India Hydraulic Cylinders Market Size, Share, Trends and Forecast by Function, Type, Bore Size, Application, End-Use Industry, and Region, 2025-2033

India Hydraulic Cylinders Market Size and Share:

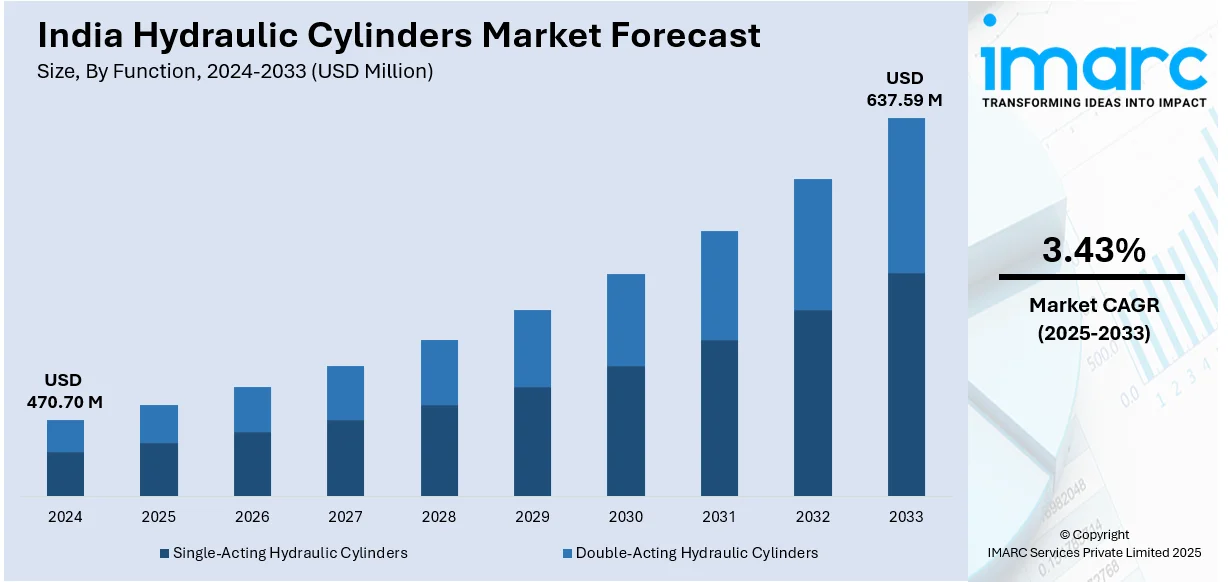

The India hydraulic cylinders market size reached USD 470.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 637.59 Million by 2033, exhibiting a growth rate (CAGR) of 3.43% during 2025-2033. The market is driven by increasing infrastructure development, rising mechanization in agriculture, and growing demand from construction and industrial sectors. Technological advancements, such as IoT-enabled smart cylinders, and the need for customized solutions further propel the India hydraulic cylinders market growth. Government initiatives and the push for automation also contribute significantly to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 470.70 Million |

| Market Forecast in 2033 | USD 637.59 Million |

| Market Growth Rate (2025-2033) | 3.43% |

India Hydraulic Cylinders Market Trends:

Increasing Demand for Hydraulic Cylinders in Agriculture and Construction

The India hydraulic cylinders market share is witnessing significant expansion due to the rising demand from the agriculture and construction sectors. With the Indian government’s focus on infrastructure development, including projects such as smart cities, highways, and metro rail networks, the need for heavy machinery equipped with hydraulic cylinders is accelerating. The deadline for India’s Smart Cities Mission has been extended to March 2025 to allow for the completion of 830 pending projects worth INR 19,926 Crore (approximately USD 2.43 Billion), while 90% of projects have already been completed. Urban infrastructure development continues to be a priority, with INR 46,585 Crore (approximately USD 5.68 Billion) (97% of allocated funds) released and 93% utilized. With construction gaining pace in India, the demand for heavy machinery in smart city initiatives is rising. Construction operations employ machinery such as excavators, loaders, and cranes, which utilize hydraulic cylinders extensively. In addition, the agricultural sector is gradually adopting mechanized farming practices, resulting in the increased adoption of hydraulic cylinders for tractors, harvesters, and other agricultural implements. The pursuit of enhancing productivity and efficiency in both sectors is additionally augmenting the growth of the market. The unique needs of these industries will ensure continuous demand in the future as manufacturers are highly focused on manufacturing durable and high-performance hydraulic cylinders.

To get more information on this market, Request Sample

Adoption of Advanced Technologies and Customization

The India hydraulic cylinders market outlook is experiencing a shift toward the adoption of advanced technologies and customized solutions. With the growing emphasis on automation and precision in industries such as manufacturing, automotive, and aerospace, there is a rising demand for hydraulic cylinders that offer enhanced performance, reliability, and efficiency. A research report from the IMARC Group indicates that the global automotive motors market was valued at USD 41.6 Billion in 2024. It is projected to grow to USD 61.9 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.28% from 2025 to 2033. Manufacturers are increasingly incorporating IoT-enabled sensors and cutting-edge technologies into hydraulic cylinders to enable real-time monitoring and predictive maintenance. Such an advancement is particularly important in industries with assets where equipment downtime may lead to enormous financial losses. Moreover, there is a growing need for custom hydraulic cylinders made for specific applications such as high-pressure environments or limited space. All this focus on innovation and customization helps organizations to remain differentiated in a competitive space while serving much of the changing needs of end-users in a broad range of industries.

India Hydraulic Cylinders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on function, type, bore size, application, and end-use industry.

Function Insights:

- Single-Acting Hydraulic Cylinders

- Double-Acting Hydraulic Cylinders

The report has provided a detailed breakup and analysis of the market based on the function. This includes single-acting hydraulic cylinders and double-acting hydraulic cylinders.

Type Insights:

- Tie-Rod Cylinders

- Welded Cylinders

- Telescopic Cylinders

- Mill-Type Cylinders

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes tie-rod cylinders, welded cylinders, telescopic cylinders, and mill-type cylinders.

Bore Size Insights:

- <50 MM

- 50–150 MM

- >150 MM

The report has provided a detailed breakup and analysis of the market based on the bore size. This includes <50 MM, 50–150 MM, and >150 MM.

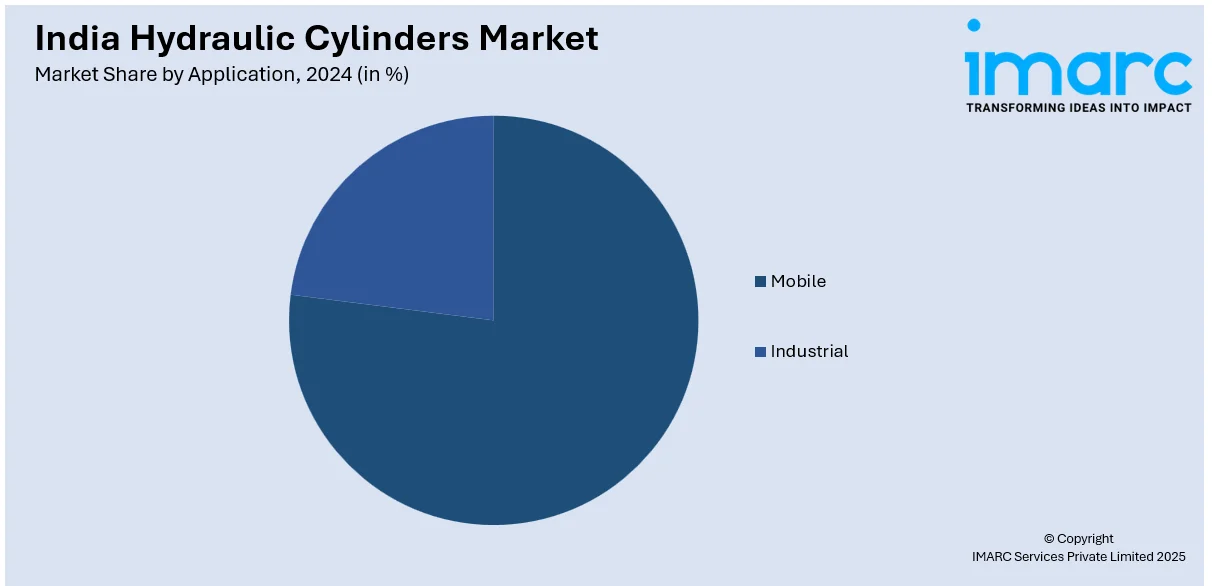

Application Insights:

- Mobile

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mobile and industrial.

End-Use Industry Insights:

- Construction

- Aerospace and Defense

- Material Handling

- Agriculture

- Automotive

- Mining

- Oil and Gas

- Marine

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes construction, aerospace and defense, material handling, agriculture, automotive, mining, oil and gas, marine, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydraulic Cylinders Market News:

- August 22, 2024: Wipro Hydraulics has inaugurated its new sixth manufacturing unit in Jaipur, Rajasthan. The new plant comes up with an investment of INR 250 Crore (approximately USD 30.49 Million), thus contributing to the scope of hydraulic cylinders in India. The new facility is expected to manufacture 1,000 hydraulic cylinders per day and is expected to generate 400 jobs as it addresses the potential increasing demand in the market.

India Hydraulic Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Single-Acting Hydraulic Cylinders, Double-Acting Hydraulic Cylinders |

| Types Covered | Tie-Rod Cylinders, Welded Cylinders, Telescopic Cylinders, Mill-Type Cylinders |

| Bore Sizes Covered | <50 MM, 50–150 MM, >150 MM |

| Applications Covered | Mobile, Industrial |

| End-Use Industries Covered | Construction, Aerospace and Defense, Material Handling, Agriculture, Automotive, Mining, Oil and Gas, Marine, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydraulic cylinders market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydraulic cylinders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydraulic cylinders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydraulic cylinders market in India was valued at USD 470.70 Million in 2024.

The India hydraulic cylinders market is projected to exhibit a CAGR of 3.43% during 2025-2033, reaching a value of USD 637.59 Million by 2033.

The key drivers of India’s hydraulic cylinders market include rapid infrastructure and construction growth across roads, rail, and smart-city projects; expanding demand from material handling, mining, agriculture, and manufacturing sectors; and technological advances like IoT-enabled smart cylinders, energy-efficient systems, and predictive maintenance tools.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)