RTLS) to track hospital assets and medical equipment are optimizing workflow efficiency and guaranteeing prompt availability of crucial devices. Furthermore, hospitals are also using digital health records and analytics powered by artificial intelligence to automate patient data management, thereby making clinical decisions faster and better informed. Energy-efficient infrastructure in the form of smart HVACs and automated lighting is also on the agenda to drive sustainability and cut operational expenditure. As India's healthcare industry becomes modernized, the use of smart hospital equipment is transforming medical services, delivering higher quality patient care, efficient hospital functions, and data-led healthcare delivery improvements.

India Hospital Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on equipment type, distribution channel, and end user.

Equipment Type Insights:

- Diagnostic Equipment

- X-ray Machines

- MRI Scanners

- CT Scanners

- Ultrasound Devices

- Endoscopy Equipment

- Therapeutic Equipment

- Ventilators

- Dialysis Machines

- Infusion Pumps

- Laser Therapy Devices

- Surgical Equipment

- Electrosurgical Devices

- Surgical Navigation Systems

- Endoscopic Instruments

- Patient Monitoring Equipment

- ECG Monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Fetal Monitoring Systems

- Mobility and Support Equipment

- Wheelchairs and Stretchers

- Hospital Beds

- Patient Lifting Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes diagnostic equipment (X-ray machines, MRI scanners, CT scanners, ultrasound devices, and endoscopy equipment), therapeutic equipment (ventilators, dialysis machines, infusion pumps, and laser therapy devices), surgical equipment (electrosurgical devices, surgical navigation systems, and endoscopic instruments), patient monitoring equipment (ECG monitors, blood pressure monitors, pulse oximeters, and fetal monitoring systems), mobility and support equipment (wheelchairs and stretchers, hospital beds, and patient lifting equipment).

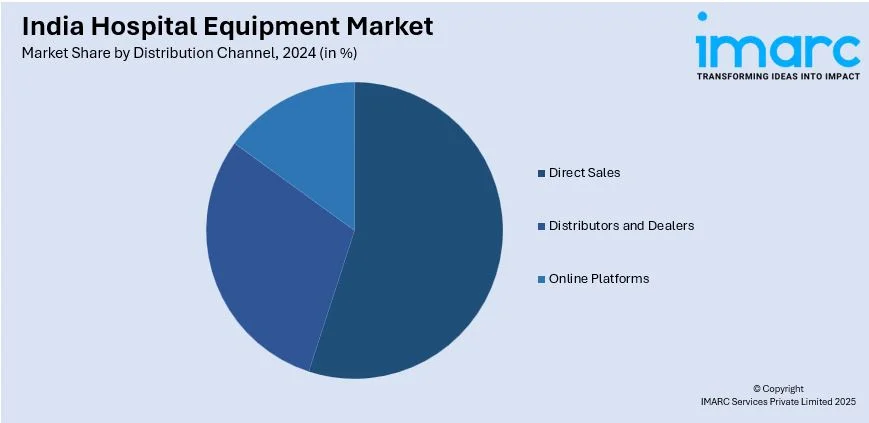

Distribution Channel Insights:

- Direct Sales

- Distributors and Dealers

- Online Platforms

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales, distributors and dealers, and online platforms.

End User Insights:

- Hospitals and Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, diagnostic centers, ambulatory surgical centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hospital Equipment Market News:

- In March 2025, Wipro GE Healthcare has released the Versana Premier R3, an artificial intelligence-based, Made-in-India ultrasound solution that will enhance diagnostic accuracy and clinical effectiveness. Made in Bengaluru, this solution brings in advanced imaging, workflow automation, and AI-infused insights to aid India's increasing demand for high-quality yet affordable healthcare offerings.

- In March 2024, Kailash Hospital & Neuro Institute in Noida introduced a state-of-the-art joint replacement robot, the first of its kind in the city. The sophisticated system increases surgical accuracy, reduces recovery time, and enhances patient outcomes, representing a significant leap in India's robotic-assisted orthopedic surgery.

India Hospital Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors and Dealers, Online Platforms |

| End Users Covered | Hospitals and Clinics, Diagnostic Centers, Ambulatory Surgical Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hospital equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hospital equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hospital equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hospital equipment market in India was valued at USD 1.30 Billion in 2024.

The India hospital equipment market is projected to exhibit a CAGR of 11.42% during 2025-2033, reaching a value of USD 3.46 Billion by 2033.

The expansion of India hospital equipment sector is driven by the rapid growth of healthcare facilities, increased healthcare investments, rising demand for advanced diagnostic and therapeutic tools, greater health awareness, and governmental efforts to enhance healthcare services, especially in rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)