India HVAC Ductwork Market Size, Share, Trends, and Forecast by Type, Shape, Application, and Region, 2025-2033

India HVAC Ductwork Market Overview:

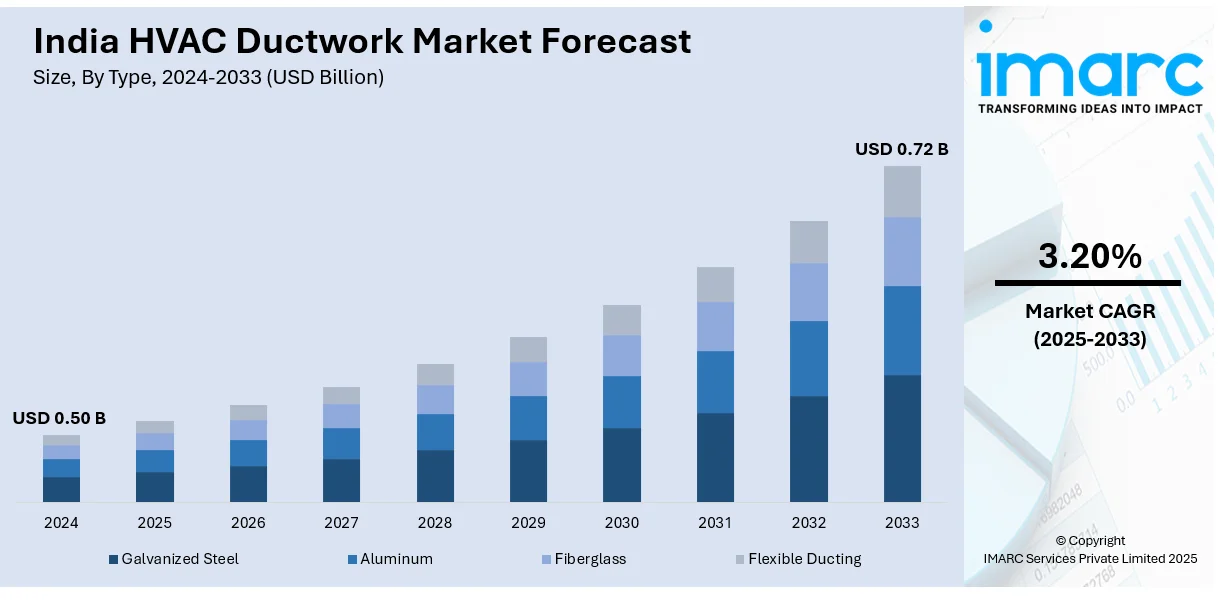

The India HVAC ductwork market size reached USD 0.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.72 Billion by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The market is experiencing robust growth, driven by rapid urbanization, industrial expansion, and an increasing demand for energy-efficient solutions. Additionally, rising construction activities in both residential and commercial sectors, along with government initiatives, are propelling the adoption of advanced ductwork systems across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.50 Billion |

| Market Forecast in 2033 | USD 0.72 Billion |

| Market Growth Rate 2025-2033 | 3.20% |

India HVAC Ductwork Market Trends:

Rising Demand for Energy-Efficient and Smart HVAC Ductwork

Energy efficiency is a major impetus in India's HVAC ductwork industry as commercial buildings and industries concentrate on minimizing operational expenses and meeting sustainability norms. High-performance ducting materials, such as pre-insulated aluminum panels, fiberglass ducts, and flexible insulated ducts are increasingly popular due to their high thermal efficiency and low energy loss. Additionally, driven by government campaigns like Energy Conservation Building Code (ECBC) and increasing acceptance of green building certifications (LEED, IGBC), the developers are putting emphasis on low-leakage, thermally effective duct systems in new projects as well as retrofits. For instance, in May 2024, the Chandigarh administration announced the adoption of the Energy Conservation Building Code (ECBC), mandating that new commercial buildings with specific energy loads or built-up areas comply with energy-efficient standards. Moreover, the shift towards energy-efficient ductwork is further driven by the expanding commercial real estate, data centers, and healthcare sectors, where consistent temperature control is crucial. While initial costs of advanced duct systems are higher, the long-term savings in power consumption and maintenance are making them a preferred choice for sustainable HVAC installations.

To get more information on this market, Request Sample

Expansion of Prefabricated and Modular Ductwork Solutions

Prefabricated and modular HVAC ductwork is gaining momentum in India due to its ability to reduce installation time, enhance precision, and minimize onsite labor requirements. Manufacturers are increasingly shifting to factory-made pre-insulated ducts, spiral ducts, and modular ducting systems to meet the growing demand for fast-track construction projects. This trend is particularly evident in commercial buildings, industrial facilities, metro stations, and large-scale infrastructure developments, where timely project completion is critical. Moreover, modular ductwork reduces material wastage, ensures uniform quality, and simplifies maintenance by allowing easy replacements or modifications. The use of automated CNC cutting, laser welding, and 3D modeling technologies in duct manufacturing further enhances precision and efficiency. For instance, in November 2024, the event, LASER World of PHOTONICS INDIA 2024 highlighted advanced laser applications for duct fabrication, featuring 117+ exhibitors and 4,361+ visitors. This represents the growing inclination towards laser technology in India. Additionally, modular solutions cater to the rising demand for customized HVAC systems in data centers, pharmaceuticals, and cleanroom environments, where airflow control must be highly specialized. With the construction sector emphasizing speed and efficiency, prefabricated ductwork solutions are expected to witness increased adoption, reshaping India's HVAC ductwork industry.

India HVAC Ductwork Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, shape, and application.

Type Insights:

- Galvanized Steel

- Aluminum

- Fiberglass

- Flexible Ducting

The report has provided a detailed breakup and analysis of the market based on the type. This includes galvanized steel, aluminum, fiberglass, and flexible ducting.

Shape Insights:

- Rectangular Ducts

- Round Ducts

- Oval Ducts

A detailed breakup and analysis of the market based on the shape have also been provided in the report. This includes rectangular ducts, round ducts, and oval ducts.

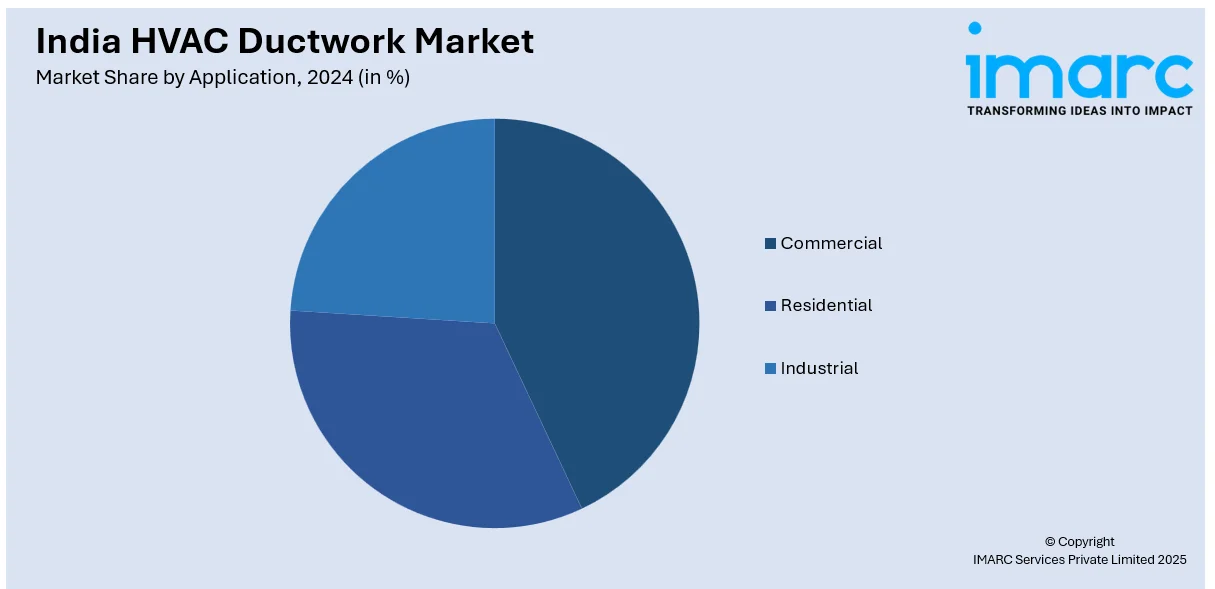

Application Insights:

- Commercial

- Residential

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, residential, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India HVAC Ductwork Market News:

- In February 2024, ZECO Aircon unveiled its latest HVAC products and technologies at the 23rd ACREX India in Delhi, highlighting advancements in the HVAC manufacturing sector and its growing importance in India’s industrial landscape.

India HVAC Ductwork Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Galvanized Steel, Aluminum, Fiberglass, Flexible Ducting |

| Shapes Covered | Rectangular Ducts, Round Ducts, Oval Ducts |

| Applications Covered | Commercial, Residential, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India HVAC ductwork market performed so far and how will it perform in the coming years?

- What is the breakup of the India HVAC ductwork market on the basis of type?

- What is the breakup of the India HVAC ductwork market on the basis of shape?

- What is the breakup of the India HVAC ductwork market on the basis of application?

- What is the breakup of the India HVAC ductwork market on the basis of region?

- What are the various stages in the value chain of the India HVAC ductwork market?

- What are the key driving factors and challenges in the India HVAC ductwork market?

- What is the structure of the India HVAC ductwork market and who are the key players?

- What is the degree of competition in the India HVAC ductwork market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India HVAC ductwork market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India HVAC ductwork market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India HVAC ductwork industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)