India Hybrid Vehicles Market Size, Share, Trends and Forecast by Hybrid Vehicle Type, Vehicle Type, and Region, 2025-2033

India Hybrid Vehicles Market Summary:

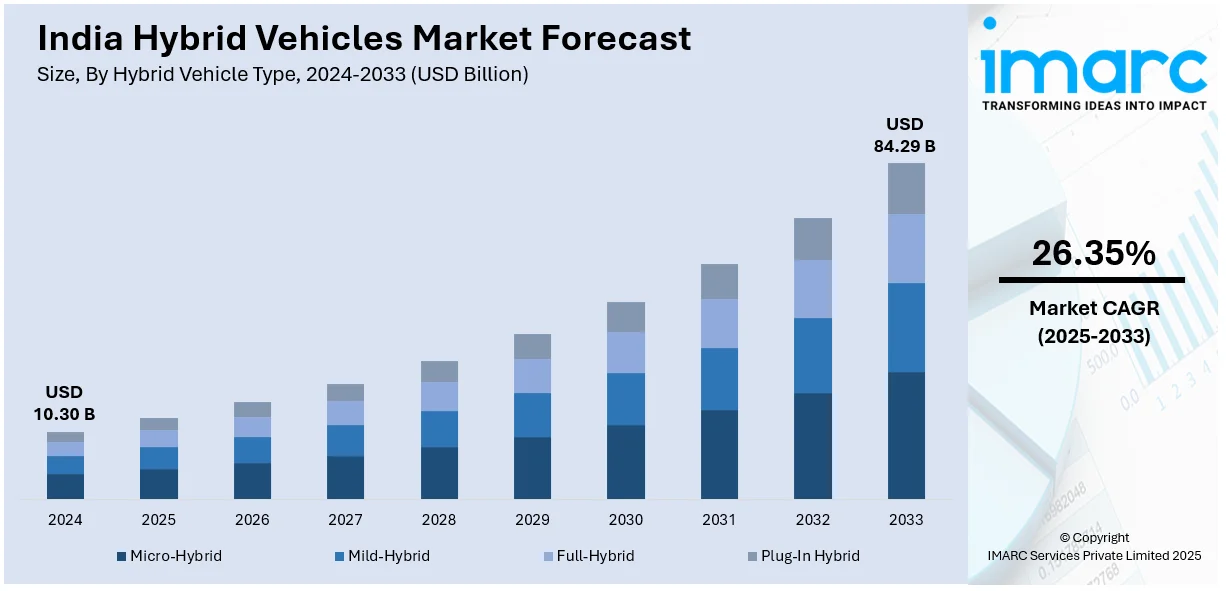

The India Hybrid Vehicles Market size is estimated at USD 10.30 Billion in 2024, and is expected to reach USD 84.29 Billion by 2033, growing at a CAGR of 26.35% during the forecast period (2025-2033). The market is driven by rising fuel prices, environmental concerns, and government incentives including FAME-II. Increasing demand for fuel-efficient, low-emission vehicles, coupled with expanding charging infrastructure and technological advancements, is also accelerating product adoption. Automakers are introducing affordable hybrid models, catering to cost-conscious and eco-aware consumers, thus fueling the India hybrid vehicles market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.30 Billion |

| Market Forecast in 2033 | USD 84.29 Billion |

| Market Growth Rate 2025-2033 | 26.35% |

India Hybrid Vehicles Market Trends:

Rising Demand for Fuel-Efficient Vehicles

The growing need for fuel-efficient transportation solutions is significantly expanding the India hybrid vehicles market share. With rising fuel prices and increasing environmental concerns, consumers are shifting toward hybrid vehicles that combine internal combustion engines with electric propulsion. This dual technology offers better mileage and reduced emissions, making it an attractive option for cost-conscious and eco-aware buyers. Government policies promoting cleaner energy and incentives for hybrid vehicle adoption further bolster this trend. On 17th July 2024, the U.P. government removed the registration tax for strong hybrid cars below INR 20 Lakh (approximately USD 24,390). Automakers are responding by introducing affordable hybrid models tailored to the Indian market, catering to both urban and semi-urban consumers. As the awareness about the long-term cost benefits of hybrids spreads, this trend is expected to accelerate, positioning hybrid vehicles as a key segment in India's automotive industry.

To get more information on this market, Request Sample

Expansion of Charging Infrastructure and Government Support

Another notable trend creating a positive India hybrid vehicle market outlook is the rapid expansion of charging infrastructure and increased government support. To encourage the adoption of hybrid and electric vehicles, the Indian government has launched initiatives such as the FAME-II scheme, which provides subsidies and tax benefits for hybrid vehicle buyers. On 16th September 2024, Amazon Climate Pledge Fund launched a USD 2.65 Million project for communal electric vehicle charging stations in Bengaluru that will serve over 5,500 electric vehicles by 2030. The project runs on 100% renewable energy and is expected to save 11.2 million liters of fuel and 25,700 tonnes of carbon dioxide. This move reinforces the hybrid and electric vehicle industry as India streamlines its electric vehicle framework, improving green transportation methods in the country. Additionally, private and public players are investing heavily in developing charging stations across major cities and highways, addressing range anxiety among potential buyers. This infrastructure development, coupled with favorable policies, is creating a conducive environment for hybrid vehicle growth. Automakers are also collaborating with technology providers to enhance battery efficiency and reduce costs, making hybrids more accessible to the mass market. As these efforts gain momentum, the hybrid vehicle market is poised for robust growth.

India Hybrid Vehicles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on hybrid vehicle type and vehicle type.

Hybrid Vehicle Type Insights:

- Micro-Hybrid

- Mild-Hybrid

- Full-Hybrid

- Plug-In Hybrid

The report has provided a detailed breakup and analysis of the market based on the hybrid vehicle type. This includes micro-hybrid, mild-hybrid, full-hybrid, and plug-in hybrid.

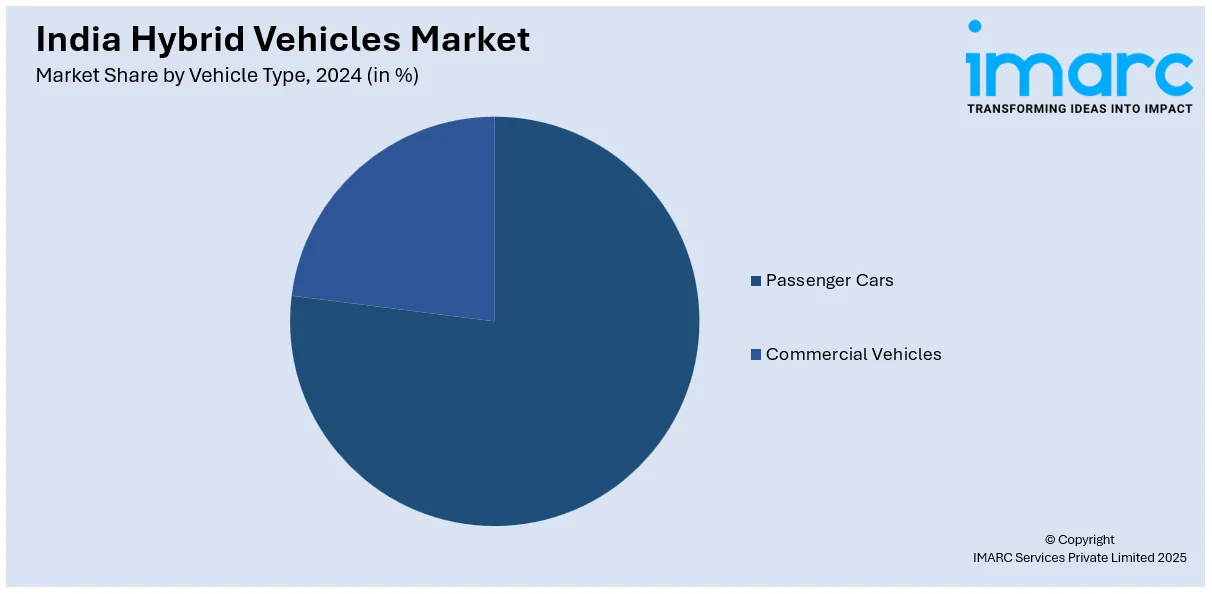

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars and commercial vehicles.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hybrid Vehicles Latest News:

- April 30, 2024: Hyundai Motor Group announced plans to launch its first hybrid SUV in India around 2026-27, aiming to tap into a growing segment where hybrids accounted for 2% of 4.1 million car sales in 2023.

- July 9, 2024: The Uttar Pradesh government issued a circular granting a 100 percent waiver of registration (and road) tax on strong hybrid and plug‑in hybrid vehicles, effective immediately, aiming to incentivize greener transportation. This measure allows manufacturers such as Maruti Suzuki, Toyota, and Honda to pass on savings of up to INR 3.5 Lakh to customers, reducing acquisition costs by approximately 10%. Aligned with India’s broader environmental objectives, the policy may influence other states and is part of Uttar Pradesh’s strategy to diversify its green vehicle incentives beyond fully electric models.

- September 10, 2024: Skoda confirmed plans to launch hybrid cars in India ahead of the launch of its first electric vehicle, the Enyaq, in 2026. The firm is investing ₹15,000 Crore (approximately USD 1,829.27 Million) to upgrade its Chakan facility to manufacture mild hybrids, plug-in hybrids, and battery electric vehicles.

- September 16, 2024: Amazon India’s Climate Pledge Fund, in partnership with The Climate Pledge signatories, announced a USD 2.65 Million initiative—JOULE—to deploy a network of renewable‑energy‑powered EV charging stations in Bengaluru, with five sites coming online by year‑end. The program aims to support more than 5,500 electric vehicles by 2030, reduce carbon emissions by an estimated 25,700 tonnes, save over 11.2 million liters of fuel, and create approximately 185 jobs. Backed by partners, the project demonstrates a scalable model for public-private collaboration in accelerating India’s EV infrastructure.

India Hybrid Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Hybrid Vehicle Types Covered | Micro-Hybrid, Mild-Hybrid, Full-Hybrid, Plug-In Hybrid |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hybrid vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hybrid vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hybrid vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hybrid vehicles market in India was valued at USD 10.30 Billion in 2024.

The hybrid cars in India are expected to reach a value of USD 84.29 Billion by 2033.

The hybrid vehicle segment in India is projected to exhibit a CAGR of 26.35% during 2025-2033.

India’s hybrid vehicle market is growing due to rising fuel costs, stricter emission rules, and a shift toward cleaner transport. Government schemes promoting electric mobility, along with manufacturer-led launches of hybrid models, are encouraging buyers to consider hybrids as a practical middle ground between conventional and fully electric vehicles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)