India Hydraulics Pneumatics and Actuator Market Size, Share, Trends, and Forecast by Type, Functionality, Component, End-User Industry, and Region, 2025-2033

India Hydraulics Pneumatics and Actuator Market Size and Share:

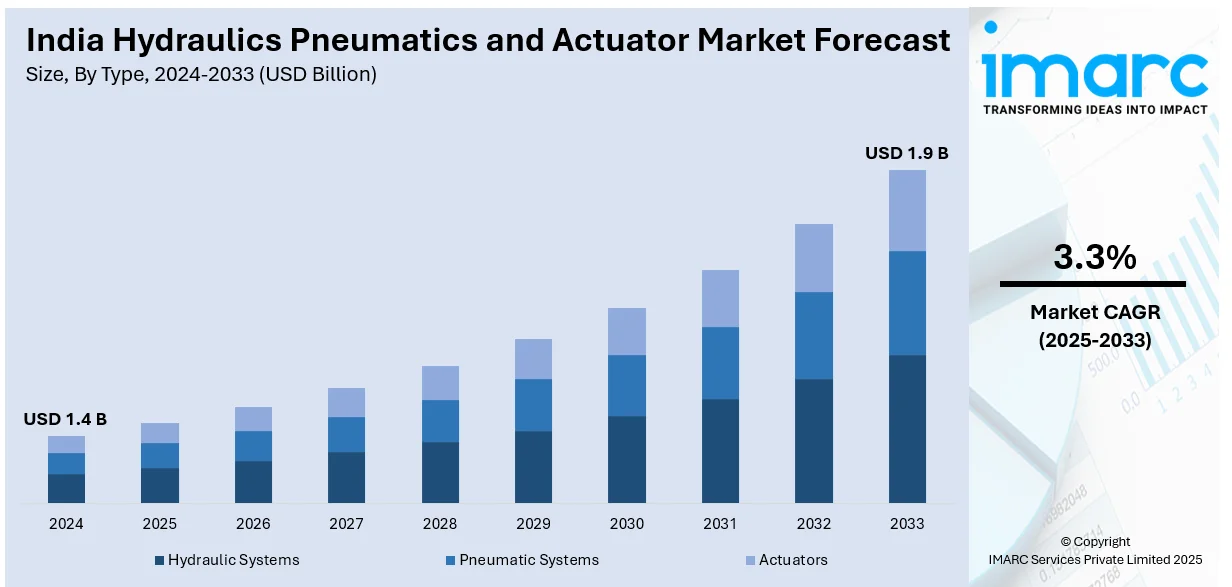

The India hydraulics pneumatics and actuator market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.3% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for automation in manufacturing and industrial sectors and expansion of infrastructure and construction projects driving demand for heavy-duty actuation systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Market Growth Rate (2025-2033) | 3.3% |

India Hydraulics Pneumatics and Actuator Market Trends:

Rising Demand for Automation in Manufacturing and Industrial Sectors

India's hydraulics, pneumatics, and actuators market is witnessing rapid growth, mainly due to increasing automation in industries such as the automobile, aerospace, and heavy machinery. The pace of adoption of hydraulic and pneumatic systems in automated production lines, robotic systems, and precision machinery is greatly driven by Industry 4.0 and smart manufacturing practices. Such mechanism improves efficiency at work, reduces human intervention, and raises the overall productivity. The Indian government's initiatives promoting investments in manufacturing automation, such as the Make in India program, have also contributed to greater demand for hydraulic and pneumatic actuators. The burgeoning rise of EVs is another factor driving the industry, as these manufacturers call increasingly upon motion control technology for the precision assembly and testing processes. For instance, in September 2024, as per industry reports, India's electric vehicle sales may hit 3-4 million units by 2025 and 10 million by 2030. Currently, two- and three-wheelers dominate, comprising 80% of the market, driving rapid industry growth. Moreover, advancements in sensor technologies and IoT-enabled hydraulic and pneumatic systems are facilitating predictive maintenance, minimizing downtime, and reducing operational costs. With increasing labor costs and the need for enhanced efficiency, industries are investing in high-performance actuation systems. This trend is prompting key market players to innovate and offer energy-efficient, intelligent actuator solutions that integrate seamlessly with automated industrial setups. Consequently, the market is positioned for ongoing expansion, fueled by technological progress and changing industry needs

To get more information on this market, Request Sample

Expansion of Infrastructure and Construction Projects Driving Demand for Heavy-Duty Actuation Systems

India’s ongoing infrastructure development, including highways, railways, smart cities, and urban mobility projects, is significantly boosting the demand for hydraulic, pneumatic, and actuator systems. Hydraulic actuators play a crucial role in heavy equipment such as excavators, cranes, loaders, and material-handling machinery, which are essential for large-scale construction activities. With government initiatives like the National Infrastructure Pipeline (NIP) and PM Gati Shakti, the demand for reliable and efficient hydraulic and pneumatic systems is increasing. The surge in investments in renewable energy projects, including solar and wind power plants, is further driving demand for actuators in applications such as turbine blade control and solar tracking systems. The growing emphasis on sustainability is also leading to innovations in hydraulic and pneumatic systems, focusing on energy efficiency and reduced environmental impact. Manufacturers are increasingly developing electro-hydraulic and electro-pneumatic hybrid systems that optimize power consumption while maintaining high performance. For instance, in March 2025, John Cockerill Defense and Electro Pneumatics & Hydraulics announced a joint venture to manufacture hydraulic actuator-integrated turrets for India’s Light Tank program, boosting defense self-reliance under ‘Make in India’ with advanced weapon systems. Furthermore, India’s expanding logistics and warehousing sector is contributing to the rising demand for automated material handling equipment, forklifts, and conveyor systems equipped with advanced actuation technologies. These developments indicate a sustained growth trajectory for the hydraulics, pneumatics, and actuator market, as infrastructure and industrial expansion continue to shape demand patterns.

India Hydraulics Pneumatics and Actuator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, functionality, component, and end-user industry.

Type Insights:

- Hydraulic Systems

- Pneumatic Systems

- Actuators

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydraulic systems, pneumatic systems, and actuators.

Functionality Insights:

- Power Transmission

- Motion Control

- Force Generations

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes power transmission, motion control, and force generations.

Component Insights:

- Pumps

- Valves

- Cylinders

- Compressors

- Actuator Control Systems

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes pumps, valves, cylinders, compressors, and actuator control systems.

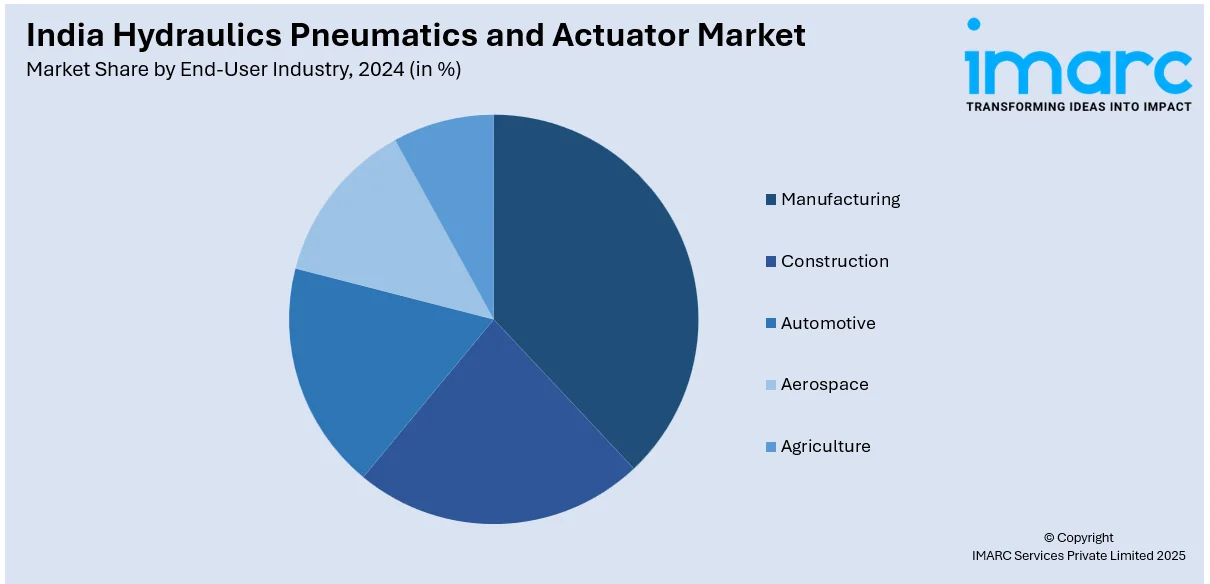

End-User Industry Insights:

- Manufacturing

- Construction

- Automotive

- Aerospace

- Agriculture

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes manufacturing, construction, automotive, aerospace, and agriculture.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major Indiaal markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydraulics Pneumatics and Actuator Market News:

- In April 2024, DRDO’s Aeronautical Development Agency (ADA) announced delivering of the first batch of indigenous Leading Edge Actuators and Airbrake Control Modules to HAL, advancing self-reliance in aeronautical technology. HAL, Lucknow, is set for production, integrating high-pressure electro-hydraulic servo actuators into 83 LCA Tejas Mk1A fighter jets.

India Hydraulics Pneumatics and Actuator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydraulic Systems, Pneumatic Systems, Actuators |

| Functionalities Covered | Power Transmission, Motion Control, Force Generations |

| Components Covered | Pumps, Valves, Cylinders, Compressors, Actuator Control Systems |

| End-User Industries Covered | Manufacturing, Construction, Automotive, Aerospace, Agriculture |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydraulics pneumatics and actuator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydraulics pneumatics and actuator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydraulics pneumatics and actuator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydraulics pneumatics and actuator market in India reached USD 1.4 Billion in 2024.

The India hydraulics pneumatics and actuator market is projected to exhibit a CAGR of 3.3% during 2025-2033, reaching a value of USD 1.9 Billion by 2033.

The market is driven by rising automation in manufacturing, expansion of infrastructure projects, demand for heavy-duty actuation systems, smart manufacturing adoption, government initiatives like Make in India and NIP, growth of EVs, and advances in sensor and IoT-enabled hydraulic and pneumatic technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)