India Humidifier Market Size, Share, Trends and Forecast by Type, Coverage Area, and Region, 2025-2033

India Humidifier Market Overview:

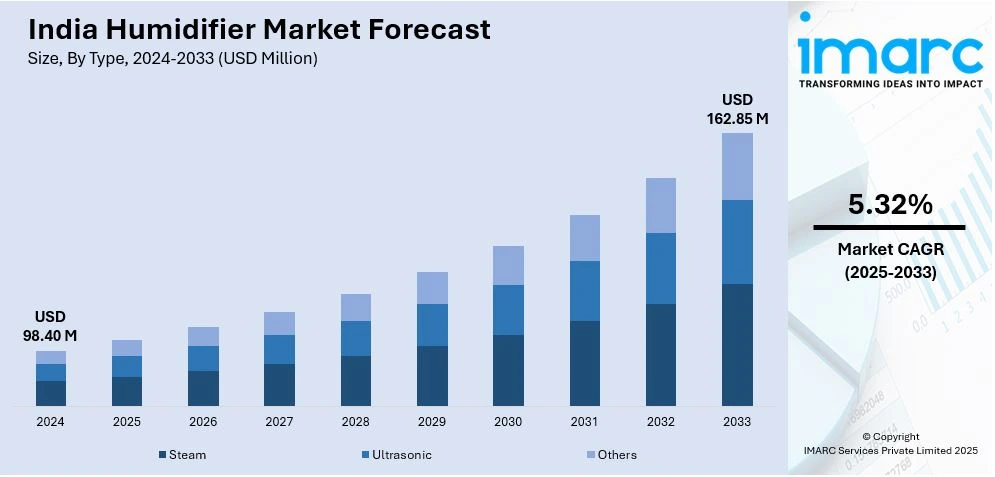

The India humidifier market size reached USD 98.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 162.85 Million by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The market is driven by rising awareness regarding indoor air quality, increasing cases of respiratory issues, rapid urbanization, and growing demand for health-focused home appliances. Seasonal dryness, air pollution, and higher disposable incomes further boost the adoption of humidifiers across residential and commercial spaces.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 98.40 Million |

| Market Forecast in 2033 | USD 162.85 Million |

| Market Growth Rate 2025-2033 | 5.32% |

India Humidifier Market Trends:

Rising Air Pollution and Health Awareness

India’s increasing air pollution, particularly in urban centers such as Delhi, Mumbai, and Kolkata, has heightened public awareness of indoor air quality. For instance, in December 2024, residents reported breathing difficulties and eye and throat itching due to the air quality being 35 times higher than the World Health Organization's (WHO) acceptable guideline. Parts of Delhi had pollution levels of 550 on Wednesday morning, well beyond even the "hazardous" standard of 300, according to the Swiss air quality index IQAir. Prolonged exposure to pollutants leads to respiratory problems, allergies, dry skin, and throat irritation. Consumers are turning to humidifiers to maintain optimal humidity levels indoors, improving breathing comfort and overall wellness. Doctors and health experts also recommend humidifiers for managing asthma and sinus-related issues, particularly during winter months. This health-centric approach is fueling demand, making humidifiers a part of many Indian households, especially among families with children, the elderly, or individuals with respiratory sensitivities, creating a positive India humidifier market outlook.

To get more information on this market, Request Sample

Growth in Urbanization and Modern Lifestyles

Rapid urbanization and the rise in modern residential infrastructure have created more demand for home wellness devices, including humidifiers. According to the data from the World Bank, urban areas will contribute almost 70% of the nation's GDP, and by 2036, 600 million people, or 40% of the population, will reside in towns and cities, up from 31% in 2011. Urban dwellers living in air-conditioned apartments often experience dry indoor environments, leading to discomfort and health issues. As more Indians shift toward urban, indoor-focused lifestyles with reduced natural ventilation, the need to regulate indoor humidity is growing. Humidifiers are increasingly seen not just as seasonal appliances but as year-round comfort enhancers. This trend is particularly noticeable among middle- and upper-income groups who prioritize home aesthetics, air quality, and lifestyle convenience, thereby boosting the India humidifier market growth in metro and Tier-1 cities.

Increasing Prevalence of Respiratory and Skin Conditions

With rising instances of respiratory ailments like asthma, bronchitis, and sinusitis, as well as dermatological issues like dry skin and eczema, Indian consumers are increasingly turning to humidifiers as a preventive and therapeutic tool. According to industry reports, although about 3% of people in India have asthma, over 80% of those who have the condition go undetected. Medical professionals often recommend humidifiers to maintain healthy moisture levels in the air, particularly for patients recovering from infections or surgeries. This trend is especially noticeable in winter, when low humidity exacerbates these conditions. Additionally, parents are investing in humidifiers to create safer, more comfortable environments for babies and toddlers. The rising focus on health management at home is a significant factor fueling the India humidifier market share.

India Humidifier Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and coverage area.

Type Insights:

- Steam

- Ultrasonic

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes steam, ultrasonic, and others.

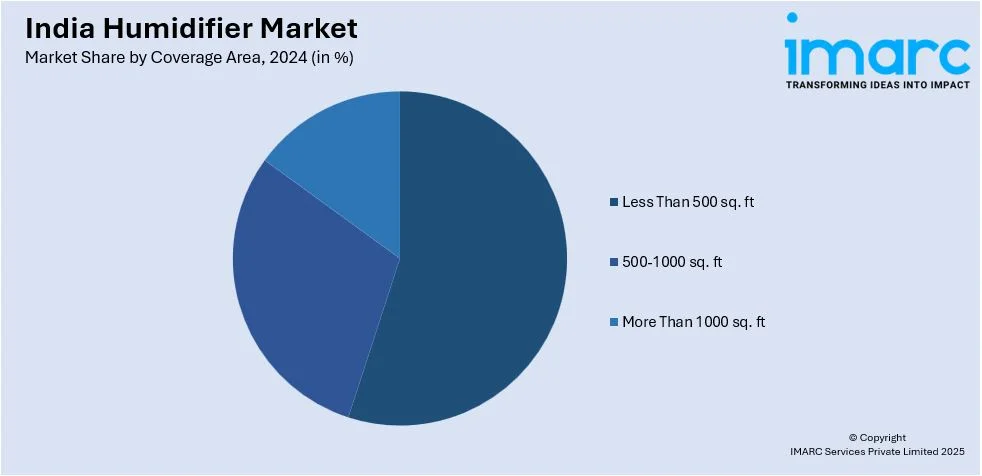

Coverage Area Insights:

- Less Than 500 sq. ft

- 500-1000 sq. ft

- More Than 1000 sq. ft

A detailed breakup and analysis of the market based on the coverage area have also been provided in the report. This includes less than 500 sq. ft, 500-1000 sq. ft, and more than 1000 sq. ft.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Humidifier Market News:

- In February 2025, Air India's luxury passenger experience reached new heights with the introduction of the state-of-the-art Humidifier Onboard technology. This innovation, which is only available in the airline's A350-900 Premium cabins, aims to make flying healthier, more tranquil, and pleasantly comfortable for passengers. It's a revolution rather than merely an improvement, solidifying Air India's position as a leader in passenger welfare.

- In September 2024, KENT announced the launch of its KENT Dew Ultrasonic Humidifier, designed to alleviate dry air throughout the year. Equipped with advanced ultrasonic mist technology, it features a 4-liter tank with a runtime of up to 35 hours and incorporates a UV LED light for improved air quality.

India Humidifier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steam, Ultrasonic, Others |

| Coverage Areas Covered | Less Than 500 sq. ft, 500-1000 sq. ft, More Than 1000 sq. ft |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India humidifier market performed so far and how will it perform in the coming years?

- What is the breakup of the India humidifier market on the basis of type?

- What is the breakup of the India humidifier market on the basis of coverage area?

- What is the breakup of the India humidifier market on the basis of region?

- What are the various stages in the value chain of the India humidifier market?

- What are the key driving factors and challenges in the India humidifier?

- What is the structure of the India humidifier market and who are the key players?

- What is the degree of competition in the India humidifier market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India humidifier market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India humidifier market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India humidifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)