India Hydrogel Market Size, Share, Trends and Forecast by Raw Material Type, Form, Composition, Application, and Region, 2025-2033

India Hydrogel Market Overview:

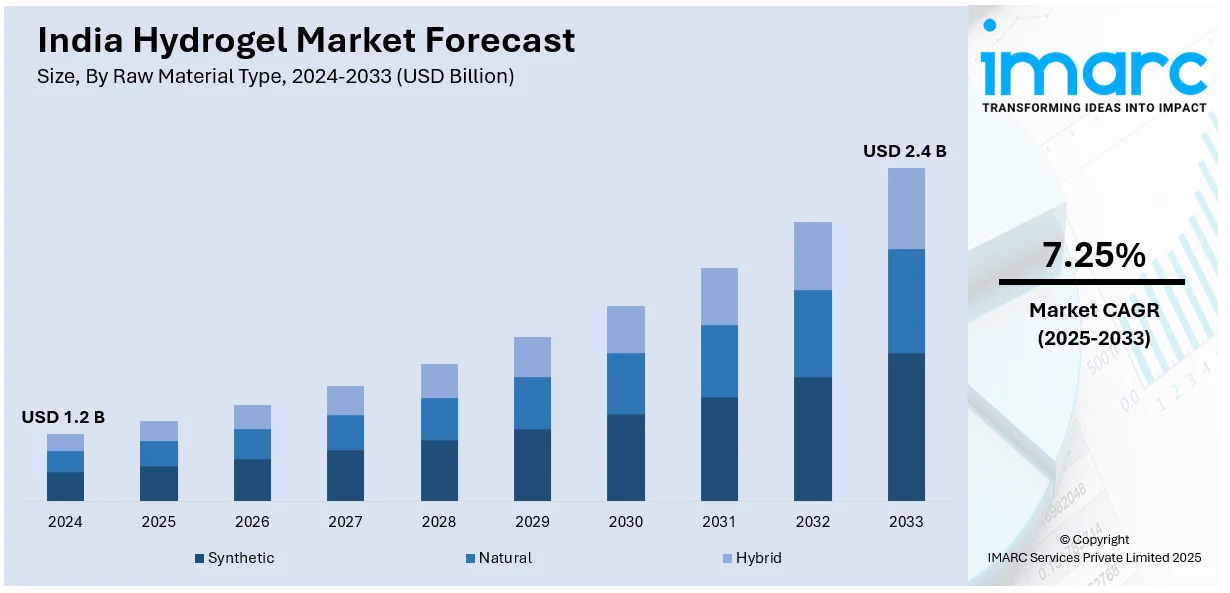

The India hydrogel market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.25% during 2025-2033. The market is driven by the increasing demand for water-efficient farming, government initiatives promoting sustainable practices, and rising awareness among farmers. In healthcare, the India hydrogel market share is augmented by applications in wound care and drug delivery, while the personal care sector benefits from hydrogel-based skincare products and rising disposable incomes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 7.25% |

India Hydrogel Market Trends:

Increasing Demand for Hydrogels in Agriculture

The rise in demand for water-efficient farming in the agricultural sector is creating a positive India hydrogel market outlook. According to a research report by IMARC Group, the Indian agriculture sector was worth over INR 99,689.0 Billion (approximately USD 1,196.27 Billion) in 2024. It is estimated that the market will reach INR 236,603.2 Billion (approximately USD 2,839.24 Billion) by 2033, exhibiting a compound annual growth rate (CAGR) of 10.08% between 2025 and 2033. Hydrogels are being increasingly adopted as water retention agents to address water scarcity and improve crop yield. With India's agriculture heavily dependent on monsoon rains, hydrogels offer a sustainable solution by retaining moisture in the soil and releasing it gradually, ensuring optimal hydration for crops. This trend is further fueled by government initiatives promoting water-efficient farming practices and the growing awareness among farmers about the benefits of hydrogels. Moreover, there is a rise in the popularity of organic farming, hence increasing the requirement for environmentally sustainable agricultural inputs, which is driving the use of hydrogel-based products. This in turn is creating a strong growth path for the market, with manufacturers focused on developing inexpensive biodegradable hydrogels suitable for Indian agriculture.

To get more information on this market, Request Sample

Expansion of Hydrogels in Healthcare and Personal Care

The rapid growth in the healthcare and personal care sectors, driven by increasing consumer awareness and advancements in hydrogel technology is favoring the India hydrogel market growth. In healthcare, hydrogels are widely used in wound care, drug delivery systems, and contact lenses due to their biocompatibility and moisture-retention properties. The rising prevalence of chronic wounds and diabetes-related complications has further enhanced the demand for hydrogel-based wound dressings. World Diabetes Day 2024 is observed under the theme "Breaking Barriers, Bridging Gaps," as making diabetes care more accessible is the need of the hour. According to the ICMR INDIAB study, India is home to an estimated 10.1 crore (around 101 million) cases of diabetes. Reacting to the epidemic, the Indian government has opened over 6,200 health centers where, as part of an NP-NCD (National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Disease, and Stroke), diabetes screening and prevention are performed with lifestyle modifications and affordable insulin access. With increasing diabetes awareness and rising demand for hydrogel-based wound dressings, the market in India is set for significant growth. In the personal care industry, hydrogels are gaining popularity in skincare products, such as moisturizers and masks, owing to their ability to provide deep hydration and improve skin elasticity. The growing middle-class population, coupled with rising disposable incomes, is also contributing to the increased adoption of hydrogel-infused personal care products. As a result, companies are investing in research and development to introduce innovative hydrogel applications, positioning the market for sustained growth in these sectors.

India Hydrogel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on raw material type, form, composition, and application.

Raw Material Type Insights:

- Synthetic

- Natural

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the raw material type. This includes synthetic, natural, and hybrid.

Form Insights:

- Amorphous

- Semi-Crystalline

- Crystalline

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes amorphous, semi-crystalline, and crystalline.

Composition Insights:

- Polyacrylate

- Polyacrylamide

- Silicone-Modified Hydrogels (SiH)

- Others

The report has provided a detailed breakup and analysis of the market based on the composition. This includes polyacrylate, polyacrylamide, silicone-modified hydrogels (SiH), and others.

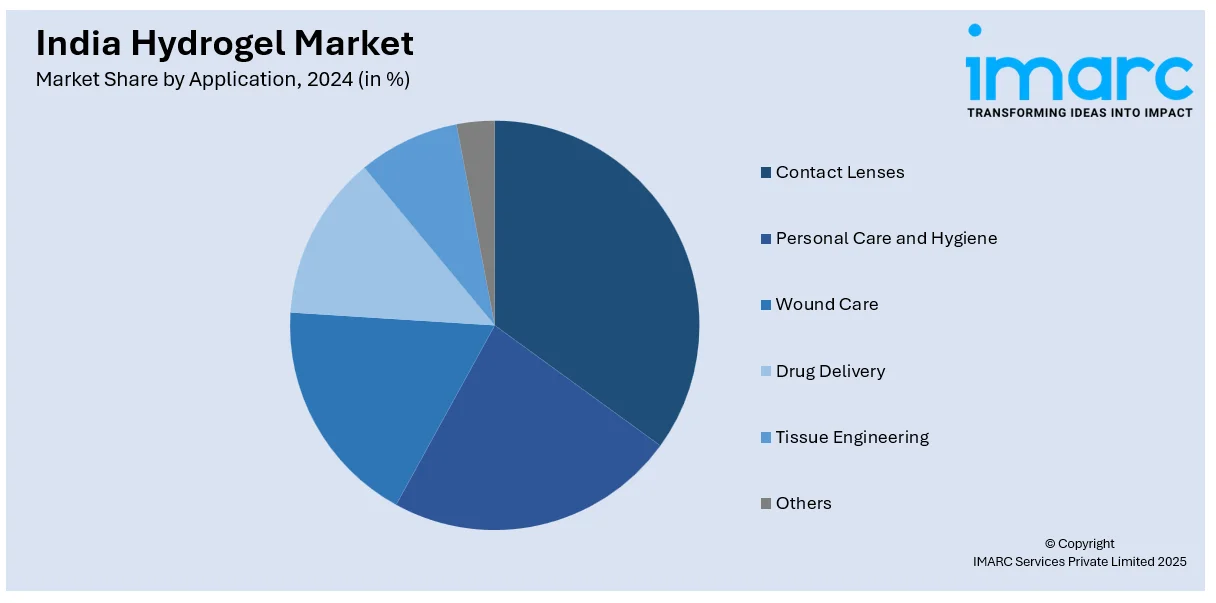

Application Insights:

- Contact Lenses

- Personal Care and Hygiene

- Wound Care

- Drug Delivery

- Tissue Engineering

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes contact lenses, personal care and hygiene, wound care, drug delivery, tissue engineering, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydrogel Market News:

- January 02, 2025: IIT-Guwahati, together with Bose Institute, Kolkata, developed a unique injectable hydrogel for directed therapy of breast cancer, showing a significant reduction of adverse effects associated with chemotherapy. The hydrogel, made from ultra-short peptides, delivers drugs precisely to the tumor site, responding to specific conditions in the tumour micro-environment, and remains insoluble in biological fluids, ensuring it stays localized at the injection site.

India Hydrogel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Material Types Covered | Synthetic, Natural, Hybrid |

| Forms Covered | Amorphous, Semi-Crystalline, Crystalline |

| Compositions Covered | Polyacrylate, Polyacrylamide, Silicone-Modified Hydrogels (SiH), Others |

| Applications Covered | Contact Lenses, Personal Care and Hygiene, Wound Care, Drug Delivery, Tissue Engineering, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India hydrogel market performed so far and how will it perform in the coming years?

- What is the breakup of the India hydrogel market on the basis of raw material type?

- What is the breakup of the India hydrogel market on the basis of form?

- What is the breakup of the India hydrogel market on the basis of composition?

- What is the breakup of the India hydrogel market on the basis of application?

- What is the breakup of the India hydrogel market on the basis of region?

- What are the various stages in the value chain of the India hydrogel market?

- What are the key driving factors and challenges in the India hydrogel market?

- What is the structure of the India hydrogel market and who are the key players?

- What is the degree of competition in the India hydrogel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydrogel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydrogel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydrogel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)