India Hydraulic Press Market Size, Share, Trends and Forecast by Type, Application, End-Users, and Region, 2025-2033

India Hydraulic Press Market Overview:

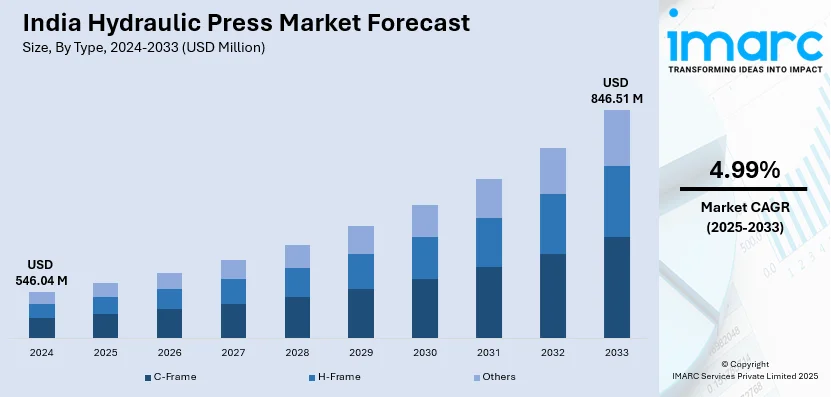

The India hydraulic press market size reached USD 546.04 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 846.51 Million by 2033, exhibiting a growth rate (CAGR) of 4.99% during 2025-2033. Growing industrial automation, increasing demand for precision metal forming, expanding automotive and aerospace sectors, rising investments in manufacturing infrastructure, government initiatives like ‘Make in India,’ advancements in hydraulic technology, and the need for energy-efficient machinery are driving the India hydraulic press market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 546.04 Million |

| Market Forecast in 2033 | USD 846.51 Million |

| Market Growth Rate 2025-2033 | 4.99% |

India Hydraulic Press Market Trends:

Increasing Demand from Automotive and Manufacturing Sectors

The India hydraulic press market share is witnessing significant expansion, driven by rising demand from the automotive and manufacturing industries. With the expansion of automobile production and increasing focus on precision engineering, hydraulic presses are essential for metal forming, stamping, and molding applications. For instance, the Bharat Mobility Global Expo 2025 was officially opened by Prime Minister Narendra Modi on January 17, 2025, at Bharat Mandapam in New Delhi. He pointed to the 12% increase in India's automobile industry over the previous 12 months, with yearly sales of about 2.5 crore vehicles. Additionally, government initiatives like "Make in India" and infrastructure development projects are fueling the need for advanced machinery. Manufacturers are investing in automated and energy-efficient hydraulic press systems to improve productivity and reduce operational costs. The rising adoption of Industry 4.0 and smart manufacturing practices is further accelerating the market’s expansion.

To get more information on this market, Request Sample

Technological Advancements and Customization Trends

The hydraulic press market in India is experiencing a shift toward technologically advanced and customized solutions to meet diverse industrial requirements. For instance, on July 18, 2024, Volvo Construction Equipment (Volvo CE) India introduced the EC210, a 20-ton class hydraulic excavator designed specifically for the Indian market. The next-generation positive control hydraulics system and Tier 3 electronic engine of the EC210 provide great fuel efficiency and excellent torque at low RPM for a variety of applications, such as general construction and road building. Along with partnering with Shriram AutoMall to enable machine exchange and promote equipment lifecycle circularity, Volvo CE also launched the 'Karo Zyada Ki Umeed' campaign to highlight the EC210's improved performance, value, savings, and uptime. Innovations such as servo-hydraulic presses, which offer higher energy efficiency and precision, are gaining significant traction. Additionally, the integration of IoT and AI-based monitoring systems is improving predictive maintenance and operational efficiency. Custom-built hydraulic presses designed for specific applications, including aerospace, defense, and heavy engineering, are becoming more popular. As industries demand greater automation and process optimization, the adoption of digitally controlled hydraulic press systems is expected to rise, thereby positively impacting the India hydraulic press market outlook.

India Hydraulic Press Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, application, and end-users

Type Insights:

- C-Frame

- H-Frame

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes C-frames, H-frames, and others.

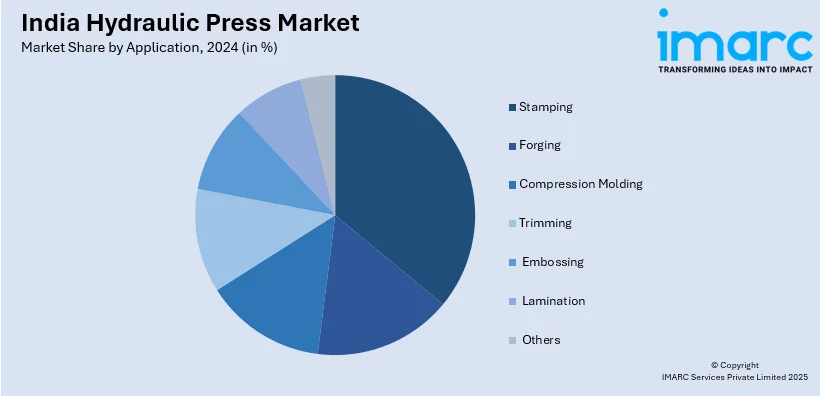

Application Insights:

- Stamping

- Forging

- Compression Molding

- Trimming

- Embossing

- Lamination

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes stamping, forging, compression molding, trimming, embossing, lamination, and others.

End-Users Insights:

- Automotive

- Food and Beverage

- Metal Fabrication

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end-users have also been provided in the report. This includes automotive, food and beverage, metal fabrication, manufacturing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydraulic Press Market News:

- On October 29, 2024, Wheels India Ltd. declared that it aims to double its hydraulics business in the next two to three years, with the goal of increasing its present contribution from INR 150 Crore to INR 300 Crore. The business has allocated INR 225 Crore for capital expenditure this year, with an emphasis on growing its capabilities in hydraulic cylinders, agricultural wheels, windmill castings, and cast aluminum wheels.

- In June 2024, Hindustan Aeronautics Limited (HAL) declared that it would improve its capacity to manufacture aircraft engines and airframes by purchasing a 20,000-ton isothermal press and a 50,000-ton hydraulic press. In order to lessen dependency on imports for vital parts like the F-414, AL-31F, and RD-33 engines that power the Indian Air Force's fighter jets, HAL will be able to manufacture massive, complicated forgings in-house thanks to these presses.

India Hydraulic Press Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | C-Frames, H-Frames, Others |

| Applications Covered | Stamping, Forging, Compression Molding, Trimming, Embossing, Lamination, Others |

| End-Users Covered | Automotive, Food and Beverage, Metal Fabrication, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hydraulic press market performed so far and how will it perform in the coming years?

- What is the breakup of the India hydraulic press market on the basis of type?

- What is the breakup of the India hydraulic press market on the basis of application?

- What is the breakup of the India hydraulic press market on the basis of end-users?

- What is the breakup of the India hydraulic press market on the basis of region?

- What are the various stages in the value chain of the India hydraulic press market?

- What are the key driving factors and challenges in the India hydraulic press?

- What is the structure of the India hydraulic press market and who are the key players?

- What is the degree of competition in the India hydraulic press market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydraulic press market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydraulic press market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydraulic press industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)