India Hydrogen Peroxide Market Report by Application (Chemical Synthesis, Bleaching, Disinfectant, Cleaning and Etching, and Others), End Use (Pulp and Paper, Food and Beverages, Water Treatment, Textiles and Laundry, Oil and Gas, Healthcare, Electronics, and Others), and Region 2025-2033

Market Overview:

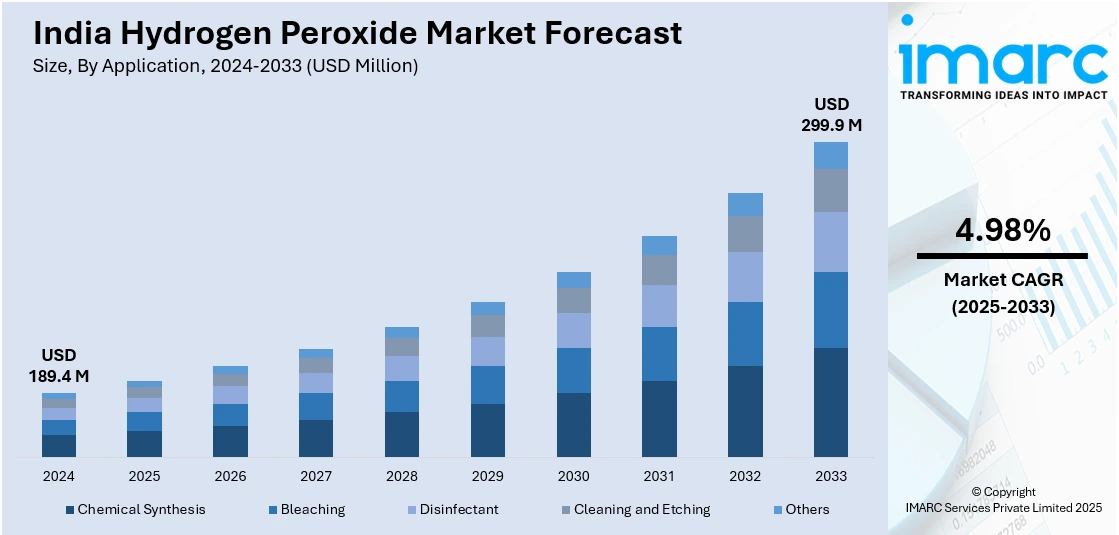

The India hydrogen peroxide market size reached USD 189.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 299.9 Million by 2033, exhibiting a growth rate (CAGR) of 4.98% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 189.4 Million |

|

Market Forecast in 2033

|

USD 299.9 Million |

| Market Growth Rate (2025-2033) | 4.98% |

Hydrogen peroxide (H2O2) is a clear, pale blue chemical compound in its pure form. It is naturally found in biological systems and is a well-documented component of living cells. Due to its unstable nature, hydrogen peroxide is usually stored in a weak acidic solution with a stabilizer. Hydrogen peroxide is also a preferred oxidizing agent due to its low molecular weight. In India, it is utilized in the form of carbamide peroxide for tooth whitening, both professionally or in self-administered products.

To get more information on this market, Request Sample

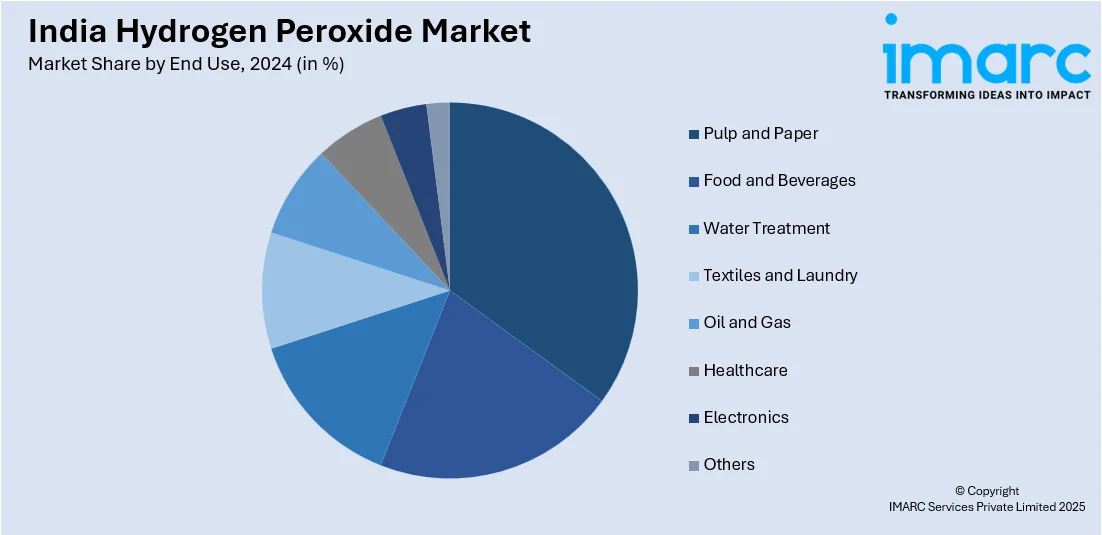

The India hydrogen peroxide market is primarily driven by the increasing utilization of hydrogen peroxide as a disinfectant in the food processing industry and as a bleaching agent in the pulp and paper industry. Apart from this, several environmental laws and regulations established by the Government of India have promoted the use of hydrogen peroxide due to its emission-free and eco-friendly properties. This has also led to a significant rise in the use of this compound for water treatment and pollution control applications. Moreover, with the coronavirus disease (COVID-19) outbreak, hydrogen peroxide is widely employed in sanitizers and other hygienic products as it actively acts against viruses.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India hydrogen peroxide market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on application and end use.

Breakup by Application:

- Chemical Synthesis

- Bleaching

- Disinfectant

- Cleaning and Etching

- Others

Breakup by End Use:

- Pulp and Paper

- Food and Beverages

- Water Treatment

- Textiles and Laundry

- Oil and Gas

- Healthcare

- Electronics

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Application, End Use, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The hydrogen peroxide market in India was valued at USD 189.4 Million in 2024.

The growth of the India hydrogen peroxide market is driven by its increasing use in industries like pulp and paper for bleaching, textiles for fabric processing, and water treatment for disinfection. The rise in requirement for eco-friendly and cost-effective alternatives to chlorine-based chemicals, along with its applications in healthcare and food processing, further fuels market expansion. Additionally, growing industrial activities in India support this demand.

The hydrogen peroxide market in India is projected to exhibit a CAGR of 4.98% during 2025-2033, reaching a value of USD 299.9 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)