India Hydrogen Energy Storage Market Size, Share, Trends and Forecast by Storage Form, Technology, Application, End User, and Region, 2025-2033

India Hydrogen Energy Storage Market Overview:

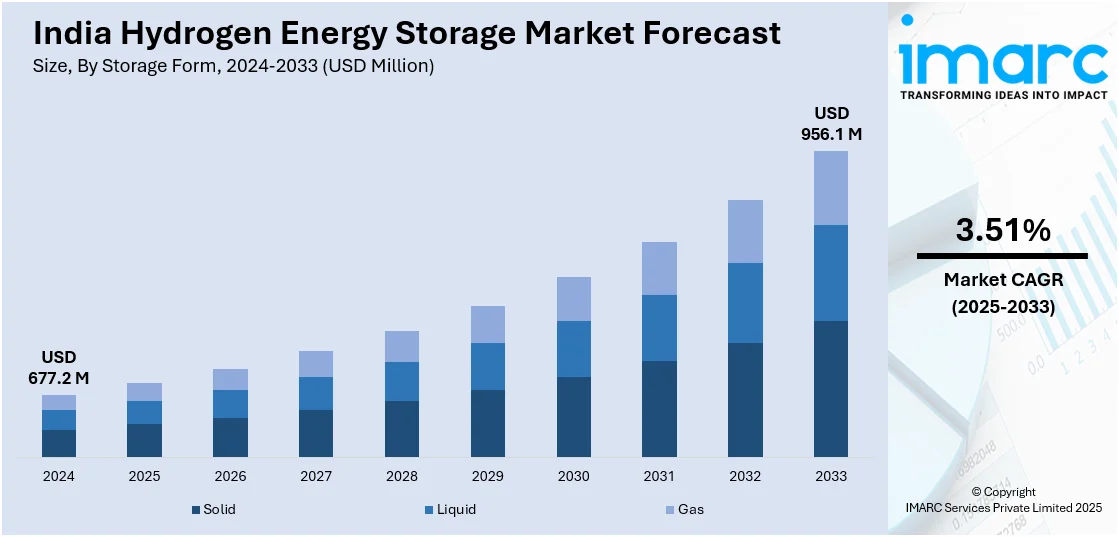

The India hydrogen energy storage market size reached USD 677.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 956.1 Million by 2033, exhibiting a growth rate (CAGR) of 3.51% during 2025-2033. Growing renewable energy deployment, rising demand for grid stability, and strong policy backing under the National Green Hydrogen Mission are propelling the market growth. Falling electrolyzer costs, cheaper solar and wind energy, and the encouragement for industrial decarbonization are making green hydrogen storage more feasible, further supporting the market growth. Efforts to reduce fossil fuel imports, rising fuel cell vehicle initiatives, and advancements in hydrogen compression and storage materials are supporting adoption. Apart from this this, energy security concerns, export ambitions, public-private pilot projects, and demand from hard-to-abate sectors like steel and fertilizers are driving the India hydrogen energy storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 677.2 Million |

| Market Forecast in 2033 | USD 956.1 Million |

| Market Growth Rate 2025-2033 | 3.51% |

India Hydrogen Energy Storage Market Trends:

Renewable Energy Integration and Grid Stability

The need for flexible and reliable storage systems is rising as the share of renewable energy sources like wind and solar power in India's power pool is growing. Since these sources are intermittent in nature, balancing demand and supply has become an increasing problem. By transforming surplus renewable electricity into hydrogen, which can be stored and then converted back into power when needed, hydrogen energy storage provides a workable long-term solution. Particularly when renewable generation is low, this capability helps stabilize the grid and guarantees steady power availability. India plans to add 500 GW of non-fossil capacity by 2030, which will put more strain on the grid and increase the interest in hydrogen-based storage. Moreover, large-scale hydrogen deployment is possible in isolated areas or next to renewable parks, serving as a buffer that reduces curtailment and optimizes energy use. These practical advantages position hydrogen as a critical enabler for India’s renewable energy transition.

To get more information on this market, Request Sample

Policy Support through the National Green Hydrogen Mission

The National Green Hydrogen Mission of the Indian government is a key factor propelling the market for hydrogen storage. The mission, which has been allocated USD 2.4 billion (INR 19,744 crore), lays out specific goals and incentives to encourage the production, use, and storage of green hydrogen. It is reducing India's reliance on imported fossil fuels and establishing the nation as a global center for green hydrogen. Funds specifically allocated to infrastructure development, pilot projects, and research and development in hydrogen storage and transportation are driving the India hydrogen energy storage market growth. Furthermore, a strong basis for market expansion is established by the policy framework's demand-creation initiatives for public sector organizations and industrial users. By offering visibility and financial support, the mission is de-risking early investments and encouraging both public and private participation. As the policy continues to take shape, it is expected to trigger stronger market signals and boost adoption across energy, mobility, and industrial segments.

Cost Reduction in Electrolyzers and Renewables

Green hydrogen production is becoming more economically feasible due to declining electrolyzer and renewable energy costs, which directly benefits the storage market. Electrolyzers are vital pieces of machinery that separate water into hydrogen and oxygen using electricity. Until recently, green hydrogen was more costly than alternatives based on fossil fuels. However, electrolyzer costs are gradually declining due to advancements in global supply chains, manufacturing scale, and technology. At the same time, solar and wind energy prices in India have dropped to all-time lows, increasing the appeal of producing hydrogen using renewable energy. Moreover, reduced production costs make stored hydrogen more affordable overall, making it a more desirable energy storage medium for industry, transportation, and grid applications. This change is making it possible for project developers to think about hydrogen as a viable choice for energy storage on a commercial scale, especially with high renewable output.

India Hydrogen Energy Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on storage form, technology, application, and end user.

Storage Form Insights:

- Solid

- Liquid

- Gas

The report has provided a detailed breakup and analysis of the market based on the storage form. This includes solid, liquid, and gas.

Technology Insights:

- Compression

- Liquefaction

- Material Based

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes compression, liquefaction, and material based.

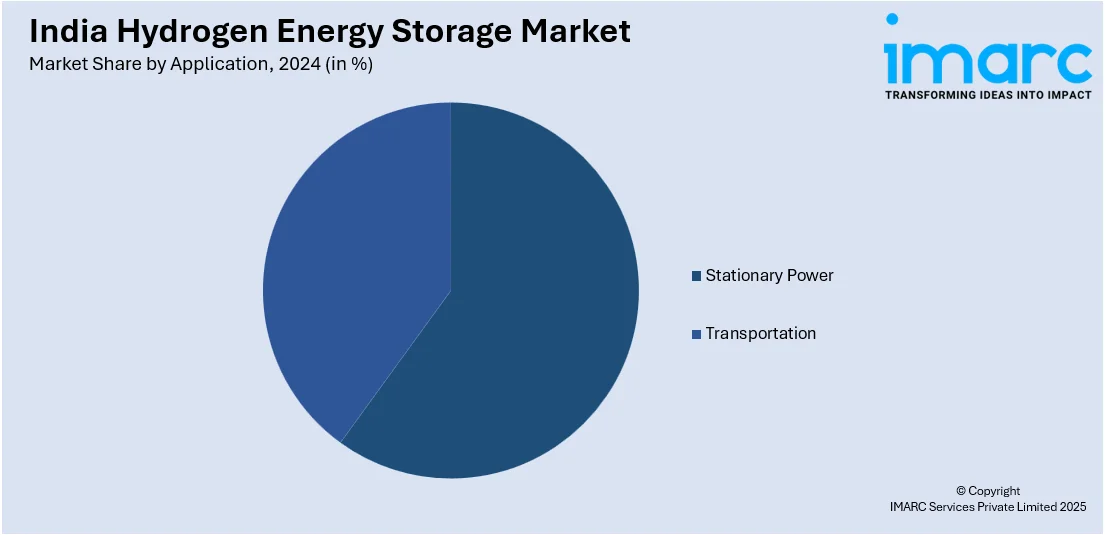

Application Insights:

- Stationary Power

- Transportation

The report has provided a detailed breakup and analysis of the market based on the application. This includes stationary power and transportation.

End User Insights:

- Utilities

- Industrial

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes utilities, industrial, and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Hydrogen Energy Storage Market News:

- In April 2025, Bharat Petroleum Corporation Limited (BPCL) partnered with Singapore-based Sembcorp to develop green hydrogen and renewable energy projects across India. The collaboration also explores green ammonia production and port emissions reduction initiatives.

- In January 2025, Greenko Group and Belgium's John Cockerill are constructing a USD 500 million electrolyzer manufacturing facility in India. The gigafactory aims to produce electrolyzers at a competitive cost, supporting India's green hydrogen ambitions.

- In April 2024, the Indian government announced pilot projects to demonstrate green hydrogen's feasibility in shipping, steel manufacturing, and transport sectors. With a budget of approximately USD 127.92 million (INR 10,660 million), these projects aim to showcase green hydrogen's technical performance in real-world conditions.

India Hydrogen Energy Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Storage Forms Covered | Solid, Liquid, Gas |

| Technologies Covered | Compression, Liquefaction, Material Based |

| Applications Covered | Stationary Power, Transportation |

| End Users Covered | Utilities, Industrial, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India hydrogen energy storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India hydrogen energy storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India hydrogen energy storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydrogen energy storage market in India was valued at USD 677.2 Million in 2024.

The growth of the India hydrogen energy storage market is driven by increasing requirement for clean energy solutions and the integration of renewable energy sources like solar and wind. Hydrogen offers a reliable storage option for excess energy. Additionally, government support through incentives and policies, coupled with advancements in hydrogen storage technologies and growing industrial applications, are accelerating market expansion.

The hydrogen energy storage market in India is projected to exhibit a CAGR of 3.51% during 2025-2033, reaching a value of USD 956.1 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)